Author: Matt Source: X, @mattdotfi Translation: Shan Ouba, Golden Finance

Before projects such as Lens, Farcaster, and FriendTech really pushed SocialFi to the forefront, few people would seriously consider building decentralized social networks or designing mechanisms to reward content creators. However, the incentive design and sustainability issues on these platforms are precisely at the core of their popularity and even decline.

This article will review the models adopted by these early projects and analyze what went wrong with them. In our next article later this week, we will focus on the improvements of the new generation of SocialFi projects and possible future development directions.

What is SocialFi?

The boundaries between social and finance are becoming increasingly blurred. Against this backdrop, SocialFi (a fusion of Social + Finance) aims to revolutionize the way people interact online and reshape the monetization path of our digital existence. Compared to Web2 social media (such as Instagram and TikTok) that concentrate value and revenue in the hands of the platform, SocialFi pays more attention to the core concepts of Web3: decentralization, direct ownership of content, and freedom of expression.

In the SocialFi ecosystem, users can profit directly from interactions. Social reputation and influence can also be quantified and exchanged as "social capital".

Pioneers

Lens Protocol

Lens Protocol is one of the first projects to propose the SocialFi narrative, now renamed Lens Chain. It was released in 2022 and was initially deployed on Polygon, and later migrated to an independent second-layer network based on zkSync. Lens allows users to own their own social profiles and content through NFTs, providing a decentralized alternative to social platforms. What’s special about it is that Lens also acts as a “Layer 0”, providing underlying content and ownership support for other social applications such as Phaver.

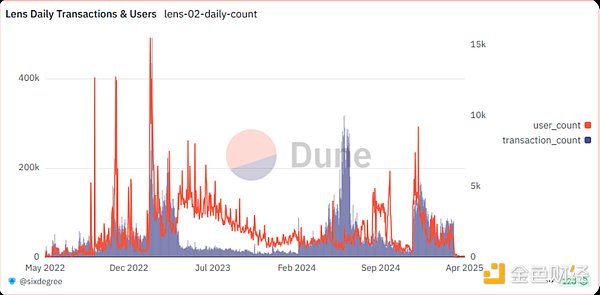

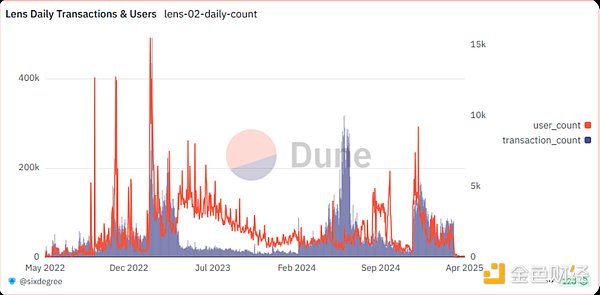

Although Lens had a craze in the early days, with user-registered NFT accounts once being hyped to more than $300 and successfully launched on the mainnet in 2025, it has always been difficult to attract and retain a wider user base. Competition from platforms such as FriendTech and Farcaster, coupled with disappointing airdrops and unclear platform positioning, has prevented Lens from forming a real network effect. As of now, although the platform has more than 600,000 registered accounts and a small number of active ones, the overall popularity is gradually fading from people's vision.

FriendTech

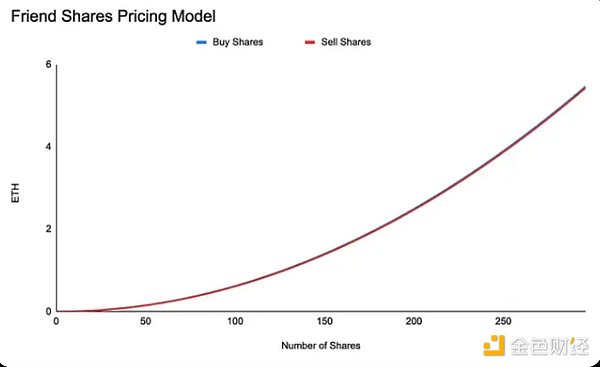

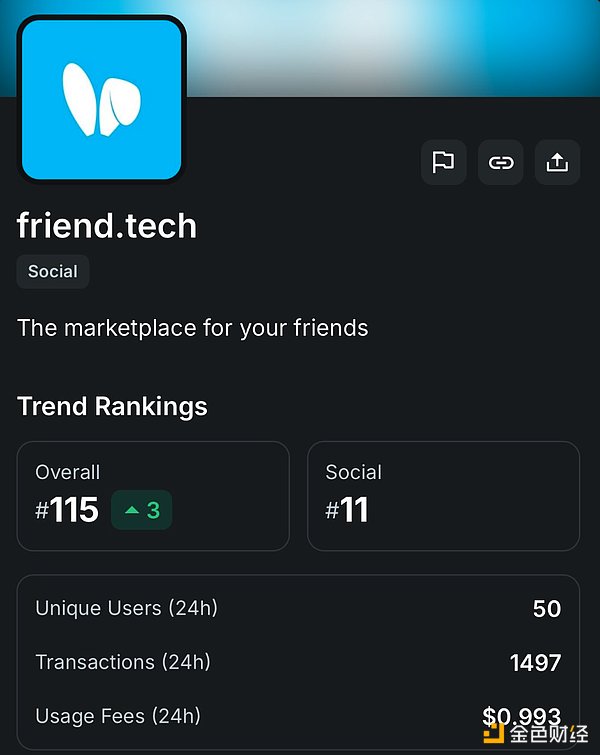

Another early and once very successful SocialFi project was @FriendTech, launched in 2023. The platform attempted to redefine the way users interact with content creators. It did so by issuing "shares" to price the activity of creator accounts. Users who hold these shares can establish direct connections with creators, while creators can earn income through the sale and purchase of shares.

