Author: DeFi Cheetah - e/acc Source: X, @DeFi_Cheetah

In many people's minds, B2B payment systems seem to be just about pressing a "send" button to transfer funds from one entity to another. Therefore, many stablecoin projects also focus on improving the efficiency of transaction channels, such as checks, wire transfers, or digital transfer technologies, but often ignore the critical and highly relevant workflows before and after the funds are transferred.

In fact, B2B payments are the final result of a large number of workflows. These workflows mainly revolve around data verification, compliance review, and multi-party approvals, and a lot of preparation work has been completed before the actual payment occurs.

This misunderstanding of B2B payments - from "just need to pay" to "must verify contract terms and operational details first" - is particularly prominent in cross-border transactions. Different national legal frameworks, localized tax regulations, and exchange rate fluctuations make cross-border operations exponentially more complex. At the same time, with the rise of digital assets, especially stablecoins (as described by @hadickM), these emerging tools are gradually intersecting with traditional workflows, and if combined with powerful process automation capabilities, they are expected to greatly simplify the process of money movement.

The core point of this article is that the introduction of stablecoins should not be seen as an efficiency improvement in the payment execution link, but must be part of the overall workflow optimization. Only in this way can the trillion-dollar market potential proposed by @PanteraCapital be truly unleashed. In the entire stablecoin payment stack, the most value-creating link is the coordination layer, which can effectively simplify complex workflows and cover more regions, as @robbiepetersen_ emphasized.

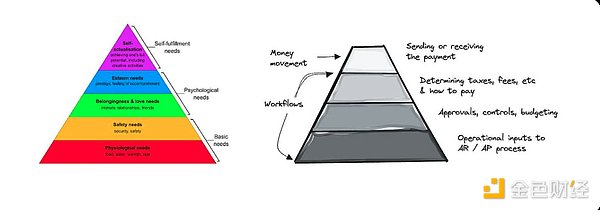

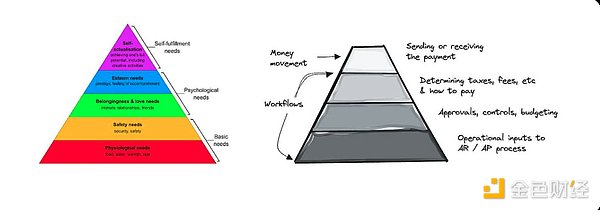

B2B payment demand hierarchy model

To understand B2B payments, we can use a "demand pyramid" model, with the following layers:

Data collection and invoice management

B2B transactions usually require aggregating supplier information, parsing invoice content, and checking and reconciling with purchase orders or delivery records.

Compliance and regulatory review

Companies need to ensure that suppliers comply with local or international regulations, such as KYC (know your customer) and AML (anti-money laundering) regulations.

Tax reconciliation

Cross-border transactions involve complex tax obligations, such as withholding tax, value-added tax (VAT), etc., which are particularly complex when goods are shipped internationally.

Approval and audit process

Most organizations have multi-layer approval chain requirements and need to maintain complete audit records and real-time approval visibility throughout the process.

Payment execution

The actual movement of funds - whether by check, ACH, SWIFT or other channels - is at the top of the pyramid.

Recognizing that payment execution is only the most superficial action and its success depends on the coordinated support of multiple links below is the key to designing an efficient and reliable B2B payment system. Ignoring data traceability, compliance processes or approval chain integrity may lead to delays or failures in the entire capital flow process.

Cross-border payment workflow: where is the real bottleneck?

Compared to domestic payments, cross-border B2B payments amplify existing challenges in various ways:

1. Regulatory complexity

Each jurisdiction has unique requirements for foreign currency transactions, including not only AML/KYC compliance checks, but also often specific documentation requirements related to trade regulations and customs procedures.

2. Detailed tax obligations

From import duties to value-added tax (VAT), cross-border transactions require accurate tax tracking, and sometimes even require the breakdown of tax responsibilities between different countries and regions.

3. Extended approval levels

There is often a complex chain of approval processes between subsidiaries and parent companies. Any mistakes in local compliance, product classification or document preparation can cause the payment process to be stalled indefinitely. In fact, these complexities are often more of a real obstacle to timely and accurate payments than the friction of the payment channel itself. Industry Case Analysis 1. Freight and Logistics: More Than Just Freight Review Background: In the field of freight and logistics, multiple carriers will charge transportation fees, loading and unloading fees, surcharges, and even fines for early or late arrival. Fluctuating fuel prices, coupled with multi-stage transportation arrangements, often lead to extremely complex bills.

