In CryptoDCA's recent article "What kind of mentality should we have before fixed investment", we recognize that when implementing a fixed investment strategy, we must pay close attention to national policies and use these long-term and macro factors to guide our investment decisions. The impact of policy factors is often persistent and long-term. Take a country's industrial development policy as an example. Such policies usually take decades to show their effectiveness, and factors at this level of influence are usually easy for the public to understand, and their future trends can be predicted. Therefore, they can become an important reference for investors when considering market trends, especially for the prediction of long-term market trends.

01 Appointments and Acts

As one of the world's leading developed countries, the United States' policy making in the field of cryptocurrency is undoubtedly worthy of our in-depth review and study. The United States' cryptocurrency policy will not only directly affect its own market and economy, but may also have a profound indirect impact on the relevant policies of other countries. We must pay close attention to this.

Taking political factors into consideration, the Democratic Party and the Republican Party may take different policy positions on cryptocurrencies, which we also need to pay attention to. Differences in policies between the two parties may cause fluctuations in the cryptocurrency market, which in turn affects investor confidence and market stability.

On January 23, 2025, US President Trump, who returned to the White House again, delivered a speech at the Davos Forum. He emphasized his position on cryptocurrencies, believing that cryptocurrencies have potential innovative value, but also pointed out the risks and challenges they may bring. Trump's statement undoubtedly brought new uncertainties to the global cryptocurrency market.

On the same day, he appointed Republican Senator Cynthia Lummis of Wyoming as the chairman of the Senate Banking Digital Assets Subcommittee (X: @SenLummis). The group is committed to promoting bipartisan digital asset legislation, promoting responsible innovation and protecting consumers, covering topics such as market structure, stablecoins and strategic Bitcoin reserves.

Speech by Cynthia Lummis when she took office as Chair of the Senate Banking Committee's Digital Assets Subcommittee

On the day of her appointment, Cynthia Lummis made a statement on X: Digital assets indicate the direction of future development. In order to ensure that the United States can continue to lead in global financial innovation, Congress needs to take quick action to pass bipartisan legislation to establish a comprehensive legal framework for digital assets. She also emphasized that by strategically establishing Bitcoin reserves, the global influence of the US dollar can be further strengthened. She feels very honored that her colleagues have entrusted her with the important task of chairing this historic subcommittee, and looks forward to promoting bipartisan legislation this year to ensure the future of finance and submitting it to President Trump for signature.

In fact, as early as July 31, 2024, Cynthia Lummis submitted a bill on the establishment of a strategic reserve of Bitcoin (S.4912 - BITCOIN Act of 2024) in the Senate. The bill aims to promote the US government to start the strategic reserve of Bitcoin as soon as possible and establish relevant facilities and equipment.

We have every reason to believe that the strategic reserve of Bitcoin will become the focus of competition between the two parties in Congress, whether in promoting the passage of existing bills or submitting new bills. Therefore, we currently need to analyze the Bitcoin Strategic Reserve Bill proposed in 2024 and gain insight into future trends.

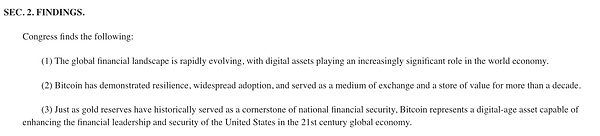

02 FINDINGS (Survey Results)Status Recognition

In FINDINGS, the rapid rise of digital currency was first affirmed. In just over a decade, it has played an important role in the world economy.

At the same time, Bitcoin was mentioned in the second article. Bitcoin has been around for 16 years since its launch in 2008. From a technical perspective and from the perspective of the entire mechanism design, it can be said that it has withstood the test. Although it has experienced the ups and downs of several bull and bear markets, it is still steadily improving and showing an overall upward trend.

BTC: 2012 — 2025 Overall Trend

In the third article, combined with the trends of the first two articles, we can observe that in the magnificent digital economic era, the United States has shown a strong desire to maintain its financial hegemony. Due to this desire, the United States undoubtedly pinned its hopes on Bitcoin, which is known as "digital gold". As an investment object that has passed the dual tests of technology and the market, Bitcoin not only has the title of "digital gold", but its role as a weathervane in the field of cryptocurrency has been widely recognized.

In early 2011, Bitcoin started from an extremely low price and gradually attracted people's attention. In February, the price of Bitcoin broke through the $1 mark for the first time and began to attract media attention. In April, the price of Bitcoin quickly climbed to $10. Then, in June, Bitcoin reached a peak of $32.

