Text: Song Xuetao, Tianfeng Macro

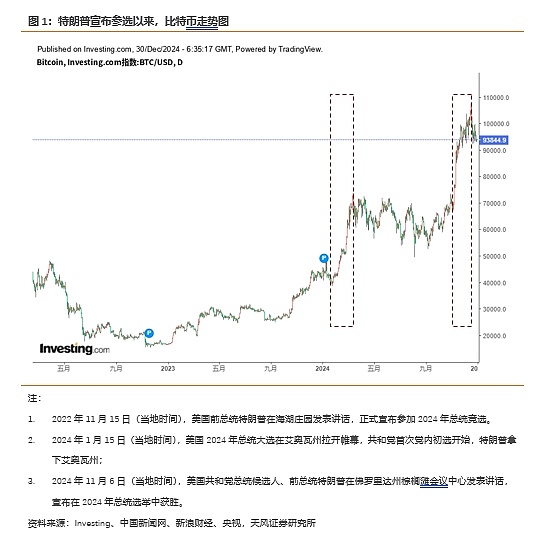

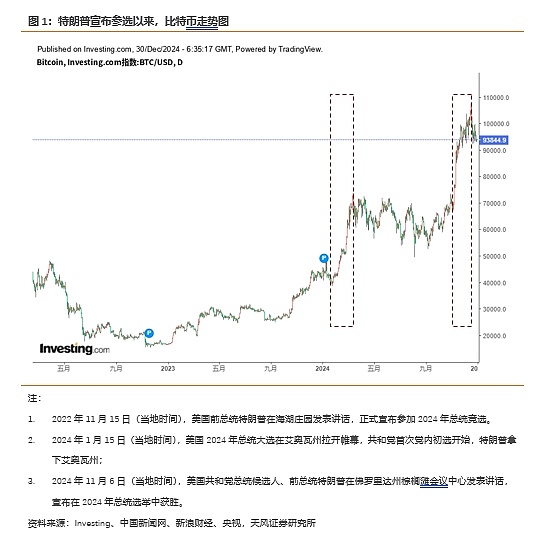

Trump fulfilled his campaign promise on Bitcoin and nominated cryptocurrency supporter Paul Atkins as SEC Chairman to replace the current Chairman Gary Gensler, who is known for his tough regulatory stance on cryptocurrencies. After Trump's election, the price of Bitcoin quickly broke through $76,000, setting a record high, and then continued to soar and break through the $100,000 mark.

Trump was a skeptic of cryptocurrency in the 1.0 period, but in the 2.0 period, he turned into an active advocate of "making the United States the cryptocurrency capital of the world". One of the main reasons is that MAGA needs an alternative to maintain the hegemony of the US dollar, and Bitcoin has been given a special mission that transcends technological development.

In order to escape the political fate of stepping down due to stagflation, Trump 2.0 hopes to improve fiscal efficiency and total factor productivity through AI, but if AI fails to achieve the expected results, deficit monetization will accelerate the process of "de-dollarization". In the past two years, gold has become a beneficiary of de-dollarization and a favorite of investors.

However, MAGA cannot tolerate the monetary hegemony of the US dollar being shaken, so Trump needs an alternative plan to maintain the status of the US dollar. This alternative plan must be one that the United States can control and influence. Gold is likely to be out of the options, while cryptocurrencies represented by Bitcoin may still have a chance. But the essence of currency is credit. If there is no credit, then inject credit.