Workflow Pain Points:

The core of the problem is not as simple as "paying the truck company", but to reliably match each fee with the contract agreement, verify whether the cargo weight and transportation distance are calculated correctly, and properly handle various exceptions.

Importance:

If B2B payment solutions only focus on simplifying the payment interface and ignore the heavy work of invoice verification, they will not truly solve the pain points of enterprises. A better way is to directly integrate transportation documents, track changes in transportation arrangements in real time, warn of invoice anomalies, and complete error interception before payment.

Real Case:

Companies such as Loop first focus on transportation auditing and workflow logic, and then integrate payment functions. Another approach is to use AI to automatically scan and parse shipping documents, push exceptions to a processing queue, and trigger payment after verification is complete.

2. Construction industry and upstream supply chain management

Background:

Construction projects typically involve multiple layers of supply chains, from wood and cement to electrical and mechanical subsystems, and tax burdens vary greatly depending on the region and project type.

Workflow pain points:

Payment is not just about "buying 50 cubic yards of concrete", but also about ensuring that the purchase is linked to a specific project or permit number, correctly applying local tax rates, and ensuring that the purchase is in line with the project budget and authorization code.

Importance:

Failing to capture and automate these approval and compliance processes without simply accelerating payments will ultimately fail to address the underlying issues. More valuable B2B solutions automate approvals, integrate building permit management, coordinate subcontractor budgets, and handle partial deliveries.

Real Case:

The Nickel platform integrates a tax calculation engine that manages the complexity of different tax rates for the same material based on usage, buyer classification, and geographic location. Other solutions ensure compliance before payment by embedding material usage forms and automatically generating compliance documents.

3. Fuel Card and Expenditure Management

Background:

In the daily operation of corporate fleets (trucks, cars, engineering equipment or official vehicles), fuel expenses account for a large amount of operating expenses.

Workflow Pain Points:

Although fuel expenses are obvious, drivers may also use them to purchase non-work-related items (such as snacks, fuel for personal use, etc.). Therefore, real-time control and visual management of expenses are more important than simply "refueling and paying" itself.

Importance:

Platforms such as Wex, Fleetcor, Mudflap, AtoB and Coast combine payment actions with real-time policy controls, allowing managers to promptly detect and block unauthorized consumption while optimizing gas station selection and reducing costs.

Real Case:

Some solutions integrate vehicle communication systems and route optimization software to automatically detect mileage or fuel consumption anomalies, flag suspicious transactions, and release payments only after approval.

4. Supplier Management and Invoice Approval

Background:

Large companies often have thousands of suppliers, and invoice formats vary - there are electronic versions, PDFs, and even paper documents.

Workflow Pain Points:

The Accounts Payable (AP) team needs to ensure that each invoice is valid, non-duplicate, correctly assigned to the budget code, and complies with the terms of the agreement signed with the supplier.

Importance:

In fact, the actual "payment" step (such as issuing a check or initiating an ACH transfer) is the easiest part. Verifying whether a $3,500 invoice is accurate (for example, whether there is a $100 premium) often consumes a lot of manpower.

Real Case:

Solutions like Tipalti, Coupa or SAP Concur integrate invoice receiving, expense management and supplier onboarding processes, standardize messy data, support multi-level approval, automatically handle currency conversion, and ultimately trigger payment actions.

5. Sales Commission Management in the SaaS Industry

Background:

SaaS companies often have complex sales commission systems, with different commission rates and bonuses broken down by product type, sales region or subscription package.

Workflow Pain Points:

Calculating and verifying each commission is far more complicated than actually issuing sales bonus checks. If errors occur, it is easy to cause disputes and employee dissatisfaction.

Importance:

Building a correct and transparent commission automation system requires a powerful system to connect with CRM data, track subscription usage or expansion sales in real time, and handle the split between multiple sales staff.

Real Case:

Platforms such as CaptivateIQ and Spiff focus on solving the data and workflow problems behind commission calculations. Before payment occurs, a large amount of complex data has been automatically processed and cleaned, avoiding the errors that are prone to traditional manual spreadsheets.