If the bull market in 2011 was just a self-indulgent behavior of Bitcoin enthusiasts, then the bull market in 2013 began to have a certain breaking effect.

On April 17, 2013, Cyprus President Nicos Anastasiades announced through a televised speech that in order to obtain a 10 billion euro emergency aid loan from the European Union, the Cypriot government will impose a deposit tax on local bank deposits. The specific tax rate is: accounts with deposits of 100,000 euros or more are subject to a tax of 9.9%, while accounts with less than 100,000 euros are subject to a tax of 6.75%.

As soon as the news was released, Cypriots flocked to banks, and long queues formed in front of ATMs, and the situation quickly got out of control.

The measure taken by the Cypriot government to obtain funds caused a chain reaction in the global market.

On April 18, the major stock indexes of Asia-Pacific and European stock markets fell across the board after the opening of the market. Commodity markets such as New York crude oil were not spared and suffered sell-offs, and risky assets generally suffered a "Black Monday".

In order to curb the further deterioration of the situation, many banks in Cyprus announced a temporary holiday on the 19th and suspended online banking and international transfer services. At this time, the ATMs that could withdraw cash had already been emptied by depositors and could not provide services. In order to alleviate the cash shortage, the British Air Force even dispatched a plane to urgently airlift 1 million euros to Cyprus.

The Cyprus incident also had an impact on other countries in the eurozone. People began to worry about the safety of their deposits, and Bitcoin became an attractive alternative investment.

After the Cyprus incident, people generally felt uneasy and exchanged their currencies for Bitcoin to avoid potential policy risks. The price of Bitcoin soared from more than 30 US dollars to 265 US dollars in just a few days. It is estimated that about 90% of Bitcoin players entered the market due to this incident. It was the surge in Bitcoin prices caused by this crisis that made the world really pay attention to the existence of Bitcoin.

This is the first time in history that Bitcoin, a digital currency, has truly attracted widespread attention worldwide. There is no doubt that this milestone event will become the "beginning" for governments and financial institutions to begin to consider and establish strategic reserves of Bitcoin, that is, this event marks the beginning of a new era, and countries will begin to take it seriously and formulate relevant strategies to deal with this emerging digital currency.

2017 was a year of explosion in the cryptocurrency market, with Bitcoin prices rising sharply and Ethereum also rising rapidly. The ICO (Initial Coin Offering) craze promoted the emergence of a large number of new projects, and the influx of funds in the market formed an unprecedented prosperity.

At the beginning of 2017, the value of Bitcoin was about $1,000. However, in March 2017, the US Securities and Exchange Commission (SEC) rejected the application for a Bitcoin ETF (Exchange Traded Fund), and this decision caused a brief correction in the market.

Then, in May 2017, the price of Bitcoin achieved a breakthrough growth, exceeding $2,000 for the first time. Then, in August 2017, Bitcoin experienced an important fork event, resulting in Bitcoin Cash (BCH). Despite the market disagreement, the price of Bitcoin continued to climb. By December 2017, the price of Bitcoin reached an impressive all-time high of nearly $20,000, an achievement that highlights the importance of Bitcoin in the cryptocurrency market. Other currencies also soared due to this wave of market conditions. Ethereum (ETH) rose from about $8 to nearly $1,400, an increase of about 175 times. Ripple (XRP) rose from about $0.006 to nearly $3.8, an increase of about 630 times. Litecoin (LTC) rose from about $4 to nearly $375, an increase of about 93 times. The bull market in 2017 was an important milestone in the cryptocurrency market. The prices of Bitcoin and other currencies rose sharply, and the number of market participants and the scale of funds increased significantly. Although it ended in a correction, this bull market laid a solid foundation for the popularity and future development of cryptocurrencies.

New Wine in Old Bottles

According to Article 456 of this section, by acquiring and holding a large amount of Bitcoin for a long time, the United States can strengthen its financial strength and provide an effective hedging strategy for economic uncertainty and currency fluctuations. As a decentralized and limited digital asset, Bitcoin has unique properties that can add a new dimension to national reserve assets and thus strengthen the position of the US dollar in the global financial system. This strategy will diversify the US national asset portfolio, including Bitcoin, which will enhance the resilience of the financial system and ensure that the United States maintains its leading position in global financial innovation.

