In the past week, the White House and the Federal Reserve turned a blind eye to the plunge in U.S. stocks, and both sides seemed to have no intention of giving in first in this "game of chicken". Although the creation of recession expectations is most likely just a negotiation tactic of Trump's extreme pressure, the uncertainty of policy games has further stimulated the market's risk aversion.

However, so far, the continued decline of U.S. stocks is more like the behavior of the top leaders to actively compress the valuation bubble, rather than a precursor to the spiral outbreak of the crisis. The most typical example is that during the process of issuing an additional $5 trillion in U.S. stocks, A-shares, Hong Kong stocks, European stocks and gold rose sharply. This is different from the previous situation where the global market collapsed collectively when the U.S. dollar liquidity crisis broke out (the U.S. dollar circulation is the heart of global liquidity).

Although the encryption market has suffered liquidity backlash amid the valuation contraction of U.S. stocks, Bitcoin's structural stress resistance remains good, which is mainly reflected in three aspects:

1.

2. According to Bloomberg terminal data, since the global liquidity crisis in March 2020, in the extreme situation where the Nasdaq fell by more than 15% in a single month (calculated on a 30-day basis) seven times, the adjustment of Bitcoin this time has converged significantly (-21%). Compared with the two historical extreme values of -53.6% in March 2020 and -37.2% in June 2022, the volatility this time has been compressed by 65.8% and 50.8% respectively. 2. Unlike the extremely pessimistic expectations generated by several rounds of historical declines, the funding rate of Bitcoin perpetual contracts and the premium rate of Bitcoin quarterly contracts remained stable during this decline, which shows that the will of the main bulls has not been shaken in the decline.

3. This adjustment not only has a relatively gentle trend, but also there has been almost no extreme spikes in the intraday, which shows that the decline is mainly due to panic selling by small and medium-sized retail investors, and whale investors are still holding on.

Based on these analyses, the author tends to believe that the decline of Bitcoin this time is just a technical retracement after consecutive ATHs, and the $76,000 area is likely to be the mid-term bottom.

Although it is difficult for Bitcoin to benefit from the liquidity spillover of U.S. stocks in the short term, under the dual stimulation of favorable policies and macro catalysts , Bitcoin is still expected to usher in a new round of paradigm growth transformation.

First, as the US encryption regulation shifts from "suppression mode" to "strategic support", Bitcoin's status in the global major asset class has been unprecedentedly improved. Especially after Trump announced the establishment of a strategic reserve of Bitcoin

, sovereign wealth funds, pension funds and other long-term capital began to increase their allocation to Bitcoin. According to data disclosed in the SEC 13F documents in the fourth quarter of 2024, Abu Dhabi's sovereign wealth fund Mubadala purchased a Bitcoin ETF worth $437 million for the first time, the Wisconsin Pension Fund increased its Bitcoin ETF holdings from $164 million to $321 million, and the Norwegian Central Bank Investment Management Company significantly increased its holdings of MSTR and COIN in the fourth quarter, expanding its Bitcoin exposure to $370 million. Based on the ratio of gold to Bitcoin market value of 10:1, the theoretical allocation ratio of global sovereign wealth funds and pension funds to Bitcoin can reach 0.1%-0.2% (1%-2% of gold), or $67 billion to $134 billion.

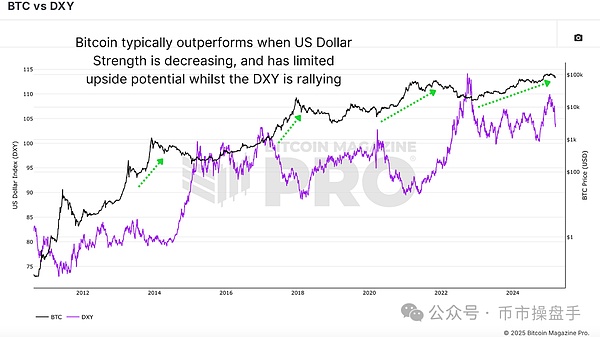

Secondly, under the framework of the Mar-a-Lago agreement, the overvaluation of the US dollar has become the main obstacle to resolving debts and revitalizing the manufacturing industry. In the future, the United States is very likely to reconstruct the current world trade system and financial structure by actively devaluing the US dollar. The end of the strong cycle of the US dollar will inevitably trigger capital flows to neutral currencies such as gold and Bitcoin. According to public data, from 1985 to 1987 after the Plaza Accord was signed, the US dollar depreciated by 50% and 47% against the Japanese yen and the German mark respectively, and the price of gold rose from about US$300 per ounce to about US$500, an increase of about 66%. This process has led to the reallocation of trillions of dollars in assets. The current scale of US dollar assets is tens of thousands of times that of 1985. Therefore, the hedging demand brought about by the devaluation of the US dollar will be even greater.

During the Fed's balance sheet reduction cycle, government spending is the key driving force for the growth of the private sector and residents' income, and is also the basic foundation for supporting US consumption and investment. If there is a lack of countercyclical adjustment of the Fed's monetary policy in the process of cutting government spending, not only will the debt reduction target be difficult to achieve, but economic growth may also face the risk of stalling. This has led to widespread market concerns that the Fed will become a strategic stumbling block for Trump. But in fact, one year after the Plaza Accord was signed (1986), the Fed cut interest rates three times in a row, but the CPI fell from 3.5% to 1.9%. The fundamental reason is that fiscal tightening has a more obvious suppression of inflation. Therefore, the author agrees with Trump and Bessant: interest rates will fall soon!

Aaron

Aaron

Aaron

Aaron Hui Xin

Hui Xin Clement

Clement Aaron

Aaron Brian

Brian Catherine

Catherine Jasper

Jasper Joy

Joy Hui Xin

Hui Xin Jasper

Jasper