Author: David C, Bankless; Translator: Deng Tong, Golden Finance

Investing in stablecoins or Solana’s native liquidity staking tokens may not be as exciting as searching for the next breakout token, but can provide a reliable way to make money.

Stablecoins provide price stability, while LST allows you to earn basic staking rewards while maintaining liquidity.Through DeFi platforms such as Kamino, Drift, and Save (formerly Solend), you can put your stablecoins and LST to work to increase your returns through yield farming strategies.

Whether you prefer passive, low-risk returns or are willing to take on higher risks for greater rewards, this article breaks down the best yield opportunities for leading stablecoins like USDC and PYUSD, as well as Solana’s leading LST, to help you find the best match for your risk profile.

USD Stablecoins

Stablecoins on Solana have seen explosive growth in this market cycle. While USDC dominates on the chain, a unique phenomenon compared to Tether’s USDT, Paypal’s PYUSD has experienced explosive growth following its recent launch, fueled by rewards from DeFi protocols.

These stablecoins offer a relatively low-risk option for yield farming when used in DeFi protocols like Kamino, Drift, and Save (formerly Solend). Whether you’re looking for a steady income or a higher risk-reward option, these assets are a must-have for those aiming to hedge against market volatility and earn a steady return.

USDC

Kamino

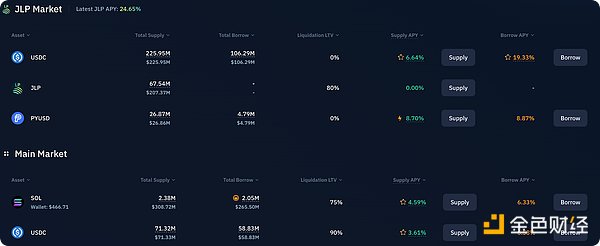

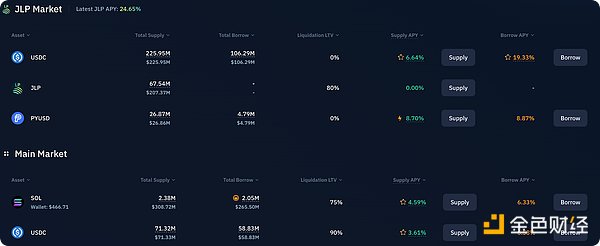

Kamino Finance offers a variety of yield options for USDC holders, with its main pool vault currently offering an annualized interest rate of approximately 3.5%, which is lower than its historical 6-9% range, but still reliable for passive, low-risk returns. For higher yields, Kamino's altcoin pool offers an annual interest rate of about 7.5% on USDC, and the JLP (Jupiter Liquidity Provider) pool offers an annual interest rate of about 6.6%. Its concentrated liquidity strategy makes it an ideal choice for users who want to balance risk and higher returns.

