Recently, discussions about the RWA project have been heated in major Web3 communities. Industry observers on the Internet often put forward the conclusion that "RWA will reconstruct the new financial ecology of Hong Kong", and believe that relying on the existing regulatory framework of the Hong Kong Special Administrative Region, this track will usher in a breakthrough development. In the process of communicating and discussing with colleagues, Crypto Salad found that everyone has been arguing about the so-called "compliance" issue recently, and the understanding of the question of "what is compliance" is also different. There is always a situation where the public has its own reasons and the woman has her own reasons. This phenomenon is actually based on the differences in the understanding of the concept of RWA.

Therefore, Crypto Salad needs to talk about how the concept of RWA should be defined on this issue from the standpoint of a professional lawyer team, and sort out the compliance red lines of RWA.

1. How should the concept of RWA be defined?

(I) Background and advantages of RWA project

Currently, RWA is becoming the focus of market discussion and gradually forming a new round of development wave. The formation of this phenomenon is mainly based on the following two backgrounds:

First, the advantages of the token itself can make up for the shortcomings of traditional financing.

Projects in the traditional financial market have long faced inherent shortcomings such as high entry barriers, long financing cycles, slow financing speed, and complex exit mechanisms. But token financing can just avoid these defects. Compared with traditional IPOs, RWA has the following significant advantages:

1. Fast financing speed:Since the circulation of tokens is based on blockchain technology, it is usually circulated in decentralized intermediary trading institutions, thus avoiding obstacles such as foreign investment access restrictions, industry policy constraints, and lock-up period requirements that traditional financial projects may encounter. At the same time, it can also compress the review process that originally took months or even years, greatly improving the financing rate.

2. Asset diversification:Traditional IPOs have a single asset type and only support equity issuance, so they have strict requirements on the revenue stability, profitability and asset-liability structure of the issuer. But for RWA, the types of suitable assets are more diverse, and can include various types of non-standard assets, which not only expands the scope of financeable assets, but also shifts the focus of credit assessment to the quality of underlying assets, significantly lowering the qualification threshold of the issuer.

3. Relatively low financing costs: Traditional IPOs require long-term participation and collaboration from multiple intermediaries such as investment banks, audits, and law firms. The full listing process costs can be as high as millions or even tens of millions of yuan, which is very expensive. However, RWA issues tokens through decentralized exchanges, saving a large amount of intermediary fees, and at the same time saves another large amount of labor costs through smart contract operation.

In summary, RWA has taken the forefront of financing projects with its unique advantages, and the Web3 world and the currency circle just happen to be in particular need of traditional real-world funds and projects. This has led to the current situation where, whether it is to complete substantial business transformation or simply to take advantage of the "trend" and "ride on the heat", leading projects in the subdivided fields of listed companies and "strange" start-up projects at the grassroots level are actively exploring the application possibilities of RWA.

Second, Hong Kong's "compliance" has added fuel to the heat.

In fact, RWA has been developing overseas for a while. This wave of heat is so fierce because after a series of regulatory innovations and the implementation of several benchmark projects in Hong Kong, it has provided domestic investors with a channel to participate in "RWA" in compliance for the first time. The "compliant" RWA that Chinese people can touch has been implemented. This breakthrough has not only attracted native crypto assets, but also prompted projects and funds in traditional fields to begin to pay attention to the investment value of RWA, ultimately pushing the market heat to a new high.

However, do users who want to try RWA really understand what RWA is? There are many RWA projects, and the underlying assets and operating architectures are varied. Can everyone tell the difference between them? Therefore, we believe that it is necessary to use this article to carefully define what a compliant RWA is.

It is generally believed that RWA is a financing project that tokenizes underlying real-world assets through blockchain technology. But when we carefully examine the underlying assets of each project and work backwards to determine the process of project operation, we will find that the underlying logic of these projects is actually different. We have conducted a systematic study on this issue and summarized the concept of RWA as follows:

We believe that RWA is actually a broad concept and there is no so-called "standard answer". The process of tokenizing assets through blockchain technology can be called RWA.

