Author: Revelo Intel Source: substack Translation: Shan Ouba, Golden Finance

Last week we discussed the Fed’s decision to cut interest rates by 50 basis points. However, we also spent considerable time discussing easing measures around the world, especially in China, the world’s second largest economy. We pointed out that China has not yet taken “hard” measures, such as cutting interest rates, but has begun to choose some more subtle mild easing measures, such as possibly allowing mortgage refinancing.

This situation continued to be seen when trading opened in mainland China and Hong Kong on Monday, with the People’s Bank of China making several important announcements that attracted the attention of international investors from the cryptocurrency and traditional financial sectors. These announcements and measures are not as clear as a simple 50 basis point rate cut, but are intended to direct liquidity directly to the areas of the Chinese economy that need it most, especially the real estate and stock markets that have been in trouble in recent years.

With the emergence of a series of recent policy adjustments, we will release this week’s macro newsletter in advance. In today’s edition, we’ll dive deeper into these measures and explore China’s global implications that could impact cryptocurrencies in the coming months and years.

PBOC Breaks Silence

The fact that the PBOC held a press conference was itself seen as an improvement. US investors wanted some forward-looking information.

With this in mind, we can surmise that this was an important message from the PBOC that warranted a press conference. This press conference was the PBOC’s first since January. It reflects the Chinese authorities’ recognition of the current delicate situation – we all know that markets typically overreact to Fed comments, often pricing in months in advance. Given the current state of Chinese asset prices, it seems reasonable that the PBOC would want to fully explain its thinking and avoid any misunderstandings.

PBOC Announcement

Let’s take a look at exactly what the PBOC announced on Monday:

7-Day Repo Rate Cut:The People’s Bank of China cut its 7-day repo rate by 20 basis points, lowering banks’ borrowing costs. The move is intended to encourage businesses and consumers to lend, thereby stimulating consumption and economic activity.

Reduction of Reserve Requirement Ratio:The central bank announced a 50 basis point cut in the reserve requirement ratio for major banks, from 10.0% to 9.5%. The adjustment is expected to free up more capital for banks to lend, helping to offset weak credit activity.

Support for the property market:The People's Bank of China plans to increase support for the mortgage market by reducing interest rates on outstanding mortgages and lowering the minimum down payment for buying a second home from 25% to 15%. In addition, the proportion of funding support for unsold homes will be increased from 60% to 100%.

Changes in monetary policy framework:The People's Bank of China will formulate new monetary policy rules aimed at stabilizing and growing the stock market and ensuring better access to liquidity for companies. The measure establishes a RMB 500 billion swap line with the People's Bank of China specifically for stock brokerage firms and mutual funds. This will allow stock exchanges to obtain funds directly from the People's Bank of China. If this swap line proves effective, another RMB 500 billion swap line will be established.

