The human heart is unpredictable, yet Chinese people look to the West for their hopes.

@YBSBarker is hiring interns for front-end and back-end development, based in Shenzhen. Please contact us privately.

The theory of randomness originated in gambling, and is naturally inferior to geometry, which originated in the Greek sages.

The expression of quantified uncertainty became the original subject of probability theory, which is also the biggest difference between prediction markets and casinos. If you look at PolyMarket's documentation, its defense argues that casinos have a house commission, and according to the law of large numbers, anyone who gambles over the long term will lose. The prediction market is a two-way game of PvP. Polymarket charges no user deposit or withdrawal fees, nor does it take a commission on orders, completely avoiding any disruption to randomness. But that's not enough. PvP alone isn't enough to make market price equal probability. Expectation is also necessary. Only when quantified expected returns can cover the cost of speculation can the prediction market break free from the constraints of a casino and become a pure financial product. The Odds of Fun to Death. All authority, politics, and news are nothing more than digital gains and losses.

The monopoly on information isn't achieved by obstructing the source of news, but by monopolizing its dissemination channels.

Modern journalism originated from press censorship during World War II. Schramm established communication as an independent discipline, incorporating qualitative and quantitative methods from sociology and statistics. Journalistic professionalism has become the industry's unshakable shield.

At the same time, with the continued expansion of the voter base (including women, blacks, and young people), polls have truly begun to influence the careers of politicians. Inferring the overall inclinations of voters from a smaller sample size has become a commercially profitable activity, driven by the media, political parties, and even opponents. However, both polls and news have long operated on a B2B model, where media outlets sell users' and the public's attention to businesses. Users are merely one part of the equation, and media outlets themselves cannot profit from concentrated consciousness and bias. This echoes the anger directed at platforms in the decentralized sector. Privacy violations are merely a pretext; the key issue is the platforms' refusal to pay. As early as 2014, academics were already exploring how to integrate blockchain and prediction markets to break away from the traditional centralized platform model of taking commissions. Vitalik recalls the launch of Augur v1, the first generation of prediction markets, in 2015, as a manifestation of this trend of thought.

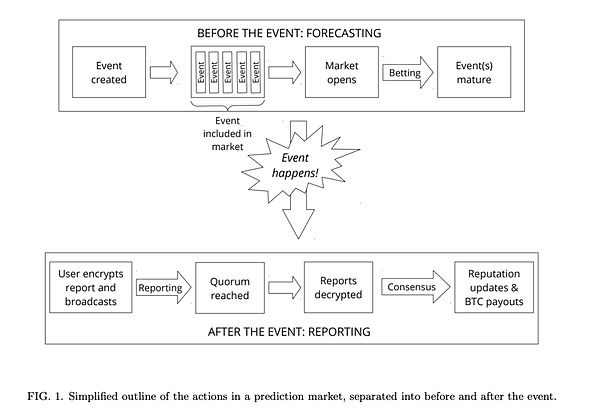

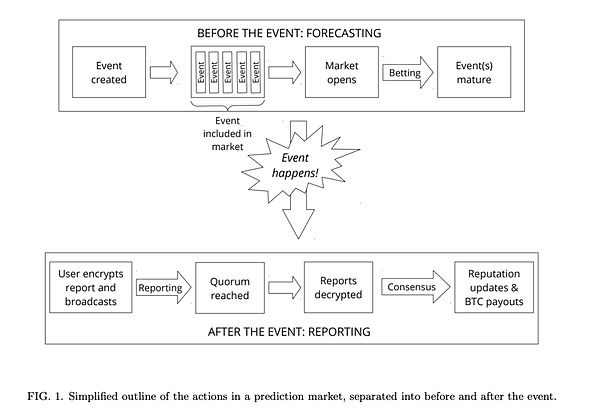

Unfortunately, the Augur v1 white paper is built on the Bitcoin sidechain, and Ethereum is not yet sufficient to support large-scale applications on the chain. Augur's "excessive pursuit of decentralization" also makes it always linger among a niche group of people, unable to form positive externalities, and eventually lost in the crowd.

