Source: Liu Jiaolian

At 8 o'clock last night, BTC, which had been breaking away from the 45k sideways position since 6 o'clock in the evening, reached the fastest acceleration of its downward decline. In just 2 hours, it went from 45k pins to nearly 40k.

Look at those three thousand feet, what is flowing down is not the Milky Way, but the color of blood.

The bulls who were caught off guard were defeated and were in a hurry to organize forces to fight back.

There are copycats (such as MKR, ARB, etc.) that are in the process of controlling the market. The market makers did not expect that the short sellers would suddenly call for a long-range firepower saturation attack. In an instant, all the defenders were wiped out, and the market making depth was It was penetrated instantly, forming a long lower shadow line (commonly known as a pin).

The bulls were eating hot pot and singing songs on the battlefield, waiting for their strong support from the SEC to arrive on the 10th, launch a "New Year Offensive", and send the shorts to the Tathagata Buddha to celebrate the New Year, but they did not expect that the shorts would not say anything. Wu De, launched a sneak attack in advance, and sent the new company helmed by Wu Jihan, the original mining tycoon who had failed to hard fork BTC, to provide far-reaching fire coverage. In two hours, all the bulls on the position were sent to their seats.

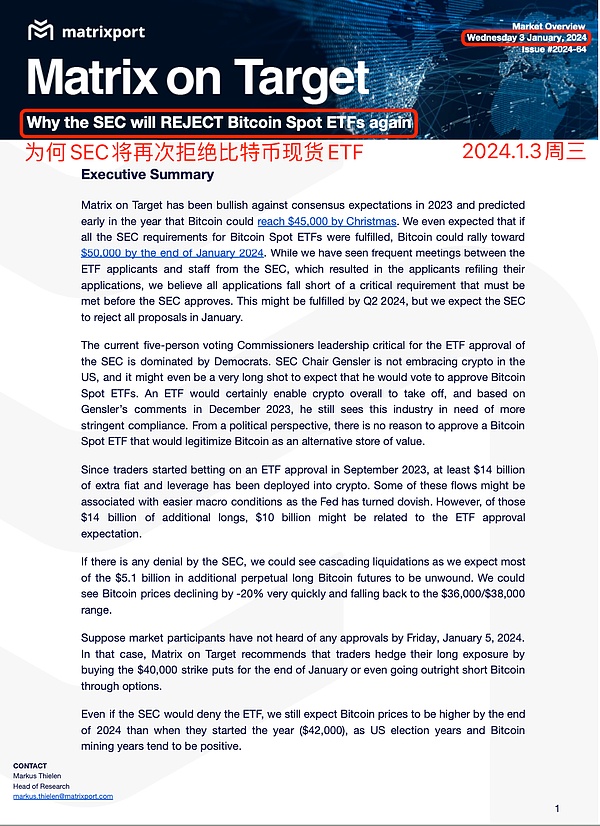

You read that right, the published report is only this short one page "Executive summary" (with a one-page disclaimer attached), and in English.

It was written in English, but it made waves in the Chinese-speaking market. This is the essence of distant fire strike.

From the preparation and release of English summaries, to the linkage between industry Chinese media and KOLs and big Vs, they have translated, forwarded, and pushed, and cooperated with traders to ship goods. The news and market crashes were almost at the same time, like a downpour. Generally, it pours out like a pour. The rain instantly filled every inch of space, and the water on the ground instantly turned into a river.

What is even more confusing than Yuanhuo is that as the boss, Wu Jihan actually stood up and said publicly that our analysts are independent and are not subject to management constraints and influence. The implication is that their analysts can publicly express various opinions at will and use the company's influence to influence the market (and perhaps "coincidentally" cooperate with certain traders to change the situation), but the company is not responsible for the consequences they cause.

This is as magical as a foster parent talking about the independence of the foster child in front of the public camera.

Matrixport, which was established after Wu Jihan lost BCH and sadly left Bitmain, has always been unknown in the industry. After this battle, it can be regarded as creating a huge buzz. The Leeks lost money so deeply that they remembered its name in their hearts!

Matrixport’s core point of view is very simple and clear:

1. It’s almost the deadline in January, and the SEC is still frequently meeting with applicants, so it must be There are still key issues with the application that need to be revised. If this problem is not corrected, it will be very difficult for the SEC to deal with it. It will definitely be too late in the short term. It is estimated that all applications will be rejected in January and will be approved again in the second quarter.

2. The SEC’s voting committee has 5 people, with the Democrats accounting for the majority (3:2). SEC Chairman Gary Gensler is not a supporter of cryptocurrencies. He also reiterated in December that the encryption industry needs stricter regulation. From a political perspective, there is no need to approve such a product, which would make BTC a legitimate alternative store of value.

3. Since the approval of bets on ETFs in September last year, at least 14 billion U.S. dollars of funds and leverage have flowed into the crypto market. Excluding some bets on the Fed’s interest rate cuts, at least 10 billion U.S. dollars have remained. Bet on ETFs approved. If the ETF is rejected, an estimated $5.1 billion in leverage will be liquidated. This will cause BTC to quickly drop 20% and return to the 36k-38k line.

4. It is recommended that investors buy 40k put at the end of January to hedge their long positions, or even use option tools to short BTC.

5. In the long term, even if the SEC rejects ETF, it is still believed that BTC will be expected to exceed the opening price of 42k at the beginning of the year by the end of 2024.

(Risk warning: The above five points are the views of the Matrixport report and do not represent the views of the author of this article and do not constitute any investment advice)

It seems that the words are quite sensible. However, the flaw is also obvious, that is, the entire starting point of the reasoning is based on speculation: judging from their frequent meetings, there must be issues that have not been discussed, right?

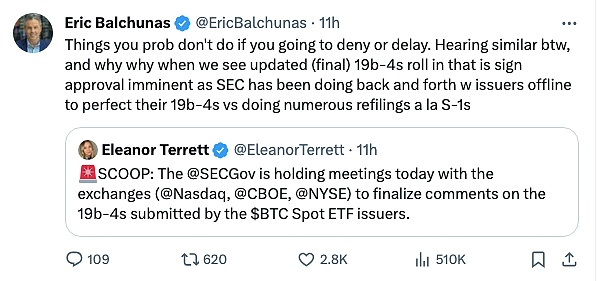

Soon, Bloomberg analysts responded, tweeting that the frequent discussions were for the purpose of quickly improving materials, rather than for unresolved key differences.

At this moment, it is the time in the East Eighth District.

The market rebounded to 43k in a short time. And the shock range is re-established here.

This is really:

The old man calls the single dog, and his hands are wet with rain and clouds. The rivers and lakes are evil and happiness is thin. A guess, the geometry of the liquidation. Wrong, wrong, wrong.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo Catherine

Catherine Beincrypto

Beincrypto Beincrypto

Beincrypto Nansen

Nansen Bitcoinist

Bitcoinist Nulltx

Nulltx