With the passage of the spot Bitcoin ETF, the next most important narrative in the crypto world is undoubtedly the fourth Bitcoin halving, which is expected to be on April 22, 2024. The block reward will drop from 6.25 BTC to 3.125 BTC.

As one of the most important narratives in the encryption industry, "Bitcoin halving" has always been a good medicine to boost market confidence. So this halving cycle will be the same as Did you use the same rhyme before? What unexpected impacts may new variables in the Bitcoin ecosystem have since 2023?

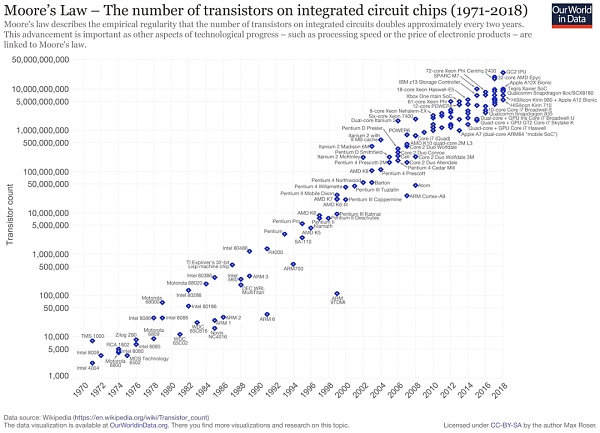

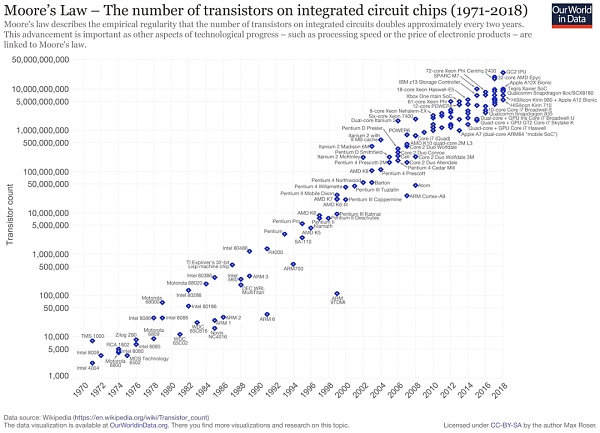

PoW Mining on "Moore's Law"

"Bitcoin becomes the flag of technology" mentioned in the article that dozens of The growth chart of "Transistor Count" per unit chip in recent years, under the control of "Moore's Law", shows a terrifying growth trend visible to the naked eye.

Mapped to the field of mining machines such as Bitcoin mining chips, in the past ten years since Bitcoin mining entered the market, mining hardware has gone through many changes, driven by the pursuit of "beauty of computing power" inspired by Bitcoin and other PoW currencies. From the evolution of CPU to GPU to FPGA and ASIC, the chip manufacturing process has also gone from hundreds of nanometers to tens of nanometers to today's 7 nanometers or even smaller, gradually approaching the ceiling, and the next step will involve the quantum field.

Capital in the industry has always liked to collectively bet on the "halving event". This is the case in the bear and bull cycle from 2018 to 2020. The Bitcoin mining field is built on this On a positive note, factors such as growing computing power, new hardware, and the upcoming reward halving will determine the overall growth of the industry and Bitcoin, even more so today:

Just yesterday, February 3, according to BTC.com data, the Bitcoin mining difficulty ushered in a mining difficulty adjustment at block height 828,576, with the mining difficulty raised by 7.33% to 75.5 T, continued A record high. The current average computing power of the entire network is 550.07 EH/s. In addition, the 7.33% mining difficulty increase has also reached the highest record since March 2023.

Now we are at the waist of a new halving cycle. There is still a two-year window period before the next Bitcoin halving. This may also be an absolute disaster. This is the first (or second) time for most practitioners and investors of this round to witness and experience the Bitcoin halving "event" in person, and the exquisite mechanism design is bound to leave a deep impression on everyone.

The historical cycle of halving

Having a negative impact on the encryption industry It is said that each round of halving is indeed a grand event, especially the first two halving cycles of Bitcoin, which both saw an astonishing increase of dozens of times (in the short term, after the two halvings, there was an increase in profit margins. fell in the short term, but then the adjustment was completed and the long-term rising market emerged).

However, starting from the third halving in 2020, the number of industry employees, market attention and the perfection of supporting infrastructure have all improved significantly compared with before. , Bitcoin is no longer a niche product limited to geek circles, and has begun to interact with more external factors.

Simple summary:

Before the first halving, geeks in the circle More concerned about the possibility of Bitcoin as electronic cash;

During the second halving cycle, the focus on Bitcoin shifted to its becoming a payment tool The attributes of BCH also triggered a series of debates (the subsequent BCH fork was almost the top trend in the circle);

And in the third halving cycle, Bitcoin has become an alternative asset, and attention to the layout of traditional institutions and capital has begun to become the main theme;

So compared to the previous two halvings, Bitcoin’s third The popularity of the second halving is also unprecedented. At the same time, the overall political and economic environment of the world during Bitcoin’s third halving also affected its performance:

Under the influence of macro factors, from March 12 to March 13, two months before the halving on May 11, Bitcoin began to decline from $7,600, first falling to $5,500 and fluctuating. Subsequently, it broke through the support point all the way, reaching as low as 3,600 US dollars. The overall market value evaporated by 55 billion US dollars in an instant, and the entire network liquidated more than 20 billion yuan, accurately achieving "price halving".

