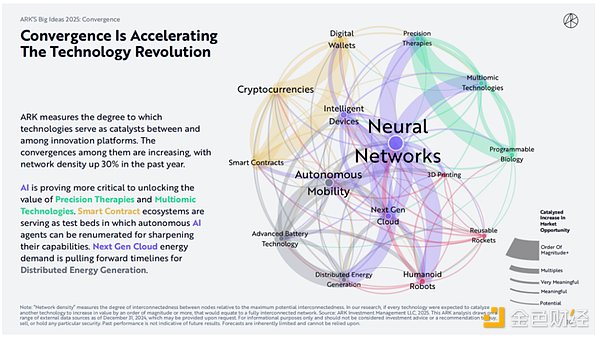

As we stand on the cusp of an unprecedented new era of growth,ARK Invest’s “Big Ideas for 2025” illuminates the complex convergence of five technology-enabled innovation platforms evolving today: artificial intelligence, robotics, energy storage, public blockchain, and multi-omics sequencing. These platforms are driving exponential progress across industries and catalyzing a step-change in global economic growth.

ARK Invest’s 2025 report presents 11 big ideas that illustrate the dramatic changes taking place today that are expected to dramatically increase productivity, revolutionize industries, and create long-term investment opportunities with profound impacts on investors, businesses, and society as a whole.

As a result, we have sorted out the sections of the 2025 report on AI Agents, stablecoins, and public blockchains to present a way of looking at such issues from the perspective of a Wall Street fund. This perspective allows us to get rid of the current PVP status of the crypto market and look at the real utility and future trends of innovative AI Agents, stablecoins, and public blockchains from a more traditional and universal perspective.

Take Aways:

AI Agent will change the logic of people's search and shopping, and will be carried by digital wallets;

Digital wallets can further integrate the savings, lending, insurance, investment, consumption and other functions in traditional banking financial services. Through the AI Agent innovation paradigm, the value chain of global e-commerce and digital consumption of downstream platforms can be moved upstream;

Combined with the utility of AI, the valuation of digital wallet companies will be improved. Importantly, the digital wallet here can not only cover the vast existing user base of Web2 and form a closed loop of value through AI Agent, but also seamlessly access the innovative applications of Web3 to bring greater economic benefits to users;

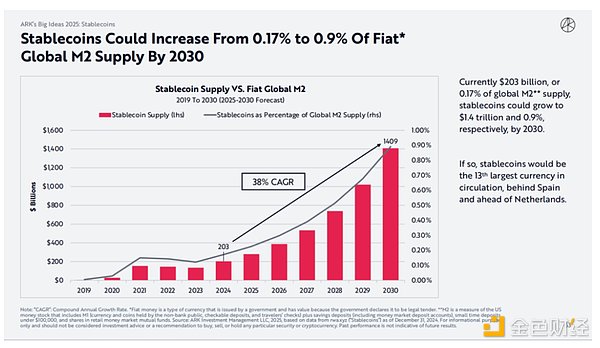

The annual transaction volume of stablecoins is close to that of Visa and Mastercard, and its supply and the number of active stablecoin addresses hit a record high in 2024;

Innovations around blockchain-based stablecoins will emerge in an endless stream and become one of the important ways to export US dollars. It is estimated that by 2030, the market value of stablecoins may grow to 1.4 trillion US dollars;

In this field, with the continuous improvement of innovative financial infrastructure and its integration with traditional financial infrastructure, coupled with the help of AI, we will inevitably see more investment and mergers and acquisitions from the traditional financial level.

1. Five major innovation platforms accelerate economic growth

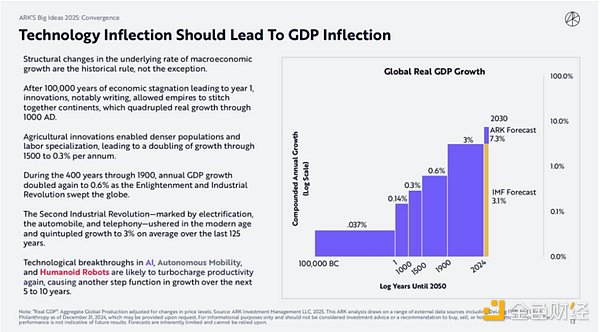

The change in macroeconomic growth conforms to historical laws. After 100,000 years of economic stagnation since the beginning of human history, innovation (especially writing) enabled empires to connect continents, quadrupling the real growth rate by 1000 AD. Thereafter, agricultural innovations increased population density and specialized labor, leading to a doubling of growth in 1500 to 0.3% per year.

