Deng Tong, Jinse Finance

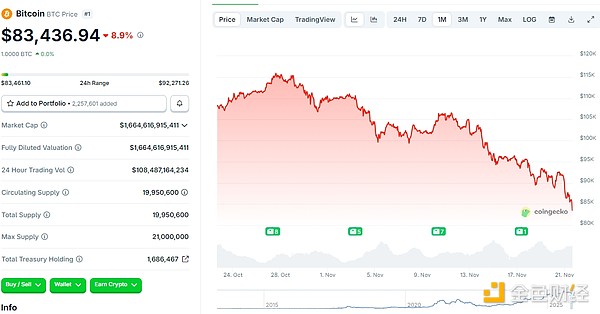

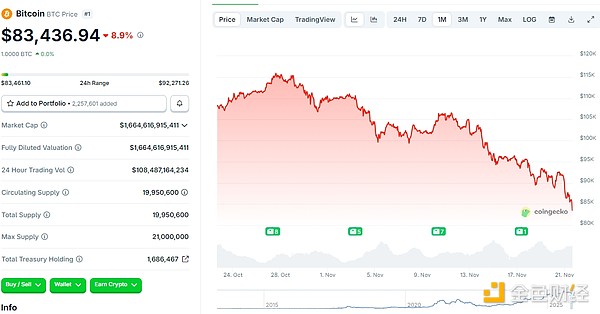

On November 21, 2025, Bitcoin fell to $83,400, Ethereum fell below $2,800, and the total market capitalization of cryptocurrencies dropped below $3 trillion, currently trading at $2.97 trillion, a 24-hour drop of 8.7%.

Recently, the crypto market has been declining. What's happening with whales, DAT, and ETFs?

I. Whales: Bullish with Floating Losses, Bearish with Huge Profits, Profit-Taking Sell-Off

According to Glassnode data, the number of Bitcoin "whales" (addresses/investors holding large amounts of Bitcoin) has increased by 2.2% in three weeks, reaching its highest level in four months; meanwhile, the number of small-scale retail Bitcoin investors has fallen to its lowest point this year.

1. Bullish with Floating Losses

According to on-chain analyst Yu Jin's monitoring, a whale that shorted ASTER after CZ revealed his holdings has now seen a floating loss of $31.84 million on its $261 million long positions. Its liquidation prices are: ETH $2,528 and XRP $1.55.

After closing out its short position on ASTER a few days ago, it chose to go long on ETH and XRP, opening a position worth nearly $300 million, which has suffered significant losses in the past few days due to the decline.

According to analyst Yu Jin's monitoring, a certain whale/institutional investor has recently exhibited a clear swing trading strategy.

Five days ago, this investor sold 70,000 ETH (approximately $223 million) at an average price of $3,188, only to re-enter the market. He transferred 153 million USDT to Binance and withdrew 57,725 ETH (approximately $162 million), with an average purchase price of $2,820. Currently, this investor holds approximately 432,000 ETH (worth $1.24 billion), with an average holding price of $3,332, resulting in a paper loss of approximately $200 million. Previously, this investor had successfully shorted ETH, profiting $24.48 million, before switching to a long position and using 1.5x leverage to increase his position. With "Brother Machi" experiencing another partial liquidation, he has been liquidated 145 times since the "1011 crash." Previous reports indicated that with the market decline, Brother Machi's 25x leveraged Ethereum long position experienced partial liquidation, resulting in total losses exceeding $20 million. According to Onchain analyst Yu Jin, a whale who had been accumulating WBTC and ETH at high prices through revolving loans sold off 18,517 ETH worth approximately $56.45 million within two days to avoid liquidation, incurring a loss of $25.29 million. After selling off the ETH, the whale still holds 1,560 WBTC at a cost of $116,762, currently showing a floating loss of $41.12 million. 2. A Bearish Whale Profits According to OnchainLens, a "ultimate short seller" whale holds a 20x leveraged short position in Bitcoin, currently showing a floating profit of $30 million and earning over $9 million from funding fees. Its opening price was $111,400, with a position size of 1,231 BTC. According to Lookonchain monitoring, a whale (0x5D2F) shorted 1,232 BTC (worth $108.63 million) with 20x leverage, and currently has over $28.7 million in unrealized profits. Limit orders have been placed between $75,819 and $79,919 to lock in profits. According to on-chain analyst Ai Yi, on November 20th, an address sold 175 WBTC at an average price of $92,444.59, for a total transaction value of $16.177 million. This address bought these Bitcoins at an average price of $74,746.46 between August and October 2024. Although the profit has retraced by over $5,900,000 compared to the market peak, this sale still yielded a profit of $3,097,000. Currently, this address still holds 491.84 WBTC.

II. DAT: Floating Losses, Averaging Down, and Shelving

1. Floating Losses and Averaging Down

According to Ember Monitoring, ETH treasury company Bitmine continues to average down by averaging down: Bitmine received 17,242 ETH (worth $48.96 million) from BitGo and FalconX. This week, Bitmine has increased its holdings by 63,114 ETH (worth $188 million) through Kraken, BitGo, and FalconX. Currently, the company holds 3.56 million ETH at an average price of $4,009, resulting in a floating loss of $4.16 billion, while its total market capitalization is only $7.4 billion.