Image Caption: Augur v1 Design

Image Source: @AugurProject

In the DeFi Summer of 2020, in addition to DEX and lending, people including Jeff from Hyperliquid and Shayne Coplan from Polymarket were trying a new generation of prediction markets. With Ethereum + L2 + centralized governance, technological development has made efficiency no longer a problem. The lack of sufficient consumers is the real problem. When the time comes, heaven and earth will unite. The global lockdown of 2020 has made people around the world embrace online lifestyles, which naturally includes prediction markets. The 2022 World Cup will see a cyclical climax in global casino activity, with a significant portion of the $100 billion global online gambling market driven by the World Cup. The 2024 presidential election will see Trump's excessive charisma create a series of twists and turns, with unprecedented drama. For Polymarket, even 1% of the traffic from this global carnival is a bonanza. After the election, Polymarket maintained a stable market share through continuous financing, continuous profit sharing (free of charge), and continuous entry into the sports market. Just as Hyperliquid maintained its market share after issuing its token, Polymarket has overcome its most dangerous moment. The 2026 World Cup will be the decisive battle to determine whether Polymarket can grow into a giant in the online prediction market. Political uncertainty is too great and far less safe and profitable than sports. Here we need to explain why the prediction market is efficient. Taking the Trump campaign as an example, the total sample size of 240 million American voters is the total sample size, but in reality there are only 150-160 million voters. Billions of people will vote (effective sample space), but beyond the fixed red and blue states, the true presidential outcome lies in a handful of swing states, which can be further divided into different swing counties. Therefore, polls targeting swing states are crucial. Mainstream polling organizations like Gallup will also design more "scientific and reasonable" sampling methods to conduct surveys. Since it's impossible to survey all voters, inferring the whole from a small sample becomes a huge challenge. The paradox here is that there will always be a critical minority that can influence the majority's choice, while prediction markets can continuously analyze the various parameters of the sample, allowing them to bet on higher probabilities before the actual outcome occurs. In other words, it's not that prediction markets have a higher sampling capacity, but rather that they constantly adjust the parameters derived from the sampling, and everyone's opinion is constantly reflected in the real-time odds. In other words, Polymarket is a "clustering algorithm" that continuously samples the maximum probability value from discrete data and cross-validates it with the final result to improve accuracy. Odds are the pricing of long/short, disagreement/consensus. In Polymarket, events are the basic unit, and each standard contract is minted into 1 USDC, corresponding to Yes + No = 1. For example, 0.5 Yes must be matched by 0.5 No.

Assume that Alice and Bob’s purchase prices are 0.1 Yes and 0.1 No respectively, and the current market price is 0.5:

• If Alice believes that the future probability will exceed 0.5, when the final result is announced, Alice will make a net profit of 0.9U;

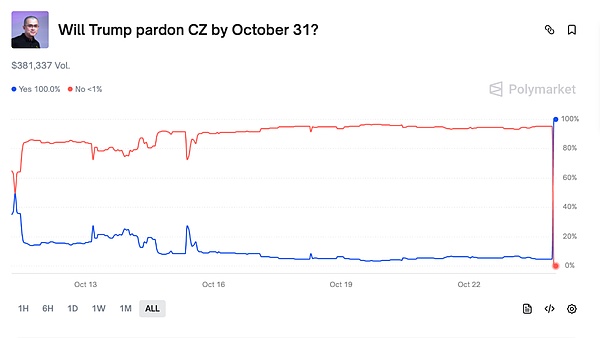

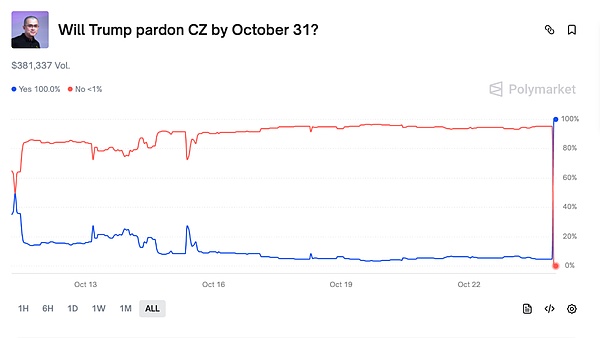

• If Bob believes that the future probability will not exceed 0.5 and sells the share, Bob will lock in a profit of 0.5U in advance and make a net profit of 0.4U. Of course, the initial price generation and price fluctuations here require the participation of market makers and Polymarket's approval for market opening. It adopts a CLOB mechanism similar to Perp DEX. Polymarket also supports more complex gameplay such as limit orders. The Polymarker mechanism is not complicated. The overall value is 1. The difference between the current price of Yes and No and 1 is the profit margin. For example, a 93% probability means 0.93 Yes + 0.07 No = 1 USDC. If the final reversal is No, the 0.93 becomes a surprising profit.

Image Caption: Upset Time

Image Source: @Polymarket

After placing a bet, players can buy/sell at any time, becoming part of market liquidity and a more efficient market-making method than "buy and forget". Yes/No bets are each other's source of profit/loss. In the ultimate PvP market, the platform only needs to ensure fairness. Of course, this article won't go into too much detail about oracles and their governance, the opening and closing of markets, the adjudication of disputes, and many other details. Broadly speaking, Polymarket is a commercialized internet prediction product that happens to utilize blockchain and stablecoin technology, and has little to do with decentralization. The spread of monopolies is largely the result of deliberate collusion between organized capital and organized labor.

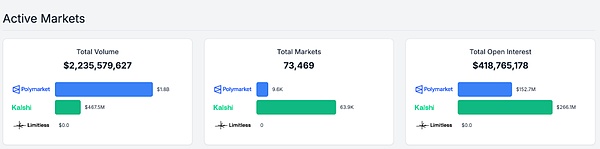

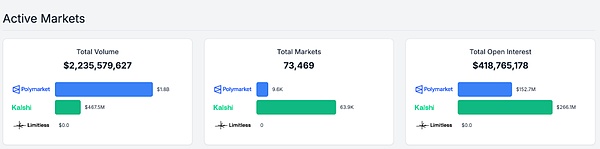

Polymarket's current three pillars are political elections (US), news events (Events), and sports. Its biggest competitor, Kalshi, focuses on compliance and cooperates with Robinhood, Jupiter, etc., focusing on generating traffic even if it does not make money.

