Author: David C, Bankless; Compiled by: Deng Tong, Golden Finance

Since Blast announced it was raising $20 million in funding last November, the cryptocurrency community has been questioning how it could justify supporting such a The project was so keen on attracting funding that its main investor, Paradigm, had to distance itself from the project.

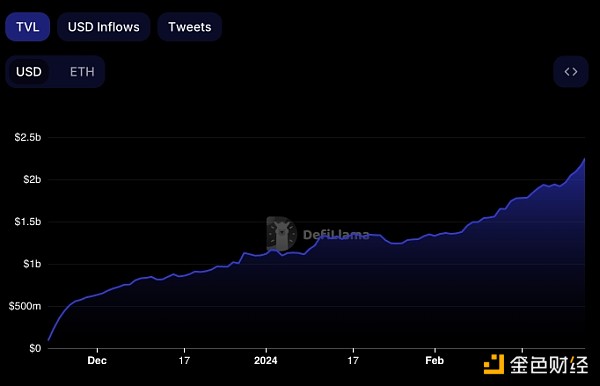

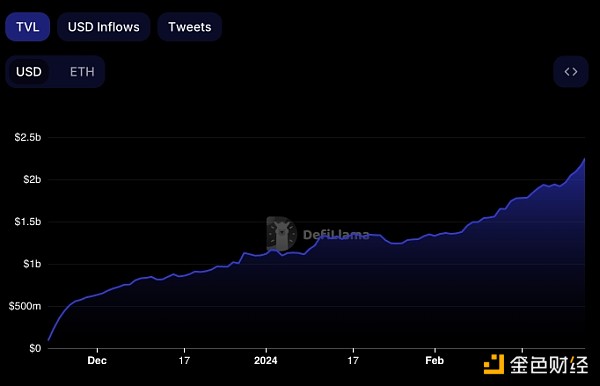

Three months in, and unsurprisingly, the cryptocurrency seems content to let over $2 billion in TVL speak for itself.

Today, the Blast Network mainnet is unveiled. The big question is, can they build a sustainable network over the long haul?

While the Blast event over the next few weeks should give us an idea of the level of demand for this L2, the real test will come in May, when Blast will be eligible for airdrops. While only time will tell, examining the strategy employed by Blast so far, the performance of its sister project Blur, and the potential benefits of native yields may give us some insight into the future of blockchain.

What makes Blast Different?

Blast's innovation lies not only in its technical capabilities, but also in its pre-launch strategy. From the beginning, Blast fostered a unique user habit of only allowing people to communicate when they received a referral code—giving the entire experience aFeeling of exclusivity.

What many call “Ponziomics” is incorporated into this recommendation system, Users can earn A certain percentage of points earned by the inviter by bridging ETH or stablecoins. This strategy proved successful. In just over a month, they amassed over $1 billion in TVL, which Blast used as an incentive to attract developers to participate in the Big Bang competition.

Big Bang Competition

This developer-centric The competition ran from January 16 to February 18, with 3,000 projects vying to be among the first to be launched on the mainnet.

This contest provides early access to Blast’s accumulated TVL, a substantial allocation from the upcoming airdrop, and direct, ongoing support from Blast investors and operators.

Many of the 47 winners announced last Friday chose to allocate all upcoming airdrops to users in an attempt to "retweet" and attract further attention. While these projects sacrifice potential airdrop rewards, by incentivizing user activity through airdrops, projects will profit from Blast’s native revenue and gas fee sharing, which they clearly see as a more lucrative pursuit.

Native revenue and Gas cost sharing

Blast's native revenue and gas cost sharing functionality is arguably its most notable feature.

By integrating with Lido and MakerDAO on the backend, Blast provides the Stablecoins offer annualized returns of 4% and 5% respectively, and can be located anywhere on the chain.

Blast also shares net revenue from gas fees with the dapps that generate those fees, giving developers another revenue stream to tap into. This blend of incentives makes L2 a place for users to park their funds and developers to earn revenue directly from smart contract contributions.

Between its initial launch strategy and unique technical features, Blast has demonstrated some standout features that make it unlike any other blockchain we’ve seen.

However, the question remains, will this be enough to keep it running after the airdrop?

