Source: Ye Kaiwen

Nowadays, many people and projects related to RWA are very microscopic and revolve around an asset package or enterprise.

Many people come up and ask: Can real estate be used as RWA? This old topic has been answered many times. Let me answer it again: There is no opportunity for real estate in the mainland, but there are still some opportunities overseas, such as in Singapore, Dubai, and the United States.

Many people also ask: Can consumption-related products be used as RWA? For example, consumption points, store turnover, etc., but most consumption-related products are just turnover, without assets.

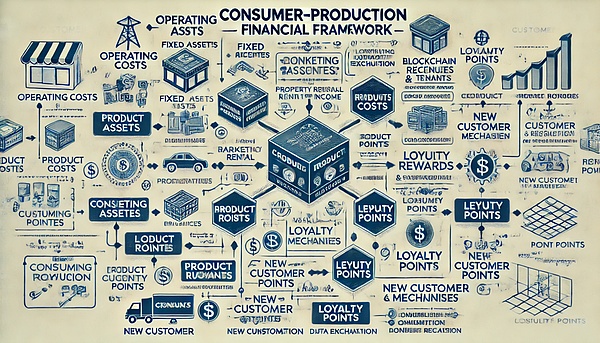

This is actually because most people do not look at it from the perspective of consumption upgrade, and rise to an overall consumption-production-finance model. Commercial real estate is an asset that is not very popular in RWA; consumption turnover is an asset without assets; entertainment traffic, although lively, does not constitute an asset; but these can be combined into an overall consumption-production-finance model.

Commercial real estate is a fixed asset, brand merchants are operating cash flow assets, consumers are consumption points and consumption scenarios, cultural and entertainment traffic is the conversion of traffic, and the consumption data assets or content assets of producers and consumers. When a complete consumer production and finance ecosystem is formed, these combined assets may become a high-quality RWA asset package.

This consumer production and finance asset package model solves the problem of securitization of consumer points assets. The only way out for consumer points is to put them in a large RWA under the background of consumer production and finance, because consumer points are essentially liability assets of enterprises. If they lack liquidity, they will gradually lose their appeal and value. 2C consumer liability assets can be tokenized through RWA, and 2C liabilities can be converted into 2B cash flow for a Loyalty operating SPV. Asset securitization is more of a 2B corporate financing market, and financial products are difficult for 2C.

The structure of the entire consumer industry and finance can be broken down into the following:

Operating costs—operating real estate fixed assets, the leasing relationship between owners and merchants, the income of merchants is the guarantee of the owners’ real estate leasing income, and if it is data from the on-chain Oracle mechanism;

Marketing costs—advertising, traffic, the conversion of marketing traffic determines consumption;

Consumer subject—consumers, consumption income is the core of merchant income;

Consumption scenarios—commodity consumption and consumption accumulation Points scene - membership rights and gift redemption, incentives and unpaid liabilities between merchants/brands and consumers; Repeat purchase - points incentives, merchants and consumers; Recommend new customers - membership loyalty and points incentives, headcount/traffic, merchants and consumers; Production and sales data - consumption data and communication data assetization around consumption scene labels, data assets that merchants and brands are willing to pay for, which has the design space of AI Agent intelligent agents; Traffic marketing - IP digital marketing, similar to the meme phenomenon, the key to converting consumption and IP narrative, can be coordinated with some derivative NFT or meme tokens. From the split asset package structure, let's look at the economic model of consumption production and finance. The core is: Prosumer, consumption is production.

We can see that the owners of operating real estate and merchants who rent shops, the operation and cash flow of merchants come from consumers' consumption scenarios. Consumers obtain tokenized consumption points (consumption mining). Traffic diversion and conversion are actually personalized customized consumption ticket NFTs designed by brands based on AI tags. Ultimately, the incremental value is the tokenization of consumption data assets and traffic tokenization.

Here, real estate assets can be combined with merchants' operating cash flow assets, and combined with consumption points, consumption data assets, and cultural and entertainment traffic assets: real estate-operating real estate, cash flow-consumption scenarios, consumption points-liability assets, consumption and data-producers and consumers, consumption diversion-consumption ticket cards, entertainment diversion-traffic assetization.

If further extended, the large consumer industry needs to be planned in several stages:

The first layer, RWA underlying assets, fixed assets, current assets, liability assets, supply chain financial assets, etc. around operating real estate;

The second layer, consumer industry space + industry scenarios, around the consumption, production, consumption, incentives, etc. of consumption and operating cash flow, including production and sales data assets;

The third layer, industrial finance Defi, compliant consumer production and financing stablecoins and consumer upstream and downstream payment PayFI

The fourth layer, RWA consumer metaverse, virtual and real finance and meme space combined with operating real estate

However, this kind of planning is only suitable for similar enterprises: consumer retail industry head, new retail IP traffic head.

And those policies such as consumption upgrades, consumption points, and cultural tourism to drive consumption basically need to be coordinated with consumer production and finance. Whether it is fast-moving consumer goods retail, sports and entertainment, or new concept brand experience space, or even the upgrade direction of WeChat business communities, they are essentially consumer industry and finance RWA.

The core of consumer industry and finance RWA is IP narrative, which is to upgrade the consumer industry scene based on the main brand or space theme into an IP narrative with unique tone, plot, conflict and contrast. Real estate is not just a place. It can be designed as a cultural narrative with brand merchants, tonal consumer scenes and individual consumers, that is, the consumer entertainment metaverse, or a large-scale interactive drama and game metaverse.

RWA is not only the tokenization of assets, but also the combination of real assets and virtual assets. The narrative upgrade of RWA, from the perspective of Web3.0, is the consumer metaverse that combines the real world and the virtual world, combining the scene + narrative + marketing of Meme.

If you are still willing to think, you can extend your thinking:

"IP + RWA tokenization + RWA trading market + liquidity scenarios (consumption, games, etc.) + meme"

#ARAW Always RWA Always Win! In 2025, the RWA market will quickly find its place in the wild growth. In the new year, Brother Kai will officially open classes to recruit disciples to teach and help. Young talents who are interested in the RWA direction are welcome to take a seat.

More and more friends are asking specific project questions. It is impossible to answer them in detail on WeChat. In-depth analysis courses and practical study camps will be launched soon. It is better to come to the classroom to listen in detail and interactively discuss and sandbox simulations. You can add WeChat YekaiMeta to join the RWA industry seminar group to participate in specific RWA track and project product discussions.

Brian

Brian

Brian

Brian Hui Xin

Hui Xin Joy

Joy Brian

Brian Hui Xin

Hui Xin Brian

Brian Aaron

Aaron YouQuan

YouQuan Aaron

Aaron Aaron

Aaron