Author: degentrading, crypto KOL; Translation: Jinse Finance xiaozou

Will Ethena collapse in a UST-style crisis?

I have seen some misunderstandings in some posts, and I just want to clarify these misunderstandings in this article. (I have no relationship with them and will not gain any benefits from their success or failure.)

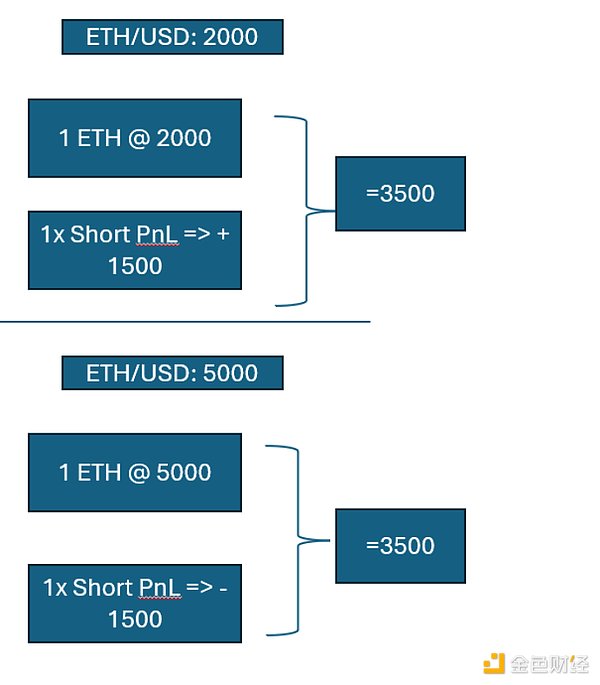

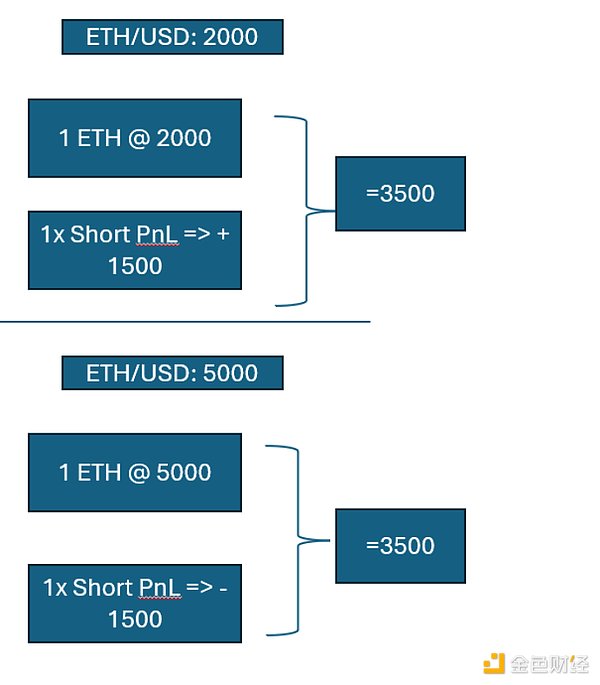

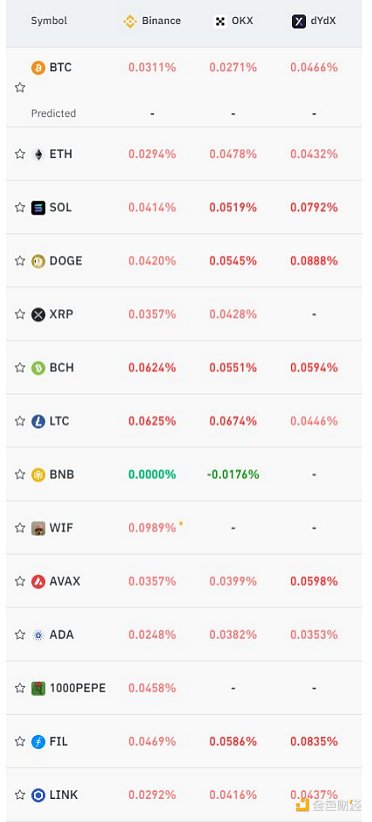

First of all, what is Ethena? It is a synthetic dollar protocol. Taking 1 ETH synthetic dollar as an example, when buying spot ETH (or stETH), it will hedge the nominal equivalent of ETH shorts accordingly. So why is it one dollar? This is because under any normal circumstances, the return is fixed. As long as the basis of the forward/futures/perpetual contract to the spot remains unchanged, a basket of spot and its corresponding short position will maintain the same value, without holding and funding rates.

