Author: Nancy Lubale, Cointelegraph; Compiler: Songxue, Golden Finance

The native token of Sui Layer 1 smart contract platform SUI is making a splash in the DeFi field after rising 300% in three months Make waves.

SUI prices dropped in October 2023 as South Korean regulators accused supply manipulation, but recent technical and on-chain data suggest that SUI’s recent price reversal is based on improving fundamentals.

SUI/USD daily price chart. Source: TradingView

Protocol TVL jumps 2,000%

A rising tide lifts all boats, and it’s clear that SUI benefits This is due to the recent bullish momentum across the cryptocurrency market. What’s more important is to observe any changes in metrics that reflect the health, growth, and sustainability of the project’s ecosystem.

SUI’s trading volume surpassed $950 million on January 13 after growing approximately 2,200% in three months, according to CoinMarketCap.

SUI’s total value locked (TVL) has also been growing over the past three months, up from $54.39 million in early October, according to DeFi data aggregator DefiLlama More than 828%. By 2023, the present value will be $319.23 million.

Lock the total value of Sui. Source: DeFiLama

Sui Foundation Managing Director Greg Siourounis acknowledged SUI’s TVL growth, saying:“$300 million in TVL is an important milestone” marking the An increase of more than 2,000% since August 2023.

The protocols behind SUI’s rising TVL are Cetus, a decentralized exchange (DEX) with $62 million locked in; Navi Protocol, which has a TVL of $60 million, in the past Growth of 485% in 90 days; Scallop Lend at $54 million, DeepBook ($33 million) and FlowX Finance ($31 million).

A few months after the mainnet launch, Sui has also managed to attract a number of new projects, and Solend, the main lending protocol on Solana, has just announced plans to expand to Sui.

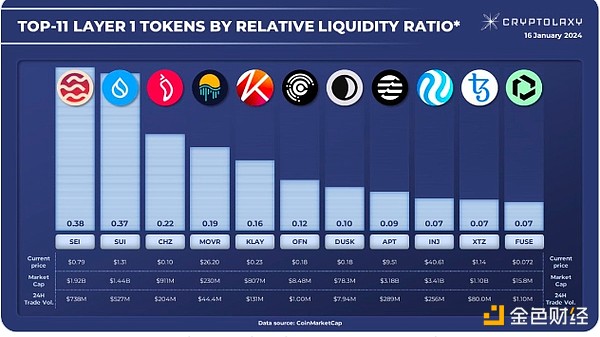

SUI's relative liquidity ratio shows trader interest

SUI's triple-digit price gains continue Attracting traders, cryptocurrency market analyst Cryptoloxy noted that SUI’s relative liquidity ratio (RLR) reflects this growing interest. RLR is the ratio of 24-hour trading volume to market capitalization, indicating that the higher the ratio, the higher the trader interest in the token and token liquidity.

RLR Top 11layer 1 token. Source: Cryptolaxy

SUI approaching key levels in the short term

Finding $0.36 price area After the support, SUI price rose by about 300%, hitting a swing high of $1.4486 on January 15.

All major moving averages are still pointing upwards, and the Relative Strength Index (RSI) sits at 68, indicating that market conditions remain favorable for bullish traders.

The swing highs of $1.40 and $1.44 are key levels to watch on the upside. Other obstacles may arise at the psychological levels of $1.60 and $1.70.

SUI/USD daily chart. Source: TradingView

Currently, the RSI shows that SUI is heavily overbought, and the ongoing correction is likely to continue in the coming days as sellers take profits.

The first line of defense may occur at the 23.6% retracement level at $1.29. Additional support area is seen at $1.0 and the 61.8% retracement level at $0.80.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Miyuki

Miyuki Xu Lin

Xu Lin JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance 铭文老幺

铭文老幺 Bitcoinworld

Bitcoinworld Others

Others Cointelegraph

Cointelegraph