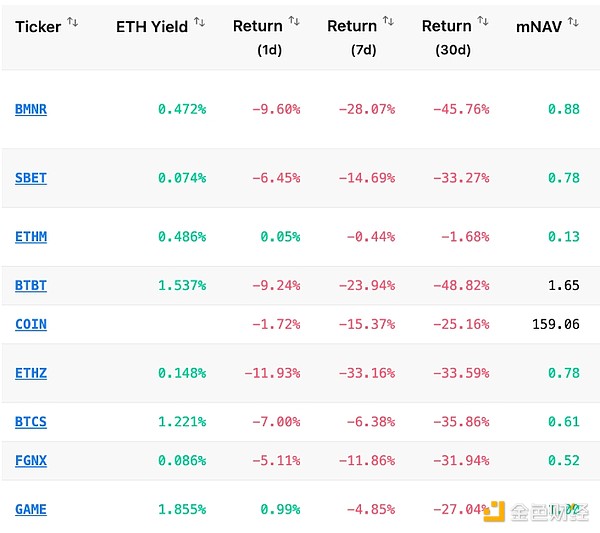

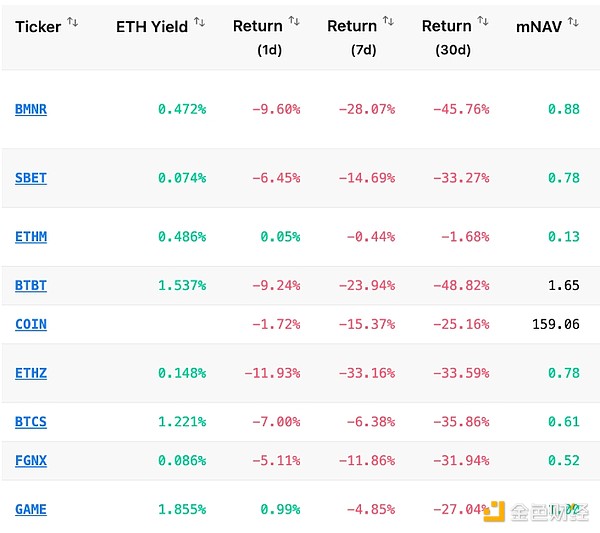

As Ethereum fell below $3,000, other ETH treasury companies also fell into difficulties. According to data from Capriole Investments, the returns on ETH assets held by these companies ranged from negative 25% to 48%.

As shown in the chart below, all of the top ten DAT companies have incurred losses on both weekly and daily timeframes.

Data source: Capriole Investments

Data from Capriole Investments also shows that most of these companies have a market capitalization to net asset value (mNAV) ratio (a metric used to assess the valuation of digital asset libraries) that has fallen below 1, indicating impaired fundraising capabilities.

Data from StrategicETHreserve.xyz shows that total holdings in strategic reserves and ETFs have decreased by 280,414 ETH since November 11. [Image of Ethereum treasury and ETF holdings] Data Source: StrategicETHreserve.xyz

On November 20th, US-listed company DDC Enterprise announced it would purchase 300 Bitcoins, reportedly its largest single Bitcoin acquisition to date. Following the transaction, DDC Enterprise's total Bitcoin holdings will increase to 1,383, and the company expects a 99% return on its Bitcoin holdings by the second half of 2025.

On November 20th, Metaplanet announced the issuance of $150 million worth of Class B perpetual preferred stock with a fixed dividend rate of 4.9% and a conversion price of 1,000 yen, to be used for further Bitcoin acquisitions.

On November 20th, Japanese listed apparel company ANAP Holding (3139.T) purchased an additional 20.44 Bitcoins, bringing its total holdings to 1,145.68 Bitcoins.

2. Shelved On November 19th, news broke that the $1 billion Ethereum DAT project led by Li Lin, Shen Bo, Xiao Feng, and Cai Wensheng had been shelved, and the funds raised had been returned. This project was the largest DAT project led by Asian investors. Industry insiders speculated that the shelving was mainly due to the bear market following the 1011 incident, and the recent sharp decline in the stock prices of many DAT companies. Regarding whether the project will be restarted, relevant personnel stated that the interests of investors will be prioritized, and the market situation remains to be seen. According to an earlier Bloomberg report, Li Lin (founder of Huobi) was collaborating with Shen Bo (co-founder of Distributed Capital), Xiao Feng (CEO of HashKey), and Cai Wensheng, founder of Meitu, and other early Ethereum supporters in Asia to establish a new digital asset trust fund, with an initial plan to purchase approximately $1 billion worth of ETH. The team is in talks to acquire a Nasdaq-listed shell company for structuring purposes, with funding including $200 million from Li Lin's Avenir Investments and approximately $500 million from Asian institutions such as Sequoia China. 3. What's happening with Strategy? On November 17th, Strategy continued to buy 8,178 BTC, bringing its total BTC holdings to 649,870. According to the latest data from SaylorTracker, the market value of Bitcoin holdings at Bitcoin treasury company Strategy has decreased significantly to $56.11 billion, with a median NAV of 1.01. The unrealized profit of its 649,870 Bitcoins has fallen below $10 billion, dropping to $7.738 billion, resulting in an overall return of 16%. Strategy's average purchase price for Bitcoin is currently $74,433, and the current market price is only about $11,000 away from falling below that level. Strategy's net asset value (NAV) recently fell below 1, indicating that the market currently values the company's equity below the value of its Bitcoin holdings. Historically, this has often been a signal of tightening liquidity and rising risk aversion. If macroeconomic conditions worsen, a further drop in its $73,000 cost price could further dampen market sentiment and trigger greater risk-averse sentiment. [Image of MSTR mNAV compared to diluted share capital] Data Source: StrategyTracker

