In February this year, former CFTC Commissioner Brian Quintenz officially became the candidate chairman of the CFTC. According to Bloomberg on May 27, in a document released by the U.S. Government Ethics Office on May 25, Brian Quintenz disclosed his key positions in cryptocurrency and market companies that are directly related to the CFTC's regulatory focus and disclosed assets worth at least $3.4 million.

Who is Brian Quintenz? What companies are he associated with? In the future, what impact will the CFTC have on the crypto industry?

Brian Quintenz is an American financial manager and policy advisor who served as a member of the U.S. Commodity Futures Trading Commission (CFTC) from 2017 to 2021. On February 11, 2025, President Trump nominated Quintenz as Chairman of the CFTC.

Earlier in his career, Quintenz worked as a consultant for Rose International and was a senior associate at Hill-Townsend Capital.

From 2001 to 2007, he worked for U.S. Representative Deborah Pryce, first as an assistant and later as a senior policy advisor.

He was previously a principal at Saeculum Capital Management, an investment firm he founded in 2013.

In March 2016, Quintenz was nominated by Obama to serve on the Commodity Futures Trading Commission.

In early 2017, Trump withdrew Quintenz's nomination to the Commodity Futures Trading Commission, and then re-nominated him to complete the remainder of his five-year term, which expires on April 13, 2020.

On August 3, 2017, Quintenz was confirmed by the U.S. Senate and began serving on the Commission on August 15.

Currently serving as the global head of cryptocurrency policy at Andreessen Horowitz, he said he would resign from the position if the Senate confirms him as CFTC chairman. Quintenz holds interests in three AH Capital Management investment funds, CNK Fund III, CNK Seed 1 Fund and CNK IV Fund, as well as capital commitments to the respective general partners. These funds focus on investing in blockchain networks, blockchain-based storage and data retrieval systems, as well as smart contracts, blockchain applications and payment solutions.

Upon confirmation of my appointment, I will resign from my position at AH Capital Management. As a result of my employment with the firm, I hold unvested and vested carried interests in CNK Fund III, LP, CNK Seed 1 Fund, LP and CNK IV Fund, LP. AH Capital Management has agreed to accelerate the vesting of my unvested carried interests in the above funds prior to my assumption of the role of Chairman. I will forfeit any carried interest that remains unvested as of the date I assume the role of Chairman and divest all of my carried interests in the funds prior to assuming the role of Chairman, or otherwise forfeit such interest. I have confirmed that I will be able to complete the divestments within the time periods set forth above. He also sits on the board of directors of prediction market platform Kalshi and owns shares and unvested stock options in the company. Founded in July 2021, Kalshi Inc. is an American financial trading and prediction market headquartered in Lower Manhattan, New York City, that offers event contracts. Retail and institutional traders can trade on a variety of future events, including economic indicators, weather patterns, awards, and political and legislative outcomes. The company has been involved in a regulatory battle with the CFTC for attempting to offer derivatives based on political events. Kalshi has also partnered with major trading platforms such as Robinhood and Webull to launch event contracts to retail investors.

Upon confirmation of my appointment, I will resign from my position at KalshiEx. I hold KalshiEx shares and unvested stock options that vest monthly, and have no other equity interests. I will waive all unvested stock options at the time of my resignation and divest all vested stock options and shares as soon as possible (but no later than 90 days) after confirmation of my appointment.

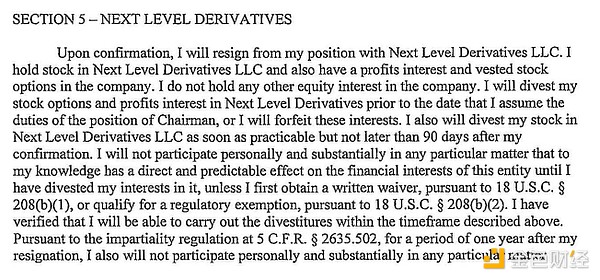

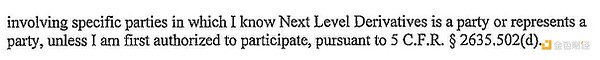

Quintenz also works for Next Level Derivatives, a market research firm that provides liquidity solutions to the Treasury markets.

Upon confirmation of my appointment, I will resign from my position with Next Level Derivatives LLC. I hold stock, profit interests, and vested stock options in the company and have no other equity interests. I will divest my stock options and profit interests prior to assuming the role of Chairman, otherwise I will relinquish these interests and divest my stock as soon as practicable, but no later than 90 days, after confirmation of my appointment.

Third, what efforts did Quintenz make when he served as a CFTC commissioner in Trump’s first administration?

Enforcement Matters

While serving as Commissioner, Quintenz supported enforcement matters, holding market participants accountable for apparent violations of the Commodity Exchange Act and CFTC regulations. His past statements have focused on fairness and ensuring that entities “do not circumvent these rules to the detriment of American customers and law-abiding market participants.” While serving as Commissioner, Quintenz often worked to promote innovation and advised the CFTC against taking steps that could discourage institutions from developing new products or services or participating in market activities. “I prefer engagement over enforcement — but without engagement, enforcement is our only option,” he said in a 2018 speech.

