Source: Liu Jiaolian

Three or two peach blossoms outside the bamboo. It is the time when pufferfish are about to come up.

Unconsciously, we have bid farewell to the warm and cold March and the first quarter of 2024. In March, BTC (Bitcoin) opened at 62.7k, the highest was 73.8k (historical high), the lowest was 59k (March 6th), and the closing price was 70.4k. The monthly closing price was successfully above 70,000 dollars, which is the highest monthly closing price in history, which is 10,000 dollars higher than the closing price of 60.4k in October 2021 in the previous bull market.

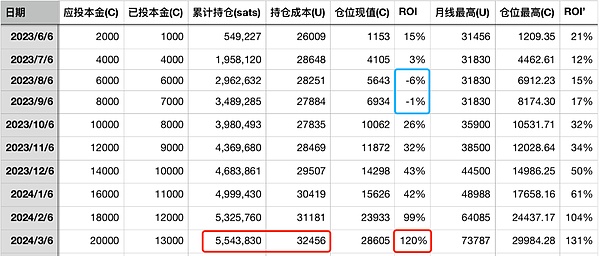

Due to the increase in March, this time it still skipped a decline in positions. From June 2023 to March 2024, there have been 12 cumulative positions, with a total position of 5.54 million satoshis, a holding cost of more than 30,000 dollars, and a yield of 120%.

In addition, it can be seen that in August and September last year (2023), when the yield retreated to negative values and fell into floating losses, it should be a good time to increase the strength of the position.

If the sky is a hundred feet high, the stars can be picked with your hands.

I dare not speak loudly for fear of alarming the heavenly man.

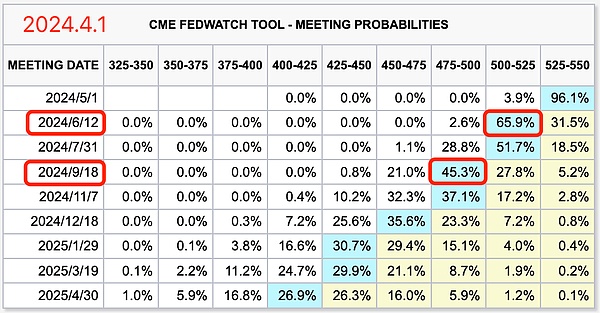

Powell, the "heavenly man" (Chairman of the Federal Reserve), suddenly expressed a hawkish attitude, saying that it is not appropriate to enter the interest rate cut channel too quickly. This statement made the expectation of a rate cut in June disappear.

The above chart shows that the market expects the probability of a rate cut in June to have fallen to less than 3%. Currently, more than 65% of the market expects that the current interest rate level will remain unchanged. The earliest expectation of a rate cut will be in September.

The pressure is on Treasury Secretary Yellen.

It is reported that Yellen will visit Beijing again in April.

She came once in July last year and set up two working groups.

This time she came to us again. I guess she is under great pressure.

After all, the "Huashan Sword Contest" is nearing its final stage.

It is Yellen's unshirkable responsibility to work for a soft landing.

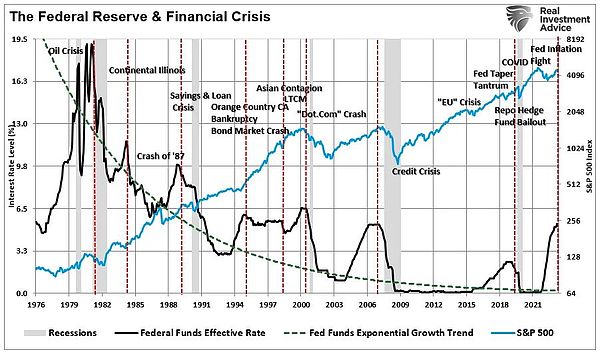

The Fed has always been stubborn and will not turn back until the market collapses. The Fed reluctantly starts the interest rate cut channel only when the market collapses and the Fed is killed. This has been the case since the Volcker shock in the 1980s until today.

Some people look back at historical data and say that the market collapses as soon as the Fed cuts interest rates. This is putting the cause and effect in the wrong place.

In fact, it should be said the other way around: it is precisely because the market is about to collapse that the Fed quickly put down the high-interest magic weapon it was holding and cut interest rates to save the market.