1 Trump's indissoluble bond with Bitcoin

After announcing his candidacy for president again, Trump's relationship with the currency circle has become increasingly close. First, Trump's "relaxation of regulation" coincides with the needs of the cryptocurrency circle. Secondly, Silicon Valley elites including Musk and Peter Thiel are increasingly unable to tolerate the increasingly left-leaning policy tendencies of the California government and the Democratic Party. For example, antitrust threatens the growth of the business of technology giants that prioritize efficiency. This indirectly promotes Trump's cooperation with Silicon Valley and, to a certain extent, becomes a catalyst for the development of Bitcoin. Since Trump announced his candidacy for president, Bitcoin prices have experienced two waves of significant growth, both of which have increased by more than 40%, namely, from about $40,000 to about $70,000 after his first victory in Iowa, and from about $70,000 to about $100,000 after winning the presidential election. The rise in Bitcoin prices is related to Trump's association with the MAGA concept during the campaign. Trump said that "Bitcoin is a miracle of technology and human achievement, and will surpass gold in the future. He also proposed to give Bitcoin the same reserve currency status as the US dollar, maintain the country's strategic Bitcoin reserves, never sell Bitcoin seized by the government, and make the United States the capital of cryptocurrency."

2. Bitcoin is not a substitute for gold

After Trump’s election, the decline of gold and the rise of Bitcoin formed a sharp contrast. The discussion of whether cryptocurrencies, especially Bitcoin, which is known as digital gold, can replace gold has once again surfaced.

(1) Bitcoin and gold are similar in three aspects:

First, both have supply scarcity. Specifically, as of 2023, the above-ground gold stock is 212,582 tons, and the underground storage is about 59,000 tons. The Bitcoin protocol stipulates that the total amount is capped at 21 million, and the mining reward of Bitcoin, that is, the "block reward", will be halved every four years, which is also one of the key mechanisms for the Bitcoin protocol to maintain its scarcity, which means that the difficulty of mining will gradually increase.

Secondly, both are decentralized and non-sovereign assets. Neither gold nor Bitcoin is issued by a central authority. In other words, the central bank cannot decide to mint more gold coins. Similarly, the Minister of Finance cannot order the slowdown or acceleration of Bitcoin mining. In the past, investors chose to invest in gold to diversify their assets in order to hedge against monetary and fiscal policy risks, but now Bitcoin has become a new choice.

And, both have certain speculative and safe-haven attributes. However, there is a big difference in degree. Bitcoin is more of a risk asset with strong speculative properties, and only occasionally shows safe-haven characteristics. In this respect, gold is like a mirror image of Bitcoin, with a more significant safe-haven property and only occasionally showing speculative characteristics. The speculative property of gold may be a momentum effect that occurs when the price rises rapidly, but this reaction is usually short-lived because gold has different characteristics from Bitcoin.

(2) There are also three differences between gold and Bitcoin:

First, gold has physical uses, involving industrial production, personal consumption, etc., while Bitcoin is a digital asset composed of code and is a virtual existence. Physical objects have physical uses, and virtual objects have virtual uses. For example, Bitcoin may be used in gray areas such as money laundering, tax evasion, and financing illegal activities. This also brings challenges to global anti-money laundering supervision, especially cross-border fund tracking.

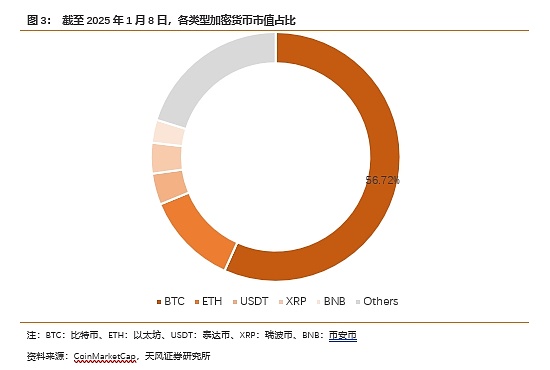

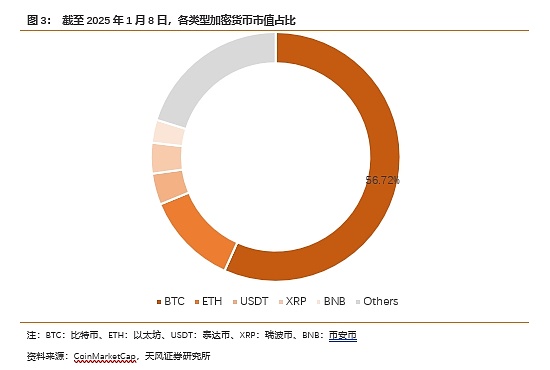

Secondly, gold has a unique position in the commodity market, and other precious metals, whether silver or platinum, are difficult to compare with gold. Bitcoin still dominates the cryptocurrency market, accounting for about 56.72% of the market value of all cryptocurrencies, but more and more Bitcoin alternatives are emerging, such as Ethereum and Binance Coin.