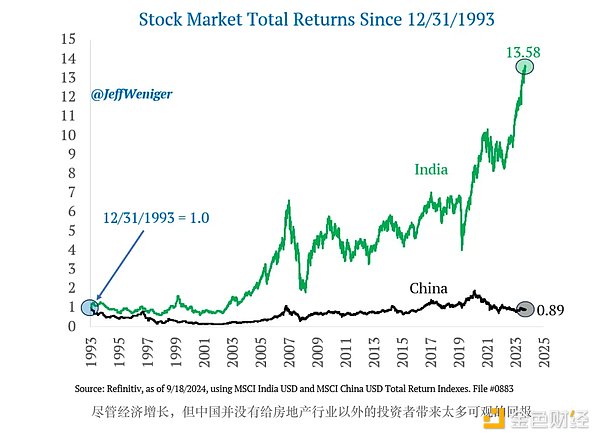

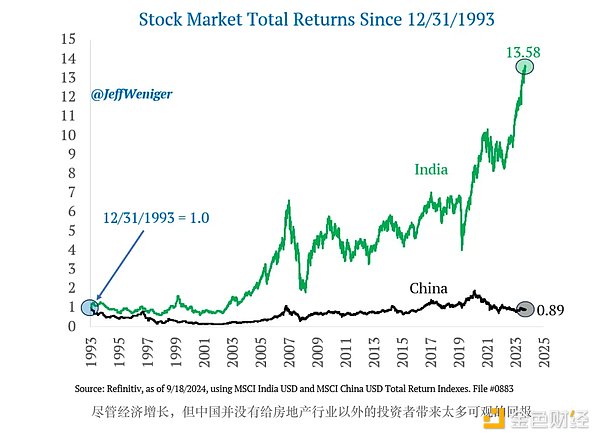

This last point made many English headlines. Ultimately, the value of this policy implementation was only about $70 billion per swap line, which is a drop in the bucket compared to the total market value of stocks eligible for this funding, which totals about $10 trillion plus. Only 10% of the Chinese population owns stocks, so the stock market does not receive much attention, as shown in our historical stock market returns chart above. This may be why this specific measure has attracted attention despite its relatively small impact. There is also the issue that stocks are the most accessible market for US investors and their main way to play China's economic growth. Other known ways to invest in China include mining stocks and European luxury stocks, which benefit from the growth of Chinese consumption.

Other Measures

Beyond the major announcements, there are other signs that Chinese authorities are inclined to relax policy further. Take, for example, the recent Kanye West concert on the Chinese island of Hainan. The actual economic impact of the event was not large, with an estimated contribution of about $60 million in consumption.

But the event and other celebratory tours involving American personalities show some willingness to encourage foreign economic interaction with China in order to increase consumption and boost GDP growth. This comes against the backdrop of the Chinese government banning several American celebrities from performing in the country over the past decade. Although such a move may seem small, it shows that Chinese authorities want to make Hainan Island a tourism and consumption hub, similar to a tropical special economic zone (SEZ). Speaking of special economic zones and special administrative regions, let's talk about Hong Kong.

Today, Hong Kong officials announced plans to reduce taxes on spirits. The move may seem small, but it may be a sign of a larger trend in the city. As China develops, more and more investment can be made directly in mainland China, without the need for Hong Kong as an intermediary. This puts Hong Kong's added value in question - a possible alternative is to move towards a consumption center, attracting tourists from China and overseas for purposes closer to leisure rather than pure business. Many believe that China is emphasizing the role of consumption in GDP growth and not relying too much on investment and exports, which is also an idea being mentioned.

Previously we mentioned that China is not the best place for foreign direct investment (FDI). The authorities may be looking to patch things up with overseas investors in certain areas, with the recent move to allow foreigners to fully own private hospitals and medical facilities. These are additional examples pointing to a larger picture of further easing of policy in the Chinese economy.

Real easing or KPI?

It is important to note the timing of these recent announcements. Not only did they come immediately after the Fed and ECB decided to cut rates, but we are about to enter the fourth quarter of 2024. This is important because it is the last chance for Chinese authorities to meet their annual KPI targets.

For those who follow the US market, this may be a slightly unfamiliar concept. The US does not set economic growth targets regularly. The Chinese government has set a 5% GDP growth target for 2024.

The consensus seems to be that US GDP growth will be between 2-3% this year. And the projected growth in the Eurozone is thought to be even lower, below 1%, with an improvement expected in 2025. But the Eurozone, the US and China are very different economies, with the former two already extremely mature, while China is still growing rapidly. Therefore, a 5% growth rate could be twice that of the US, or even five times that of the Eurozone. Although the U.S. economy is larger than China’s, a smaller growth rate is still feasible.

The key is that while 5% may seem high, it is low compared to the 8% and 9%+ growth rates that China has achieved in recent years.Thus, the recent announcements may be an attempt to meet this annual quota rather than serve as a basis for medium- to long-term growth. Speculators must watch for any further moves by the People’s Bank of China or other Chinese entities that suggest a more forward-looking approach.

On the other hand, these announcements came just days after the Federal Reserve quickly began cutting rates. The timing may indicate the importance the People’s Bank of China places on the medium- to long-term outlook, intending to follow the Fed and provide more momentum to its economy without worrying too much about the depreciation of the RMB against the dollar.

The Impact of China’s Easing Measures

The biggest impact of China’s recently announced easing measures was immediately felt on Chinese stock indices, reversing many of the losses and leaving the indices close to flat year-to-date. The Shanghai Stock Exchange Composite Index is currently down about 2% year-to-date. Other mainland indices remain in the thick of the decline. Hong Kong’s Hang Seng Index is up more than 13% year-to-date, making it the go-to for many people in assessing the health of Chinese stocks.