(II) Elements and characteristics of RWA projects

A true RWA project needs to have the following characteristics:

1. Based on real assets

Whether the underlying assets are real and whether the project party can establish a transparent and third-party auditable off-chain asset verification mechanism are the key basis for judging whether the project token will achieve effective value recognition in reality. For example, PAXG issues tokens that are anchored to gold in real time. Each token is backed by 1 ounce of physical gold, and the gold reserves are on a third-party management platform. Quarterly reserve audits are conducted by a third-party auditing company, and even tokens can be used to redeem the corresponding amount of physical gold. This highly transparent and regulated asset verification mechanism enables the project to win the trust of investors and also provides the basis for it to be effectively valued in the real financial system.

2. Asset Tokenization on the Chain

Asset tokenization refers to the process of converting real-world assets into digital tokens that can be issued, traded, and managed on the chain through smart contracts and blockchain technology. The value transfer and asset management process of RWA are both automatically executed through smart contracts. Unlike the traditional financial system that relies on intermediaries for transactions and settlements, the RWA project can use smart contracts to implement transparent, efficient, and programmable business logic execution on the blockchain, thereby significantly improving asset management efficiency and reducing operational risks.

Asset tokenization gives RWA the key characteristics of divisibility, tradability, and high liquidity. After asset tokenization, assets can be split into small tokens, which lowers the investment threshold, changes the way assets are held and circulated, and enables retail investors to participate in the investment market with high thresholds.

3. Digital assets have ownership value

The tokens issued by the RWA project should be digital assets with property attributes. The project party should clearly distinguish the difference between data assets and digital assets: data assets are a collection of data owned by an enterprise, which can create value. But in contrast, digital assets are value itself and do not need to be repriced through data. For example, when you design a painting, upload it to the blockchain and generate an NFT, this NFT is a digital asset because it can be confirmed and traded. But the feedback, browsing data, click volume and other data collected by a large number of users on this painting are data assets. You can judge user preferences, improve your work, and adjust its price by analyzing data assets.

4. The issuance and circulation of RWA tokens are in compliance with legal regulations and are subject to administrative supervision

The issuance and circulation of RWA tokens must be operated within the existing legal framework, otherwise it may not only lead to project failure, but also may cause legal risks. First of all, real-world assets must be real and legal, with clear ownership and no disputes, so that they can serve as the basis for token issuance. Secondly, RWA tokens usually have income rights or asset rights, which can easily be identified as securities by regulators in various countries. Therefore, they must be compliant with local securities regulations before issuance. The issuer must also be a qualified institution, such as holding an asset management or trust license, and complete KYC and anti-money laundering procedures. After entering the circulation link, the trading platform of RWA tokens also needs to be regulated, usually requiring a compliant exchange or a secondary market with a financial license, and not allowing random trading on a decentralized platform. In addition, continuous information disclosure is required to ensure that investors can obtain the true situation of the assets linked to the tokens. Only under such a regulatory framework can RWA tokens be issued and circulated legally and safely.

In addition, RWA's compliance management has typical cross-jurisdictional characteristics. Therefore, it is necessary to build a systematic compliance framework covering the legal norms of the asset location, the capital flow path and various regulatory authorities. In the entire life cycle of asset on-chain, cross-chain, and cross-border and cross-platform circulation of tokens, RWA must establish a compliance mechanism covering multiple links such as asset confirmation, token issuance, capital flow, income distribution, user identification and compliance audit. This not only involves legal consultation and compliance design, but may also require the introduction of third-party trust, custody, audit and regulatory technology solutions.

(III) Types and supervision of RWA projects

We found that there are two parallel types of RWA projects that meet the requirements:

1. Narrowly defined RWA: Physical assets on the chain

We believe that narrowly defined RWA specifically refers to projects that tokenize authentic and verifiable real assets on the chain, which is also the RWA that we generally understand, and its application market is also the most extensive, such as projects that anchor tokens to offline real assets such as real estate and gold.

2. STO (Security Token Offering): Financial assets on the chain

In addition to narrowly defined RWA projects, we found that a large number of RWA projects on the market are STOs.

(1)Definition of STO

Based on the underlying assets, operating logic and token functions, the existing tokens on the market can be roughly divided into two categories: utility tokens and security tokens. STO refers to the issuance of tokenized shares or certificates in the form of security tokens on the blockchain after the financialization of real assets.

(2)Definition of Security Tokens

Security tokens are the opposite of utility tokens. Simply put, they are on-chain financial products driven by blockchain technology that are subject to securities regulations, similar to electronic stocks.

