Author: Yanz, TechFlow

From the end of 2024 to the beginning of 2025, the performance of the Cosmos ecosystem attracted particular attention, but not because of the good news.

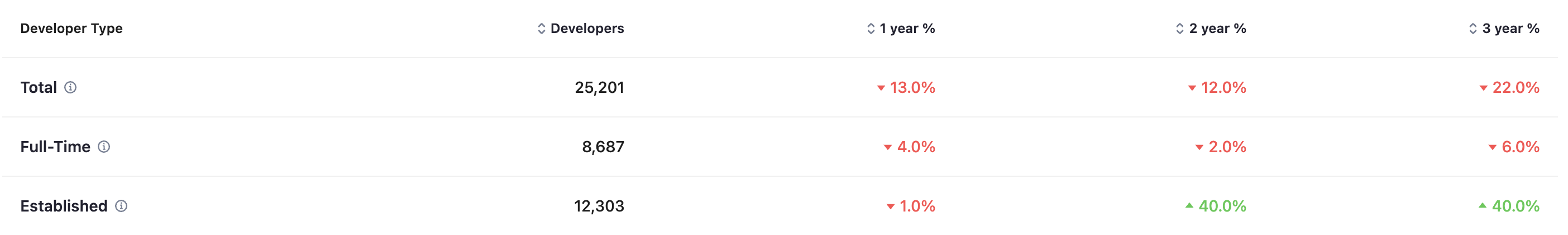

As of August 5, 2025, the price of Cosmos' core token, ATOM, had shrunk to $4.2, a 90% drop from its peak. Meanwhile, compared to the end of 2024, major projects like Osmosis (OSMO) have plummeted 79%, while JUNO's price has shrunk 82% to almost zero. Even the relatively strong Injective (INJ) has fallen from $34 to around $12, not to mention the widespread declines seen for Kava, Evmos, Cronos, and Fetch.AI... Cosmos, which once bucked the trend in 2022 and ranked second in TVL, is now facing a collective destruction of value. What exactly happened to the Cosmos ecosystem, once considered the core of the blockchain internet? From a star project during the 2021 DeFi boom to today's sluggish market performance, what's behind this shift? A closer look at its recent performance reveals a deeper underlying reason behind this plunge—one that goes beyond simple market fluctuations. Airdrop Carnival, Death Loop: In early 2024, when news of the Celestia (TIA) airdrop spread throughout the crypto community, no one could have predicted that this bonanza of free wealth would become the beginning of a nightmare for the entire Cosmos ecosystem. Celestia, a modular data availability network built on the Cosmos SDK, is deeply integrated with the Cosmos ecosystem through the IBC (Inter-Blockchain Communication) protocol. A year ago in the spring, the price of TIA soared to a peak of $20.17, igniting social media with tales of overnight wealth. However, the frenzy lasted only two months before a sell-off ensued, sending the price plummeting 91.9% to its current price of around $1.60. This collapse was not unique to the entire Cosmos ecosystem. The Celestia airdrop perfectly exemplified the vicious cycle of hype and dump within the Cosmos ecosystem. Upon announcement of the airdrop, a flood of speculative capital poured in, driving prices up rapidly and creating a false sense of prosperity. However, this growth, based on expectations rather than actual value, was destined to be unsustainable. When early holders began selling to lock in profits, prices began to fall, and panic quickly spread, triggering a larger sell-off and ultimately a price crash. Osmosis experienced a similar process during the 2022 liquidity mining craze, with its price plummeting from a peak of $11 to its current level of $0.17. Each such cycle depletes the ecosystem's trust and funding base. This short-term speculation drives out true long-term builders and immerses the entire ecosystem in a volatile atmosphere. Puppet Emperors and Divided Kingdoms Ecosystem projects are unable to escape this cycle of death, and the price performance of ATOM, the core asset of the Cosmos ecosystem, has also encountered bottlenecks. In a multi-chain parallel architecture, ATOM's role as network fuel hasn't formed an effective closed loop. Numerous sub-chains have independent native tokens that don't directly rely on ATOM, hindering the return of ecosystem traffic and value. While the high inflation model with no cap on total supply incentivizes staking and governance participation, it also creates long-term price dilution pressure. More importantly, while Cosmos's philosophy of free chain construction encourages innovation and competition, it also leads to fragmented traffic and independent projects, a stark contrast to Ethereum's model of locking the majority of value in ETH. ATOM has become a puppet emperor of Cosmos, further spreading governance challenges and failing to benefit the federation. The JUNO project is a prime example: in April 2022, the JUNO community discovered that a single whale user had circumvented airdrop restrictions through multiple wallets, acquiring approximately $35 million worth of JUNO tokens. After intense community debate, the JUNO DAO officially voted to approve Proposal 20 on April 29, 2022, confiscating the tokens, effective May 4. This controversial decision severely divided the community and led to a significant decline in investor confidence in the JUNO project's governance mechanisms. This governance failure not only failed to address the project's technical and market challenges, but actually accelerated its decline, with the price of JUNO plummeting 99% from $43 to $0.09. However, these aren't the only issues facing Cosmos, nor are they even unique crises. The Multi-Chain Ecosystem's "Midlife Crisis" When we discuss Cosmos's predicament, we're actually analyzing the collective anxiety facing the entire multi-chain ecosystem—the profound disconnect between technological innovation and market adoption. In April 2025, Cosmos ranked first among blockchain projects in development events. This apparent lead cannot mask the fatigue of the gradually declining number of active crypto developers.