Finally, gold and Bitcoin also differ in terms of security. As a physical asset, gold is not susceptible to cyber attacks or digital fraud, but it needs to be stored safely, especially in cross-border transportation. Bitcoin holders may suffer from hacker attacks or loss of private keys, thus losing control, and lack additional security measures. Bitcoin wallets are divided into hot wallets that store private keys online and cold wallets that are stored offline. In Bitcoin transactions, users must use private keys to digitally sign to prove their control and ownership of the wallet. However, hot wallets are often stolen by hackers. As for cold wallets, investors often lose a lot of Bitcoin due to equipment damage or loss.

3. Bitcoin is Plan B under AI failure

Trump, who has returned to the White House, has realized that if the efficiency problems of US finance and manufacturing production are not solved, the US economy will become increasingly dependent on deficit monetization. Once a certain critical point is broken, a debt spiral will appear, and the hegemony of the US dollar will be accelerated. Therefore, Trump's governing philosophy for his second term is very clear. He wants to improve production efficiency and government fiscal efficiency through AI, get the United States out of the track of stagflation, and maintain the dollar's globally recognized reserve currency status. In this process, Musk will play an important role, so Trump has promoted Musk's political status and made him the most important person around him, and Musk has had a direct impact on the US government budget bill.

Once it fails, the US dollar will not only depreciate relative to gold, but may even further shake its position as the world's reserve currency and sovereign credit currency. Although the probability is low in the short term, this kind of shaking often accelerates suddenly at a certain moment. Historically, the change of the status of great powers often goes through a long period of parallel and competition, and the final change of power is completed in a short period of time. Therefore, Trump needs to formulate a Plan B to maintain the status of the US dollar in response to the failure of AI technology to improve production efficiency, reduce fiscal deficits, reduce inflation, and narrow the gap between the rich and the poor, and this alternative is Bitcoin.

Although there is no currency that can replace the US dollar in the short term, pegging Bitcoin to the US dollar can be regarded as a risk-averse hedging strategy against the status of the US dollar. Once the global reserve currency status of the US dollar is seriously threatened, the United States can at least weaken the status of gold by controlling Bitcoin and continue to maintain the currency status of the US dollar.