In the 400 years before 1900, as the Enlightenment and the Industrial Revolution swept the world, annual GDP growth doubled again to 0.6%. Then, the Second Industrial Revolution, marked by electrification, cars, and telephones, ushered in modernization and quintupled growth rates to an average of 3% over the past 125 years.

Today, technological breakthroughs in artificial intelligence and smart robots may once again increase productivity and drive economic growth to another level in the next 5 to 10 years. By 2030, ARK Invest expects growth to reach 7.3%, compared with the IMF's 3.1%.

Public Blockchains

After mass adoption, all currencies and contracts may migrate to public blockchains, enabling verification of scarcity and proof of ownership of digital assets. The traditional financial system may reconfigure assets to accommodate the rise of cryptocurrencies and smart contracts. These technologies increase transparency, reduce the impact of capital and regulatory controls, and reduce the cost of contract execution.

In such a world, as more assets are more easily monetized, and businesses and consumers gradually adapt to the new financial infrastructure, digital wallets that hold everyone's assets will become increasingly important.

AI

As data evolves, AI computing systems and software can solve tough problems, automate knowledge work, and accelerate the integration of AI technologies into every economic sector. The adoption of neural networks should be more important than electrification and could create tens of trillions of dollars in value. At scale, these systems will require unprecedented computing resources, and AI-specific computing hardware will dominate the next generation of cloud data centers that train and operate AI models.

The potential for end users is obvious: AI-driven fleets of smart devices will permeate people's lives, changing the way they consume, work, and play. The adoption of AI should transform every industry, impact every business, and catalyze every innovation platform.

II. AI Agent redefines consumer interaction and enterprise work processes

AI Agent understands intent through natural language, uses reasoning and appropriate context for planning, uses tools to take actions to achieve intent, and improves through iteration and continuous learning. With the birth of smarter AI models, AI Agents will use more and more complex tools to complete higher-value tasks.

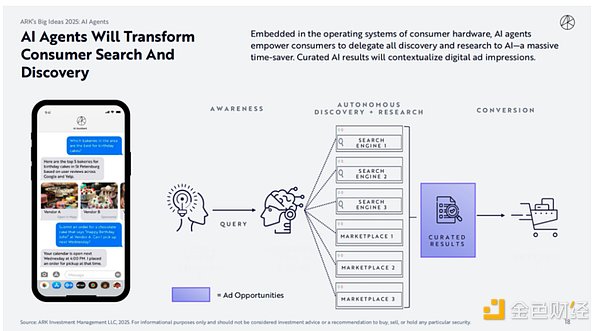

AI Agent will accelerate the adoption of more digital applications and bring about an epoch-making change in human-computer interaction. Whether it is hardware sales or software subscriptions, the combination of AI Agent and it will promote the large-scale application of AI. For example, embedding AI Agent in the operating system of consumer-grade hardware will enable consumers to entrust all discovery and research to AI, saving a lot of time.

2.1 AI Agent will change people's search and shopping logic

AI Agent may become the entrance to personal search. If search turns to personal AI Agent, its advertising revenue may surge. By 2030, ARK Invest believes that AI advertising revenue may account for more than 54% of the $1.1 trillion digital advertising market, directly grabbing market share from traditional search giants such as Google.

Digital advertising. Carefully curated AI feedback results will provide opportunities for digital advertising. If the search business shifts to personal AI agents, AI agent advertising revenues could surge. ARK Invest believes that by 2030, AI advertising revenues will account for more than 54% of the $1.1 trillion digital advertising market.