(3)Regulation of Security Tokens

Under the current regulatory framework of mainstream crypto-friendly countries such as the United States and Singapore, once a token is identified as a security token, it will be subject to the constraints of traditional financial regulatory agencies (such as the China Securities Regulatory Commission), and the token design and trading model must comply with local securities regulations.

From an economic perspective, the core goal of financial products is to coordinate the supply and demand relationship between the financing party and the investor; from a legal regulatory perspective, some countries focus more on protecting the interests of investors, while others tend to encourage the smooth flow and innovation of financing behavior. This difference in regulatory stance will be reflected in the specific rules, compliance requirements and enforcement strength in the legal systems of various countries. Therefore, when designing and issuing RWA products, it is necessary not only to consider the authenticity and legality of the underlying assets, but also to conduct a comprehensive review and compliance design of key links such as product structure, issuance method, circulation path, trading platform, investor access threshold and capital cost.

It is particularly worth noting that once the core attraction of an RWA project comes from its high leverage and high return expectations, and "hundred-fold or thousand-fold return" is used as the main selling point, then no matter how it is packaged on the surface, its essence is very likely to be classified as a securities product by the regulator. Once it is identified as a security, the project will face a more stringent and complex regulatory system, and its subsequent development path, operating costs and even legal risks will be greatly increased.

Therefore, when discussing the legal compliance of RWA, we need to deeply understand the connotation of "securities regulations" and the regulatory logic behind it. Different countries and regions have different definitions and regulatory priorities for securities. The United States, Singapore and Hong Kong have all defined the identification standards for security tokens. It is not difficult to find that the definition method is actually to determine whether the token meets the identification standards of "securities" in local securities regulations. Once the securities conditions are met, it is classified as a security token. Therefore, we have sorted out the relevant provisions of key countries (regions) as follows:

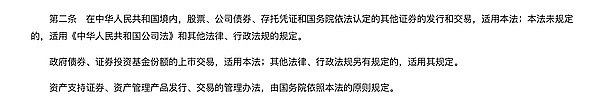

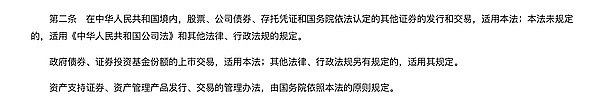

A. Mainland China

In the regulatory framework of mainland China, the Securities Law of the People's Republic of China defines securities as stocks, corporate bonds, depositary receipts and other valuable certificates that can be issued and traded as recognized by the State Council, and the listing and trading of government bonds and securities investment fund shares are also included in the regulation of the Securities Law.

(The above picture is taken from the Securities Law of the People's Republic of China)

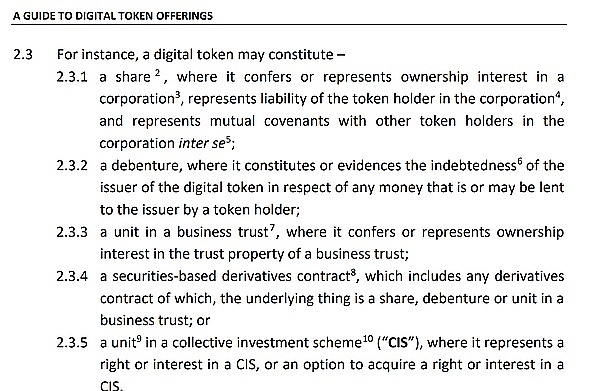

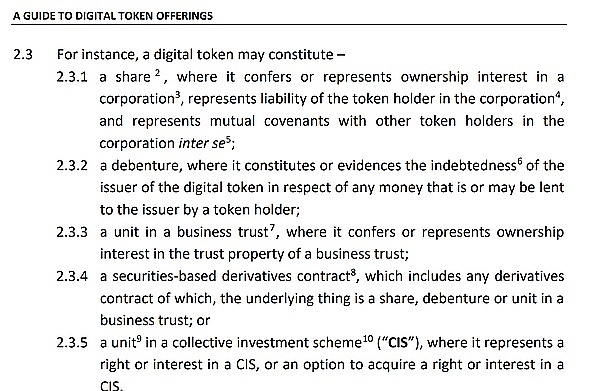

B. Singapore

Although the concept of "security tokens" does not appear directly in Singapore's "Digital Token Issuance Guidelines" and "Stocks and Futures Law", it lists in detail the different situations in which tokens will be identified as "capital market products":