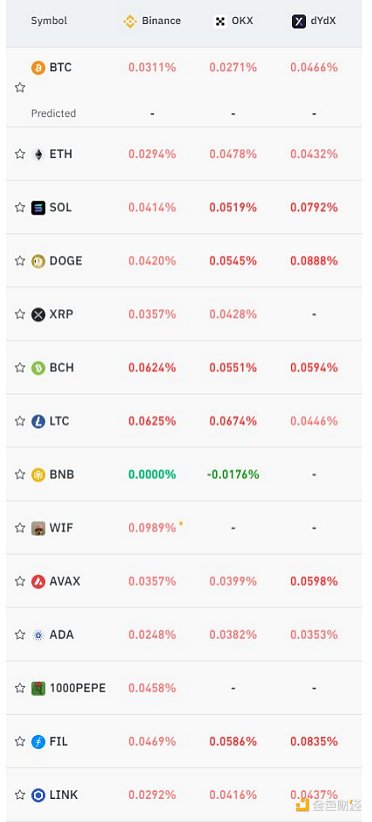

So why is it so attractive? In short, because capital injections have been very active - in a bull market, everyone is looking for leverage and cheap US dollar borrowing. 5bps every 8 hours? If the market is rising 10% every day, this is not a problem.

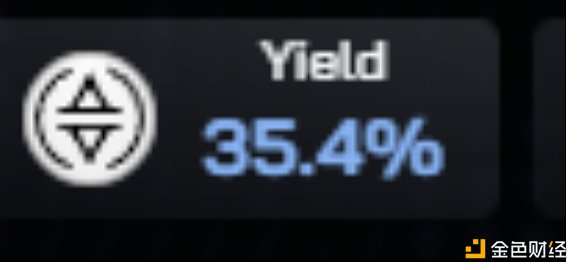

Thus, Ethena's recent yield looks to be around 35%. This is likely to continue as long as there is demand for leverage in this space.

UST failed because the collateral backing the issued UST was native Luna, and as the Luna price collapsed, the available collateral denominated in USD experienced a self-reinforcing vicious cycle when Luna was issued and sold to the market.

However, in general, for Ethena, the collateral backing the issued USDE is a basket of assets that generally maintain value throughout the price range. As long as the basis of the spot/perpetual contract or the spot/futures contract does not explode.

Cryptocurrencies generally exhibit downside convexity. Prices fall faster than they rise. In my opinion, this design is actually very beneficial to Ethena.

As the price continues to fall, the proportion of USD cash held by Ethena actually increases without liquidation. In the example below, you can see that a drop in ETH to 1k would result in 2.5k of the 3.5k collateral basket being cash…

Is there a risk here? If there is a risk, it is using stETH as collateral. Compared to ETH, stETH has much less spot liquidity. However, after the Shapella upgrade, the stETH/ETH discount IMO hit bottom.

Before Shapella, stETH sellers were at the mercy of buyers. After Shapella, if the stETH/ETH exchange rate rises severely, sellers can choose to wait longer (1-5 days) before withdrawing stETH for ETH.

The other elephant in the room will be counterparty/exchange risk. If an exchange goes bankrupt due to a crisis, Ethena could experience significant impairment. Their exchange list looks pretty good, though.

That leaves one last risk - operational risk. The Ethena concept should work. It's pretty ingenious. However, it also relies to some extent on smart trading, execution and risk management with uncertainty.

In a crisis of confidence, as long as Ethena's execution is perfect, USDe will have a floor price because the basket of assets will maintain its value. However, what I have noticed is that in general, crisis situations will make us blunder - traders may be tempted or forced to exit basis trades, thus creating delta risk. However, in general, the basic concept of Ethena should be viable.

Ethena may also change the market mechanism and bring new price relationships - however, this aspect can only be evaluated in the future.

I think Ethena will actually add fuel to the bull market. Current market makers generally do not hedge their perpetual contract shorts with spot longs (unless they are grinding basis), and what they want to see is a general disappearance of delta.

Although Ethena is delta neutral, the spot demand it inadvertently creates will cause more upward price slippage while putting pressure on the basis.

In summary, Ethena is a good concept and has good functionality. If it fails, it will be because of execution and risk issues in edge cases.

Catherine

Catherine