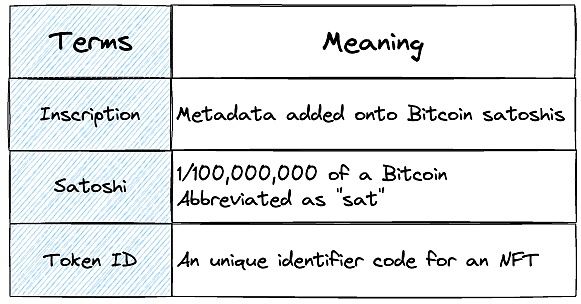

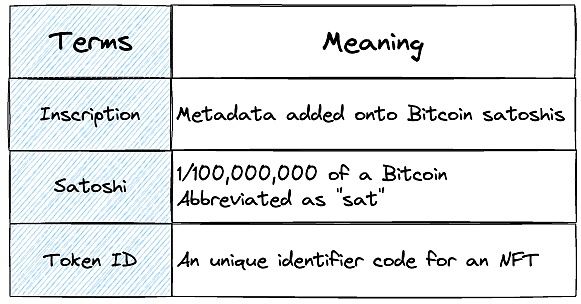

Before delving into the BRC-20 token, it is important to understand how ordinal works. By default, 1 Satoshi is a fraction of 1 Bitcoin – 100 million Satoshi is equivalent to 1 Bitcoin.

Ordinal numbers can assign a serial number to a single satoshi, allowing them to be tracked and traded via inscriptions. Each Satoshi can be imprinted with data, such as pictures, text, or videos, through Bitcoin transactions.

After a transaction is mined, the written data will be permanently stored on the Bitcoin blockchain. This makes each Satoshi different from each other and therefore irreplaceable.

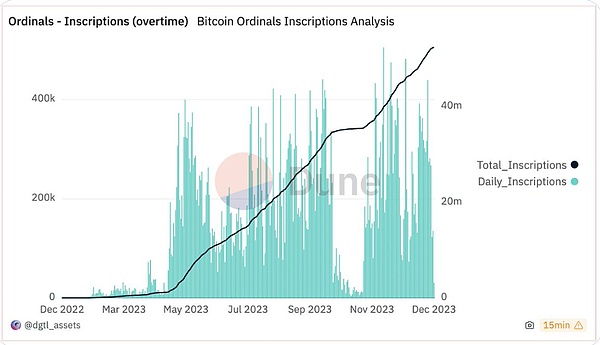

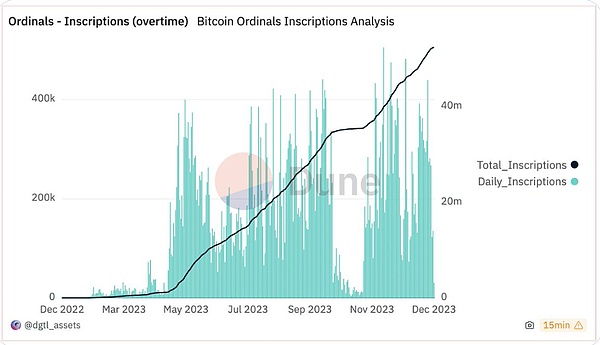

The competitive advantage of Ordinals NFTs is that they can be created directly on the Bitcoin blockchain. Since the launch of Ordinals in January 2023, inscription activity has grown significantly, and Bitcoin There has also been a considerable boom in coin NFTs.

In March 2023, @domodata used ordinal numbers to lay the foundation for a new token standard, BRC-20, an experimental token standard for fungible tokens (FTs) on the Bitcoin blockchain.

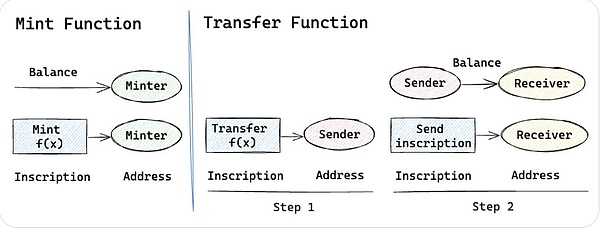

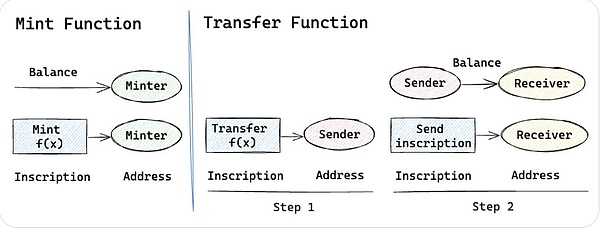

Unlike the ERC-20 standard, the BRC-20 standard does not rely on smart contracts, but utilizes ordinal inscriptions. BRC-20 tokens can be deployed, minted, and transferred by writing JSON data directly into Satoshi tokens.