(The above picture is taken from the "Digital Token Issuance Guide")

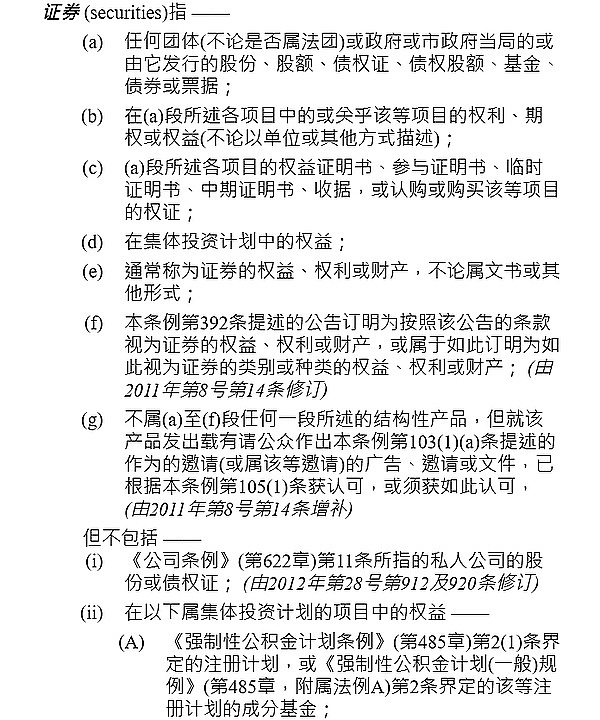

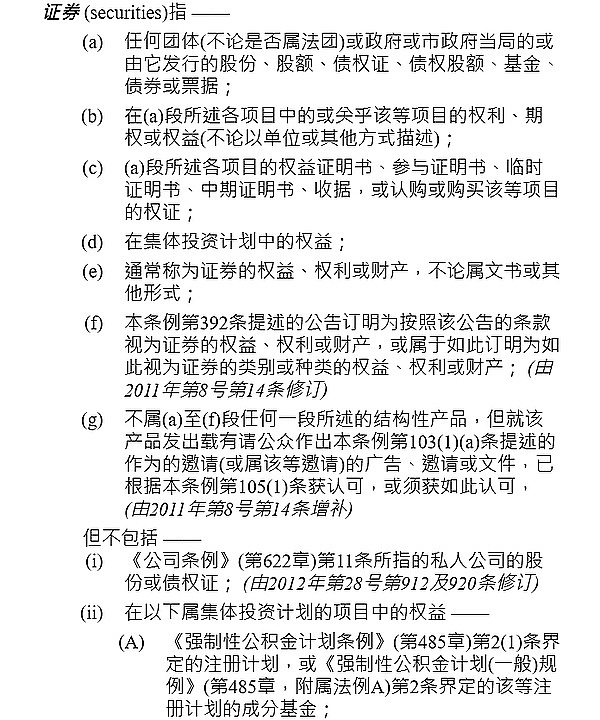

C. Hong Kong, China

The Securities and Futures Commission in Hong Kong, China has specific enumeration regulations on the positive list and negative list of securities in the "Securities and Futures Ordinance":

(The above image is taken from the Securities and Futures Ordinance)

The Ordinance defines "securities" as structured products including "shares, equity shares, notes, and bonds", and does not restrict their existence in traditional carriers. The SFC once clearly pointed out in the "Circular on Intermediaries Engaged in Tokenized Securities-Related Activities" that the nature of its regulatory objects is essentially traditional securities packaged in tokenization.

D. United States

The U.S. Securities and Exchange Commission (SEC) stipulates that any product that passes the Howey Test will be identified as a security. And any product identified as a security needs to be regulated by the SEC. The Howey Test is a legal standard established by the U.S. Supreme Court in the 1946 SEC v. W.J. Howey Company case, which is used to determine whether a transaction or program constitutes an "investment contract" and is therefore subject to U.S. securities law regulation.

The Howey Test lists four conditions for a financial product to be considered a "security". The Framework for "Investment Contract" Analysis of Digital Assets" issued by the U.S. SEC lists the application of the Howey Test in digital assets. We will analyze this in detail below:

The Investment of Money

Refers to investors investing money or assets in a project in exchange for certain rights or expected returns. In the field of digital assets, whether using fiat currency or cryptocurrency to purchase tokens, as long as there is a value exchange, it can usually be considered to meet this standard. Therefore, most token issuances basically meet this condition.