As a non-traditional asset, Bitcoin adds a new dimension to the US national reserve assets, with the aim of reducing dependence on traditional assets (such as gold and US dollar bonds). As we all know, between 2019 and 2020, the Federal Reserve System of the United States, commonly known as the Fed, implemented a series of quantitative easing policies. These policies led to a large amount of money over-issuance, which had a profound impact on the economy. In early 2020, the outbreak of the new coronavirus pandemic quickly plunged the global economy into a state of panic. In response to this panic, the Federal Reserve took emergency measures to inject liquidity into the market on a large scale to stabilize the economy. This move gave rise to a bull market in the US stock market in the short term, and many investors received generous returns as a result. However, in the long run, this large-scale money over-issuance and liquidity injection may have planted huge hidden dangers in the global financial market. These hidden dangers may erupt at some point in the future, causing further shocks to the global economy. Therefore, the US government should prepare as soon as possible so that it can minimize losses and damage when future shocks come.

The scarcity of Bitcoin and its decentralized nature make it an effective hedging tool in times of economic crisis or currency devaluation, thereby enhancing the United States' ability to resist economic fluctuations. Cryptocurrency, represented by Bitcoin, offers a completely different investment option from traditional investment products due to its decentralized nature.

It is precisely because of Bitcoin's unconventional characteristics that it is seen as a hedge against financial risks and market volatility. However, fundamentally, its purpose is nothing more than to continue the United States' financial hegemony. From the US dollar, gold, and oil in the past, Bitcoin has now been added.

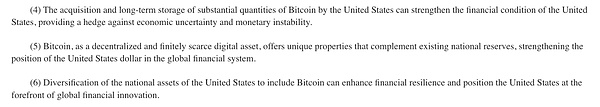

03 Building a Strategic Bitcoin Reserve

In this section, the guiding principles for building a Bitcoin strategic reserve network are detailed.

Distributed Cold Storage

In clause (a), we can observe that the bill explicitly proposes the necessity of building a decentralized Bitcoin security storage network, which is collectively referred to as the Strategic Bitcoin Reserve. Its core purpose is to provide a safe and reliable cold storage solution for the government's Bitcoin assets (cold storage of Government Bitcoin holdings) to ensure the security and confidentiality of these assets.

The design concept of the Strategic Bitcoin Reserve network is based on the idea of decentralization, aiming to reduce the risk of single point failure through decentralized storage, thereby enhancing the security of the entire network. In this way, the government can effectively protect its Bitcoin assets from hacker attacks, system failures or other potential threats. In addition, the cold storage solution means that these bitcoin assets will be stored in an environment isolated from the Internet, further improving security because it can prevent remote access and cyber attacks.

Physical Security

In clauses (b), (c), and (d), special emphasis is placed on the core responsibilities of the Strategic Bitcoin Reserve, which cover the generation, custody, and management of private keys directly related to the government's bitcoin assets. These private keys are key to ensuring the security of assets, and therefore, the Secretary of the Treasury is given the important task of continuously supervising and auditing the status of the Strategic Bitcoin Reserve's assets. In addition, in order to further enhance the security and stability of the assets, the Secretary of the Treasury must also ensure that the Strategic Bitcoin Reserve's facilities are geographically dispersed in various regions of the United States. This decentralized layout strategy is designed to effectively reduce the risks that may be caused by centralized storage. At the same time, it can also significantly improve the overall risk resistance of the strategic bitcoin reserve and ensure that the integrity and availability of assets can be maintained in the face of various potential threats.

Technical Assurance

In accordance with the provisions of clause (e), in order to ensure the security of the strategic bitcoin reserve, the most advanced physical and cybersecurity technologies currently on the market must be adopted. This is critical because the security of the strategic bitcoin reserve is directly related to the country's economic security and financial stability. Therefore, the Secretary of the Treasury has the responsibility to ensure that these technologies are fully implemented and maintained. In addition, in order to achieve the best security effect, the Secretary of the Treasury also needs to work closely with the Secretary of Defense, the Secretary of Homeland Security, and security experts from different industries. Through this cross-departmental and cross-industry collaboration, it can be ensured that the strategic bitcoin reserve meets the highest security standards in terms of physical and cybersecurity. Such cooperation includes not only technical exchanges and sharing, but also regular security assessments and emergency drills to ensure that in the face of potential threats, a prompt and effective response can be made to protect the strategic Bitcoin reserve from damage.

Airdrops and Forks

Pursuant to the clear instructions of clause (f), all Bitcoin assets managed by the Strategic Bitcoin Reserve, as well as all digital assets generated from the fork of the Bitcoin blockchain, including all types of digital assets allocated to Bitcoin addresses through airdrops, should be included and must be properly kept and maintained to ensure that they become part of the Strategic Bitcoin Reserve. Starting from the date of the fork or airdrop event, these digital assets generated by the above events shall not be sold in any form or disposed of in any other way within the next five years.

