Author: Nancy Lubale, CoinTelegraph; Compiler: Deng Tong, Golden Finance

Key Points:

Spot Bitcoin ETF inflows reached the highest level since January 2025.

Exchange inflows fell to the lowest level since December 2016.

Bitcoin's negative funding rate may trigger a short squeeze.

BTC prices are above major moving averages, which can now provide support.

On April 23, the BTC price rose to a new high of $94,700, the highest value since March 2.

Multiple analysts say the next psychological resistance level remains at $95,000, and prices could fall to test support below.

“The $94,000 to $95,000 area is clearly a resistance level that needs to be broken,” Swissblock said in an April 24 article on X.

The on-chain data provider asserts that the next logical move for Bitcoin would be a pullback to the $90,000 area to gain momentum to move higher. BTC/USD chart. Source: Swissblock

Prominent Bitcoin analyst AlphaBTC believes that the asset may consolidate in the $93,000 to $95,000 range "before pushing up to liquidity above $100,000".

Some bullish signs suggest that BTC is expected to break through $95,000 in the coming days or weeks.

Bitcoin ETF Demand Rebounds

One factor supporting the bull case thesis for Bitcoin is the recovery in institutional demand, which is reflected in the large inflows into spot Bitcoin exchange-traded funds (ETFs).

According to data from SoSoValue, spot Bitcoin ETFs saw total net inflows of $936 million and $917 million on April 22 and April 23, respectively.

These inflows are reportedly the highest since January 2025 and more than 500 times the average daily inflows in 2025.

Spot Bitcoin ETF flows. Source: SoSoValue

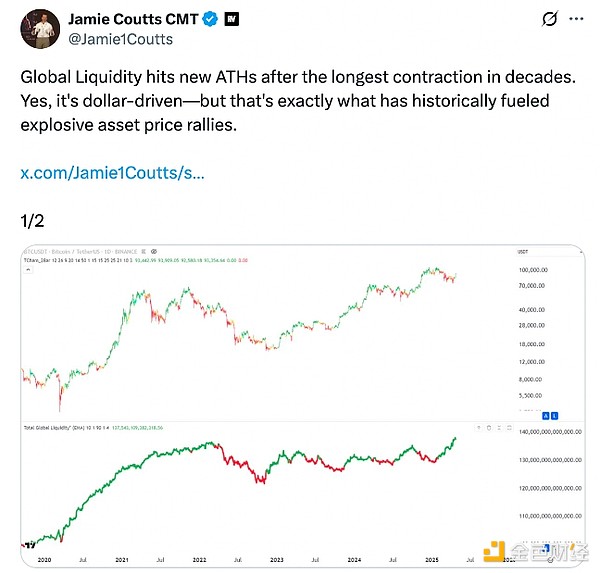

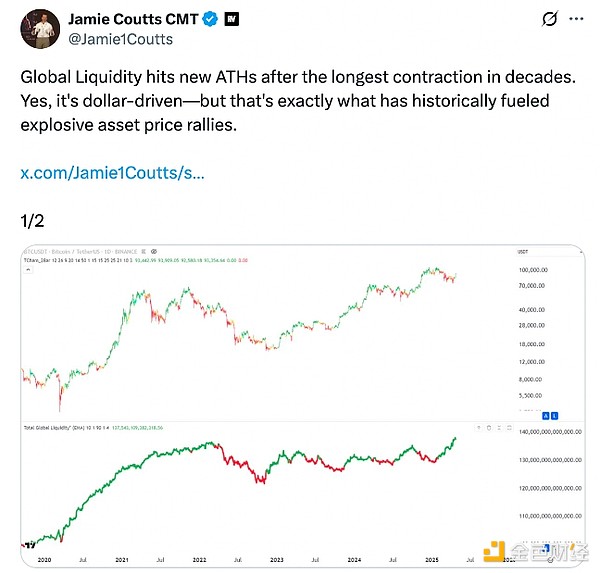

The trend reflects growing confidence among traditional financial players, as observed by market analysts such as Jamie Coutts, who point out that global liquidity is at an all-time high, which historically has driven asset prices higher.

Institutional buying exerts sustained upward pressure on Bitcoin prices by absorbing existing supply.

BTC supply decreases on cryptocurrency exchanges

The trend of decreasing inflows to Bitcoin exchanges continues, indicating that selling pressure may be easing.

The total amount of Bitcoin transferred to exchanges has dropped from a year-high of 97,940 BTC on February 25 to 45,000 BTC on April 23, according to CryptoQuant.

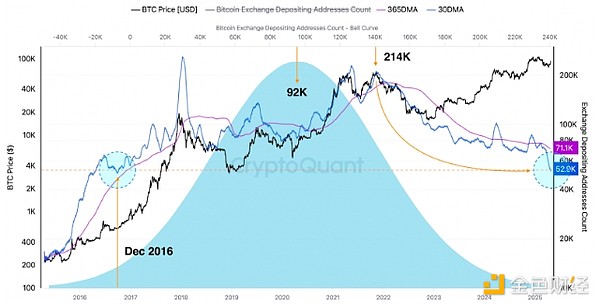

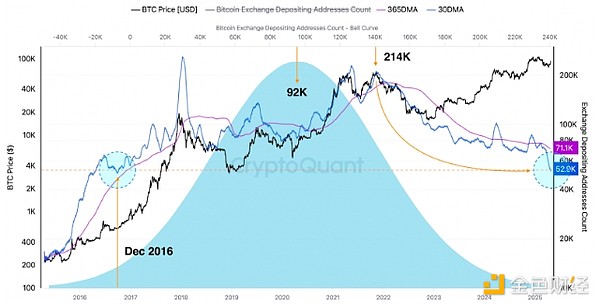

CryptoQuant analyst Axel Adler Jr. said the phenomenon was further exacerbated by the decline in the number of addresses depositing Bitcoin to exchanges, which has been "steadily declining" since 2022.