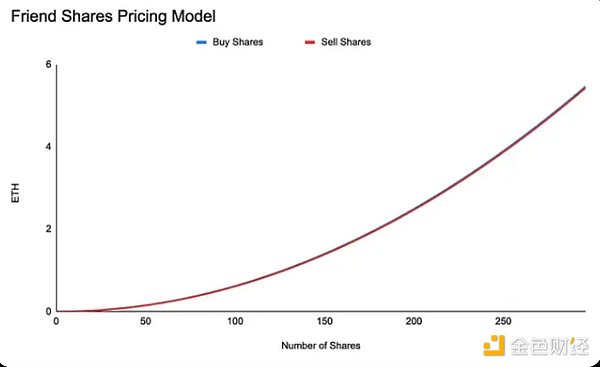

However, a key reason for the failure of FriendTech was precisely its share pricing mechanism. Instead of a fixed price or the classic CPMM (Constant Product Market Making) model, it uses a quadratic curve binding mechanism to determine the price of each share.

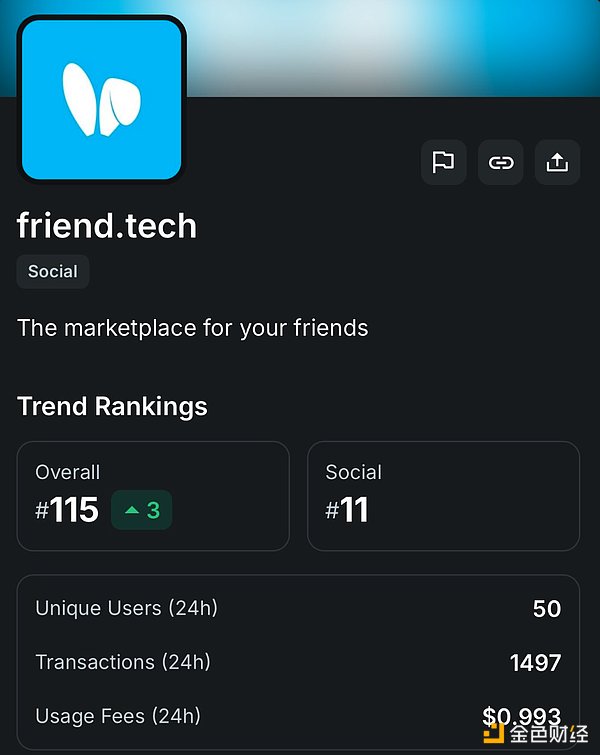

In the early days of the project, FriendTech had set off a wave of enthusiasm due to the participation of a large number of crypto KOLs on X (Twitter) and the expectation of future FRIEND token airdrops. But soon, this economic model began to be questioned as a variant of a Ponzi scheme because it was highly dependent on the continuous influx of new users and the share market was extremely illiquid.

Vitalik (founder of Ethereum) also publicly criticized FriendTech, calling it a bad game finance that replaced the real value that should be in content creation with pure speculation.

With the continuous decline in the number of active users and the gradual decline in creators' income, FriendTech was finally closed in September 2024, when the platform's daily income had dropped to only $71, which was obviously unable to maintain the team's operating costs.

Farcaster

Farcaster was founded in 2020 by former Coinbase employees with the goal of building a truly decentralized social network similar to X (formerly Twitter). The project completed a $150 million financing in May 2024 with a valuation of $1 billion.

It’s true that Vitalik isn’t “invisible” on Farcaster, but his presence isn’t particularly active or influential either. Farcaster’s path is slightly less disappointing than FriendTech’s, perhaps because it hasn’t yet issued an airdrop. However, its active user count and current revenue are still well below their 2024 peak levels.

The platform sets a bar by charging a $5 annual subscription fee, but doesn’t offer a significant improvement in user experience over traditional social media. Unlike FriendTech’s “share model”, Farcaster prefers to issue meme coins (such as DEGEN) and launched a feature post called “Frames” that allows users to complete on-chain operations without leaving the platform.

But the problem is that with the rise of AI agents like @SimulacrumAI, these functions can also be easily implemented on X. At the same time, Farcaster’s mini-program function (Mini Apps) did not arouse user interest. This leads to a key question: When users can already complete these operations on existing platforms, why should they migrate to a completely new platform?

Conclusion

The ideas of these projects are interesting, but their actual execution has obvious problems. They tried to build new platforms that could compete with giants like X, Telegram, and Discord, but failed to achieve several key goals:

failed to form a real network effect;

failed to design a sustainable flywheel of user growth and platform growth;

failed to make users willing to "go out of the circle" because the platform did not provide a clear value proposition other than the implicit "airdrop promise".

Joy

Joy