Will Blast maintain its momentum?

We will understand the demand for Blast in the coming weeks, but we can better understand by examining Blur’s post-airdrop trajectory and delving into the specific use cases and business models enabled by native revenue and gas fee sharing. Find out if the network continues to exist.

Blur and its airdrop

The development trajectory of Blur, the NFT trading platform also founded by Pacman, after the airdrop . Marks the promise of Blast.

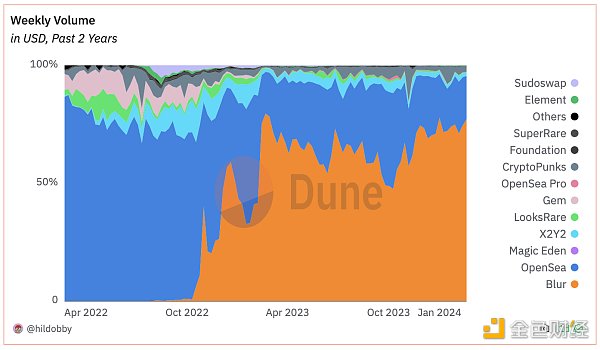

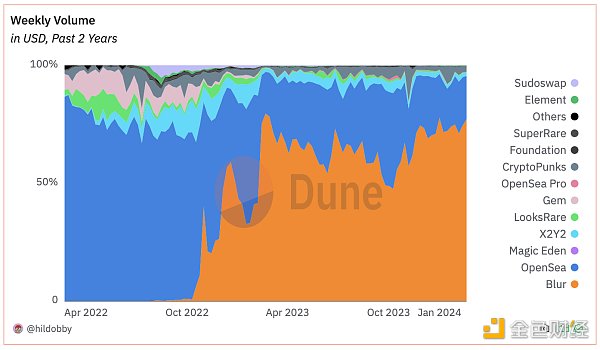

After the first airdrop, Blur did experience a drop in weekly trading volume, which was seen as a downturn in the overall NFT market, which bottomed out in October 2023. Since then, Blur's market share has not only recovered, but grown. The platform currently accounts for approximately 77% of weekly trading volume, a number that continues to grow even after Blur launched its second airdrop last November.

Although it is not exempt Subject to market dynamics, Blur’s innovative incentive program keeps premium users active on the platform, and large airdrops tend to only draw more attention to the platform.

Blast also adopts a similar incentive structure innovation method, that is, using new mechanisms such as native revenue and Gas fee sharing to retain and attract users, which also shows the strategy adopted by Blur.

Example of native revenue and Gas fee sharing

Although 4-5% yield and Gas fee It may not seem like much at first, butBlast’s native yield and gas fee sharing enable things that were previously impossible or unprofitable Unique use cases and business models.

To give a few examples, look at Monoswap and BlastOff.

Monoswap is a new DEX on Blast that uses native yields to provide points with real uses, rather than just redeeming tokens. For actions performed on its platform, users receive MonoXP (their points), providing them with unique rewards and privileges - such as the ability to share in native revenue redistribution, Gas revenue sharing, developer airdrop allocations, and the Mono ecosystem The overall profit of the system. Through this, MonoXP demonstrates an attempt to tightly integrate users with the platform, using points in novel ways while further gamifying the DeFi experience.

Next, launchpad and yield aggregator BlastOff puts yield to work in novel ways with Native Yield IDO. On their platform, users who stake ETH and stablecoins can choose to allocate a portion of their proceeds to support IDOs, combining passive income with early-stage investment opportunities without risking principal. Together, these two platforms demonstrate use cases that are only possible natively, which could provide Blast's staying power.

Conclusion

Blast’s journey from its controversial debut to its mainnet launch has certainly been interesting.

Blast has attracted a cult following by combining a controversial (but compelling!) pre-launch strategy with unique technical features. Comparisons to Blur’s post-airdrop trajectory, as well as the novel use cases enabled by native revenue and gas fee sharing, further solidify the argument for Blast’s continued relevance.

With all of these forces working together, it’s clear that Blast has placed itself in the enviable position of thriving in this new bull market, leveraging its product and community commitment among the many upstart L2s stand out.

JinseFinance

JinseFinance