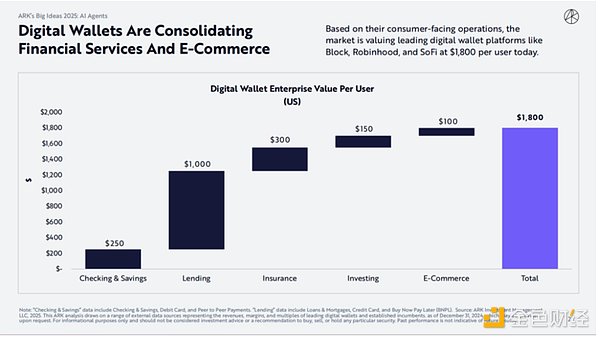

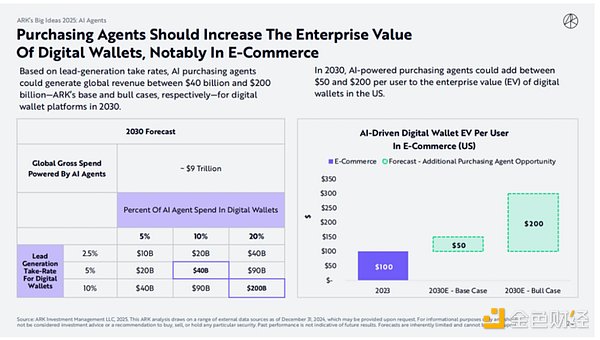

Online consumption. By 2030, AI Agent shopping volume could approach 25% of the global online shopping reach. Consumers using AI agents in shopping will simplify product discovery, provide personalized solutions, and facilitate purchases. ARK Invest's research shows that by 2030, AI agents can promote nearly $9 trillion in total online consumption worldwide. ARK Invest research shows that digital wallets authorized by AI Agents will take share from traditional payment methods such as credit and debit cards, and may account for 72% of all e-commerce transactions by 2030. Digital wallets are integrating financial services and e-commerce. Based on their consumer-facing businesses, the market values leading digital wallet platforms such as Block, Robinhood, and SoFi at $1,800 per user.

In addition to the ability of digital wallets to integrate traditional banking financial services such as savings, lending, insurance, investment, and consumption, with the help of the AI Agent innovation paradigm, digital wallets can take over the value chain of global e-commerce and digital consumption on downstream platforms, thereby moving the value chain upstream.

As a result, the previous "one-click checkout" model of e-commerce platforms such as Amazon may give way to the "query once and buy" model of AI Agent wallets.

2.3 The valuations of digital wallet companies will be improved

Based on the lead generation rate and the impact of the AI Agent innovation paradigm, by 2030, AI Agent could generate $40 billion to $200 billion in global revenue for digital wallet platforms (ARK’s base case and optimistic case, respectively). By 2030, AI Agents could add $50 to $200 in enterprise value (EV) to each user of digital wallets in the U.S.

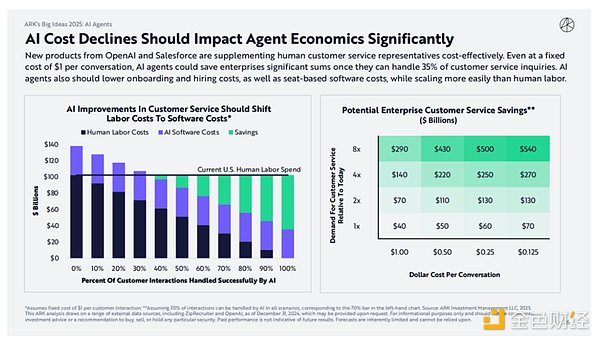

For internal cost reduction and efficiency improvement, companies deploying AI Agents should be able to increase the number of units while keeping the workforce unchanged and/or optimize the workforce for higher-value activities. As artificial intelligence develops, AI Agents may handle a higher proportion of workloads and complete higher-value tasks independently.

At the same time, as the cost of AI decreases, more and more low-priced and efficient AI Agent products will emerge. New products from OpenAI and Salesforce are supplementing human customer service representatives in a cost-effective way. Even if the fixed cost of each conversation is $1, as long as AI agents can handle 35% of customer service inquiries, it can save companies a lot of money. AI agents should also reduce onboarding and recruitment costs and seat-based software costs, while being easier to scale than manual labor.

