Recently, the x402 protocol launched by Coinbase in May of this year has been a hot topic in the industry. From a quick understanding perspective, it completes a key piece of the puzzle for enabling artificial intelligence to use cryptocurrencies.

Personally, I've always held the view that cryptocurrencies may not be for human use, but rather for artificial intelligence. The industry is very confident in AI + Crypto, and this confidence has quickly spread to the payment field. But does Coinbase's x402 truly combine the two? Is it really as fast and efficient for AI as they describe, or is it just another hype gimmick in the cryptocurrency world?

Okay, let's take it step by step. A few questions: What is the HTTP protocol? What is an x402 error? Why haven't we heard of HTTP being used for payments before? Why are we using it now?

The HTTP protocol is a set of rules for communication between browsers and servers. For example, if you enter www.bilibili.com in your browser, the browser will find Bilibili's server according to the path and retrieve the content, returning it to the browser, allowing you to see the official Bilibili website.

The HTTP protocol is a set of rules for communication between browsers and servers. For example, if you enter www.bilibili.com in your browser, the browser will find Bilibili's server according to the path and retrieve the content, returning it to the browser, allowing you to see the official Bilibili website.

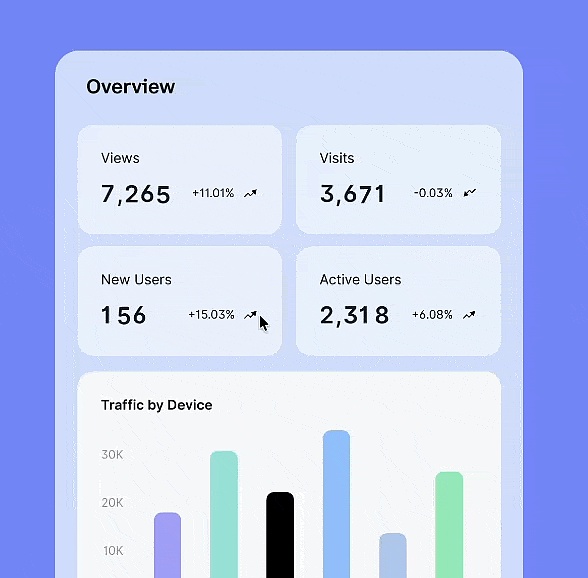

The 402 in x402 is a status code in the HTTP protocol. HTTP status codes have many types, from 1xx, 2xx, 3xx, 4xx to 5xx. 402 belongs to the 4xx status codes. 401 indicates unauthorized access, 403 indicates access denied, and the familiar 404 indicates the requested resource was not found. 402 indicates payment is required. Here, the "x" in x402 indicates an extended version of 402. What's extended? The other 4xx status codes simply indicate a status; for example, 404 means the resource was not found and doesn't actually solve the problem. The extended 402 code not only tells you that payment is required but also helps the client complete the payment. That is, the API sends a payment (which could be stablecoins or other cryptocurrencies) along with the user's request. The receiving server verifies the payment and then returns the relevant data, which can be the paid content. The HTTP 402 status code was first defined in the HTTP/1.1 protocol, initially intended to support an ideal scenario: for example, paying a few cents to read an article or use a service, a process as seamless as loading an image. However, in the early days of the internet and for a long time afterward, technology couldn't support this vision: on the one hand, payment costs were too high; traditional credit card payments typically included a fixed fee (e.g., $0.30) plus a percentage of the transaction amount. This was extremely uneconomical for micropayments of a few cents or even a few dollars, as the fees could far exceed the payment amount itself. Secondly, the network experience was fragmented. At the time, network speeds were relatively slow. If every small payment required redirecting to a complex third-party payment page for authentication, it would severely disrupt the user experience and prevent the realization of the "seamless payment" concept. Thirdly, there was a lack of unified standards. No widely accepted, standardized technical protocol existed to regulate this payment process embedded in HTTP requests. If different websites implemented it independently, it would create significant complexity and confusion for both developers and users. Having discussed the protocol's origins, how does the x402 perform? Coinbase provides a chart (as shown below) comparing it with credit cards, PayPal, and the Ethereum mainnet in terms of average fees, time to settlement, refund capability, and TPS. From this graph, we can see that in terms of average fees, x402's fees are almost negligible, and transaction confirmation time is in the seconds, giving it a significant advantage. However, x402 is completely unable to handle chargebacks, a common issue in modern commodity transactions, due to the irreversible nature of blockchain transactions. x402's TPS is around a thousand, better than Ethereum, but significantly inferior to credit cards and PayPal. Here I want to elaborate a bit. In a later article, I'll mention that X402 offers refund capabilities, but this chargeback refers to a chargeback. In the credit card system, if you don't like the transaction within 30-150 days and request a refund, the bank can forcibly deduct the money from the merchant's account. This chargeback is very consumer-protective, but it doesn't work in the blockchain world. Overall, X402 inherits the characteristics of blockchain transactions—low fees and fast settlement—but it also inherits the current shortcomings of blockchain: non-revocable transactions and poor performance. Let's look at the specifics. The x402 protocol's entire process is divided into two steps: 1. Client requests data → Server returns a 402 Payment Required (meaning "You need to pay first to get the data"). 