Common Enterprise

Common Enterprise refers to a close binding of interests between investors and issuers, usually manifested as a direct correlation between investors’ returns and project operating results. In a token project, if the return of token holders depends on the business development of the project party or the platform operation results, it meets the characteristics of a “common enterprise”, and this condition is also easier to establish in reality.

Reasonable Expectation of Profits Derived from Efforts of Others

This is the key to determining whether a token will be classified as a security token. This condition means that if the purpose of investors purchasing a product is to expect future product appreciation or other economic returns, and such returns do not come from their own use or business behavior, but rely on the overall development of the project created by the efforts of others, then such a product may be regarded as a “security”.

Specifically in the RWA project, if the purpose of investors buying tokens is to obtain future appreciation or economic returns, rather than the income from their own use or business operations, then the token may have "profit expectations", thereby triggering the determination of securities attributes. In particular, when the income of the token is highly dependent on the professional operation of the issuer or project team, such as liquidity design, ecological expansion, community building or cooperation with other platforms, this "dependence on the efforts of others" feature further strengthens its possibility of securitization.

RWA tokens with sustainable value in the true sense should be directly anchored to the real income generated by the underlying real assets, rather than relying on market hype, narrative packaging or platform premium to drive its value growth. If the value fluctuation of the token is mainly due to the "re-creation" of the team or platform behind it, rather than the income change of the asset itself, then it does not have the characteristics of "narrow RWA" and is more likely to be regarded as a security token.

The introduction of the Howey test by the US SEC in the regulation of crypto tokens means that it no longer relies on the form of tokens to determine its regulatory attitude, but turns to substantive review: focusing on the actual functions, issuance methods and investor expectations of tokens. This change marks that the legal positioning of US regulators on crypto assets has become stricter and more mature.

Second, what is the legal logic of the "compliance" stratification of RWA projects?

After talking about so many concepts and definitions of RWA, now we return to the core question raised at the beginning of the article, which is also the focus of general attention in the industry:

RWA has developed to this day. Which types of RWA can be considered as truly "compliant" RWA? How can we meet the compliance of RWA projects in practice?

First of all, we believe that compliance means being regulated by local regulators and complying with the provisions of the regulatory framework. In our understanding, the compliance of RWA is a tiered system.

First layer: Sandbox compliance

This specifically refers to the Ensemble Sandbox project designed by the Hong Kong Monetary Authority (HKMA), which is currently the narrowest and most regulatory pilot definition of "compliance". The Ensemble Sandbox encourages financial institutions and technology companies to explore technology and model innovations in tokenized applications through projects such as RWA in a controlled environment to support the digital Hong Kong dollar project led by it.

The Hong Kong Monetary Authority (HKMA) has shown great attention to the sovereignty of the future monetary system in promoting the central bank's digital Hong Kong dollar (e-HKD) and exploring the supervision of stablecoins. The game between the central bank's digital currency and stablecoins is essentially a redefinition and competition for "monetary sovereignty". The sandbox provides policy space and flexibility for project parties to a certain extent, which is conducive to promoting the exploratory practice of real assets on the chain.

At the same time, the HKMA is also actively guiding the development of tokenized assets, trying to expand their application in real-world scenarios such as payment, settlement, and financing under a compliance framework. Many technology and financial institutions, including Ant Group, are members of the sandbox community and participate in the construction of the digital asset ecosystem. Projects entering the regulatory sandbox, to a certain extent, mean that they have high compliance and policy recognition.

However, from the current situation, such projects are still in a closed operation state and have not yet entered the broad secondary market circulation stage, indicating that they still face practical challenges in asset liquidity and market connection. Without a stable funding mechanism and efficient secondary market support, it is difficult for the entire RWA token system to form a true economic closed loop.

Second layer: Hong Kong administrative regulatory compliance

As an international financial center, the Hong Kong Special Administrative Region has continued to promote institutional exploration in the field of virtual assets in recent years. As the first region in China to clearly promote the development of virtual assets, especially tokenized securities, Hong Kong has become a target market for many mainland project parties with its open, compliant and clear regulatory environment.