3. Stablecoins reshape the digital asset field

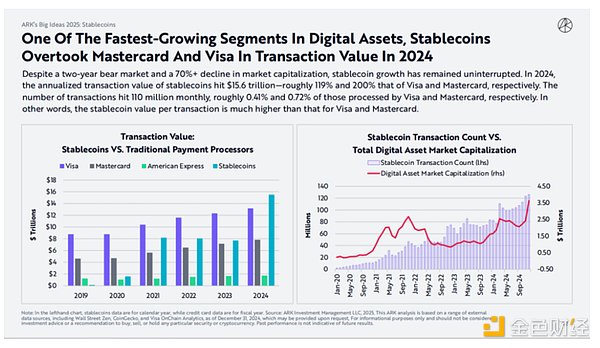

3.1 Stablecoin transaction volume is close to Visa and Mastercard

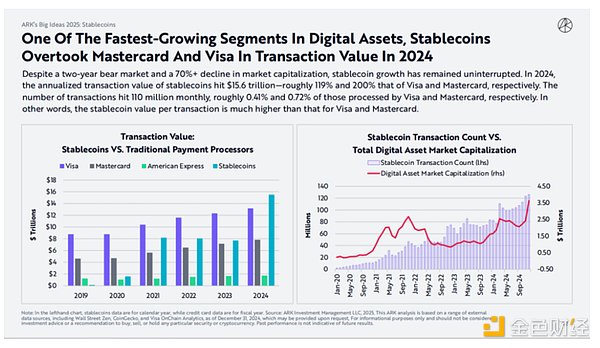

According to a report by ARK Invest, in 2024, the annualized transaction volume of stablecoins will reach 15.6 trillion US dollars, which is approximately 119% and 200% of Visa and Mastercard respectively. The monthly transaction volume reached 110 million, accounting for about 0.41% and 0.72% of the transactions processed by Visa and Mastercard. In other words, the value of stablecoins per transaction is much higher than Visa and Mastercard.

(visaonchainanalytics.com/transactions)

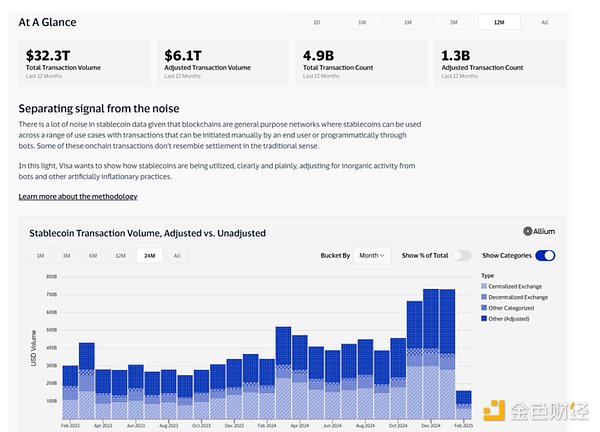

Since stablecoins can be used for a variety of use cases and transactions can be initiated manually by end users or programmatically through bots, there is a lot of noise in the stablecoin data. Therefore, Visa adjusts the data of stablecoins to remove inorganic activities of adaptation robots and other artificial inflation behaviors.

According to Visa Onchain Analytics Dashboard: Overvie, the adjusted annualized transaction volume of stablecoins in 2024 reached 5.62 trillion US dollars. We analyze it based on the data of the first 12 months as of February 2025:

Original data:

The annualized transaction volume of stablecoins is 32.3 trillion US dollars, with a total of 4.9 billion transactions and a transaction volume of 6,592 US dollars per transaction. Corresponding to the total amount of 200 billion stablecoins, the capital turnover rate is 161.5.

Adjusted data (excluding robot operations and high-frequency data behaviors):

The annualized transaction volume of stablecoins is 6.1 trillion US dollars, totaling 1.3 billion transactions, with each transaction amounting to 4,692 US dollars. Corresponding to the total volume of 200 billion stablecoins, the capital turnover rate is 30.5.

Therefore, according to Visa's data, the adjusted stablecoin transaction volume is close to Mastercard's annual transaction volume level, and the value of each transaction is higher.

(If the data is wrong or there are other statistical calibers, please communicate and correct it)

