Source: Barron's Chinese

The subsequent trend of the stock market will depend on Trump's tax and fiscal policies, and how the 10-year Treasury yield responds to these policies.

The U.S. stock market rebounded strongly, driven by falling Treasury yields and lower-than-expected core inflation data.

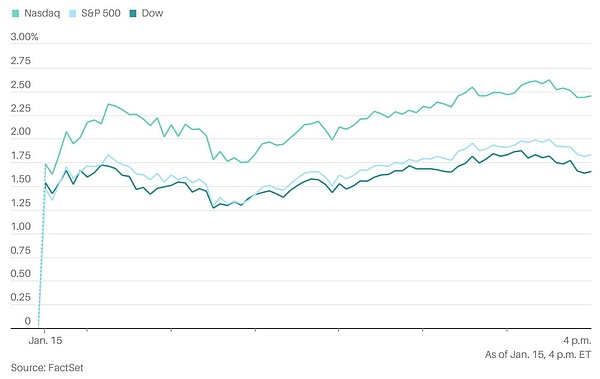

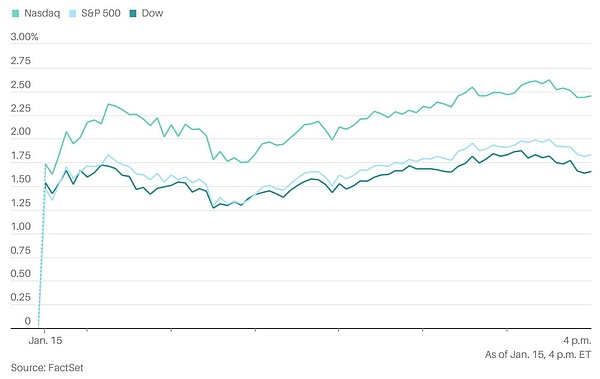

The S&P 500 rose 1.8% to close at 5,949 on Wednesday (January 15), marking its biggest one-day gain in 10 weeks. The Dow Jones Industrial Average rose 703 points, or 1.7%, to close at 43,221. The Nasdaq Composite Index rose 2.5%. All three major stock indexes posted their biggest one-day percentage gains since Trump's election victory.

Data released by the U.S. Bureau of Labor Statistics on Wednesday showed that the year-on-year increase in the core CPI, excluding food and energy prices, fell back to 3.2% in December 2024, rekindling investors' expectations that the Federal Reserve will cut interest rates sometime this year.

John Luke Tyner, head of fixed income at Aptus Capital Advisors, commented: "We think the stock market was too pessimistic before, and today's market reaction is expected."

The lower-than-expected inflation data is undoubtedly good news, yields have fallen from their highs, and the market expects the Fed to cut interest rates in June," the global market strategy team of New York Life Investments wrote in a report to clients on Wednesday.

However, due to the uncertainty of the impact of the Trump administration's tariffs and tax cuts on the US debt burden, whether the current bullish sentiment can be sustained is a big question.

Tyner believes that if the S&P 500 rises to around 5,975 points, the stock market may encounter resistance.

Cooling core inflation ignites expectations of rate cuts, and the three major stock indexes rose strongly

The decline in yields eases stock market pressure

The benchmark 10-year Treasury yield fell sharply by 13.4 basis points to 4.653% on Wednesday, calming investors' nervousness. The yield rose to 4.802% the day before, the highest level since October 2023.

Recently, the 10-year Treasury yield broke through the 4.75% mark, which some Wall Street people believe could trigger a stock market correction.

"Investors have been given a reprieve after three weeks of volatility and they need to assess their asset allocations," said Richard Steinberg, chief market strategist at Focus Partners Wealth, referring to the pullback in yields.

The sharp rise in long-term interest rates has weighed on markets: the gains in U.S. stocks after Trump's election have been eroded, high-valuation technology stocks have been suppressed, and cryptocurrencies have fallen sharply after setting records.

Bond yields have risen sharply despite multiple rate cuts by the Federal Reserve since September last year, while the U.S. economy has continued to grow and the labor market has maintained strong momentum during this period, and investors are assuming that the policies of the incoming Trump administration may lead to high inflation.

These factors may prevent the Federal Reserve from further cutting interest rates in 2025. Rising yields have always been a headache for growth stock investors, especially when stock valuations are high.

Trump's tax and fiscal policies determine the next trend

Steinberg's team's forecast for the S&P 500 to reach 6,500 points by the end of this year (a 9% return) has not changed, but he noted that the S&P 500's rise will show a pattern of pauses and continuations as investors begin to understand more about corporate taxes under Trump's second term.

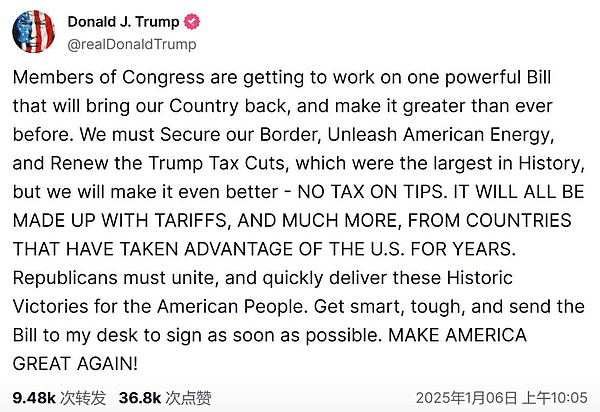

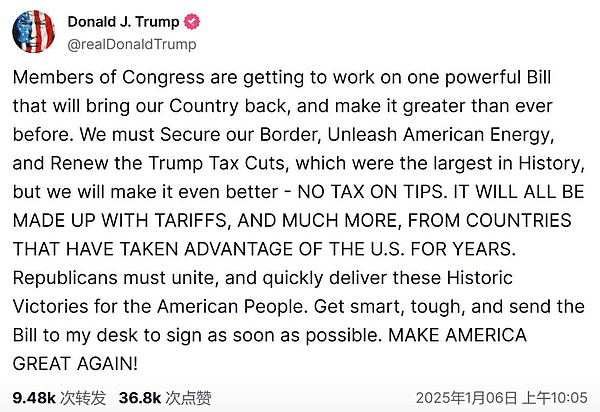

Trump recently posted on Truth Social that he would propose "a strong bill" on border issues, U.S. energy production and the expiring 2017 tax cuts, which would be funded by tariffs on other countries.

Lower corporate taxes could make current stock valuations look less expensive relative to earnings, especially if the Federal Reserve cuts interest rates further this year and long-term U.S. Treasury yields fall further, reducing borrowing costs.

However, if government spending is not cut, tax cuts will further increase the already heavy debt burden of the United States, a factor that could trigger another bond market sell-off and a return of "bond vigilantes."

"I think tax policy may be the biggest unknown factor facing the market right now," Steinberg said. "What impact will fiscal and tax policies have? How will the 10-year Treasury yield react? These questions will determine the subsequent trend of the stock market."

Jixu

Jixu