"Derivatives are the holy grail of DeFi." As early as 2020, the market had reached a consensus that on-chain perp protocols were DeFi's ticket to the second half.

But the reality is that over the past five years, whether limited by performance or cost, perp DEX has always made a difficult trade-off between "performance" and "decentralization." During this period, the AMM model represented by GMX, although it achieved permissionless transactions, could not match CEX in terms of transaction speed, slippage, and depth. Until the emergence of Hyperliquid, leveraging its unique on-chain order book architecture, it achieved a smooth CEX-like experience on a fully self-hosted blockchain. The recently approved HIP-3 proposal has further torn down the barriers between Crypto and TradFi, opening up the possibility of trading a wider range of assets on-chain. This article will also take you through an in-depth analysis of Hyperliquid's operating mechanisms and revenue sources, objectively analyze its potential risks, and explore the revolutionary variables it brings to the DeFi derivatives market. The Cycle of the Perp DEX Track Leverage is a core primitive of finance. In mature financial markets, derivatives trading far exceeds spot trading in terms of liquidity, capital volume, and transaction scale. After all, through margin and leverage mechanisms, limited funds can leverage a larger market volume to meet diverse needs such as hedging, speculation, and yield management. The crypto world has also confirmed this rule, at least in the CEX sector. As early as 2020, CEX derivatives trading, represented by contract futures, began to replace spot trading and gradually became the dominant market.

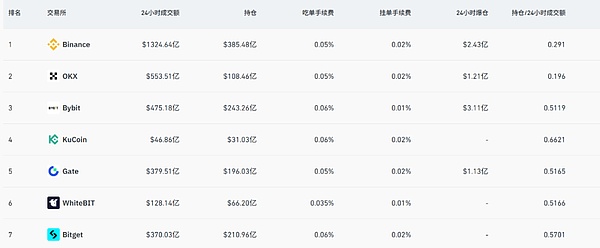

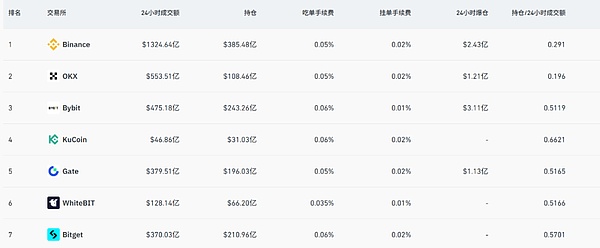

Coinglass data shows that in the past 24 hours,the daily trading volume of leading CEX contract futures has reached tens of billions of US dollars, and Binance has exceeded 130 billion US dollars.

Source: Coinglass

In contrast, on-chain perp DEX has been a long journey of five years. During this period, dYdX explored a more centralized experience through on-chain order books, but faced challenges in balancing performance and decentralization. Although the AMM model represented by GMX has achieved permissionless transactions, it is still far behind CEX in terms of transaction speed, slippage and depth. In fact, the sudden collapse of FTX in early November 2022 briefly stimulated a surge in trading volume and new users for on-chain derivatives protocols like GMX and dYdX. However, due to constraints in the market environment, on-chain trading performance, trading depth, trading variety, and other comprehensive trading experiences, the entire sector quickly fell into silence again. To be honest, once users discover that on-chain trading carries the same risk of liquidation but lacks the liquidity and experience of CEXs, their willingness to migrate naturally diminishes. Therefore, the key issue isn't whether there's demand for on-chain derivatives, but rather the persistent lack of a product that can both provide irreplaceable value to CEXs and address performance bottlenecks. The market gap is clear: DeFi needs a perp DEX protocol that can truly deliver a CEX-level experience. It's against this backdrop that the emergence of Hyperliquid has brought new variables to the entire field. What's less well-known is that, although Hyperliquid only officially debuted this year and entered the field of vision of many users, it was actually launched as early as 2023 and has continued to iterate and accumulate experience over the past two years. Is Hyperliquid the ultimate form of on-chain CEX? Facing the long-standing "performance vs. decentralization" dilemma in the perp DEX space, Hyperliquid's goal is straightforward: to replicate the seamless CEX experience directly on-chain. To this end, it has chosen a radical path, not relying on the performance constraints of existing public chains. Instead, it has built its own dedicated L1 application chain based on the Arbitrum Orbit technology stack, and equipped it with an order book and matching engine that runs entirely on-chain. This means that, from order placement and matching to settlement, all transaction steps occur transparently on-chain, while achieving millisecond processing speeds. Therefore, from an architectural perspective, Hyperliquid is more like a "fully on-chain version" of dYdX, no longer relying on any off-chain matching, aiming directly at the ultimate form of "on-chain CEX." This radical approach has had an immediate impact.