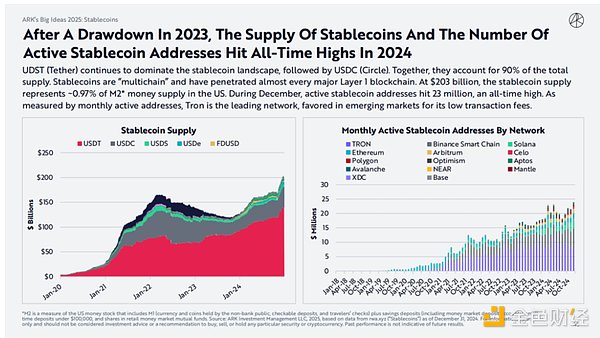

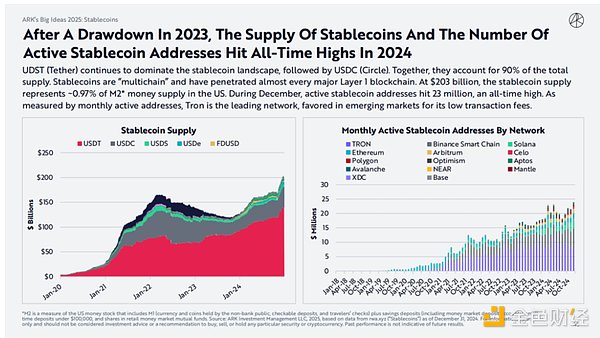

3.2 The supply of stablecoins and the number of active stablecoin addresses hit a record high in 2024

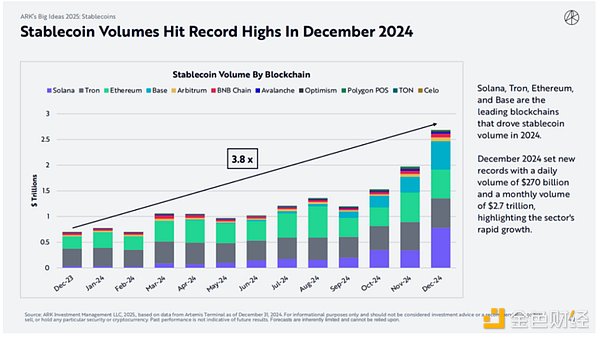

Although there are differences in data statistics, the overall market value of stablecoins has exceeded 2000 $270 billion and maintains a continuous upward trend. Solana, Tron, Ethereum, and Base are the leading blockchains driving stablecoin transaction volume growth in 2024. December 2024 set new records with daily transaction volume of $270 billion and monthly transaction volume of $2.7 trillion, highlighting the rapid growth of the industry.

After the decline in 2023, UDST (Tether) continues to dominate the stablecoin field, followed by USDC (Circle). Together, they account for 90% of the total supply. Multi-chain stablecoins have penetrated almost all major L1 blockchains. The current stablecoin supply is $203 billion, accounting for about 0.97% of the US M2* money supply. In December 2024, active stablecoin addresses reached 23 million, a record high. Tron is the leading network measured by monthly active addresses and is favored by emerging markets for its low transaction fees.

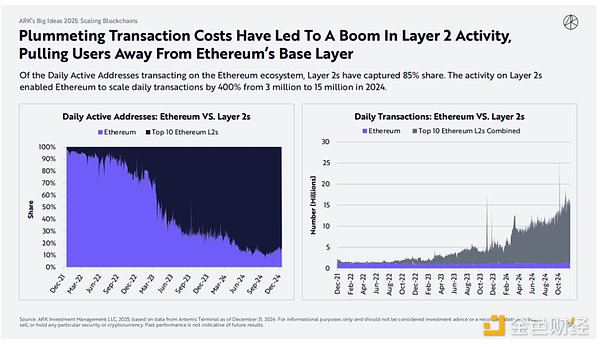

L2 blockchains are attracting the interest of retail investors due to their lower costs and higher efficiency. Retail investors are flocking to Layer 2 for cheaper and more convenient stablecoin transactions, increasing the market share of blockchains such as Arbitrum, Base, and Optimism. Meanwhile, whales and institutions continue to operate on Ethereum's base layer. Transactions below $100 dominate on Base and Optimism, while transactions above $100 dominate on Ethereum's base layer.

3.3 Peer-to-peer trading and personal wallet storage dominate stablecoin use cases

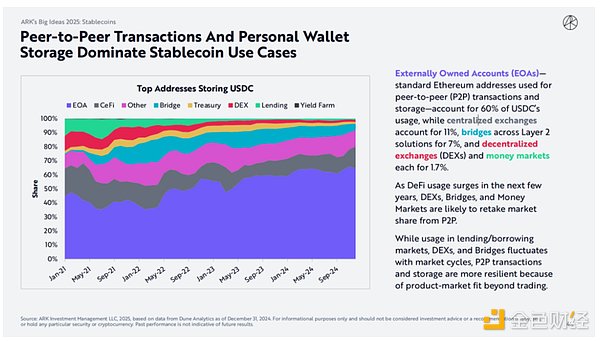

EOA wallets—standard Ethereum addresses for peer-to-peer (P2P) trading and asset storage—account for 60% of USDC usage, while centralized exchanges account for 11%, cross-chain bridge L2 solutions account for 7%, and decentralized exchanges (DEX) and money markets account for 1.7% each.