By combing through the relevant circulars and policy practices issued by the Hong Kong Securities and Futures Commission, it is not difficult to find that the core of Hong Kong's supervision of RWA is actually to include it in the framework of STO and then manage it in compliance. In addition, the Securities and Futures Commission has established a relatively complete virtual asset service provider (VASP) and virtual asset trading platform (VATP) licensing system, and is preparing to issue the second virtual asset policy declaration to further clarify the regulatory attitude and basic principles when virtual assets are combined with real assets. Under this institutional framework, tokenization projects involving real assets, especially RWA, have been included in the scope of higher-level compliance supervision.

From the perspective of the RWA projects that have been implemented in Hong Kong and have a certain market influence, most projects have clear securities attributes. This means that the tokens issued involve ownership, income rights or other transferable rights of real assets, which can constitute "securities" as defined under the Securities and Futures Ordinance. Therefore, such projects must be issued and circulated through security tokens (STO) in order to obtain regulatory approval and achieve compliant market participation.

In summary, Hong Kong’s regulatory positioning for RWA is relatively clear: all on-chain mappings of real assets with securities attributes should be included in the STO regulatory system. Therefore, we believe that the RWA development path currently promoted by Hong Kong is essentially the specific application and practice of the security tokenization (STO) path.

Third layer: clear regulatory framework in crypto-friendly regions

In some regions that are open to virtual assets and have relatively mature regulatory mechanisms, such as the United States, Singapore and some European countries, a relatively systematic compliance path has been established for the issuance, trading and custody of crypto assets and their mapped real assets. RWA projects in such regions can be regarded as compliant RWAs operating under a clear regulatory system if they can obtain relevant licenses in accordance with the law and comply with information disclosure and asset compliance requirements.

The fourth level: “pan-compliance”

This is the broadest form of compliance, as opposed to “non-compliance”. It refers specifically to RWA projects in specific offshore jurisdictions, where the government temporarily “let it go” on the virtual asset market, and has not been explicitly identified as illegal or illegal. Its business model has a certain degree of compliance space under the local current legal framework. Although the scope and concept of this compliance are relatively vague, and the degree does not constitute a complete legal confirmation, before legal supervision is clear, it belongs to the business state of “what is not prohibited by law can be done”.

In reality, we can observe that most RWA projects are actually difficult to achieve the first two types of compliance. Most projects choose to try the first three paths - that is, relying on the loose policies of some crypto-friendly jurisdictions, trying to bypass the sovereign regulatory boundaries and complete formal “compliance” at a lower cost.

Therefore, RWA projects appear to be continuously implemented “like dumplings”, but the time when they can really generate substantial financial value has not yet arrived. The fundamental turning point will depend on whether Hong Kong can explore the secondary market mechanism of RWA, especially how to open up the cross-border circulation channel of capital. If RWA transactions are still confined to the closed market for local retail investors in Hong Kong, asset liquidity and fund size will be extremely limited. To achieve a breakthrough, global investors must be allowed to invest funds in China-related assets through compliance mechanisms and indirectly "bottom-fish China" in the form of RWA.

The role played by Hong Kong here can be compared to the significance of Nasdaq to global technology stocks in the past. Once the regulatory mechanism is mature and the market structure is clear, the first stop for Chinese people who want to "go overseas" to find financing and foreigners who want to "bottom-fish" Chinese assets must be Hong Kong. This will not only be a regional policy dividend, but also a new starting point for the reconstruction of financial infrastructure and capital market logic.

In summary, we believe that the compliance of RWA projects should be done within the current scale, and all projects must maintain policy sensitivity. Once there is a legal adjustment, it must be adjusted urgently. In the context of the current supervision not being fully clear and the RWA ecosystem still in the exploratory stage, we strongly recommend that all project parties take the initiative to carry out "self-compliance" work. Although this means that more resources will be invested in the early stages of the project, and higher time and compliance costs will be incurred, in the long run, this will significantly reduce systemic risks in terms of law, operations, and even investor relations.

Among all potential risks, fundraising risk is undoubtedly the most lethal hidden danger to RWA. Once the project design is identified as illegal fundraising, whether the assets are real or the technology is advanced, it will face major legal consequences, posing a direct threat to the survival of the project itself, and a heavy blow to the assets and reputation of the company. In the development of RWA, the definition of compliance in different regions and different regulatory environments is bound to be different. For developers and institutions, it is necessary to combine their own business types, asset attributes and regulatory policies of the target market to formulate detailed phased compliance strategies. Only on the premise of ensuring that risks are controllable can the implementation of RWA projects be steadily promoted.

