Author: Pavel Paramonov, blockchain researcher at Dewhale Capital; Translation: 0xxz@黄金财经

In the bull market of 2021, we witnessed L1 blockchains fighting for the title of "Ethereum Killer". However, there is no winner in this war. The founders realized, "If you can't beat them, join them." It was Solana that prompted this shift.

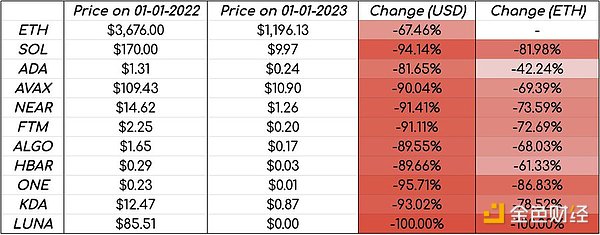

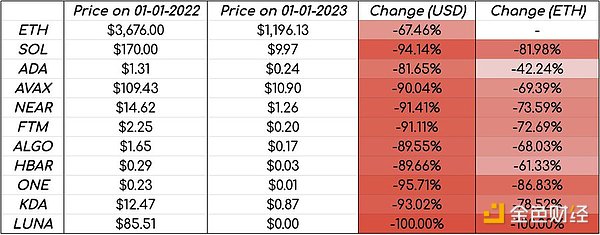

From the beginning of 2022 to the end of the year, the native tokens of most L1 blockchains depreciated by more than 90%.

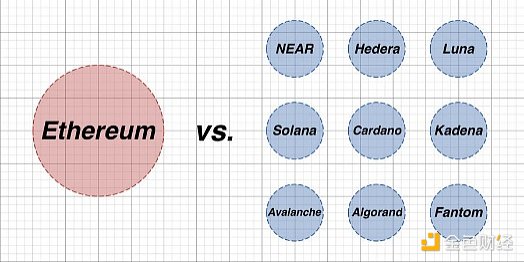

All blockchains have tried to solve the blockchain trilemma, claiming to be faster and more secure than Ethereum. However, no one has really won this competition, because it is quite difficult to compete with the giants.

Imagine that you started from scratch and tried to build a wallet to compete with MetaMask. You might have a better UX/UI, better features, and better processes. But most people would still prefer to use MetaMask, just because they are used to it.

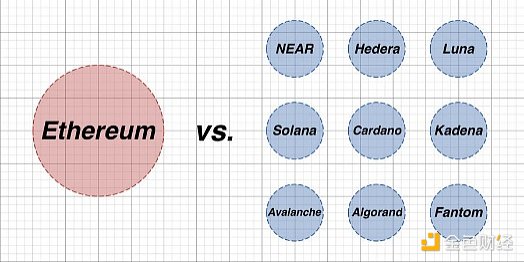

1, Solana can become the only non-EVM blockchain that users care about.

You can't say that about any other non-EVM blockchain, such as NEAR Protocol, Cardano Community, Algorand Technologies, or Kadena.

The ecological landscape in 2021 is like this:

If we talk about real users, the current TPS of these chains does not exceed 10. Solana also has some problems that everyone is talking about:

- Multiple downtimes

- "Association" with SBF and FTX

- OKX delists USDC and USDT on Solana

- DeGods bridges Ethereum, etc…

However, this is the only team that really cares about users, technology and the future. Solana Labs co-founder Anatoly Yakovenko and the team received all the feedback, were able to address all the issues, and basically just continued to overcome difficulties. Solana did not win the L1 war, it was just a path that had not been explored, and thanks to Helius Labs CEO Mert Mumtaz, Superteam and other core contributors, this path was explored.

2 Blockchains cannot compete for liquidity in the L1 field, so they decided to benefit instead of fight.

Why compete with Ethereum if you can benefit from it directly? Deploying L2 usually means benefiting from the Ethereum economy while having your own economic ecosystem.

If you are a rollup, it is easier to attract liquidity because you are building on hundreds of millions of TVL on the native chain. At the same time, creators have the ability to create their own native tokens and have their own small economy in this huge ecosystem.

