Author: Aaron Wood, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Meta, the parent company of Facebook, Instagram, WhatsApp, and Messenger, is facing an antitrust lawsuit that could limit its ability to develop artificial intelligence among its many competitors.

The Federal Trade Commission (FTC) first filed the lawsuit in 2021, alleging that Meta's acquisition strategy (rather than competing with it) violated antitrust laws. If the court rules against Meta, it may be forced to spin off its various instant messaging services and social media sites into independent companies.

The loss of its stable of social media companies could not only hurt Facebook's competitiveness in the social media industry, but also its ability to use data from these sites to train and develop its proprietary Llama artificial intelligence model.

The trial could take anywhere from a few months to a year, but its outcome will have a lasting impact on Meta's position in the AI race.

Meta's Antitrust Case and Its Implications for AI

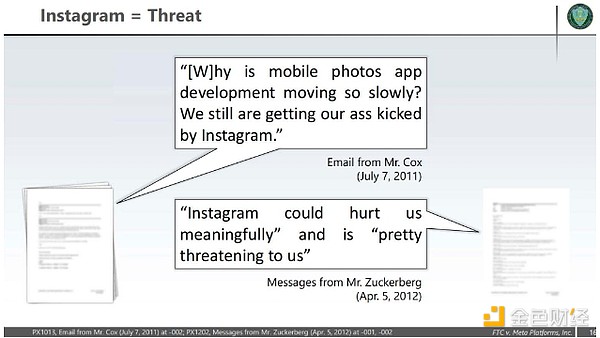

The Federal Trade Commission (FTC) first filed suit against Meta in 2020, when the company was still operating under the name Facebook. A year later, the agency's amended complaint accused Meta (then called Facebook) of using an illegal "buy or bury" strategy against more creative competitors after "failed to develop innovative mobile features for its network." This led to a monopoly in the "friends and family" social media market.

On April 14, the first day of the FTC v. Meta case, Meta founder and CEO Mark Zuckerberg had a chance to respond to the allegations. He testified that only 20% of user content on Facebook and about 10% of user content on Instagram is generated by the user's friends. Zuckerberg claimed that the nature of social media has changed.

"People just keep participating in more and more things that their friends don't do," he said - meaning the nature of Meta's social media assets is diverse enough.

The FTC accuses Meta of identifying potential threatening competitors and acquiring them. Source: FTC

When the FTC first filed its complaint, Meta called the allegations "revisionist history" and reiterated that claim on April 13, saying the agency "ignored reality." The company argued that the acquisitions of Instagram and WhatsApp benefited users and that YouTube and TikTok brought competition.

If the D.C. Circuit rules against Meta, the global social media giant would be forced to split the services into independent companies. Jasmine Enberg, vice president and chief analyst at eMarketer, told the Los Angeles Times that such a ruling could cost Meta its competitive advantage in the social media market.

"Instagram is really its biggest growth driver because it has long been making up for Facebook's shortcomings, especially in terms of younger users," Enberg said. "Facebook hasn't been the place where cool college students hang out for a long time."

Such a ruling would also affect the database Meta uses to train its artificial intelligence models. In July 2024, Meta stopped launching its artificial intelligence models in the European Union, citing "regulatory uncertainty."

Prior to this, privacy advocacy group None of Your Business filed complaints in 11 European countries about Meta's use of public data from its platform to train its artificial intelligence models, and Meta subsequently suspended this practice. The Irish Data Protection Commission then ordered a suspension of the practice until a review is conducted.

On April 14, Meta received approval to use public data (i.e., posts and comments from adult users across all its platforms) to train its models. If the companies were dissolved into separate companies, with their own organizational structures and data protection policies and practices, Meta would lose the ocean of data and human interaction that could improve its AI.

Andrew Rossow, a cyberspace lawyer and CEO of AR Media Consulting at Minc Law, noted that in this scenario, "the companies would likely control their own user data, and Meta would be restricted from using it unless new data-sharing agreements were reached, which would be subject to regulatory scrutiny and user/consumer privacy laws."

However, Rossow noted that it wouldn't be a complete loss for Meta. Zuckerberg's company would retain a wealth of data from Facebook and Messenger. It could continue to use "opt-in" data from consumers who allow their posts to be used for AI training, and could also use synthetic datasets as well as third-party and open data.

Meta, the AI Race, and Data Protection

The race to dominate the AI space with OpenAI and its ChatGPT model intensified last year, as DeepSeek joined the fray and Meta launched the fourth iteration of its open-source Llama model.

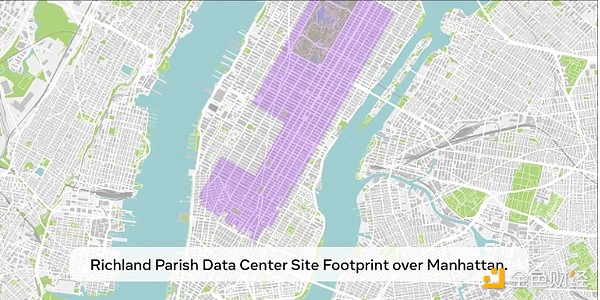

In addition to training new models, major AI development companies are investing billions of dollars in new data centers to accommodate new iterations. In January 2025, Meta announced the construction of a 2-gigawatt data center with more than 1.3 million Nvidia AI graphics processing units.

Zuckerberg wrote in a post on Threads: "This will be a defining year for AI. By 2025, I expect Meta AI to be the leading assistant serving over a billion people... To achieve this goal, Meta is building a 2GW+ datacenter fleet, large enough to cover a large portion of Manhattan."

Illustration of data map coverage. Source: Mark Zuckerberg

His announcement comes on the heels of the $500 billion Stargate Project, which will see massive investments in AI development led by OpenAI and SoftBank, with Microsoft and Oracle as equity partners.

Amid this competition, AI companies are seeking wider and more diverse sources of data to train their AI models — and have resorted to questionable practices to get the data they need. In order to stay competitive with OpenAI while developing its Llama 3 model, Meta collected thousands of pirated books from the website LibGen. According to court documents in the case against Meta, the Llama developers collected data from pirated books because licensing from sources like Scribd seemed “cost-prohibitive.”

Time is another apparent motivation for using pirated works. “It took them over 4 weeks to deliver the data,” one engineer wrote of the service through which they could purchase book licenses.

This practice is not limited to Meta. OpenAI has also been accused of mining data from pirated works hosted on LibGen.

Rossow suggested that “to ensure lasting impact — beyond short-term profits,” Meta would be better off “prioritizing investments in advanced data collection, rigorous auditing, and the implementation of privacy-preserving and encryption-based technologies.”

By focusing on transparency and responsible practices, “Meta can continue to truly advance AI capabilities, rebuild and foster long-term user trust, and adapt to evolving legal and ethical standards regardless of how the platform mix changes.”

What the FTC’s ruling means

Tech companies are currently facing lawsuits from all sides, facing accusations of privacy violations, copyright infringement, and stifling competition. The major unresolved cases facing companies like Google, Amazon, and Meta will determine how and if these companies can continue to grow as they have before, while also defining guardrails for the development of AI.

Rossow said the current antitrust case against Meta could determine how courts interpret antitrust laws against tech companies, covering tech mergers, data use, and market competition. It also suggests that the court is "willing to break up tech groups" when it comes to stifling competition, while "bringing current precedent one step closer to reconciling the law of cyberspace."

Alex

Alex

Alex

Alex Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Brian

Brian Weiliang

Weiliang Joy

Joy Alex

Alex Joy

Joy Joy

Joy