Source: Blockchain Knight

Sony and Metaplanet, two Japanese giants, have tightened their grip on Crypto assets in 2024 as the country battles a dwindling currency.

Crypto assets are seeing increasing adoption in Japan, with companies wading into the space to offer alternatives to their customers.

Sony has made its foray into the Crypto asset space with the acquisition of digital asset trading service provider Amber Japan at a valuation of $103 billion.

According to a statement issued, the company will be renamed S.BLOX.

Amber Japan operates the "WhaleFin" Crypto asset exchange, and the acquisition will make the app easier to use with more supported currencies and features. WhaleFin confirmed the development in an announcement on Monday.

The announcement reads: "Looking ahead, as a member of the Sony Group, we will strive to create new added value in Crypto asset trading services by collaborating with the group's diversified businesses."

On the other hand, Amber Japan has been facing a financial crisis since the collapse of FTX in 2022. Long before the Sony Group expressed its acquisition intention, its parent company Amber Group had to conduct a debt-for-equity transaction with Fenbushi Capital.

In addition, there are reports that investment company Metaplanet has taken similar actions.

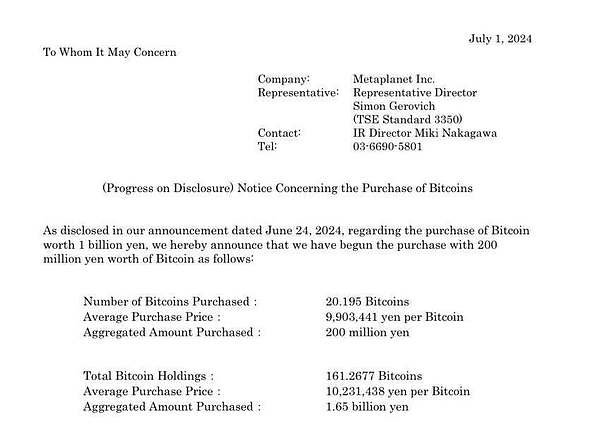

On Monday, Metaplanet invested an additional $1.02 million worth of BTC, becoming the largest corporate holder of BTC in Japan.

Like MicroStrategy, Metaplanet has also been gradually increasing its BTC holdings since April 2024.

Metaplanet disclosed on June 11 that it had purchased $1.6 million in BTC and committed on June 24 to purchase another $6 million from a bond issuance.

The report said that the company's basic policy is to hold BTC for the long term.

The report mentioned the company's commitment to reduce its exposure to the yen (Japan's national currency), and the company also hopes to provide Japanese investors with exposure to Crypto assets with a favorable tax structure.

The moves by Sony and Metaplanet indicate the growing adoption of Crypto assets in Japan. At the same time, Japanese officials are also worried about currency depreciation.

Under the influence of the sharp depreciation of the yen and some monetary policies of the Bank of Japan (BOJ), the Crypto asset landscape in Japan has undergone major changes.

According to Reuters on June 27, Japanese Finance Minister Suzuki Shunichi and Chief Cabinet Secretary Hayashi Yoshimasa expressed concerns about the plunge in the yen.

BoJ Deputy Governor Shinichi Uchida also said: "The weak yen is one of the factors that push up inflation, so we will pay close attention to currency trends when guiding monetary policy."

Stable changes in currency are controllable, but unilateral rapid changes often affect the national economy.

When a currency depreciates, investors may look for other assets to protect their wealth or seek higher returns. In this case, some investors may use BTC as a means of storing value.

For example, Metaplanet said it uses BTC as a reserve asset to reduce the risks brought by Japan's debt burden and the resulting volatility of the yen.

In the same vein, MicroStrategy founder Michael Saylor issued a bullish call for selling USD and buying BTC as the dollar moved lower ahead of this week’s key jobs report.

Edmund

Edmund

Edmund

Edmund Huang Bo

Huang Bo JinseFinance

JinseFinance Xu Lin

Xu Lin Coinlive

Coinlive  Coinlive

Coinlive  Coindesk

Coindesk 链向资讯

链向资讯 链向资讯

链向资讯 链向资讯

链向资讯