04 Bitcoin Purchase Plan

Purchase and Establishment

The Minister of Finance shall be responsible for developing a detailed Bitcoin purchase plan that will involve the purchase of no more than 200,000 Bitcoins per year over a five-year period to ensure that the total amount of Bitcoin purchased within five years reaches 1 million. In the process of implementing this purchase plan, it is necessary to ensure the transparency of the procurement process and take strategic measures to minimize potential disruptions to the overall cryptocurrency market. In addition, the plan also requires the holding and management of all Bitcoins purchased under this plan. The purchase target of 1 million Bitcoins may be based on a comprehensive and integrated consideration of the current Bitcoin market capacity, expected economic impact, and strategic value. While the bill itself does not directly explain why the target of 1 million bitcoins was chosen, it is reasonable to infer that this specific number was arrived at after an in-depth analysis and assessment of market conditions, the economic environment, and strategic significance.

Holding Plan

In order to ensure the long-term stability and security of the Strategic Bitcoin Reserve, the Secretary must hold all bitcoins acquired through the Bitcoin Purchase Program for at least 20 years. This provision is intended to protect the integrity and long-term value of the Bitcoin Reserve. With respect to the retention of bitcoins, during the minimum holding period specified in paragraph (1), i.e., 20 years, bitcoins held in the Strategic Bitcoin Reserve may not be sold, exchanged, auctioned, retained, or otherwise disposed of in any manner for the recovery of outstanding Federal debt instruments. These measures are intended to prevent the loss of the Bitcoin Reserve and ensure its availability for strategic purposes when necessary. After the holding period, the Secretary shall exercise caution and shall not recommend the sale of more than 10% of the Strategic Bitcoin Reserve in any consecutive two-year period. This limit is intended to avoid excessive market influence on the Strategic Bitcoin Reserve while maintaining the flexibility of the reserve. Not later than 1 year after the date of enactment of this Act, and annually thereafter for 20 years, the Secretary of the Treasury shall issue an annual public report on the status of the bitcoin purchase program. This report shall provide the public with detailed information about the bitcoin purchase program, including the amount of bitcoin purchased, the cost, and any relevant market developments. This will increase transparency in government operations and provide the public with information about the management and use of the Strategic Bitcoin Reserve.

05 Proof of Reserve System

To ensure transparency and accountability in the management of the Strategic Bitcoin Reserve, the Secretary of the Treasury shall establish a public cryptographically authenticated reserve proof system on a quarterly basis. This system will allow the public to verify and confirm the authenticity and integrity of the Bitcoin reserves held by the State. The Secretary of the Treasury shall be responsible for publishing detailed quarterly reports on the Strategic Bitcoin Reserve, which shall include details of total holdings, transactions, and private key control information related to the Strategic Bitcoin Reserve, including public cryptographic authentication. The disclosure of this information will help enhance public trust in the government's management of the Bitcoin Reserve:

The quarterly reports will be publicly available on the official website of the Ministry of Finance for public review. This move will ensure that all stakeholders, including investors, regulators, and ordinary citizens, have access to the latest and most accurate information on the country's Bitcoin Reserve. In this way, the government demonstrates its commitment to open and transparent management.

To further strengthen the credibility of the report, the Ministry of Finance shall select an independent third-party auditor with expertise in cryptographic authentication. This auditor will be responsible for verifying the accuracy and completeness of the quarterly report and ensuring that the data provided in the report is true and has not been tampered with or misreported. The involvement of an independent auditor will provide additional assurance of the objectivity and impartiality of the report.

The Comptroller General of the United States shall ensure compliance with this Act and conduct regular supervision of related matters. The Comptroller General's responsibilities include supervising the work of the Secretary of the Treasury and independent auditors to ensure that they follow established laws and procedures. In addition, the Comptroller General will be responsible for evaluating and reporting on the overall efficiency and effectiveness of the strategic Bitcoin reserve management, providing important reference information for policymakers and the public.

06 Consolidation of Government-Held Bitcoin Assets

Pursuant to the provisions of this section, effective immediately, all bitcoin assets under the custody of a federal agency, including bitcoin held by the Federal Marshals Service, shall be subject to the following management measures:

First, such bitcoin assets shall be strictly prohibited from being sold, exchanged, auctioned, or disposed of in any other form;

Second, only after obtaining legal ownership of the bitcoins (including after a final and non-appealable determination in a criminal or civil forfeiture case in favor of the federal agency), shall the head of the federal agency be responsible for transferring such bitcoin assets to the strategic bitcoin reserve.