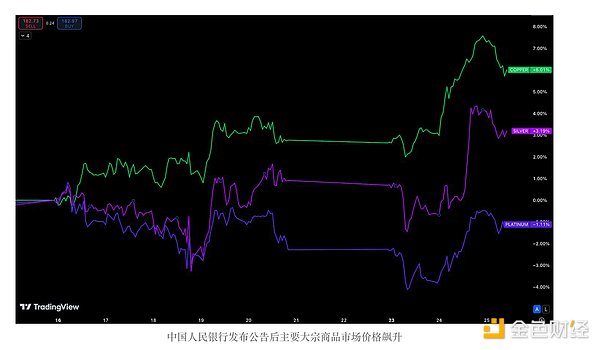

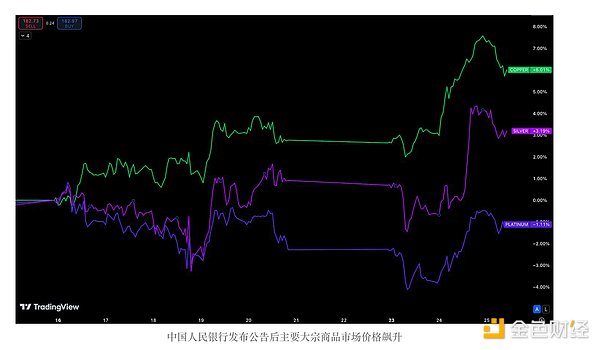

The impact of these announcements also spills over into the commodity markets. As a major global exporter, easing measures will undoubtedly stimulate growth in the manufacturing sector, increasing demand for commodities. This could also impact the U.S. economy and could affect the Fed’s decision. China’s current deflationary state has resulted in some deflation being exported, making this a factor that the Fed may consider. Rising commodity prices could affect U.S. inflation.

Last but not least, we have to talk about cryptocurrencies

The correlation between China and cryptocurrencies, if any, is not clear. But that doesn’t stop us and others from speculating. A key effect of the US Federal Reserve's easing measures (not China's) is that the estimated $5 trillion in US dollar assets held by Chinese exporters are more likely to start flowing back to China.

As China takes steps to boost confidence in its stock market, the appeal of capital flowing back to China is greater. Cryptocurrencies could also be part of this. Whenever money moves from one place to another, the chances of cryptocurrencies being considered increase. It can be argued that in China's case, this likelihood is particularly strong.

As cryptocurrencies grow in market capitalization and market attention, the chances of capital moving to cryptocurrencies will only increase, not to mention that the US itself has become more hostile to foreign holdings of the US dollar. We have seen that gold has seen a significant price increase in recent days, which is just the latest manifestation of a larger trend over the past two years.

Over the past few days, especially over the weekend, it was observed that some of the price action in the crypto market occurred outside of US trading hours. Overall, while it is difficult to tell how much of this liquidity will flow into cryptocurrencies, increased monetary liquidity bodes well for cryptocurrencies, and increased global liquidity is particularly beneficial for this asset class.

We have seen Hong Kong attempt to gain a foothold in the crypto market, with many investors and builders based in the city. It remains to be seen whether China will announce changes to its stance on mainland cryptocurrencies, or continue to operate through special economic zones and special administrative regions. The Chinese population holds a large amount of funds, and the government wants them to be put to use. Ideally, this should come in the form of consumption, such as dining at restaurants, purchasing products, etc., rather than buying cryptocurrencies, at least that's the general idea. Chinese households are estimated to have savings of more than $18 trillion. If the easing measures include any explicit relaxation that allows Chinese individuals to trade cryptocurrencies, this will be huge.

Currently, Bitcoin mining and crypto asset trading are prohibited, but China remains the second largest Bitcoin miner in the world. Owning crypto assets remains legal, but access to centralized and decentralized exchanges is prohibited.

Conclusion

Regardless of the legality of cryptocurrencies in mainland China, the fact that China, the world's second largest economy, is providing monetary stimulus, with fiscal stimulus yet to come, is a positive sign for cryptocurrencies. The Chinese economy is already the largest in the world in terms of real GDP, and it is far ahead.

The purpose of measuring with real GDP is to remove the bias of strong currencies when assessing the value of the economy, so this is not particularly important when assessing cryptocurrencies and asset flows. Regardless, despite the sheer size of the Chinese economy, especially in the crypto space, it remains poorly reported.

The impact of the global economy on crypto has become impossible to ignore in recent years. A lot of this stems from poor communication, which has led to little discussion, especially given the poor performance of Chinese assets in recent years. The recent series of announcements from the People's Bank of China seems to have turned a lot of crypto attention to China, which was not the case before. Fortunately, this is mostly good news for cryptocurrencies.

Catherine

Catherine