Author: Suvashree Ghosh, Bloomberg; Translator: Deng Tong, Golden Finance

Getting out of the blockchain bandwagon

In a world where crypto entrepreneurs are scrambling to launch blockchains — whether or not there are viable use cases — Tether has decided not to. The reason? Market saturation.

Tether Holdings, the issuer of the world’s largest stablecoin USDT, considered launching its own distributed ledger but later abandoned the plan. Its CEO said the reasoning involved the simplest equation in economics: supply and demand. “We’re very good at the technology side, but I think blockchain will almost become a commodity in the future,” Tether CEO Paolo Ardoino said in an interview. “Launching your own blockchain is probably not the right move. There are a lot of very good blockchains.”

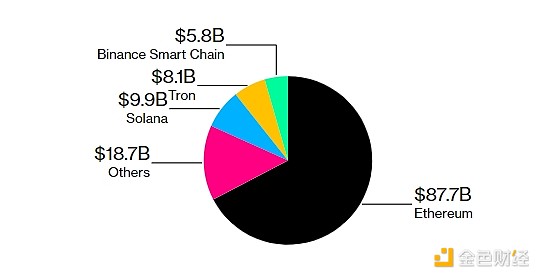

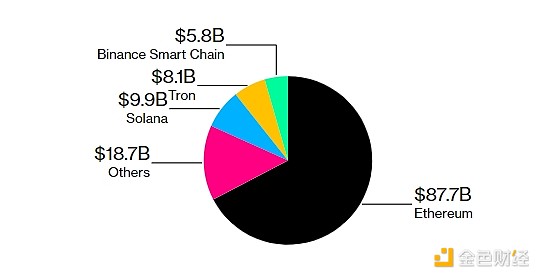

Total value locked in the top blockchains

Source: DefiLlama, Note: 306 chains have a total TVL of $133.2 billion, including staked assets

For Tether, which is well-funded and controls USDT with a market value of $117 billion For many, launching a blockchain might not be a big deal, as the stablecoin is so versatile in transactions and remittances. But that’s not enough of a reason to do so. The numbers below will explain why.

Data from DefiLlama shows that out of 306 chains, the top five chains control about 86% of the total value of locked assets. According to DefiLlama, Ethereum is the most commercially important blockchain, with a TVL of about $87.7 billion out of a total of $133.2 billion across all chains, making it the market leader. TRON, a blockchain with a TVL of $8.1 billion that was launched in 2017 by cryptocurrency tycoon Justin Sun, handles 49% of the USDT supply. TVL refers to the total value of cryptocurrencies deposited in the protocol.

High speed, low fees, use cases, and strong security are key factors in blockchain success.

Ethereum’s first-mover advantage, flexibility for developers to build smart contracts, and its position as home to the second-most liquid token are some of the key reasons for its dominance despite high fees.

Angela Ang, senior policy advisor at blockchain intelligence firm TRM Labs, said the blockchain ecosystem has become a multi-chain ecosystem, with builders and issuers discovering the benefits of being active on a variety of platforms. However, their commercial viability depends on “whether they can bring unique utility to the ecosystem — whether it’s speed, security, cost, interoperability, or something else — that doesn’t exist today,”she added.

Tether’s Ardoino is happy to remain blockchain “agnostic” as long as its stablecoin has the highest levels of security and sustainability, he said. “For us, blockchain is just the transport layer.”

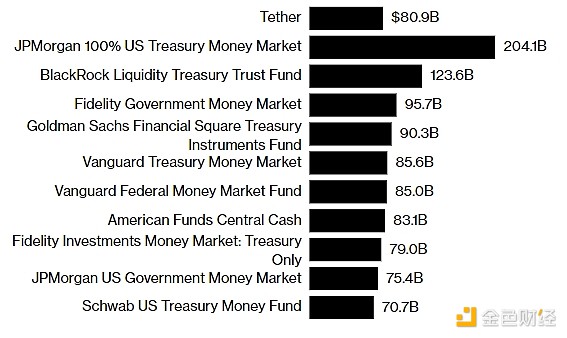

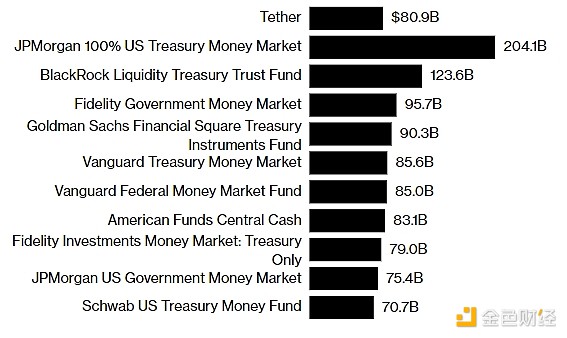

Tether’s Treasury vs. the 10 largest money market holders

JinseFinance

JinseFinance