If someone stayed up late to watch Trump's White House Crypto Summit, they would probably be quite disappointed.

The entire summit completely fits the stereotype of Trump, absurd and full of performance traces. In the weeks before the summit, the industry seemed to be facing a big test, studying the theme of the meeting, digging out the participants, imagining possible conversations, and paying attention to the participating reporters, for fear of missing any wealth codes brought by the first White House Crypto Conference. And just before the summit, news came one after another, one moment the list of crypto reserves was released, and the next moment the Bitcoin strategic reserve was established, which made the expectations hang high in the hearts of industry insiders. Once again, "the big one is coming."

Unfortunately, the slogan of "laying the foundation for four years of encryption" was held high, but no implementable policy was mentioned in the whole meeting. The market also successfully fell in this unclear summit. Bitcoin fell from $91,000 before the meeting to $85,000. It is currently falling continuously, once falling to $80,000, and now reported at $82,000.

Raised high and put down gently, but after all, it is the White House's encryption summit, and it still released some effective signals.

People who stayed up late on Saturday to follow the White House summit are "blessed".

First of all, it should be pointed out that this encryption summit was held behind closed doors. Before that, the participants had been deeply dug up. About 30 senior government officials, congressmen and corporate executives participated in the event, and leaders gathered together. In addition to the most important guest, President Trump, there were senior government officials, including David Sacks, head of encryption and AI at the White House, Tom Emmer, the majority whip of the House of Representatives, and Bryan Steil, chairman of the House Digital Assets Subcommittee, as well as leading platforms and well-known companies, including Ripple, BitGO, Crypto.com, Kraken, Coinbase, Chainlink, Mara, Gemini, and Robinhood. Trump's nepotism WLFI was also included. Top capitals also attended, including a16z, WisdomTree, Paradigm, Multicoin, etc.

Although it was a closed-door summit, there was still an official live broadcast link at the beginning of the meeting, which gave the market an important window to explore the content of the summit. Unfortunately, the official live broadcast came to an abrupt end in less than 20 minutes. In these short 20 minutes, in addition to Trump's speech of less than 5 minutes, a large-scale workplace thick black theory was also staged.

The summit, which was supposed to start at 4 o'clock, was delayed by about 45 minutes. The market finally waited for Trump, who was late, but Trump's first topic was not encryption, but the upcoming 2026 World Cup. He first let FIFA President Gianni Infantino show the World Cup trophy, and then took the opportunity to propose that Bitcoin is more valuable than FIFA and returned to the topic.

Trump thanked his right-hand men who came to the meeting, and in accordance with his usual practice, stepped hard on the Biden administration's "stupid" decision to sell Bitcoin and strangle Operation 2.0. After announcing a bill that would change the policy environment and promote the clarity of stablecoin and digital asset market supervision, and hoped that stablecoin-related legislation would be submitted to the President's Office in August, he ended his speech.

Then came the speeches of major regulatory officials and industry leaders. The imagined insights turned into bubbles. Everyone started by thanking the great president and ended by thanking the president for his wisdom. A summit became Trump's foresight and boasting base camp. It is rare for a serious meeting held by the top leader.

It is enough to see that the value of the summit is more formal than a discussion of industry development in the true sense. In other words, this is Trump's feedback on the attitude of crypto supporters and a political endorsement of crypto in the campaign agenda. But from the speech, Trump is not a senior enthusiast of the currency circle. He lacks attention to the Defi application field that the industry is concerned about, and he has no mention of the tax exemption for crypto that the market had expected. His attitude towards crypto is more like a black cat or a white cat, as long as it can make money.

Of course, this summit is not completely without information. Trump's speech still released some signals.

First, the strategic Bitcoin reserve will become the 'virtual Fort Knox' of digital gold, stored by the U.S. Treasury Department. Compared with the previous market speculation on the increase in reserves, Trump said that the Treasury and Commerce Departments will also explore new ways to increase the holdings of Bitcoin reserves, provided that there will be no cost to taxpayers.

Secondly, in terms of supervision, Trump maintained his consistent attitude of regulatory relaxation and made it clear that he would end Operation Strangulation 2.0 (the Biden administration had curbed crypto activities by prohibiting crypto access to banking services). The U.S. Office of the Comptroller of the Currency (OCC) also reiterated that the federal banking system can legally custody crypto assets, hold deposits as stablecoin reserves, and use blockchain technology to promote payment business.

The most important information is stablecoins. There have been market rumors that Trump is interested in stablecoins, and his family project WIFL has also mentioned entering the field of stablecoins. This speech confirmed this signal. Congressional lawmakers are pushing for bills on dollar-backed stablecoins and clear regulation of digital asset markets. Trump believes this will become a "promising" growth model and hopes that Congress will be able to pass relevant legislation before the August recess. It is worth emphasizing that it also mentioned that "the status of the dollar will remain stable for a long time."

From the remarks on stablecoins, it can be seen that the US dollar stablecoin will be an important part of Trump's crypto policy. In response to the impact of today's cryptocurrencies on sovereign currencies, the United States has adopted a strategy of blocking rather than dredging. Compared with a one-size-fits-all operation, it emphasizes the establishment of its own rules to grasp the right to speak, and builds the influence of the US dollar by controlling the pricing of core value targets. In fact, this approach is quite similar to the US's advocacy of oil.

