Rachel, Golden Finance

After a half-month of sideways adjustment, Bitcoin finally broke through $100,000 on the morning of December 5, 2024, Beijing time.

On December 4, Putin announced that Bitcoin would be included in the national strategic reserve, and the current SEC Chairman Powell delivered a speech, the content of which was still in line with people's expectations that the United States would cut interest rates by 25BP again in December. Including these factors, what factors have contributed to Bitcoin breaking through $100,000?

1. Russian President Putin clearly supports cryptocurrencies, suggesting that Bitcoin can become a national reserve.

Last week, Putin officially signed an important law that clearly identified cryptocurrencies as "property" and established a comprehensive tax framework for cryptocurrency transactions and mining activities. The law will be officially implemented on January 1, 2025, marking a key step for Russia in the field of cryptocurrency regulation and taxation.

In his speech on December 4, Putin questioned the necessity of Russia holding foreign exchange reserves and hinted that Bitcoin might be a better choice.

2. Powell said in his speech that Bitcoin's competitor is gold rather than the US dollar, and the Fed has not yet achieved its goal of reducing inflation.

On December 4, Powell said in his speech that the Fed has not yet achieved its goal of reducing inflation, but is still making progress in reducing inflation. The rise in price levels has made people dissatisfied. Judging from the number of employed people, the employment situation is good, but the low-income class is facing pressure. These speeches are still in line with people's expectations that the United States will cut interest rates by 25BP again in December. At the same time, he also mentioned in his speech that Bitcoin is regarded as a speculative asset, and its main competitor is gold rather than the US dollar.

3. South Korea's crypto market plummeted, and a large number of funds bought at the bottom

On the evening of December 3, South Korean President Yoon Seok-yeol announced martial law, which caused market fluctuations. The price of Bitcoin on the Korean upbit exchange once fell to about $60,000, but a large amount of funds entered the buying. South Korean traders love high-risk and high-return products. Since Trump won the election, the trading volume of crypto tokens has exceeded the Korean benchmark KOSPI index.

4. Factors related to Trump's victory in the US presidential election

After Trump was elected as the US president, he nominated Paul Atkins, a conservative lawyer who has always supported cryptocurrencies, as the chairman of the US Securities and Exchange Commission. He has long been skeptical of financial regulation and is expected to work on reducing red tape and restricting the SEC's law enforcement department. The news that Trump chose a digital asset advocate as the chairman of the US Securities and Exchange Commission ignited a new round of Bitcoin's surge.

On the other hand, his business empire is also involved in the crypto industry, such as his Trump Media Technology Group's plan to acquire the crypto exchange Bakkt.

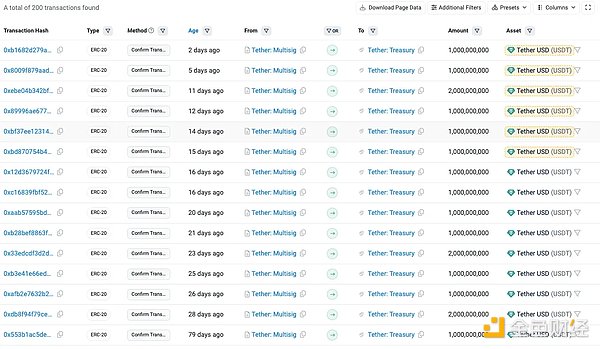

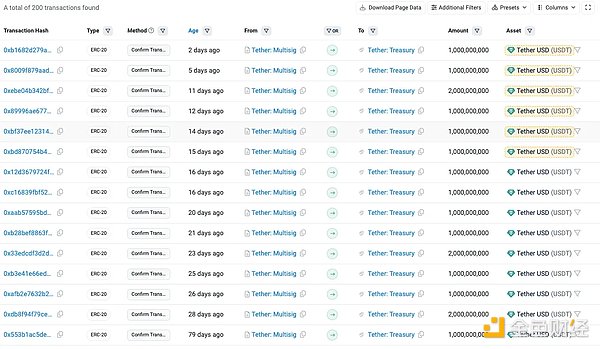

5. Stablecoins continue to increase in issuance, market value exceeds $200 billion

The increase in the issuance of stablecoins has always been a sign of hot money influx, and also represents the issuer's optimism about the future of the overall crypto market. The market shows that the total market value of stablecoins has exceeded $200 billion, now reported at $200,129,553,664, a record high, of which Tether's USD stablecoin USDT has a market value of approximately $135.77 billion. Since Trump's victory, Tether has issued $17 billion in USDT.

6. Bitcoin halving expectations:

Bitcoin halving is expected to take place in May 2024. Bitcoin has set records after the past three halvings.

7. Innovation and development of the industry

The development of the cryptocurrency industry, the combination of AI and Web3 has become a hot spot for industry innovation, and has also attracted many traditional investors and entrepreneurs. New application paradigms are gradually unfolding.

Catherine

Catherine