Source: developer report

Other multi-chain ecosystems are also sluggish: the number of Ethereum developers fell by 2.54%, the BNB Chain development index fell by 9.45%, Polygon, Arbitrum, Optimism and Avalanche fell by 10.35%, 7.62%, 6.82% and 12.08% respectively.

Polkadot ranked tenth with 3.4K developer activity, and its contributors decreased by 0.91% to 325. Faced with the slow response to JAM upgrades and market competition, the community even issued an urgent call of "React or die".

Multi-chain ecosystems face similar structural challenges:

Lack of network effect: Compared with Ethereum, there is a lack of sufficient user base and application scenarios to form a self-reinforcing ecological cycle

Insufficient developer incentive mechanism: Although the technology is advanced, there is a lack of sufficient economic incentives to attract and retain outstanding development talent

Unclear market positioning: In the competition with Ethereum, these projects often fall into the dilemma of superior technology but lack of applications

And this inherent dilemma is further amplified under the current special market environment changes. By the second quarter of 2025, the total crypto market capitalization exceeded $3.5 trillion. However, this growth was driven by institutional funds, which have a distinct investment philosophy: manageable risk, ample liquidity, and regulatory compliance. For institutional investors seeking stable returns, Bitcoin and Ethereum are clearly more attractive than technologically innovative multi-chain projects. This shift in capital flows has directly led to the further marginalization of multi-chain projects in terms of financing and liquidity. More importantly, this institutionalization process has also brought about another unintended consequence: the accelerating "Matthew effect" in infrastructure development. Stablecoins are becoming the core infrastructure connecting traditional finance and the crypto world. However, this infrastructure development primarily revolves around established networks. As stablecoins become the utilities of the new financial system, the multi-chain ecosystem finds itself on the margins. This predicament is forcing these ecosystems to re-evaluate their value propositions, shifting from pure technological competition to a more pragmatic approach focused on user experience and real-world application scenarios. This shift is not only necessary for survival but may also serve as the starting point for the next cycle of innovation. At a Crossroads: Rebirth or Fall? Standing at the 2025 timeframe, the Cosmos ecosystem stands at a crucial historical juncture. From the grand vision of a blockchain internet at the mainnet launch in 2019, to the market's frenzy for interoperability when ATOM hit an all-time high of $44.70 in 2021, to the profound reflection following the price drop to around $3.50 during the 2022-2024 bear market, Cosmos has traversed a typical yet unique growth trajectory for blockchain projects. In this dark hour, despite dismal data, Cosmos is indeed undergoing a profound self-revolution. Different institutions offer diverse forecasts for the Cosmos (ATOM) ecosystem and price trends, with significant divergence in short-term predictions. CCN and Changelly are pessimistic, emphasizing the bearish pressures indicated by technical indicators (such as RSI and moving averages), while others like CoinLore and CryptoNewsZ are more optimistic, anticipating a bull market that will push prices above $20–$40. Regarding Cosmos' uncertain future, ecosystem expansion, technological upgrades, market sentiment, regulatory environment, and competitive pressure are frequently cited as factors. It's undeniable that the actual effects of technological upgrades and governance reforms will take time to prove. Competitive pressure from Layer-2 and other interoperability solutions persists, and the impact of Federal Reserve policies and geopolitical risks on the entire crypto market cannot be ignored. More importantly, this transition from idealism to realism is inherently a painful process, requiring a delicate balance between technological innovation and market forces. History teaches us that truly great technologies and ecosystems are often born in the darkest moments. Cosmos, too, will need time to prove its worth. Will the future await, or will it be a deeper darkness?

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Others

Others Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist