Author: francesco, Castle Capital; Translation: 0xxz@金财经

Rehypothecation seems to be considered by many to be one of the main narratives of 2024.

However, while many people talk about how remortgaging works and its benefits, it is not all rosy.

This article aims to take a step back and analyze restaking from a higher level, highlighting the risks and answering the question: Is it really worth it?

Let’s start with a quick introduction to this topic:

What is re-staking?

Ethereum’s Proof of Stake (PoS) is a decentralized trust mechanism in which participants can pledge their pledges to protect the security of the Ethereum network.

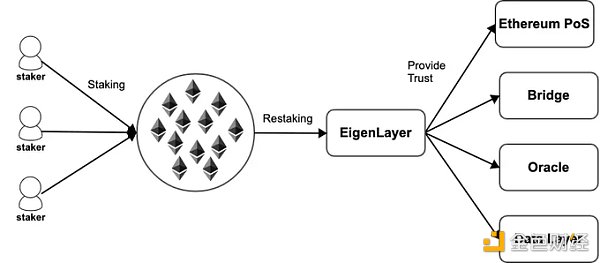

The idea of restaking is that the same staking used to secure Ethereum PoS can now be used to secure many other networks.

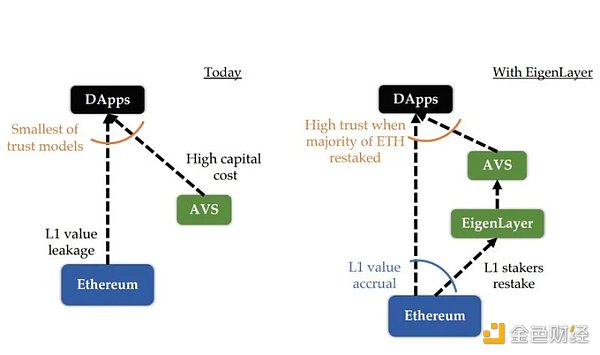

EigenLayer is "modularizing" Ethereum's decentralization ize trust so that AVS (actively validated services) can take advantage of it without having to launch their validator set, effectively lowering the barrier to entry into this market.

EigenLayer is "modularizing" Ethereum's decentralization ize trust so that AVS (actively validated services) can take advantage of it without having to launch their validator set, effectively lowering the barrier to entry into this market.

Typically, such modules require actively validating services that have their own distributed validation semantics for validation. Typically, these Actively Verified Services (“AVS”) are either secured by their own native tokens or are permissioned in nature.

< /p>

< /p>

Why do people stake again?

Simply put, it’s because of financial incentives and benefits. If Ethereum staking yields hover around 5% per year, restaking could provide attractive additional benefits.

However, this creates additional risks for stakers.

In addition to the inherent risks of leveraging staked ETH, when a user chooses to re-stake your tokens, they are essentially entrusting the EigenLayer contract to errors, double signatures, etc. on any AVS they secure The power to punish its pledge.

Rehypothecation therefore adds a layer of risk, as the rehypothecater may be penalized on the ETH, the rehypothecation layer, or both.

Is the extra income worth staking again?

R(isk)-Staking-Re-staking adds some significant risks

• ETH must be staked (or LST - therefore not liquid)

• EigenLayer smart contract risk

• Protocol-specific penalty conditions

• Liquidity risk

• Concentration Risk

In the words of ChainLinkGod: “A liquid rehypothecation token backed by liquid mortgage tokens deposited in a rehypothecation protocol that rehypothecates pledged ETH. This has It’s getting pretty serious, can we add another layer of liquidity and risk here? I don’t think we’re doing enough.”

In fact, by rehypothecating, users are taking advantage of tokens that are already exposed to risk. coins (due to staking) and adding additional risk on top of it, ultimately resulting in layered risk as follows:

In addition, any additional primitive development will add more complexity and additional risks.

In addition, any additional primitive development will add more complexity and additional risks.

In addition to the personal risk of re-staking, the Ethereum developer community has also raised questions about re-staking, especially in the famous Vitalik’s article on “Don’t overload the Ethereum consensus”.

The problem with re-staking is that it opens up new avenues of risk for protecting mainnet-staked Ethereum, some of which it destined to protect other chains (opted in by stakers).

So if they misbehave under other protocol rules (perhaps bugs or weak security), their deposits will be slashed.

The debate is very practical, with developers and EigenLayer trying to find a way to coordinate efforts and ensure that Ethereum is not penalized for these technological advancements.

Repurposing the most important "layer" that protects Ethereum's security is indeed not an easy task. Additionally, a key aspect of this is the level of risk management allowed to rehypothecaters.

Many re-pledge projects leave the whitelisting process of AVS to their DAO.

However, as a restaker, I would like to personally review and decide which AVS to restake to avoid being attacked by malicious cyberattacks and reduce the possibility of new attack vectors!

All in all, rehypothecation is an interesting new primitive worth investigating.

Still, the concerns of Vitalik and others cannot be ignored. When talking about rehypothecation, it’s important to remember how this will impact the security model of the Ethereum mainnet: in fact, it’s fair to think of rehypothecation as providing an extra level of risk on top of one of the most important mechanisms for protecting Ethereum. of.

Ultimately, whether it is worth staking again is a personal choice.

Institutional Re-Staking

Perhaps surprisingly, many institutions have expressed interest in re-staking to receive additional rewards on top of staking Ether.

Given the risks highlighted previously, it will be interesting to see whether it depends on retail investors or institutions being able to get the highest interest rates on rehypothecations.

The additional benefits beyond native Eth staking are attractive to those already involved, but given the risks, this is not a life-changing benefit for degen.

This opens up new use cases for Ethereum as a financial instrument.

A particularly interesting comparison can be made between rehypothecation applications and "corporate bonds".

The new network hopes to achieve L1 security, similar to how a company or nation-state uses its financial system to create bonds and protect its assets.

In the cryptocurrency space, Ethereum is the broadest and most liquid network, and probably the only one capable of sustaining such a market - from a similar perspective to countries in the TradFi economy, It is also the most secure network.

Nonetheless, much of the current interest in rehypothecation appears to be driven by the Eigenlayer airdrop, which may be a crypto The largest airdrop in currency history.

How will the dynamics change after the airdrop?

Perhaps actual r/r analysis might push some people toward other, potentially more fruitful, avenues.

I even think that a large part of the capital deposited and remortgaged is employment capital, which may leave after the airdrop.

Separating the speculative part is crucial to assess the true interest of users in this new primitive.

Personally, IMHO, the claims of remortgage are somewhat exaggerated and the current risks must be carefully assessed.

What can we do to mitigate these risks?

Some solutions to mitigate rehypothecation risk include optimizing rehypothecation parameters (TVL cap, penalty amount, fee allocation, minimum TVL, etc.) and ensuring diversification of funds among AVS.

One immediate step that rehypothecation protocols could consider is allowing users to choose different risk profiles when rehypothecating their deposits.

Ideally, each user should be able to evaluate and select AVS to re-stake without having to delegate the process to a DAO .

This is a joint effort between AVS and EigenLayer to ensure there is a roadmap to minimize these risks.

The EigenLayer team has worked with the Ethereum Foundation to further coordinate and ensure that rehypothecation does not add systemic risk to Ethereum, the Liquid Stake token, or the AVS that utilizes it.

Anais

Anais

Anais

Anais Weatherly

Weatherly Anais

Anais Weatherly

Weatherly Anais

Anais Weatherly

Weatherly Anais

Anais Weatherly

Weatherly Joy

Joy Weatherly

Weatherly