Economists expect this year's rate cuts to be less than investors expect, while it's unclear how Trump will ease regulations.

The fourth-quarter earnings season has kicked off, with big U.S. banks reporting results first. Big banks such as JPMorgan Chase (JPM), Citigroup (C), Goldman Sachs (GS) and Wells Fargo (WFC) all reported profits that far exceeded market expectations, while they cited very strong demand for credit, a sign of overall good health for the U.S. economy.

Big banks' investment banking and trading businesses continue to grow, driven by continued economic growth, lower interest rates than a year ago and investor enthusiasm following the U.S. presidential election.

Expectations of looser antitrust regulations in the future are part of the reason investors are bullish on the banking sector and what they see as an uptick in mergers and acquisitions. During a period of rising interest rates and tighter regulation, companies were reluctant to make big deals, which in turn curbed growth in the big banks’ businesses.

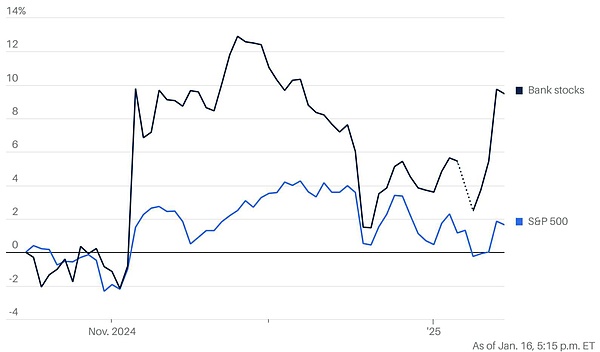

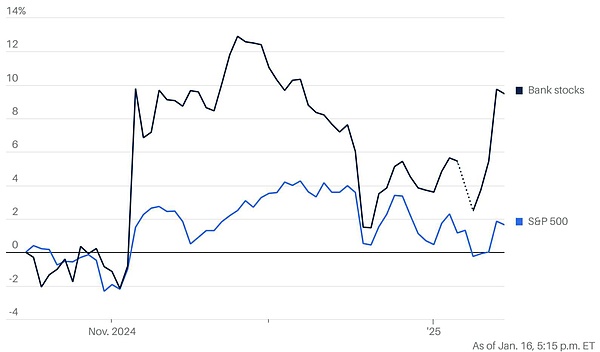

That sentiment has all but faded. The big banks impressed analysts and investors with earnings reports this week. The KBW Nasdaq Bank Index posted its biggest one-day gain since November on Wednesday before giving up a small portion of those gains on Thursday.

Note: The black line is the KBW Nasdaq Bank Index, and the blue line is the S&P 500

Source: FactSet

Morgan Stanley's (MS) fourth-quarter profits more than doubled year-on-year, with investment banking and trading revenues growing 49% combined. Goldman Sachs' 2024 profits grew 68% and investment banking revenue grew 24%, mainly due to a sharp increase in revenue from drivers such as leveraged financing activities and initial public offerings (IPOs). Meanwhile, JPMorgan's investment banking revenue grew 46%. Fees for "all products" at the big banks increased.

Wells Fargo, known for its retail banking business, saw its investment banking fees soar 59%, due to an increase in consulting fees and increased stock and bond trading activity. Goldman Sachs CEO David Solomon told analysts this week that the bank's investment banking business is currently receiving a lot of support, while companies are more willing to make mergers and acquisitions.

Solomon said on Wednesday: "No one can predict the future, but we believe there are catalysts that will continue to drive increased merger and acquisition activity. There has been a major shift in the confidence of corporate CEOs, especially after the results of the US presidential election."

The surge in performance is not just the credit of experienced bankers and stock traders. In the wave of regional bank bankruptcies in 2023, large banks had to pay a lot of money to help replenish the US government's deposit insurance fund, and their profits in the fourth quarter of that year were hit, which is also one reason why profits in the fourth quarter of 2024 were significantly better than the previous year.

At the same time, the banking industry also faces some risks. Economists expect fewer rate cuts this year than previously expected, while it's unclear how Trump will ease regulation.

JPMorgan Chase CEO Jamie Dimon noted on Wednesday that inflation remains a big problem and the Federal Reserve can't cut rates as much as investors would like. Geopolitics is another big issue, with the recent Gaza ceasefire agreement looking like it will help defuse the conflict in the Middle East, but uncertainty remains about the relationship between the United States, Russia and China.

However, even the typically "worried" Dimon acknowledged that the current U.S. unemployment rate is low, consumer spending is strong and business confidence is optimistic.

These are good for everyone, not just the big banks.

Miyuki

Miyuki