Author: TTx0x, Crypto KOL; Translator: Jinse Finance xiaozou

1. Introduction

Galaxy Digital (NASDAQ: GLXY) is arguably an undervalued opportunity at the intersection of two of the most powerful long-term trends: crypto and artificial intelligence. The market is misjudging Galaxy, viewing it as a volatile crypto company while overlooking the immense value of its crown jewel, the Helios data center. Helios is a world-class AI infrastructure platform with the potential to generate stable, high-margin, long-term cash flows.

The core of this investment thesis is that the market will ultimately re-rate GLXY due to its successful transformation from a digital asset services company to a top-tier AI infrastructure operator. The company's recently signed 15-year anchor lease with AI supercomputing service provider CoreWeave, covering Helios' currently approved 800 MW of total power, validates its business model and signals an approximately $720 million annualized recurring revenue stream and 90% EBITDA margins. Galaxy has significant advantages over competitors attempting a similar "Bitcoin miner-to-AI" transformation, primarily through a fortress-like balance sheet with over $1.8 billion in net cash and investments, a management team with deep expertise, and a clear path to expand Helios to a potential 3.5 GW campus.

2. Investment Viewpoint: Unlocking Top AI Infrastructure Targets

(1) Core Mispricing

Galaxy consists of two distinct business segments: traditional digital asset financial services business and emerging AI data center infrastructure business. However, the market currently evaluates GLXY through only a single perspective - that of a crypto company. GLXY's price trend remains highly correlated with Bitcoin, indicating that investors have not yet priced in the tailwinds provided by its AI data center business.

(2) Unexpected Acquisition Opportunities

In late 2022, Galaxy acquired the Helios data center campus from Argo Blockchain in a distressed sale for a mere $65 million. At the time, Argo was facing bankruptcy and needed to liquidate its assets. Galaxy acquired this world-class infrastructure asset at a price far below its current replacement cost. This transaction occurred before ChatGPT triggered an explosion in AI-driven power and data center demand, and this move alone repositioned Galony's growth trajectory for the next decade.

(3) Helios’ Strategic Assets

Helios is no ordinary data center; it is a first-tier infrastructure asset built specifically to meet the needs of the AI revolution.

Power Advantage:

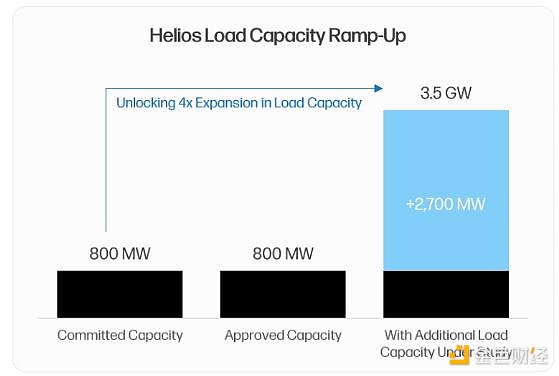

The biggest constraint facing the AI data center industry is power supply. Power contracts are the “limiting factor” that prevents supercomputing service providers from deploying GPU capabilities. Helios holds an 800 MW approved power contract with Texas utility ERCOT, enabling tenants to bypass the typical 36-month-plus waiting period for new grid connection. Furthermore, the campus has a clear expansion path, with an additional 1.7 GW of capacity under load study, bringing the initial site's potential capacity to 2.5 GW. A recent announcement in the second quarter of 2025 revealed that the company has acquired adjacent land and submitted a 1 GW grid connection application, increasing the campus' total potential capacity to a staggering 3.5 GW, making it one of the largest data center sites in the world. Scale and Location Advantages: AI supercomputing service providers prefer centralized facilities to achieve economies of scale and performance advantages. Helios, as a single, scalable campus, perfectly fits this model. Its location in West Texas provides access to some of the cheapest and most reliable electricity in the United States. Crucially, Galaxy is investing in a long-haul fiber network to ensure 10-15 millisecond latency within the Dallas/Fort Worth metropolitan area. This differentiates Helios from the growing number of pure AI training facilities—its low-latency connectivity unlocks AI inference use cases, thereby warranting premium pricing.

Designed for the Future:

Any data center built today faces the risk of obsolescence within a few years. Galaxy mitigates this risk through a phased development plan, allowing for the integration of cutting-edge technologies with each new build cycle. This includes advanced cooling solutions like direct chip liquid cooling, which is critical for next-generation GPUs. A 10-million-gallon freshwater reservoir on campus supports these critical cooling needs.