In addition, it is now easier than ever to create a rollup: there are multiple solutions for you to choose from, such as Conduit, AltLayer, and of course Optimism's OP Stack.

3, the fragmented liquidity chaos on L2 is a real-life social fragmentation problem.

Each L2 has a different focus:

- Optimism focuses on scaling.

- Arbitrum focuses on DeFi.

- Base focuses on SocialFi.

- Metis focuses on DAO.

Is this bad? Of course not!

Each rollup is unique and has the opportunity to gain unique market recognition. But sometimes, these are the ones who are speaking out about liquidity fragmentation.

As Emmanuel Awosika noticed at the ethCC conference, people mostly like to attend some side events because they tend to find more like-minded people there. However, I think it is important to not only show yourself as a zksync max, but also to be open to other cultures, perspectives, and ideas. Because we are in the same sandbox (Ethereum).

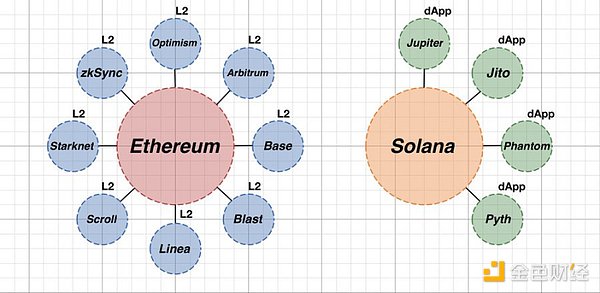

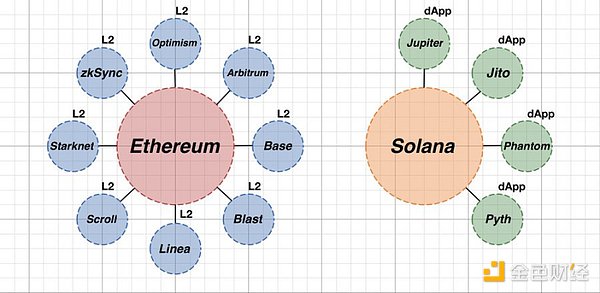

4On Ethereum, people create rollups. On Solana, people develop applications.

If I had to compare the current state of the two ecosystems, I would give a picture like this:

Right now, there is no real competition between Ethereum and Solana, as these blockchains just provide different services

Ethereum has become a big sandbox where kids (developers) build sandcastles (rollups). More and more developers are focusing on bringing the same dapp to multiple rollups. I think this may create a problem because some developers are more focused on injecting liquidity into the app than on developing a really good app.

Solana is the same sandbox, but here, the applications are the clay pots, and for now, they are prettier.

- There is no better swap experience than using Jupiter

- The best wallet experience is Phantom

- There are even native liquidity reserves for non-native assets, such as Clone

Jito is able to create the best liquid staking experience on Solana, including MEV rewards, which was not possible before. But it's not that simple.

5, Solana is currently similar to the previous stage of Ethereum.

The reason why people started migrating to L2 and creating new L2 is that the native chain has limitations.

Some people should remember that in 2021, you had to pay 200-300 US dollars in fees to swap. Ethereum itself can’t handle that much throughput, so a solution that can handle more throughput and lower fees is needed to make the network usable.

Solana is capable of handling its current activity, but there are limitations to Solana’s architecture:

- Block leaders are attacked by bots, so transactions fail.

- Failed transactions waste computational units and network bandwidth.

- The fee mechanism does not incentivize efficiency and is incompatible with the incentive mechanism.

To solve these problems, you don’t need to create L2 on Solana.

In my opinion, it makes sense to create L2 on Solana in the following two cases:

- Even after all adjustments, the network cannot handle a large number of transactions. Or it can handle a large number of transactions, but the fees are too high.

- Create an application chain to leverage Solana’s liquidity while still being able to have your own economy in your chain.

Who knows, maybe in the future we’ll have a Solana L2 war, just like we have on Ethereum now. But there won’t be a winner. In the end, cooperation is almost always better than competition.

JinseFinance

JinseFinance