On November 19th, Strategy Executive Vice President Shao Wei-Ming sold company stock again, selling 5,200 shares of MSTR stock at $200 each, worth $1.04 million.

III. ETFs: BTC and ETH Mainly Experience Net Outflows

On November 18th, BlackRock's iShares Bitcoin Trust (IBIT) reported its largest single-day net outflow since its listing in January 2024. The IBIT ETF saw a net outflow of $523.15 million, surpassing the previous record of $463 million set on November 14th. IBIT is the world's largest spot Bitcoin ETF, with net assets of $72.76 billion, and has experienced continuous net outflows since late October.

Vincent Liu, Chief Investment Officer at Kronos Research, believes that "the record outflow from IBIT indicates that institutional investors are adjusting their risk profile. Large asset allocators are reducing risk, tightening exposure, and testing entry points until macroeconomic signals become clearer. Once those signals become clearer, risk appetite and asset allocation will quickly recover." The $523 million outflow from IBIT on the 18th exceeded the inflows into Grayscale and Franklin Templeton funds, resulting in a net outflow of $372.7 million across all spot Bitcoin ETFs that day. Spot Ethereum ETFs also showed a similar trend. BlackRock's ETHA fund recorded a net outflow of $165 million, exceeding the combined net inflow of $91 million from funds managed by Grayscale, Bitwise, VanEck, and Franklin Templeton. However, the SOL ETF saw net inflows. Since its launch on October 28, Bitwise's BSOL ETF has attracted $424 million, representing 89% of the total inflows. On November 19, BSOL recorded a new net inflow of $35 million, its third-largest single-day inflow and the largest single-day inflow since November 3.

Bitwise Solana ETF net fund flows. Data source: SoSoValue

IV. Market Outlook

1. Positive Outlook

Renowned trader Peter Brandt stated that he believes Bitcoin will not break through $200,000 by the end of the year as some cryptocurrency industry executives have predicted. In fact, he believes it may take nearly four years to reach that price.

In a post on the X platform (formerly Twitter) on Thursday, Brandt stated, "The next Bitcoin bull run should push its price to around $200,000, which is expected to occur around the third quarter of 2029." He also emphasized that he is a "long-term Bitcoin bull." Brandt's prediction is noteworthy for several reasons. Many well-known Bitcoin supporters, such as BitMEX co-founder Arthur Hayes and BitMine chairman Tom Lee, have previously predicted that Bitcoin would reach at least $200,000 by the end of this year. Just in October, Lee and Hayes reiterated their confidence in this prediction. BitMine chairman Tom Lee, in an interview with CNBC, stated that the current weakness in the crypto market is highly similar to the crash of October 10th, when a stablecoin pricing error triggered the largest liquidation in history, wiping out nearly 2 million accounts and instantly depleting liquidity. Lee pointed out that such deleveraging cycles typically last about 8 weeks, and we are currently in the 6th week, suggesting the market may be nearing the end of its correction. Bitwise Chief Investment Officer Matt Hougan refuted market concerns that Bitcoin might be entering a bear market. He stated that Bitcoin's value lies in its role as a digital wealth store "service," independent of governments, banks, or other third parties. Hougan believes that despite the recent market correction, growing institutional demand for the service supports Bitcoin's long-term trajectory. Analyst Milk Road noted, "It's very likely that we'll experience more short-term pain in the future, but a reversal may occur within the next 2-3 weeks. Low market sentiment doesn't mean there won't be new all-time highs in the medium term." [Image of Cryptocurrency Fear & Greed Index. Source: CoinGlass.] 2. Weakening Outlook Cryptocurrency analytics firm Bitcoinsensus stated, "The weekly Supertrend Indicator has turned red for the first time since January 2023 (the end of the bear market)." It added, "This means that, while not certain, we may be seeing early signs that a bear market is beginning." If history repeats itself, Bitcoin could plummet to a low of $75,000, influenced by declining demand from Bitcoin treasury companies and continued outflows from US spot ETFs.

Weatherly

Weatherly