He highlighted that the metric's 30-day moving average has fallen to 52,000 BTC, a level not seen since December 2016.

The trend itself is bullish,” the analyst said, as it represents a fourfold reduction in BTC sales over the past three years, adding:

“Essentially, this represents a growing HODL sentiment, which significantly reduces selling pressure, setting the stage for further growth.”

Number of Bitcoin exchange deposit addresses. Source: CryptoQuant

Negative funding rates could drive Bitcoin higher

The price of Bitcoin has rebounded to early March levels, but futures trading has not yet fully entered.

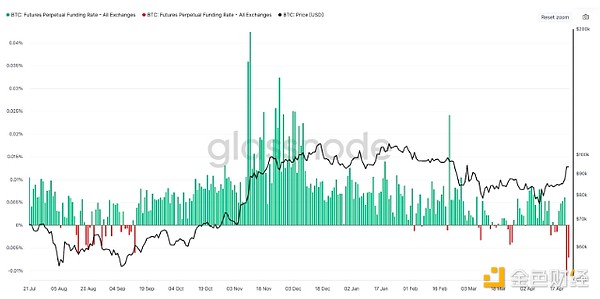

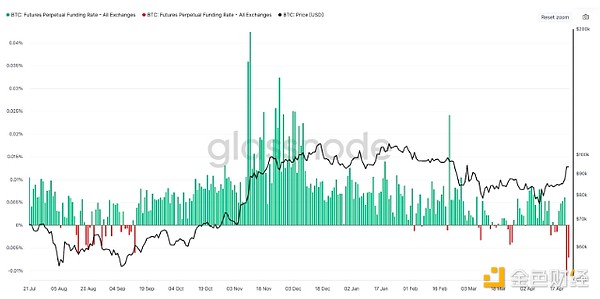

Glassnode data shows that despite the 11% increase in the price of Bitcoin between April 22 and April 23, its perpetual futures funding rate remains negative.

Bitcoin perpetual futures funding rate. Source: Glassnode

Negative funding rates mean that shorts are paying longs, reflecting a bearish sentiment that could exacerbate a short squeeze as prices rise.

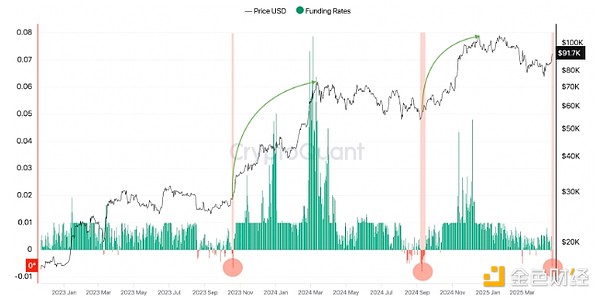

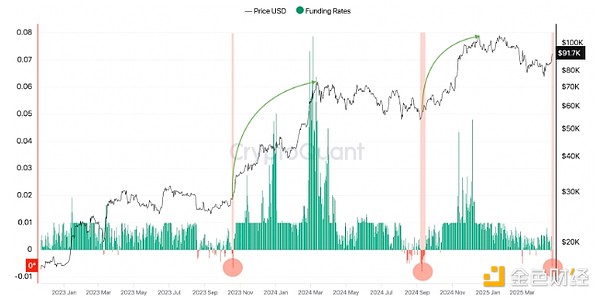

In an April 22 article on X, CryptoQuant contributor Darkfost highlighted a similar discrepancy between Bitcoin’s price and Binance’s funding rate.

“While BTC continues to climb, Binance’s funding rate has turned negative, at around -0.006 as of this writing,” Darkfost explained.

This is a rare phenomenon that has historically been followed by major rallies, such as Bitcoin’s surge from $28,000 to $73,000 in October 2023 and from $57,000 to $108,000 in September 2024, he added.

Bitcoin funding rates at Binance. Source: CryptoQuant

If history repeats itself, Bitcoin could rebound from current levels and break through the $95,000 resistance to reach $100,000.

Bitcoin Trading Above 200-Day Moving Average

On April 22, Bitcoin price broke through a key level: the 200-day simple moving average (SMA), currently at $88,690, driving a recovery across the market.

The last time BTC price broke above the 200-day moving average, it went parabolic, rising 80% from $66,000 on Oct. 14, 2024, to an all-time high of $108,000 on Dec. 17.

While Bitcoin is trading above this key trendline, this level should provide significant support. But if it doesn’t hold, the next levels to watch could be $84,379, the 50-day SMA, and the psychological level of $80,000.

BTC/USD daily chart. Source: Cointelegraph/TradingView

For bulls, the $95,000 and $100,000 resistance levels are the main focus. A break above this level will pave the way for the all-time high above $109,000 set on January 20.

Kikyo

Kikyo