III. Lawyer's advice on RWA projects

In summary, as a team of lawyers, we systematically sort out the core links that need to be paid attention to in the process of promoting the entire chain of RWA projects from a compliance perspective.

1. Choose a policy-friendly jurisdiction

Under the current global regulatory landscape, the compliance promotion of RWA projects should give priority to jurisdictions with clear policies, mature regulatory systems, and an open attitude towards virtual assets, which can effectively reduce the uncertainty of compliance.

2. The underlying assets must have real redemption capabilities

No matter how complex the technical architecture is, the essence of the RWA project is still to map the rights of real assets to the chain. Therefore, the authenticity of the underlying assets, the rationality of valuation, and the enforceability of the redemption mechanism are all core factors that determine the credibility and market acceptance of the project.

3. Obtain investor recognition

The core of RWA lies in asset mapping and rights confirmation. Therefore, whether the final buyer or user of the off-chain assets recognizes the rights represented by the on-chain tokens is the key to the success or failure of the project. This not only involves the personal wishes of investors, but is also closely related to the legal attributes of the tokens and the clarity of rights.

While promoting the compliance process, the RWA project must also face up to another core issue: investors must be informed. In reality, many projects package risks with complex structures and do not clearly disclose the underlying asset status or token model logic, which leads to investors participating in them without full understanding. Once fluctuations or risk events occur, it will not only cause a crisis of market trust, but also may attract regulatory attention, making things more difficult to handle.

Therefore, it is crucial to establish a clear investor screening and education mechanism. RWA projects should not be open to all groups, but should consciously introduce mature investors with certain risk tolerance and financial understanding. In the early stages of the project, it is especially necessary to set certain thresholds, such as professional investor certification mechanisms, participation quota restrictions, risk disclosure briefings, etc., to ensure that entrants are "informed and voluntary" and truly understand the asset logic, compliance boundaries and market liquidity risks behind the project.

4. Ensure that institutional operations in the chain comply with regulations

In the entire RWA process, it often involves multiple links such as fundraising, custody, valuation, tax processing, and cross-border compliance. Each link corresponds to the regulatory agencies and compliance requirements in reality. The project party needs to complete compliance declaration and regulatory docking under the relevant legal framework to reduce legal risks. For example, in the part involving fund raising, special attention should be paid to whether compliance obligations in securities issuance, anti-money laundering, etc. are triggered.

5. Preventing post-compliance risks

Compliance is not a one-time behavior. After the RWA project is implemented, it needs to continue to face changes in the dynamic regulatory environment. How to prevent potential administrative investigations or compliance accountability in the post-event dimension is an important guarantee for the sustainable development of the project. It is recommended that the project party set up a professional compliance team and maintain a communication mechanism with the regulatory agency.

6. Brand reputation management

In the virtual asset industry, where information dissemination is highly sensitive, RWA projects also need to pay attention to public opinion management and market communication strategies. Building a transparent, credible and professional project image will help enhance the trust of the public and regulators and create a good external environment for long-term development.

Fourth, Conclusion

In the process of virtual assets and real economy constantly merging, various RWA projects have different intentions and mechanisms, including both technological innovation and financial experiments. The capabilities, professionalism and practice paths of different projects vary greatly, which deserves our study and classification observation one by one.

In the process of extensive research and project participation, we also deeply realized that for market participants, the biggest challenge is often not at the technical level, but in the uncertainty of the system, especially the unstable factors in administrative and judicial practice. Therefore, what we need more is to explore the "practical standards" - even if we do not have the power of legislation and supervision, it is still valuable to promote the formation of industry standardization and compliance in practice. As long as there are more participants, the path is mature, and the regulatory authorities have established sufficient management experience, the system will gradually improve. Under the framework of the rule of law, promoting cognitive consensus through practice and promoting institutional evolution through consensus is a kind of "bottom-up" benign institutional evolution for society.

But we must also keep the compliance alarm bell ringing. Respecting the existing judicial and regulatory framework is the basic premise of all innovative behaviors. No matter how the industry develops or how the technology evolves, the law is always the bottom line logic to protect market order and public interests.

Special statement: This article only represents the personal views of the author and does not constitute legal advice or legal opinions on specific matters.

Weatherly

Weatherly