Although BRC-20 is a type of ordinal inscription, not all ordinal numbers are BRC-20 tokens. Standard Bitcoin serial numbers can be engraved with any information, but BRC-20 tokens are always engraved with JSON data. In short, unlike standard ordinal numbers, BRC-20 makes tokens fungible.

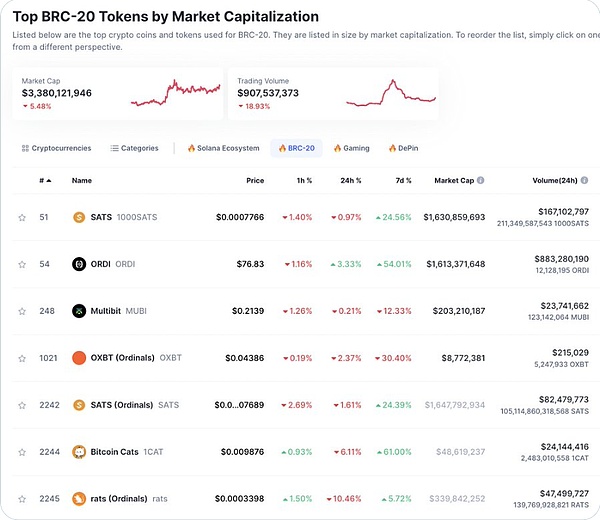

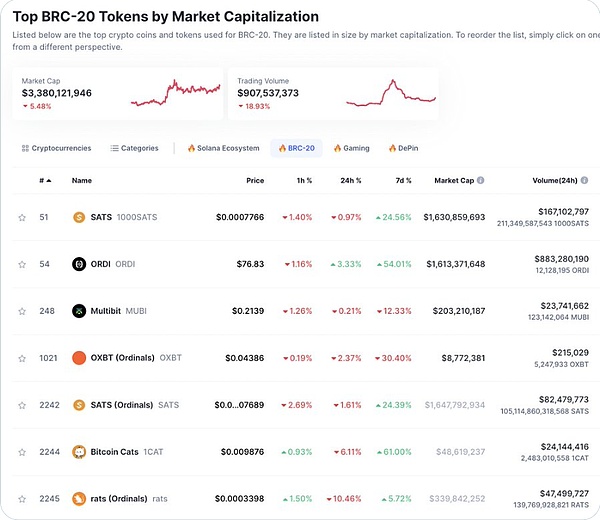

What is the current market size of BRC-20? According to @CoinMarketCap, the current market capitalization of BRC-20 is approximately $3.4 billion, a 3.4x increase in 7 months. Top tokens include ORDI (the first BRC-20 token minted), SATS, and more.

What are the advantages of BRC-20?

A tokenized enhanced version of Bitcoin that goes beyond the "digital gold" theory;

Inherits the security of the Bitcoin PoW system, so it is technically safer than Ethereum;

Completely based on the chain - no additional file system like IPFS required;

Be able to gain traction from the large and diverse network user base on the Bitcoin network;

With existing Interoperability of Bitcoin infrastructure, including wallets and exchanges;

BRC- What are the disadvantages of 20?

Due to Bitcoin’s limited block size and transaction throughput, fees and time may be incurred Increased scalability issues;

Compared to ERC-20, smart contract functions are limited and therefore cannot implement very advanced functions ;

Interoperability challenges with other blockchain networks, as BRC-20 is intended to be implemented within the Bitcoin ecosystem Interaction;

Still in the early stages, as it is still experimental and has limited support tools, so there are certain risks;

p>

By making tokens fungible, BRC-20 has changed the landscape of what defines Bitcoin game rules. As the Bitcoin L2 ecosystem develops, we may see more BRC-20 focused DeFi projects in 2024.

Although BRC-20 is still in the experimental and underdeveloped stage, the growth of research development and projects reminds us to some extent of the similar Ethereum pace. The growing interest in BRC-20 from users, projects, developers and investors is a testament to their potential.

JinseFinance

JinseFinance