However, after the halving in May, DeFi started a new bull market cycle in the summer, and Bitcoin also hit $60,000. Compared with the halving It has increased nearly 20 times from its previous lowest point.

Generally speaking, according to the laws of the historical halving cycle, from a traditional perspective, the price of Bitcoin will return to the previous level when the halving occurs. Half of the bull market price - that is, by April 2024, the price of Bitcoin may be around US$30,000.

After the halving, it is very likely to start a new bull market cycle. It may be difficult to achieve an increase of more than 10 times in terms of current volume, but it will exceed the previous The bull market high of $60,000 is still worth looking forward to.

New variables in the Bitcoin ecosystem

But with this At the same time, under the background that Bitcoin has experienced three halvings, the block reward has been reduced to 6.25, and the number of mined coins has reached more than 19 million, it is actually time to reconsider many situations and things from a new perspective.

Especially in addition to this round of Bitcoin halving, the entire industry and Bitcoin itself have seen some new variables worthy of attention compared to previous halvings. .

The dynamic game behind the halving rule

We can Briefly understand the basic knowledge of Bitcoin halving: The mechanism design of Bitcoin determines that the role of miners is extremely important and is the cornerstone of maintaining the transaction operation of the entire system. At present, the income of miners mainly comes from two parts-block rewards and procedures. fee.

The block reward starts at 50 Bitcoins and is halved every four years. It has been halved three times so far and is 6.25 Bitcoins. It will be reduced next time. Half in 2024, this will continue to decrease, and by 2140 Bitcoin will no longer have block rewards;

And the handling fees will always exist (article This is the case with the Monero mentioned at the beginning), so in the future, the income of miners will become very single, with only handling fee rewards.

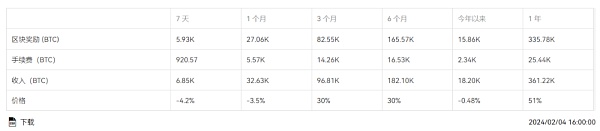

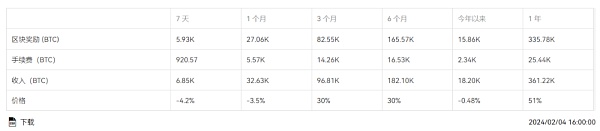

In fact, the current fee income of Bitcoin miners has exceeded the block reward and has become the core of income. So this also means that the role of miners will always exist, but the income model will completely change:

As the block reward gradually decreases until it approaches zero, then the procedures Fees will become more and more important until they eventually become the only source of income (this is also one of the reasons why miners are obsessed with large blocks: the larger the block, the more transactions that can be packaged in the same period of time, and the higher the handling fee. many).

Although it is logically possible to make up for the decrease in block rewards by increasing handling fees like a seesaw, the handling fees are too high and are not conducive to the promotion and use of Bitcoin. :

Miners maintain the network and provide value, which cannot be separated from sufficient profit incentives; users use the network to create value and cannot afford high handling fees;

The feedback and fine-tuning of the entire Bitcoin economic system has always been in such continuous contradictions, but it has always been able to achieve dynamic equilibrium through full game play by all parties.

Variables brought by BRC20

Since 2023 The prosperity of the Bitcoin ecosystem, especially BRC20, has set off a new wave of "BitcoinFi". The activity of transactions within the Bitcoin ecosystem has reached a new peak, thus boosting the surge in Bitcoin's fee income.

Especially in this context, protocol innovations such asOrdinals are accompanied by the siege of leading projects such as ORDI and SATS, which have profoundly affected the fees of the Bitcoin network. Rate model - most directly, it completely changes the economic model and incentive model of Bitcoin.

Dune's latest data shows that as of February 4, the cumulative cost of Ordinals inscription casting exceeded 6,000 BTC, exceeding $250 million.

Among them, the BTC mining fee income on December 17, 2023 hit a new high in the past five years, reaching 696 BTC (approximately US$30 million), accounting for more than 40% of the total income of miners that day.

The historical average data of miner fee income often accounts for only about 2%, but the average data in the past three months has reached over 15%, a record historical record.

As this halving approaches, subsequent block rewards will gradually decrease until they approach zero, so the handling fee will become more and more important until it eventually becomes the only source of income.

The BRC20 in 2023 is equivalent to a preview in advance. Regardless of whether it is successful or not, with the subsequent Bitcoin halving, what will happen on this road? Exploration is bound to get more attention.

If Bitcoin in the past only had the advantages of "traditional cognition" and total market capitalization, theinscription trend has directly and significantly improved the status of the Bitcoin ecosystem. The richness of new assets and human demand for new assets are everlasting. At the same time, it also indirectly increases the number of developers and user base.

At the same time, the RGB protocol, Slashtags (identity accounts, contacts, communications, and payments serving the Bitcoin Lightning Network ecosystem), and many integrations New innovations such as the Impervious browser for P2P services, the Taproot-based asset protocol Taro, and the lightning token OmniBOLT are all worth looking forward to.

Generally speaking, we are now at the end of a new halving cycle, which may also be the case for most practitioners and investors in this round. This is the first (or second) time that I have witnessed and experienced the Bitcoin halving event in person, and it is still unknown how Bitcoin and this cycle will go after the next halving.

JinseFinance

JinseFinance