4 Energy is the key to technological revolution

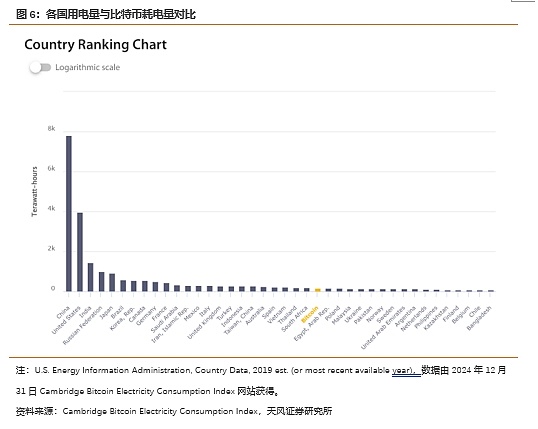

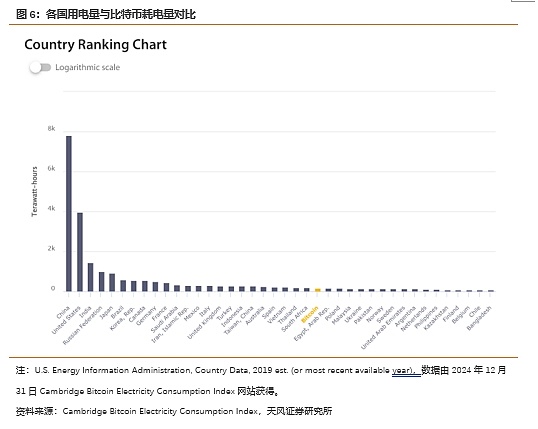

After meeting with several executives of cryptocurrency mining companies, Trump proposed in June 24 that Bitcoin should be completely "Made in the United States". Energy is a key limiting factor in Bitcoin mining and trading, and its importance is self-evident. Bitcoin's energy demand is completely dependent on electricity supply. According to estimates by the University of Cambridge in the UK, Bitcoin consumes about 172.1 terawatt-hours of electricity in one year of operation, which exceeds the annual electricity consumption of countries such as Egypt, Malaysia, and Poland. In Texas, where crypto mining companies are concentrated, 10 mining companies consume more than 1,800 megawatts of electricity each year.

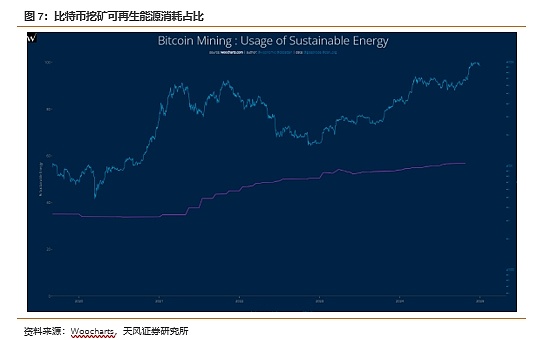

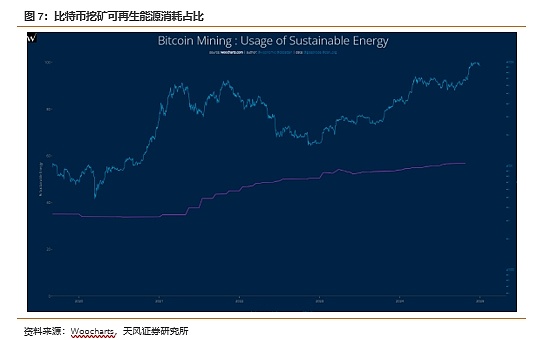

Bitcoin miners tend to look for low-cost electricity supply to ensure profitability. In 2023, 81% of new renewable energy projects (about 382 GW) will cost less than fossil fuel projects. Taking photovoltaic power generation as an example, the cost of photovoltaic power generation will drop to about 4 cents/kWh in 2023, which is 56% lower than fossil fuel and nuclear power generation. Therefore, the proportion of renewable energy in Bitcoin mining continues to increase. According to Woocharts data, as of October 24, the proportion of mining using sustainable energy was 56.8%.

Looking back at history, a country's strength is often closely linked to its energy productivity. For example, the technological revolution enabled Britain to make breakthroughs in coal mining and use technology, which provided the basis for the long-term status of the pound. The United States has consolidated the global leadership of the dollar and the United States by controlling the extraction, transportation and consumption of oil and its influence on global geopolitics. Those countries that have mastered the energy that advanced productivity relies on can stand out in the century-long competition and establish their dominant position in everything from trade to manufacturing to consumption and finance.

Today, the constraints of traditional energy are gradually weakening, and new energy represented by sustainable energy is rising. For a country, it is crucial to develop and master new energy, because low cost, stable and safe supply, decentralized layout, and mobile energy supply system are important foundations for triggering a new round of technological revolution and productivity improvement.

Therefore, AI represents plan A to maintain the status of the US dollar, and cryptocurrency represents plan B to hedge against the shaken status of the US dollar, but whether it is Bitcoin or AI, energy is a core element that cannot be bypassed. The essence of currency is credit, the essence of credit is order, the essence of order is technological competition, and the essence of technological competition is energy efficiency. Countries that master new energy can improve production efficiency and expand the scope of application of high-efficiency and low-cost by leading the application of new technologies, thereby improving total factor productivity. No matter which country wins in this competition, once the new order is established, the historical mission of the great changes represented by gold that have not been seen in a century will be declared completed.

Brian

Brian