Author: Cathy, Plain Language Blockchain

A couple of days ago, the Bitcoin ecosystem research and consulting team 1A1z published an in-depth report on the builders of Bitcoin Core.

The article, seemingly just a routine developer interview and survey, actually reveals a layer of reality in the crypto industry that is easily overlooked: there is a group of people who stay away from the center of attention, don't talk about narratives, don't do marketing, and have been maintaining the most basic and critical infrastructure of this industry for a long time.

In this list of sponsors supporting Bitcoin Core, OK's name is not in a prominent position. It is precisely because of this low profile that many people have realized for the first time: there are still large platforms in this industry that invest resources in "public research and development," something that may not yield short-term returns but will determine the long-term direction of the industry.

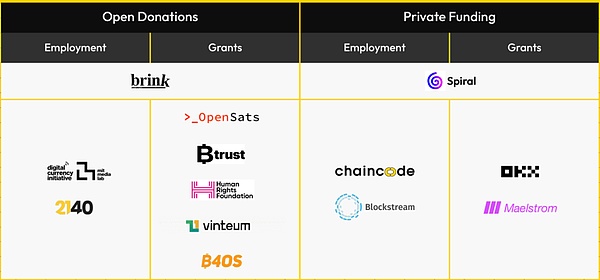

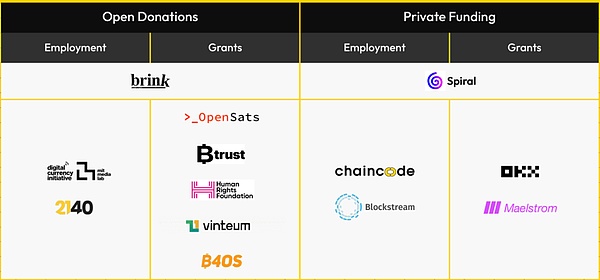

After the article was published, OK Star reposted and quoted a passage from within the team: "From the very beginning, we have insisted on contributing our modest efforts to the underlying development of Bitcoin. For the past ten years, we have never hyped or promoted ourselves, because we firmly believe in the future of blockchain." Similar expressions are not uncommon in the industry. However, when this statement is placed in the context of Bitcoin Core, its meaning is quite different—this is not a marketing slogan, but a value choice: the willingness to invest time, resources, and patience in areas where no one is paying attention. 01 The People Who Pay for Bitcoin's "Operating System" To understand the significance of this, we must first return to a core question: What exactly is Bitcoin Core? Simply put, Bitcoin Core is the "operating system" of Bitcoin. It is the software that runs on full nodes, the rule executor and transaction verifier of the entire network, and the foundation for maintaining Bitcoin's security, network consistency, and censorship resistance. The familiar BTC price, block height, transaction confirmation, and network stability—indicators mentioned countless times daily—all depend on the correct operation of the Bitcoin Core codebase. More importantly, Bitcoin Core has never been a commercial project since its inception. It has no CEO, no KPIs, no profit model, and no "return on investment cycle." It relies on the contributions of global volunteers and the long-term support of external sponsors. Some developers focus on network performance optimization, some research verification rules and security, some dedicate themselves to privacy improvements and user experience optimization, and some do work that ordinary users will never see, but the entire ecosystem cannot function without. Because Bitcoin Core has no profit model and no company backing, it needs external funding. A 1A1z report shows that sponsors supporting Bitcoin Core include foundations, research institutions, infrastructure companies, and a few trading platforms. These funds are primarily used for node performance optimization, security research, network synchronization, privacy enhancement, and code review. It's fair to say that without this continued support, Bitcoin Core would have struggled to maintain stable development for over a decade. The report identifies 13 major sponsoring organizations: Blockstream, Chaincode Labs, MIT, Spiral (formerly Square Crypto), OKEx, the Human Rights Foundation, Brink, Btrust, OpenSats, Vinteum, Maelstrom, B4OS, and 2140.

Image: Bitcoin Core's main sponsoring organizations, source: 1A1z

The criteria for being included in this core list are clear: long-term, stable, and low-profile.

This is why, although exchanges like Coinbase, Kraken, and Gemini have had developer funding programs in the past, they are not listed as core sponsors—the report points out that these projects are currently either inactive, infrequent, or no longer focused on Bitcoin development. In contrast, OKEx's funding program, which began in 2019, has continued to this day, making it the only exchange among the 13 core sponsors.

03 The Value of Long-Termism

The phrase "ten years of hard work" sounds like marketing rhetoric in the crypto industry. But looking at the numbers, some things are indeed happening.

Let's look at the industry situation in 2025: The number of tokens surged from hundreds of thousands in 2021 to tens of millions (over 50 million) in 2025. The token issuance cycle was compressed from two years to 3-6 months. Less than 20% of a project's total cost is actually spent on technology; the rest is poured into listing fees, market makers, KOLs, and media promotion (ICODA DeFi Marketing Budget Guide). In this environment, the difficulty lies in investing resources in underlying protocols, developer ecosystems, and user infrastructure—areas with "invisible returns"—because while short-term returns are not visible, long-term success or failure is crucial. This sustained investment will ultimately translate into competitiveness: Technological efficiency brings cost advantages. When your system processes data quickly and cheaply, you naturally have the space to offer users better prices. This isn't a price war; it's a technological dividend. User experience determines large-scale adoption. No need to remember mnemonic phrases, no worries about cross-chain hacking, and the system automatically finding the best price—these features address real pain points. Good attention to detail keeps users engaged. Infrastructure development determines future capacity. When the RWA market truly reaches $600 billion by 2030 (as predicted by Boston Consulting Group), the infrastructure capable of supporting these asset transfers will become the scarcest resource. At that time, those who have positioned themselves early will have the greatest first-mover advantage. This is the value of long-termism: laying the foundation while others chase trends, and completing the skyscraper by the time others realize it. 04 Summary Industry trends have cycles, but Bitcoin's development has no. Market hype may rise and fall, but the underlying infrastructure needs to be built and maintained over ten or twenty years. This is perhaps the most difficult yet most important thing in the industry. In this sense, participants like OKEx deserve attention not because of their publicity, but because they choose to do things that "someone in the industry must do" but "no one is obligated to do." Builders don't necessarily need applause, but they deserve to be seen. And where the crypto industry will ultimately go largely depends on these unseen choices.

Catherine

Catherine