As DeFi usage surges in the coming years, DEXs, cross-chain bridges, and money markets may take back market share from P2P. While the usage of lending markets, DEXs, and cross-chain bridges fluctuates with market cycles, P2P trading and storage are more resilient because there is more product-market fit beyond trading.

3.4 Four Stablecoin Issuers Dominate Stablecoin Revenue

Tether, which has fewer than 200 employees, reported $5.2 billion in profits in the first half of 2024, including USDT, other products and services, and unrealized gains on its digital assets - clearly one of the most capital-efficient businesses in history. Tether (USDT) and Circle (USDC) account for 60% of the revenue generated by the top five networks and applications. Overall, stablecoins USDT, USDC, DAI/USDS and USDE generated $3.35 billion in revenue in the second half of 2024, or $6.7 billion on an annualized basis. Circle and Tether have been generating billions of dollars in revenue from treasuries and other securities used as collateral for their stablecoins. However, in 2024, in response to competition and demand, Yield Bearing Stablecoina operating outside the United States began to pass on a significant portion of their interest income to users. Circle and Tether are unlikely to follow this trend unless absolutely necessary. Although still small in size, yield-bearing stablecoins are the fastest growing category in the stablecoin market.

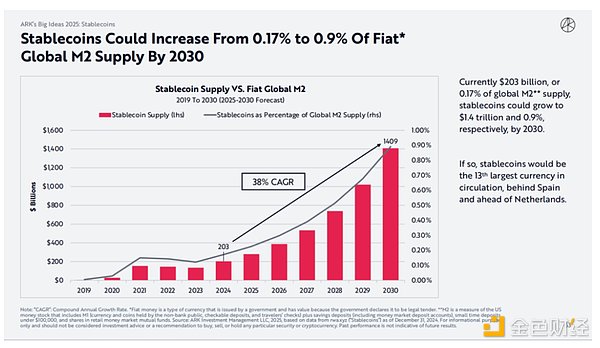

3.5 Stablecoins will accelerate growth and digest US debt

To balance "de-dollarization", stablecoins are increasing the demand for US government debt as collateral. In a world moving towards deglobalization and de-dollarization, stablecoins may drive stable demand for US Treasuries. As of December 2024, Tether and Circle have become the 20th largest holders of US Treasuries. In populous emerging markets such as Brazil, Nigeria, Turkey, Indonesia, and India, individuals and companies are adopting stablecoins as a store of value, means of payment, and cross-border currency. Stablecoins may become one of the most effective ways to export dollars. The current market value of stablecoins is $203 billion, accounting for 0.17% of the global M2** supply. By 2030, the market value of stablecoins may grow to $1.4 trillion and 0.9%, respectively. If so, the stablecoin would become the 13th largest currency in circulation, just behind Spain and ahead of the Netherlands.

Fourth, public blockchain and smart contracts: reducing costs and creating new use cases at the application layer

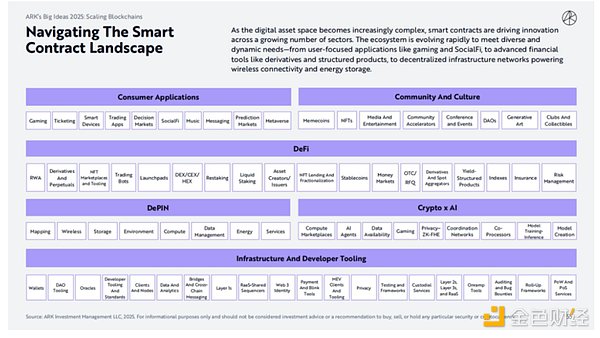

As the digital asset space becomes more complex, smart contracts are driving innovation in more and more industries. The ecosystem is rapidly evolving to meet diverse and dynamic needs - from user-centric applications such as games and SocialFi, to advanced financial instruments such as derivatives and structured products, to decentralized infrastructure networks that power wireless connectivity and energy storage.