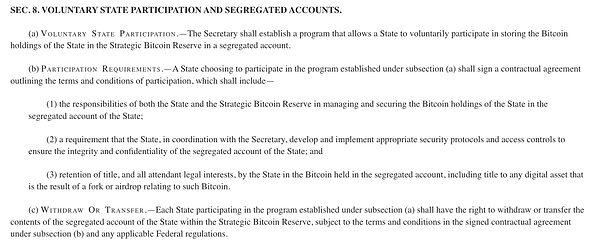

07 Voluntary State Participation and Apartheid Accounts

The Secretary of Finance shall be responsible for developing a comprehensive program that will allow countries to voluntarily opt in and store their bitcoin assets in a separate account, which will be named the "Strategic Bitcoin Reserve."

For countries interested in participating in the program established under clause (a), they will need to sign a detailed contractual agreement that clearly states all terms and conditions of participation in the program. The agreement should include the following key elements:

Clearly specify the specific duties and obligations of the state and the strategic bitcoin reserve in managing and protecting the bitcoin holdings in the state's independent accounts;

Develop and implement a series of appropriate security protocols and access control measures to ensure that the integrity and confidentiality of the bitcoin assets in the state's independent accounts are fully protected; In addition,

The agreement should also clearly state that although the bitcoin assets are stored in the independent accounts of the strategic bitcoin reserve, the state still retains ownership and related legal rights to the bitcoins held in these isolated accounts. This includes ownership of any new digital assets generated by forks or airdrops in the Bitcoin network.

This strategy has similar wisdom to accumulating gold reserves. As we know, the United States has the world's largest gold reserves. According to data as of 2023, the U.S. Treasury manages about 8,133.5 tons of gold, which is mainly stored in Fort Knox, Kentucky, and the Federal Reserve Bank of New York. These golds are not only a symbol of national wealth, but also play a vital role in economic and monetary policies. They provide a solid backing for the country's financial security. The gold reserves in different locations also allow other countries to store their own gold here, which not only reflects the economic strength of the United States, but also demonstrates its leadership in the international financial system. The core essence is the same, all for ensuring the country's economic stability and financial security.

08

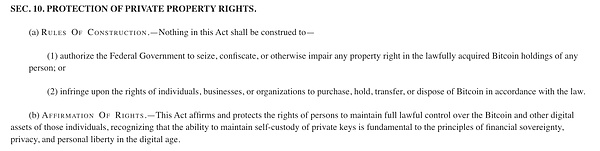

Protection of Private Property Rights

Under the provisions of this Act, no part shall be interpreted as having the following meanings:

Giving the Federal Government the power to confiscate, expropriate, or in any other manner infringe upon the property rights of individuals lawfully holding Bitcoin; or.

Violating the rights of individuals, businesses, and organizations to lawfully purchase, hold, transfer, and dispose of Bitcoin.

In addition, this Act further recognizes and protects the right of individuals to fully and legally control Bitcoin and other digital assets, and explicitly states that the ability to maintain private keys is a fundamental principle of financial sovereignty and the protection of privacy and personal freedom in the digital age.

09 Bill Summary

This bill has a striking similarity to the operating model of gold reserves in its structural design and implementation strategy. This similarity is not only reflected in the distributed storage mechanism it adopts, but also in its ability to "absorb" and integrate the reserve resources of other countries.

However, what makes Bitcoin different from traditional investment tools is that it has a significant community feature, and the community's decisions can have an impact on the market. This community feature means that Bitcoin is not just a digital asset, it also represents a decentralized financial concept that is jointly maintained and promoted by a group of people with common beliefs and goals. Community members actively participate in discussions and decision-making processes through various channels, such as forums, social media, and offline gatherings, which often directly affect the market value and future development direction of Bitcoin.

Therefore, we must be open to the possible impact of traditional centralized countries and decentralized cryptocurrencies in the financial field. With the continuous advancement and innovation of technology, we see that decentralized technology, especially cryptocurrencies, is gradually changing our understanding and use of the financial system. This change is not limited to the technical level, it also involves deep-seated changes in the economy, politics and even social structure. The rise of decentralized finance (DeFi) provides people with more transparent, efficient and non-controlled financial services, which may pose a challenge to traditional banks and financial institutions, while also bringing more choices and freedom to users. However, this change is also accompanied by risks and uncertainties. Therefore, we need to remain cautious and open-minded, deeply study and understand these emerging technologies, so as to better grasp the opportunities they bring and properly deal with possible challenges. After all, a brand new social form is in the making.

Anais

Anais