Improve workflow efficiency by integrating stablecoin payments

Although traditional payment channels (such as checks, ACH, SWIFT) are often slow and costly in cross-border payments, stablecoins have become an attractive digital settlement alternative. Key considerations include (as raised by many in the industry, such as @proofofnathan): 1. Reduced settlement time Stablecoins enable near-instant settlement of funds, bypassing the multiple intermediary banks often involved in traditional cross-border payments. This feature is particularly beneficial in scenarios where a well-established workflow is in place to ensure that all operational conditions and approval processes have been completed, effectively avoiding unnecessary payment delays. 2. Automated compliance checks By integrating the stablecoin transfer function into the workflow platform, it can be designed to initiate on-chain payments only when the conditions set by the smart contract are met, such as supplier identity confirmation, compliance documents being reviewed, or delivery certificates being uploaded. By automating compliance, manual intervention and human errors are significantly reduced.

3. Transparent foreign exchange management

Many stablecoin assets are anchored to major fiat currencies (such as the US dollar), thereby reducing the risk of exchange rate fluctuations. This stability can simplify payment verification and financial processing. Furthermore, combining stablecoin payment rails with advanced workflow systems can also automatically convert to the recipient's local currency before the payment is completed, reducing the burden of manual fund management.

4. Cost savings for cross-border small transactions

For B2B arrangements involving small, frequent cross-border payments (such as paying micro-invoices to overseas contract workers), stablecoins can effectively reduce fixed transaction fees. Workflow-based approaches can also further optimize the gas fees and network costs of blockchain networks by bundling or batching payments at regular intervals.

5. Expand value-added services

Once companies incorporate stablecoins into payment workflows, they can explore more new business opportunities. For example, they can achieve instant financing, real-time invoice factoring, or embedded dynamic discounting functions - all of which can be automatically executed through workflow logic, and the stablecoin system serves as the support for the underlying capital flow to achieve minimal friction.

Strategic advantages of workflow-first in cross-border payments

1. Improve transparency and auditability

By emphasizing documentation and automated approval, companies can ensure that every link from KYC/AML review to contract matching is clearly recorded, thereby reducing the probability of disputes and strengthening compliance assurance.

2. Minimize human intervention

Manual operations at each link are not only prone to errors, but also prolong the overall cycle. End-to-end workflow management (with stablecoin settlement as the end point) can automate and smoothly connect each link, greatly shortening the overall payment cycle.

3. Build a scalable global solution

Relying on fragmented and temporary cross-border payment methods makes it difficult for companies to scale. In contrast, a workflow platform that combines stablecoin payment tracks with dynamic compliance management can enter new markets at a lower operating cost and faster speed.

4. Packaged value proposition

Simply providing "payment" services has limited room for differentiation. By integrating document management, compliance processing and payment flows into the same platform, companies can become indispensable partners to their customers, thereby achieving more stable and profitable business relationships.

Conclusion

While traditional thinking views B2B payments as primarily a matter of accelerating the transfer of funds, the real constraint on cross-border payment efficiency is actually fragmented and unsystematically managed workflows. These obstacles stem from data management fragmentation, complex regulatory requirements, lengthy approval chains and changing tax obligations.

While there are currently a large number of stablecoin projects dedicated to improving existing payment channels, stablecoins alone cannot completely solve the multi-layered and complex workflow issues behind B2B payments. Many stablecoin projects are positioned at the "payment execution layer", however, I believe that the projects that can truly occupy the largest share of the payment market will be those that start with a systematic, workflow-first mindset and deal with the underlying processes These projects achieve a faster, more transparent, and less error-prone global payment system through real-time settlement and simplified currency exchange.

In other words, these leading projects must build powerful tools to deeply embed supplier qualification verification, invoice verification, tax management, and multi-layer approvals into automated and intelligent workflows.

This trillion-dollar opportunity belongs to projects that adopt this holistic approach, optimize workflow orchestration, and maximize the effectiveness of stablecoins. They can not only provide faster and more economical international payment services, but also seamlessly integrate compliance, tax, and document management requirements.

This deep collaboration can not only significantly improve the efficiency of daily payment operations, but also help companies expand into emerging markets, launch new financial products, and establish lasting and differentiated competitive advantages in the global B2B financial field.

Alex

Alex