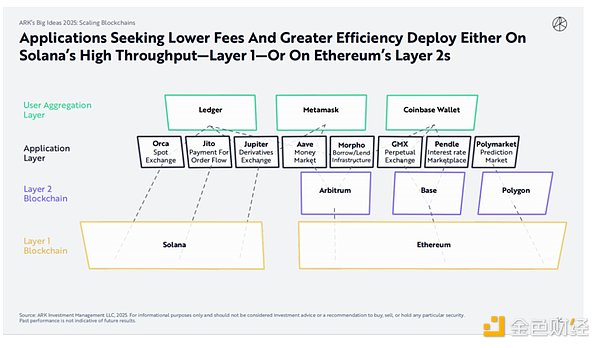

These technology stacks all need to seek a lower-cost and more efficient blockchain for deployment. This has resulted in two current patterns in the market, either deployed on Solana's high-throughput L1 or deployed on Ethereum's L2.

4.1 The Ethereum ecosystem is shifting to L2

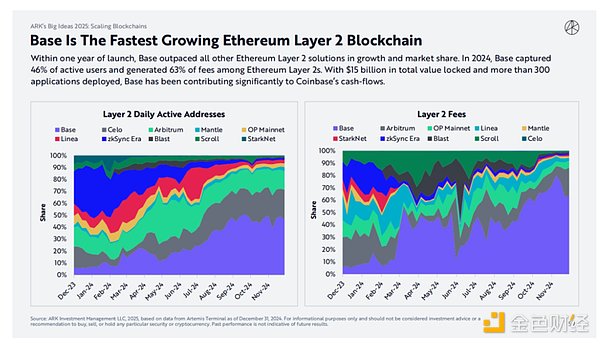

The sharp drop in transaction costs has led to a surge in L2 activity, pulling users away from Ethereum's base layer. L2 accounts for 85% of the daily active addresses conducting transactions in the Ethereum ecosystem. Activity on L2 has increased Ethereum’s daily transaction volume by 400% from 3 million to 15 million in 2024.

Among them, Base is the fastest growing Ethereum L2 blockchain. Within a year of its launch, Base surpassed all other Ethereum L2 solutions in growth and market share. In 2024, Base accounted for 46% of active users and generated 63% of fees in Ethereum L2. Base TVL is $15 billion, with over 300 applications deployed, contributing significantly to Coinbase's cash flow.

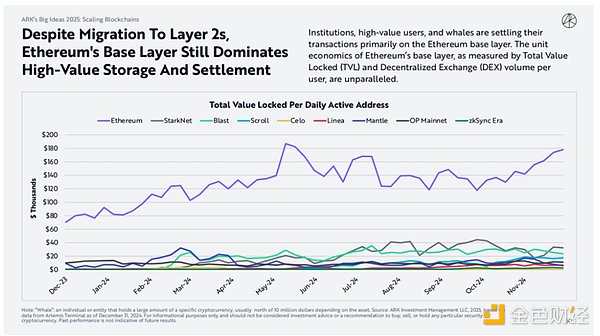

Despite this, Ethereum's base layer still dominates high-value storage and settlement. Institutions, high-value users, and whales primarily settle their transactions on the Ethereum base layer. The unit economics of the Ethereum base layer are unparalleled, measured by total locked value (TVL) and decentralized exchange (DEX) volume per user.

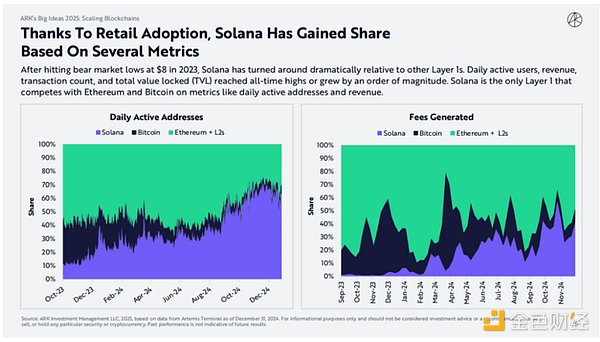

4.2 Solana’s share has been boosted according to multiple metrics due to retail adoption

After hitting a bear market low of $8 in 2023, Solana has seen a dramatic turnaround relative to other L1s. Daily active users, revenue, number of transactions, and total value locked (TVL) have all hit new all-time highs or increased by an order of magnitude. Solana is the only L1 that competes with Ethereum and Bitcoin on metrics like daily active addresses and revenue.

Solana and Base lead in developer adoption and mindshare. Of the 39,139 new crypto developers added in 2024, Solana leads with 7,625 developers, surpassing the Ethereum mainnet. With 4,287 developers, Base ranks sixth overall, surpassing Arbitrum and Starknet to become the leading Layer 2 solution on Ethereum.

Brian

Brian