Image description: Data comparison

Image source: @poly_data

Among the many emerging prediction markets, most of them want to be what Blur is to OpenSea, attracting retail investors to participate through expected airdrops in order to complete their own coin issuance. There is almost no possibility of a head-on confrontation with Polymarket and Kalshi. This has little to do with compliance. Polymarket's compliance is a pricing issue, while Hyperliquid's is a huge one. The liquidity of the two platforms is simply not on the same scale. Ultimately, US elections are a niche market unique to the US, while sports are a global mass market. Polymarket represents the collective usage preferences of young Americans. Atomized individuals may not visit betting sites or even just watch esports live streams, but this doesn't affect their ability to bet on sports. Before Polymarket, Kalshi, and the NFL partnered, the NBA had already partnered with DraftKings and FanDuel for sports betting in 2023. In addition to the New York Stock Exchange's parent company investing in Polymarket, FanDuel has also partnered with CME. Organized capital has already taken action. Enforcement against the NBA's match-fixing actions is nothing more than noise following the Supreme Court's 2018 legalization of "sports betting," and it's unlikely to stop PL and Kalshi's progress. Unfortunately, the scale of sports betting is limited and its future is uncertain. The dilemma is similar to that of Oriental Moutai: the virtualization and atomization of young people is an irreversible trend. Moreover, they view events as boring, old Deng-style games. Beyond those who like or dislike Trump, there's also a vast number of people who don't pay attention to him. Not only are they defending Shanghai together in cyberspace, but American Ma Run is also singing lines from "Bad Guys 2," though their real-life interactions may not be intertwined. Beyond generational sentiment, casinos and shady industry shells are the least of the problems in the prediction market. Polymarket, with a valuation of $15 billion, and Kalshi, with a valuation of $12 billion, are already at their peak valuations. Organized capital only invests in predictable politics, news, and sports. The future of the market can only be predicted by what young people gathered in cyberspace will be interested in. Don't try to understand Generation Z; create space for them. Old Deng marketing will backfire. Organized labor doesn't necessarily only demand economic value. In other words, what is the most expensive thing in the 21st century? It's emotional value, a projection of one's own emotional needs. For example, the pursuit of overseas identities reflects the excessive success of the household registration system, so successful that some people are suffering from aftereffects. The success of family planning lies not in a decline in marriage rates, but in Xiao Deng's active choice to be the last generation, viewing this as resistance rather than obedience. Atomized individuals' emotional need for community hasn't diminished; instead, it's growing in secrecy. Look at the countless conferences; you're not listening to panels, but to the real interactions of lonely individuals. Globally, the only people who can collectively engage young people and invest their energy and money are entertainment figures—not entertainment events, mind you, but entertainment figures. For example, if Taylor Swift, who divorced before getting married, had connected Xiaohongshu and Instagram, her conversion rate would definitely be higher than Trump's. Furthermore, during a star's explosive popularity cycle, drama is commonplace, with fans sparring with one another and fans turning against one another. Just like the evergreen Disney merchandise, celebrities can create a secondary market. This isn't just a fantasy; the entertainment-driven participation in finance has become a global consensus. Take Hurricane selling T-shirts, Mr. Beast registering MrBeast Finance, Deng Ziqi investing in AI startups, and Kanye West selling memes. This is safer than celebrities selling NFTs or manipulating the market. People are betting on people, and even insider information will be internalized as part of the market, because people have their own opinions. The core issue is that fans don't care. Fan wars within Korean groups have long been the norm. The focus is on winning. Financial losses and personal gains and losses are unimportant; satisfying one's own emotions is paramount. Prediction markets can be a financial projection of the fan economy. They can even be used to build more advanced hedging strategies. Buying "no" on a movie before it's released is equivalent to hedging against the public opinion risk of one's older sibling. After all, whether a movie is a good film and whether it can make money already becomes apparent during the filming process. The entertainmentization of finance isn't about entertainment; it's already highly entertainment-oriented. In this divided world, some cheer for the license for prediction markets, others debate why they aren't gambling, and some are already searching for new markets. The Trump family has invested in Polymarket, while outsiders are still struggling. Making some money together is the most practical approach. Conclusion: The end of globalization is the gradual decoupling of goods and services, and we're already entering the services trade phase. However, Homo sapiens naturally enjoys joining in the fun. Simply "localizing" the US election to resemble Thailand's is meaningless and will only shrink the market. Seeking consensus in a fractured world can create unique characteristics, especially for Chinese entrepreneurs. Politics and sports are both high-risk options, and operating underground always faces bottlenecks. The entertainment industry, however, offers a way to minimize risk. CZ will be questioned by the Western world because of his Chinese identity, but at least, predicting the length of Kardashian's butt will not endanger national security.

Alex

Alex