2. Client initiates a second request → This time including payment information or a signature. For example, paying $0.01, or signing an on-chain authorization to transfer 1 cent in USDC. The server verifies the signature and account balance (usually via the `/verify` interface), and then completes the payment settlement (on-chain transfer confirmation) on the `/settle` interface. After successful confirmation, the server returns the actual data. You might ask, "Does each server need to write its own code to check the blockchain and manage transactions?" The answer is: No. This leads to a key role—the Facilitator (payment intermediary). The server doesn't need to write complex on-chain verification logic; it only needs to hand over the payment signature to the facilitator, which handles the verification and on-chain settlement. Platforms like Coinbase and Thirdweb provide ready-made facilitator services. Okay, we've completed the parsing of the HTTP, i.e., the application layer protocol. So, the Web2 operations are complete. How is cryptography in Web3 accomplished? This brings us to another Coinbase chain and standard: the Base Chain and ERC-3009. We won't go into detail about the Base Chain; it's Coinbase's own chain, and all transactions generated by x402 are settled on the Base Chain. This is why the comparison table mentioned TPS reaching thousands—it's the difference between the Base Chain and the Ethereum chain. So what is ERC3009 and what is its relationship to x402? First, there's a connection in terms of underlying interests. ERC3009 is also an Ethereum extension standard proposed by Coinbase and the Circle team. It allows a wallet user to authorize others to initiate transfers on their behalf without requiring them to actively call the `transfer()` function. In other words, Coinbase has implemented a family card feature, allowing your spouse to use your money to pay for services or goods using the ERC3009 protocol. X402 is the payment entry standard at the protocol layer, while ERC3009 is the authorization mechanism at the "on-chain settlement layer." The reason for using its own ERC3009 protocol instead of a simple transfer function is that conventional payment functions require the user to initiate the transaction, requiring a signature and incurring gas fees for each transaction. In contrast, ERC3009 allows the user to authorize only once, and the server can reuse it. No gas fees! With blockchain, these fees cannot be avoided; it's just that someone else pays them for you. The facilitator pays the gas fees. Besides being convenient and gas-free, it's also suitable for instant payments and compatible with smart wallets. Finally, it supports secure revocation, i.e., refunds. This is where Coinbase's carefully designed module comes in: the escrow module. Let's take buying a $5 coffee as an example. The first step uses the core of the x402: the family card function. The user first signs an ERC3009 authorization, stating, "I allow this $5 to enter the escrow contract." The operator then uses your signature and the `transferWithAuthorization` function within the ERC3009 to actually transfer the money into the escrow contract. Of course, all of this is pre-signed and authorized by you; the system can securely execute your intentions without over-transferring or misusing funds. Then, after the merchant confirms your intention to buy coffee, the operator submits your signature to the smart contract. The smart contract itself verifies that the signature is indeed yours, the amount is $5, the authorization time is within the validity period, and the signature has not been revoked. If everything goes smoothly, $5 will be deducted from your wallet and transferred directly to the escrow contract, not directly to the merchant. This $5 is like a pending confirmation of receipt in Alipay; the merchant can see that you've paid and isn't trying to get something for nothing. However, after you confirm receipt, or the system detects that the service is complete, the merchant initiates a "capture" request through the operator, and the smart contract verifies the conditions again. If there are no problems, the transaction is complete, and the escrow contract releases the $5. If the authorization period expires, or you actively cancel the authorization, the $5 will be refunded to your wallet. This completes the entire refund process. The design philosophy and operating logic of X402 demonstrate a completely new payment method: users can complete payments directly with cryptocurrency without going through KYC. This is undoubtedly a breakthrough in terms of convenience, bringing the user experience closer to the immediacy of traditional online payments. However, this model also brings new challenges and potential risks. To authorize access, users need to sign in their private keys to the AI system, which clearly represents a step backward in terms of security and privacy protection—the encrypted asset key, which should be fully controlled by the user, partially relies on an external intelligent system, increasing potential security vulnerabilities. On the other hand, the implementation of X402 is not an isolated event; it requires collaborative advancement with other projects, protocols, and ecosystems to truly form a secure, convenient, and scalable payment solution. Technically, the combination of AI and cryptocurrency is still in the exploratory stage, requiring solutions to issues such as trust, regulation, and user education. Therefore, while X402 is forward-thinking in its concept, its widespread application still requires time and multi-party efforts. The path to AI+Crypto implementation is full of possibilities, but there are still many obstacles to overcome in reality. Finally, anyone selling meme coins under the X402 banner is a scam; please remember this.

Joy

Joy

Joy

Joy Miyuki

Miyuki Brian

Brian Brian

Brian Weiliang

Weiliang Miyuki

Miyuki Alex

Alex Alex

Alex Brian

Brian Weiliang

Weiliang