Why does Li Tianwang, the King of Totoro, never let go of the pagoda and hold it in his palm every day? Because when Li Tianwang holds the pagoda in his hand, he is Nezha's father; once he puts down the pagoda, he becomes Nezha's enemy. (The 38th chapter of Journey to the West clearly states: "… When the father saw his son holding up a sword and a knife… the Heavenly King was horrified. … Why was he so horrified? … Today, because I was idle at home, I did not hold the pagoda. I was afraid that Nezha would have the intention of revenge, so I was horrified. But I turned around and took the golden pagoda from the pagoda base and held it in my hand…")

The Federal Reserve holds the pagoda, and the market kneels and kowtows to it, looking at it every day. However, this man-made pagoda is not like the pagoda built by Buddha. It is ultimately unstable and cannot be held up.

The held pagoda will eventually be put down, and the market will rise in retaliation. The release of water to take over the market before the harvest is completed will also announce the depreciation of the US dollar again and the failure of the Federal Reserve.

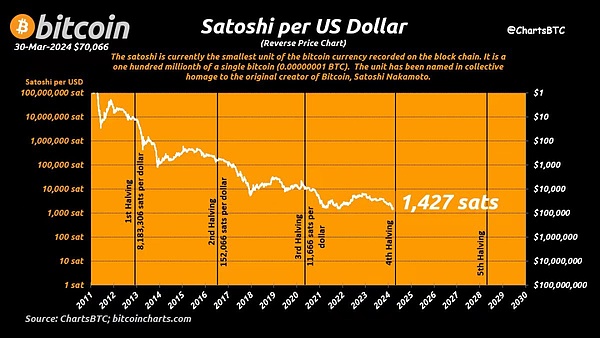

The depreciation of the US dollar relative to Bitcoin

Gold and Bitcoin, which have been soaring and hitting new highs since October last year, are like the two swords held by Nezha, holding the knife of the Federal Reserve to cut the world. The Federal Reserve was shocked, so Powell came out to sing hawkish and hurriedly brought out magic weapons.

Gold

Bitcoin

And BTC (Bitcoin) closed up for 7 consecutive months in September, October, November, December, January, February, and March. From the closing price of 27k in September, it rose all the way to the closing price of 70.4k in March, an increase of 160%.

As Jiaolian wrote: "Every gold buyer, every patient gold hoarder, is a strategic alliance and a united front. And all those who participate in this united front will benefit from the failure of the Federal Reserve and the collapse of the US financial system through the sharp increase in their assets.

The article also clearly points out that the internal force driving the rise of gold and BTC is: the defense of exchange rates by major powers + foreign exchange controls by major powers.

At that time, Jiaolian used language that the people in the currency circle could understand to make an analogy: "This is equivalent to a certain platform temporarily unable to withdraw money, which has played the role of disguised lock-up, which is more conducive to price increases. Recalling the end of 2020, there was a panic, but one of the effects of disguised lock-up was to promote the start of the bull market from the end of 2020 to the beginning of 2021."

Half a year has passed, and now looking back, the script written in September has completed the first four steps. BTC was also successfully pushed by the domestic force to break through the previous historical high, opening a technical bull market.

Now, the script is still missing the final scene:

"Step 5. When the Fed finds that the dollar assets attracted by high interest rates do not continue to flow back to the United States and U.S. bonds, but turn around and run to another channel and enter our pot, the Fed will be anxious. The U.S. financial system and domestic dollar assets will soon be unsustainable without the support of returning capital, and there will be another financial collapse like the subprime mortgage crisis and the financial storm.

"Of course, this time the Fed should be more sensitive than in 2007-2008, and its actions will be more decisive. In addition, a new tool BTFP was launched in early 2023. Finally, once something goes wrong, I believe the Fed will immediately step forward to plug the breach, quickly print money, and save the building from collapse through the devaluation of the dollar."

Although it seems that the U.S. stock market is rising well now, eating hot pot and singing songs is very enjoyable. But will this train suddenly crash into the axe that Zhang Mazi blocked on the railroad track like the opening scene of "Let the Bullets Fly", and suddenly overturn, destroying the train and killing everyone, leaving only the county magistrate's wife, and the county magistrate becoming a legal advisor?

There is still half a year, let's wait and see.

Teaching chain blind guess, the bursting of the AI bubble is likely to be the trigger of this crisis. This bubble is epic (AGI completely eliminates humans, etc.), this operation is also epic (capital dream linkage), and the collapse is likely to be epic.

Overturn the county magistrate's train, turn the county magistrate into a legal advisor, sleep with the county magistrate's wife, and Zhang Mazi will be the county magistrate.

If the epic bubble burst really happens, then perhaps the short-term panic pullback will be the last chance to get on the train before Bitcoin reaches $100,000.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian JinseFinance

JinseFinance Olive

Olive Coinlive

Coinlive  decrypt

decrypt Beincrypto

Beincrypto Beincrypto

Beincrypto Coindesk

Coindesk