Since the beginning of this year, Hyperliquid's daily trading volume has been rising all the way, reaching US$20 billion at one point. As of September 25, 2025, the cumulative total trading volume has exceeded US$2.7 trillion, and its revenue scale even exceeds that of most second-tier CEXs. This fully demonstrates that there is no lack of demand for on-chain derivatives, but a lack of product forms that are truly adapted to the characteristics of DeFi. Of course, such strong growth has also quickly brought it ecological attraction. The USDH issuance rights bidding war launched by HyperLiquid not long ago attracted heavyweight players such as Circle, Paxos, and Frax Finance to compete openly (further reading: href="https://mp.weixin.qq.com/s?__biz=Mzg3MDkwMjg1NA==&mid=2247495499&idx=1&sn=9f69751e1e6929a03d350263e06bb3b1&scene=21#wechat_redirect" textvalue="Starting from the popularity of HyperLiquid's USDH: Where is the fulcrum of DeFi stablecoins?" linktype="text">Starting from the popularity of HyperLiquid's USDH: Where is the fulcrum of DeFi stablecoins? 》) is the best example. However, simply replicating the CEX experience isn't the end of Hyperliquid. The recently approved HIP-3 proposal introduces permissionless, developer-deployed perpetual contract markets to the core infrastructure. Previously, only the core team could list trading pairs, but now any user who stakes 1 million HYPE can deploy their own markets directly on the chain. In short, HIP-3 allows the permissionless creation and listing of derivatives markets for any asset on Hyperliquid. This completely breaks the limitation of Perp DEX, which was previously limited to trading only mainstream cryptocurrencies. Under the framework of HIP-3, in the future we may see on Hyperliquid:

Stock Market: Trading Tesla (TSLA), Apple (AAPL) and other global financial market top assets;

Commodities and Foreign Exchange: Trading traditional financial products such as gold (XAU), silver (XAG) or euro/dollar (EUR/USD);

Prediction Market: Betting on various events, such as "Will the Federal Reserve cut interest rates next time" or "What will be the floor price of a blue-chip NFT";

This will undoubtedly greatly expand Hyperliquid's asset categories and potential user base, blurring the lines between DeFi and DeFi. The boundary between Hyperliquid and TradFi is this: in other words, it allows any user globally to access the core assets and financial gameplay of the traditional world in a decentralized, permissionless manner. What is the other side of the coin? However, while Hyperliquid's high performance and innovative model are exciting, there are also risks that cannot be ignored, especially since it has not yet undergone the "stress test" of a major crisis. The cross-chain bridge issue bears the brunt of the discussion and is the most discussed issue in the community. Hyperliquid connects to the mainnet via a cross-chain bridge controlled by a 3/4 multi-signature, which also constitutes a centralized trust node. If these signatures become compromised, either accidentally (e.g., due to loss of private keys) or maliciously (e.g., collusion), the security of the assets of all users on the cross-chain bridge will be directly threatened. Secondly, there's the risk of treasury strategies, as HLP treasuries don't guarantee principal. If the market maker's strategy incurs losses under certain market conditions, the principal deposited in the treasury will also be reduced. While users enjoy the prospect of high returns, they also bear the risk of strategy failure. As an on-chain protocol, Hyperliquid also faces common DeFi risks, such as smart contract vulnerabilities, oracle price feed errors, and user liquidations in leveraged trading. In fact, in recent months, the platform has experienced numerous large-scale liquidations in extreme market conditions due to malicious price manipulation of certain small-cap cryptocurrencies, highlighting the need for improvement in risk control and market regulation. Objectively speaking, there's another issue that many people haven't considered openly: as a rapidly growing platform, Hyperliquid has yet to undergo a major compliance review or serious security incident. During a platform's rapid expansion, risks are often obscured by the halo of rapid growth. Overall, the story of perp DEX is far from over. Hyperliquid is just the beginning. Its meteoric rise demonstrates both the real demand for on-chain derivatives and the feasibility of breaking through performance bottlenecks through architectural innovation. HIP-3 extends this imagination to stocks, gold, foreign exchange, and even prediction markets, truly blurring the lines between DeFi and TradFi for the first time. While high returns always come with high risks, from a macro perspective, the appeal of the DeFi derivatives market won't diminish due to the risks of a single project. It's not ruled out that a new project will emerge in the future to take over from Hyperliquid/Aster and become the next leader in on-chain derivatives. Therefore, as long as we believe in the allure and potential of the DeFi ecosystem and derivatives market, we should pay close attention to these promising players. Perhaps looking back in a few years, this will be a brand new historical opportunity.

Joy

Joy