Specifically, stablecoins are the key pricing tools in the crypto market. Only US dollar stablecoins can promote cryptocurrencies to be priced in US dollars, rather than letting decentralized currencies run rampant and shake the foundation of US dollar hegemony. In other words, the US dollar stablecoin can become another tool for the US dollar to dominate the decentralized field. Through the widespread use of stablecoins, the US dollar hegemony can be further extended to the encryption field, thereby prompting digital currency to become an appendage and derivative of the US dollar. In this context, even if the world enters the digital currency era, the US dollar will still be the first currency. In addition, the reasons for the establishment of the Bitcoin Reserve can also be seen. Bitcoin is a key pillar in the encryption field. It is most controllable to denominate it in US dollars and establish it on the basis of the stable hegemony of the US dollar. This is also why the currencies that claim to be "Made in the United States" have taken the lead in this round of copycat markets, while ETH, Defi, etc., which the industry pays more attention to, have been coldly received by the government. In order to obtain sufficient policy narratives, they can only be integrated into the system denominated in US dollars and prioritized by the United States. On the other hand, Trump's speech also demonstrated his core attitude towards cryptocurrencies. The US authorities hope to reduce debt pressure through tokenization rather than promote the development of currency prices. Whether it is the access to banking services or the legislation of stablecoins, they are laying the foundation for achieving this goal. It can be predicted that the tokenization of US debt on the chain may become the focus of the follow-up. A subtle proof is that in his speech, Trump no longer referred to it as cryptocurrency, but used digital assets instead. Stability and compliance will become the main theme of the industry. Although there is solid content, there is more nonsense. Under the premise of full expectations, this summit has disappointed the market again without exception. The price of Bitcoin also fell from $91,000 before the meeting to $85,000, and ETH fell back to around $2,000. What's more interesting is that the previous list of encrypted reserves also caused a misunderstanding. David Sacks explained that "the president mentioned the top five cryptocurrencies in market value, and people interpreted it a bit too much." Cardano founder Charles Hoskinson even said that he was not aware of Trump's plan to include ADA in the strategic reserve, saying that he didn't know why ADA was included in the reserve. At present, XRP, SOL, ADA and other presidential "favorite" tokens have all fallen, and SOL has fallen below $130, now at $127.

In addition to the summit's disappointment, the Bitcoin strategic reserve has also encountered problems. On March 10, the highly anticipated Utah Senate passed HB230, the Blockchain and Digital Innovation Amendment Bill, but ultimately deleted the clause that originally allowed the state treasury to invest in Bitcoin, which also disappointed the market. Currently, of the 31 Bitcoin reserve state bills issued, 25 are in progress, including bills from Illinois, Iowa, Kentucky, Maryland, Massachusetts, New Hampshire, New Mexico, North Dakota, Ohio and Oklahoma.

Overall, despite the frequent policies, regulatory relaxation, and the establishment of strategic reserves, the current market's upward momentum is still obviously insufficient. Bitcoin prices continue to be under pressure on macroeconomic development and global trade issues, and the horn of the policy bull market seems to have come to an end.

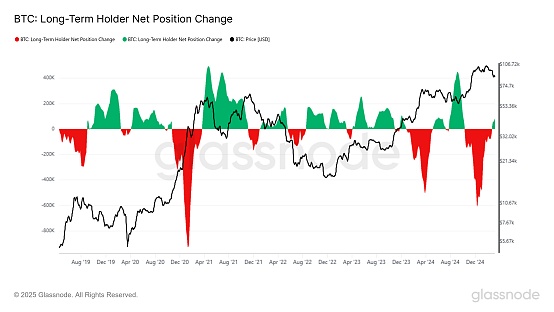

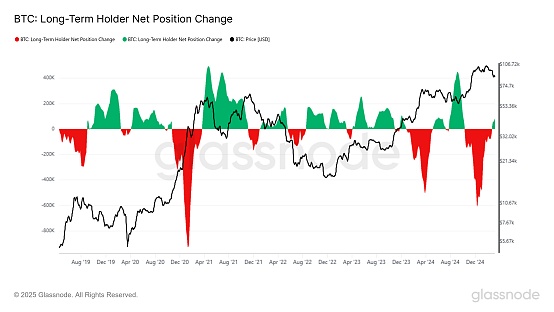

From the perspective of the market outlook, the market's prediction of the market is also hesitant. Julio Moreno, head of research at CryptoQuant, said in a post that the growth of Bitcoin spot demand is shrinking, and Bitcoin's short positions dominate the futures market. This contraction is the largest drop since July 2024, reflecting the reluctance of market participants to establish new positions. In addition, long-term holders (LTH) have shifted from distribution to holding positions, which also shows a signal of the tail end of the rising market.

And just today, BitMEX co-founder Arthur Hayes posted again on the social platform, saying that the market started poorly this week and Bitcoin may retest the 78,000 support level. If it falls below, the price will point to $75,000.

Interestingly, the market is fair. The Trump family project WLFI investment portfolio has currently lost about $110 million. The nine tokens purchased by the fund for $336 million are now worth only $226 million. It is worth mentioning that David Sacks also responded to President Trump's issuance of coins, saying "I don't think it has any impact. It has nothing to do with our work here." He also said that Trump's personal investment in encryption is "a fact without evidence."

From the current perspective, the market is at the junction of bull and bear markets, the signal is not clear, the short-term downward pressure is more obvious, and the existing policy stimulus effect is gradually reduced. Under the treacherous global situation, the crypto market's own "water absorption" ability is facing a big test. The big one is coming and it is basically over. Conspiracy theories are flying all over the sky. It is crucial to keep your own wallet.

Davin

Davin