(4)CoreWeave Partnership

The collaboration with CoreWeave is the most important validation of Galaxy AI’s data center strategy. In the second quarter of 2025, CoreWeave has committed to lease all of Helios’ currently approved 800 megawatts of total power.

Transaction Economics:

Its 15-year triple net lease agreement is very attractive. The first 600 megawatts alone are expected to generate approximately $720 million in annual revenue (including 3% annual escalation). Due to the triple-net lease structure (where the tenant assumes all operating expenses), this revenue is expected to translate into EBITDA with a profit margin as high as 90%. Risk Mitigation and Value Validation: This landmark agreement achieves several key objectives. First, it provides long-term, predictable cash flow visibility, mitigating Galaxy's financial risk. Second, it provides strong validation of Galaxy's operational capabilities and establishes the company as a reliable partner. This is crucial in attracting other hyperscale tenants, who prefer partners with a proven track record. 3. Galaxy's Traditional Business: A Profitable and Synergistic Cornerstone A common bearish view on Galaxy is that its traditional crypto business is a negative asset that increases volatility and risk. This view is misleading. In fact, Galaxy's digital asset business is a highly profitable, market-leading entity, providing capital and reputation synergies with its other businesses. Galaxy's digital asset business is primarily composed of two units: Global Markets (including institutional trading, lending, and investment banking services) and Asset Management and Infrastructure Solutions (including a series of asset management products and on-chain services such as staking).

Its financial data for the second quarter of 2025 confirms the strong profitability of the business:

The digital asset segment's adjusted gross profit reached US$71.4 million, a 10% increase month-on-month;

Global markets outperformed the broader market, with institutional loan books growing 27% to US$1.1 billion, indicating growing demand for its credit products;

The investment banking business demonstrated its strength in mergers and acquisitions advisory and was the exclusive financial advisor in Bitstamp's acquisition by Robinhood;

Total assets of the asset management and infrastructure solutions platform increased by 27% month-on-month to nearly US$9 billion;

The balance sheet for the second quarter showed US$1.18 billion in cash and stablecoins, and US$1.27 billion in digital assets (primarily BTC and ETH). Galaxy's profitable digital asset business not only generates cash flow but also strengthens its balance sheet, enabling the company to self-fund the significant equity contribution required for Helios' construction. Furthermore, this business unit has demonstrated its ability to execute large-scale, complex transactions—such as the recent sale of over 80,000 bitcoins (valued at over $9 billion) for a single client. All of these qualities assure potential supercomputing clients that Galaxy is an experienced, reliable, and well-funded partner capable of delivering multi-billion dollar infrastructure projects. This synergy creates a powerful, self-reinforcing cycle between the two businesses.

4. Competitive Landscape: A Leader in AI Transformation

Galaxy Digital is often lumped in with the group of Bitcoin miners seeking to shift their assets to AI computing hosting services. However, the following comparison shows Galaxy's unique position, making it a particularly attractive investment opportunity in this area. The competitive landscape can be divided into two tiers: companies that have signed AI agreements (such as Core Scientific and TeraWulf) and those that have merely announced strategic intentions (such as IREN, Hut 8, and Riot). Galaxy demonstrates a clear advantage over its signed peers across all key dimensions.

Galaxy's leadership in these key dimensions is specifically demonstrated in the following:

Agreement Attractiveness: Galaxy's lease with CoreWeave offers superior economics. It offers higher annual rental revenue per megawatt ($1.8 million vs. $1.4-1.6 million), better EBITDA margins (90% vs. 75-80%), and includes a 3% annual rental escalation clause that competitors lack. Balance Sheet Strength: Galaxy boasts $1.8 billion in net cash and investments. In contrast, competitors like CORZ and WULF carry significant net debt burdens—CORZ recently emerged from bankruptcy reorganization, while WULF avoided a similar fate through significant equity dilution. These competitors' mining operations continue to drain cash flow, while Galaxy's traditional operations remain profitable. Scalability: Galaxy's single Helios campus has a potential capacity of 3.5 GW, dwarfing the fragmented and limited power capacity of its competitors, enabling Galaxy to capture a larger share of future demand. Strategic Focus: Galaxy has made the strategic decision to exit Bitcoin mining entirely and focus 100% on AI data center opportunities. Competitors are attempting to adopt hybrid models, dividing their attention and capital between two distinct businesses. 5. Helios Valuation Analysis: Helios' data center business should be valued relative to other top-tier publicly traded data center REITs (real estate investment trusts) and recent private market transactions. Publicly comparable companies such as Digital Realty and Equinix trade at multiples of approximately 25 times adjusted EBITDA. Private equity M&A transactions for data center assets have also been completed at similar multiples. Baseline Scenario (Only 800 MW Currently Approved): Assume that only the 800 MW currently approved is leased at an average price of $1.8 million per MW. Applying a 20x EBITDA multiple yields an enterprise value of approximately $17.28 billion. After deducting approximately $5.73 billion in project-level debt and interest, Helios' corresponding equity value is approximately $11.54 billion. As we expect annual EBITDA to be achieved in 2028, we apply a 12% discount rate, resulting in a present equity value of $8.2 billion, or $24 per share. Bull Scenario (1,600 MW leased by FY2026): Assumes the subsequent 800 MW of capacity, expected to be approved in Q4 2025, is leased at the industry average of $1.6 million per MW. The total 1,600 MW would generate approximately $1.63 billion in annualized EBITDA. Applying a 20x multiple yields an enterprise value of approximately $34.5 billion. After accounting for approximately $11.46 billion in project-level debt and interest, Helios represents a future equity value of approximately $21.1 billion. Because we expect the 1,600 MW of capacity to be fully operational only in 2030, we use a higher discount rate of 16% to account for additional execution risk. This yields a current equity value of $10.01 billion, or $29 per share. GLXY currently trades at approximately $24 (as of September 2, 2025). The base-case valuation for the Helios project alone is $24 per share. Our valuation does not yet include Galaxy's profitable traditional digital asset business. Bullish recently completed a successful IPO at a valuation of $5.4 billion, having reported a net loss in the first quarter of 2025. If Galaxy's digital asset business were valued close to Bullish's IPO valuation, this alone would add approximately $8-10 per share to its value.

6. Key Risks and Mitigating Factors

(1) CoreWeave Tenant Concentration and Credit Risk

The most prominent bearish argument is the concentration risk of CoreWeave's single tenant and the questionable creditworthiness given its debt burden and lack of an investment-grade rating.

Risk Mitigation: CoreWeave's business model has high revenue visibility, with 96% of its revenue coming from long-term committed contracts. Its debt primarily consists of delayed draw term loans, which are used to finance growth capital expenditures based on signed customer contracts. The credit facility has been fully underwritten by sophisticated investors such as Blackstone, which has previously led significant financing arrangements for CoreWeave. In addition, CoreWeave has built a durable moat through its strategic alliance with NVIDIA, which gives it priority access to the latest GPUs and makes it the only "Neocloud" operator capable of meeting the scale requirements of top AI labs such as OpenAI. (2) Project Execution and Timeline Risks The renovation and expansion of Helios is a complex, multi-billion dollar infrastructure project with significant execution risks. Risk Mitigation: This risk is mitigated by the deep project financing and capital markets expertise of the Galaxy management team, particularly Chief Investment Officer Chris Ferraro. The company's strong balance sheet, recently strengthened by approximately $500 million in financing, provides a significant financial buffer against unexpected costs or delays. The phased development strategy reduces risk by breaking the project into manageable phases.

(3) Regulatory and Grid Risk

Future expansion beyond currently approved capacity may face review or delays from Texas grid operator ERCOT, which is closely monitoring new large-load access requests.

Risk Mitigation: Galaxy's existing 800 MW of approved access capacity is a significant de-risking asset, insulating it from the biggest bottleneck facing new projects. This approved power is already secured. Furthermore, the generally pro-business and anti-regulatory stance of Texas regulators, compared to more restrictive jurisdictions, provides a significant tailwind for future growth.

7. Conclusion

In summary, Galaxy Digital is an undervalued investment opportunity. The market continues to value GLXY through the narrow lens of a volatile cryptocurrency proxy, failing to recognize its fundamental transformation into a top AI infrastructure provider. At the heart of this investment thesis lies the Helios data center—a world-class asset hedged through a landmark 15-year triple-net lease with supercomputing giant CoreWeave. This partnership not only secures a predictable, high-margin revenue stream but also validates Galaxy's position as a trusted partner for its ambitious future expansion plans. Our valuation analysis indicates that the Helios asset alone justifies the current share price. Its profitable traditional digital asset business continues to differentiate it from other "AI transformation" competitors, highlighted by its fortress-like balance sheet, multiple uncorrelated revenue streams, and highly focused management team. While there are risks associated with tenant concentration and project execution, Galaxy's experienced management team and strong financial profile provide effective mitigation. As the company executes on its clear roadmap and the market gradually prices in the scale and stability of Helios' cash flow, we expect a re-rating of its shares.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Xu Lin

Xu Lin Joy

Joy Joy

Joy Zoey

Zoey Others

Others Nulltx

Nulltx Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Nulltx

Nulltx