Regulatory Approach

Quintenz’s perspective on rulemaking during his tenure as Commissioner emphasized a “principles-based” approach, and he has previously stated that he prefers industry-driven solutions over prescriptive regulatory requirements.

For example, in 2017, in his first public remarks as a CFTC Commissioner, Quintenz criticized the agency’s then-proposed regulation of automated trading (“Reg AT”) as “ill-formulated and flawed public policy.” He advocated for more research into the specific risks present in automated trading and the controls already in place to address them before proposing broad rulemaking. The Commission later withdrew Reg AT entirely, instead proposing and ultimately adopting the more limited “Electronic Trading Risk Principles.” Quintenz supported the move, arguing that it took a principles-based approach rather than the “extremely prescriptive requirements” of Reg AT.

Quintenz also supports developing regulations that both ensure market stability and promote innovation. This view is reflected in two areas of ongoing focus for the Commission: (1) cryptocurrency and digital asset regulation; and (2) event contracts.

During his tenure at the CFTC, Quintenz worked to promote coordination between the CFTC and the SEC. As Commissioner, he worked with SEC Commissioner Hester Peirce to coordinate and unify SEC and CFTC regulations affecting entities registered as both swap dealers/security-based swap dealers, broker-dealers/futures commission merchants, and commodity pool operators/investment funds.

Digital Assets

Quintenz sponsored the CFTC’s Technology Advisory Committee during the launch of the first Bitcoin futures contracts, and during his tenure the committee oversaw “the custody of digital assets within traditional clearing infrastructure, the adoption of blockchain technology, and the creation of crypto-tokenized commodities,” as well as discussing other topics related to digital assets.

Match Contracts

Regarding match contracts, Quintenz criticized the blanket ban on certain match contracts without a specific public interest finding. In December 2020, ErisX submitted a self-certification that certain NFL match contracts met the Commodity Exchange Act’s requirements for contracts to be listed on a registered Designated Contract Market (DCM). In dissenting from the CFTC’s order dismissing the contracts, Quintenz opposed the explicit prohibition of “gambling” as contrary to the public interest and advocated for a more precise regulatory approach. He also argued that such a broad prohibition contradicted statutory requirements and disagreed with his view that the registrant (ErisX) would have to prove that the NFL event contracts had hedging functionality (and therefore were in the public interest).

This issue is again a focus of the Commission as multiple contract markets have listed contracts related to sporting events, election results, and other novel event contract applications.

Swap Dealer Regulation/Swap Market Oversight

Quintenz emphasized that the Dodd-Frank Act’s policy objectives for swap dealer registration include reducing systemic risk, protecting counterparties, and promoting market efficiency. He noted that any adjustments to the minimum thresholds for swap dealer registration should be consistent with these objectives, particularly ensuring that the regulations effectively address anticipated risks without creating undue burdens.

Based on this view, Quintenz criticized the use of notional value as a metric for determining the de minimis threshold for swap dealers in a 2019 statement, arguing that the figure is a poor measure of dealer activity levels and suggesting that the CFTC should consider metrics that are more representative of physical market impacts rather than a one-size-fits-all approach. Quintenz also advocated for excluding cleared swaps from the de minimis threshold calculation because, from his perspective, most swaps trading activity would still fall below the $8 billion threshold. He also advocated for reviewing and adjusting the required swap dealer business conduct standards requirements, including certain disclosure obligations.

During his tenure as Commissioner, Quintenz supported flexibility in the SEF enforcement approach. He also expressed support for harmonizing SEF regulations with international standards.

“America First” Market Policy

This view is consistent with Quintenz’s overall approach to international regulatory coordination. During his tenure as Commissioner, Quintenz promoted cross-border deference and encouraged home country regulators to serve as the primary point of contact for market participants. However, Quintenz firmly defended the U.S. market from foreign regulatory intervention, especially from the European Union. He stressed the importance of maintaining trust in international regulatory relationships, especially emphasizing that foreign legislative changes may have a negative impact on U.S. market participants.

Fourth, what impact will the CFTC have on the crypto industry?

The crypto industry has long pushed for the CFTC as the main regulator, while asking the United States to develop a clearer regulatory framework. Therefore, the CFTC under Quintenz's leadership may have a profound impact on the crypto industry.

Christie Goldsmith Romero, the outgoing U.S. Commodity Futures Trading Commissioner, said: In the future, the CFTC should work to define retail customers to ensure that new investment inflows of "cryptocurrencies and some other products" have similar retail customer protection systems as the U.S. Securities and Exchange Commission.

Members of the WilmerHale Futures and Derivatives Business had this outlook at the beginning of the year: Whether it is cryptocurrency, individual stock futures, over-the-counter derivatives or artificial intelligence, we expect the CFTC to coordinate with other U.S. agencies, especially the U.S. Securities and Exchange Commission. The CFTC will also maintain a key role with the Financial Stability Oversight Council (FSO), which often serves as the center of government policy making in the financial services sector.

Source: Golden Finance, U.S. Government Ethics Office, Wikipedia, CoinTelegraph, WilmerHale, Koehler Group, Yogonet, etc.

Brian

Brian