. lang="en-US" lang="zh-CN">monthTerraTheoretically1USDTall correspond to1USD collateral,

I think that anyone who has been in the industry for more than 5years will agree with such a self-contradictory judgment.

I myself choose conditional trustUSDT, what is this condition?

I think it is the price of Bitcoin.

I started the year (2025year2month) readTetherUSDTthe company released.

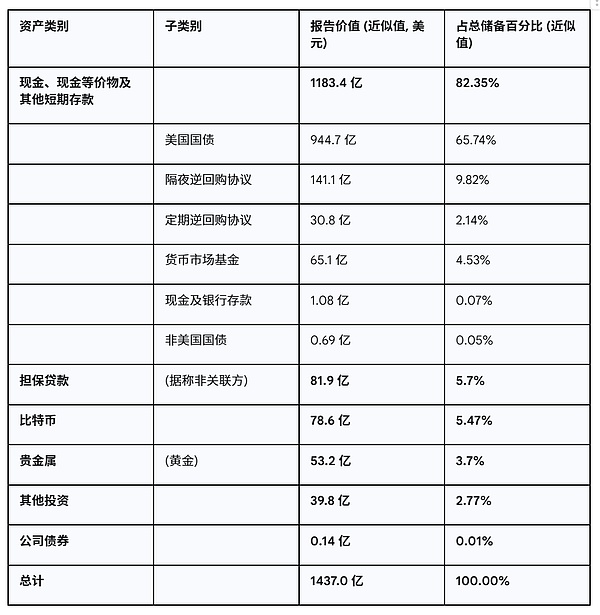

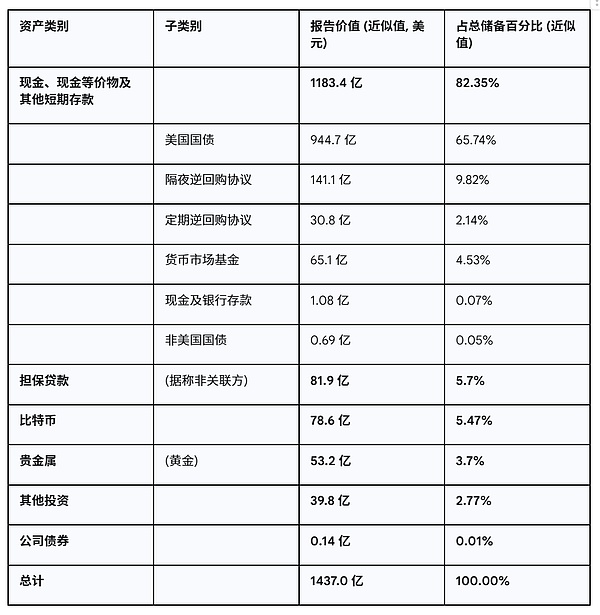

Table: Tether reserve composition (as of December 31, 2024)

From the table, we can draw the following facts:

USDTThe corresponding collateral is1183.4

USDTAlso78.6Billion dollars in Bitcoin (2024Year12Month, the price of Bitcoin was 10Ten thousand), accounting for 5.47% of total assets5.47% of total assets.

Others can be classified as assets with lower liquidity and seem less reliable, such as secured loans, precious metals, and investments, which account for 12.18%.

Of the above asset portfolio, the only one we are most familiar with and has the best transparency is Bitcoin. If the price of this 5.47% Bitcoin plummets, we can know it directly.

IfBTCthe price has increased (based on the price at the time of the balance sheet release10

USDT

There is no risk of losing anchor. But ifBTCthe price falls, for example, by 50%

than when the balance sheet was released, we have more reason to be concerned aboutUSDT text="">whether the collateral is sufficient. Other collaterals are not transparent enough, so it is difficult for us to judge whether they are healthy.

Therefore, my confidence in USDTbased on the above imprecise argument, as long as BTC

the price falls below 5 w, I will have to take risk avoidance operations on my USDT positions, such as switching to USDC. IfBTCIf the price does not fall to5w, hold itUSDT, blindly believe in its awesomeness and enjoy its liquidity advantages. Unless something else happens.

FromTether'sCEOat

FromTether CEOPosting about technology, I feel it is also nonsenseBTCUSDT, in fact it mainly relies on Ethereum's erc20, and Trc20 of Tron.

So, I judge subjectivelyTetheris the height andBTCBound. Just in caseBTChas fallen too badly, and users who holdUSDTshoulder risks if there are any options in the market.

In addition, just a few weeks ago, I was particularly worried about whether the Dai stablecoin would be unpegged.

BecauseETHContinues to plummet, pressMakerDaoProtocol design, 1hour delay in liquidation, and liquidation penalty13%, the setting of these two parameters.

IfETHThe plunge exceeded 13%

This may have an impact on the stability of

Dai. Of course, ETHDidn't happen1Plumped more than 1 hour13%. The market lost an opportunity to test MakerDao's design.

Brian

Brian