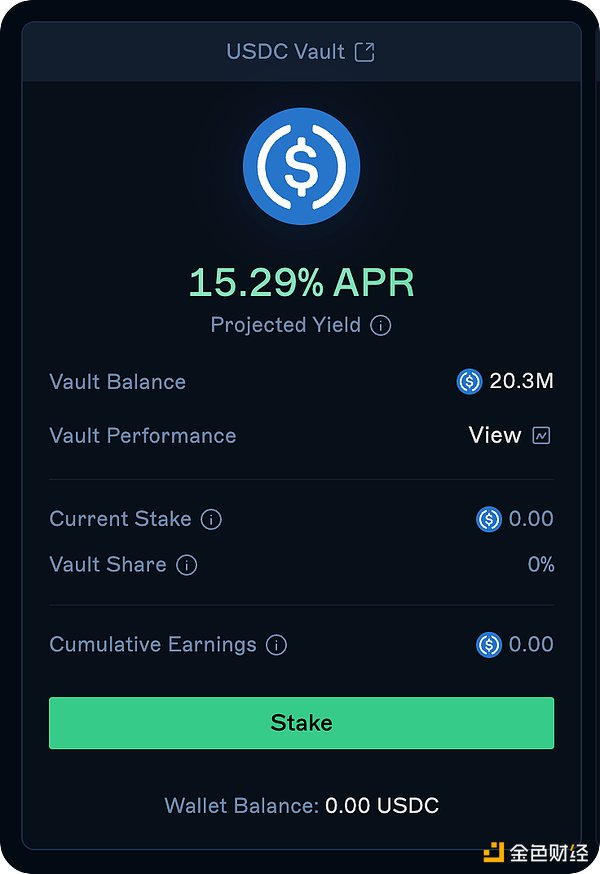

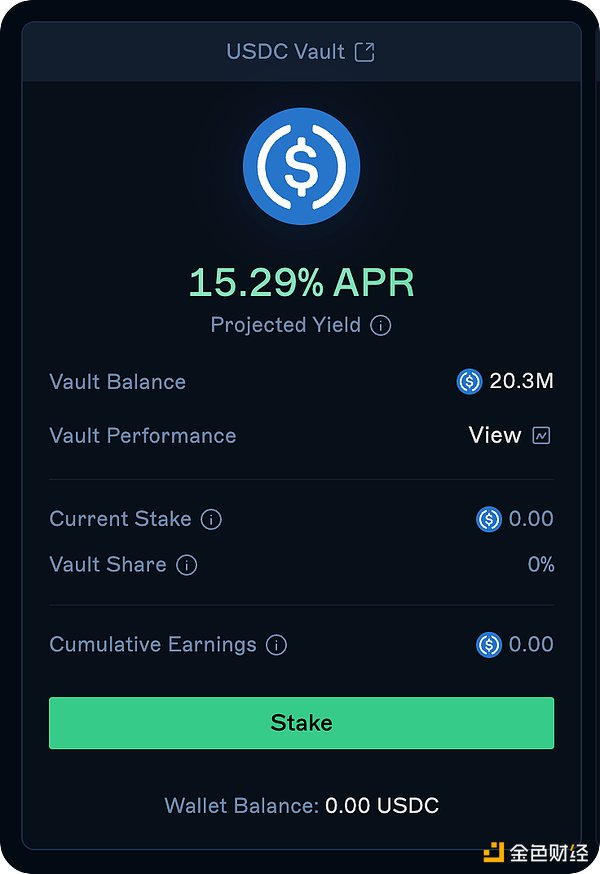

Drift

The trading protocol Drift also allows users to earn yield by lending USDC. Although the yields here are modest, around 3-4%, which is far lower than previous highs, they provide a stable, low-risk opportunity for those who are not seeking aggressive risk. Additionally, Drift’s insurance fund offers a much higher yield, currently around 15%, from fee income from trading, borrowing, and liquidation, but carries greater risk as it acts as a backstop for the protocol to remain solvent.

Save

Algorithmic lending platform Save offers 4-5% annual interest on USDC lending in its main pool. The platform also has other permissionless pools that are not deployed by the protocol, such as its JLP/SOL/USDC pool, which currently offers an annual interest rate of 8.5% for those willing to participate in riskier liquidity strategies.

PYUSD

Kamino

PYUSD is a new entrant into the Solana ecosystem, but it has quickly gained momentum thanks to Kamino’s aggressive yield strategy. While the initial yield was as high as 30%, it has since stabilized at around 7%, the highest of the Kamino main pool stablecoins. Kamino has also just included PYUSD in the JLP (Jupiter Liquidity Provider) pool, which has a higher yield than its main treasury, at around 8.5%.

Drift

Drift lending vaults offer slightly higher yields of around 10%, making the platform an attractive option for PYUSD. Additionally, in its insurance fund, Drift offers an annual interest rate of around 18.5%, but keep in mind that this comes with a higher risk.

Save

Save's PYUSD main pool yield is currently around 12% and appears to have increased recently, while Drift and Kamino's yields are declining. If this trend continues, Save may be the best platform for users who want to use PYUSD without taking on additional risk.

LST Yields

Liquidity Staking Tokens (LSTs) are an important part of Solana’s staking economy, allowing users to stake SOL while retaining liquidity for use in the broader DeFi ecosystem. The three largest LSTs on Solana by market cap — JitoSOL from MEV-enhanced liquidity staker Jito, mSOL from prominent Marinade Finance, and JupSOL from Jupiter Exchange in partnership with Sanctum — offer base yields on staking rewards of ~7.5%, ~8.12%, and ~8%, respectively, with additional opportunities to amplify these returns through DeFi, particularly on Kamino.

For each of these LSTs, additional yields can be earned through Kamino’s Main Vault or Leveraged Yield Strategy. The Main Vault provides passive returns on top of base staking rewards, while the Leveraged Yield Strategy offers higher returns for those willing to take on more risk.

JitoSOL

Main Vault Yield

Kamino’s Main Vault for JitoSOL offers a modest yield of 0.04%, adding passive income to base staking rewards. This option is suitable for those seeking stable, low-maintenance returns.

Leveraged Yield

For users looking to maximize yields, Kamino’s Leveraged Yield option for JitoSOL offers higher yields, currently up to 10.5%. The strategy uses leverage to amplify returns, but if these derivative assets decouple, risk increases compared to just holding LST.

mSOL

Main Treasury Yield

Kamino's mSOL Main Treasury offers a 0.11% yield, slightly enhancing the base staking rewards with passive DeFi returns. This vault is perfect for earning extra income while holding mSOL for the long term.

Leveraged Yield

For those who are not afraid of risk and want to increase returns, Kamino's leveraged staking strategy for mSOL can push the yield up to about 14.5%.

JupSOL

Main Treasury Yield

JupSOL on Kamino’s main treasury yields 0.02%, providing a small additional return on top of the base staking rewards. While the yield is low, it provides a steady source of passive income for JupSOL holders who want to sleep easy at night.

Leveraged Yield

Kamino’s leveraged JupSOL pool has the highest yield at around 14.7%. By leveraging staked JupSOL in DeFi, users can earn impressive returns, a strategy that is ideal for those who want to maximize staking yields while taking on higher risk.

Summary

In summary, stablecoins and LST on Solana offer a variety of yield farming opportunities, allowing users to grow the most mature or stable assets based on their risk tolerance.

PYUSD currently offers the highest yield opportunities among stablecoins, especially on platforms such as Drift, with APYs as high as about 18%. In terms of liquidity staking, JupSOL and mSOL currently have the highest leverage yields at around 15%, offering impressive returns for those willing to take on the risk of utilizing a leveraged strategy. Be sure to monitor these vaults, though, as their yields can fluctuate regularly.

Whether you choose a lower-risk stablecoin vault or a riskier LST farming strategy, there are plenty of opportunities to invest your assets in Solana’s DeFi ecosystem.

Weatherly

Weatherly