On the weekend night of March 2, the crypto market was wailing, and Trump suddenly issued a statement about the U.S. Crypto Reserve: "The U.S. Crypto Reserve will enhance the status of this critical industry, although it has suffered years of corrupt attacks during the Biden administration. That's why my digital asset executive order instructs the Presidential Task Force to advance a strategic crypto reserve containing XRP, SOL, and ADA. I will ensure that the United States becomes the world's crypto capital. We are making America great again!"

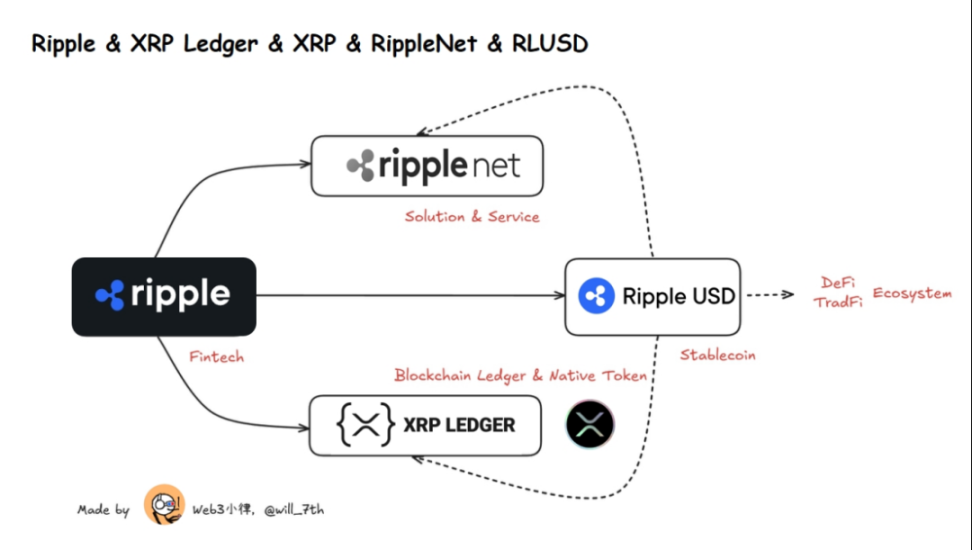

Therefore, this article will initially explain what Ripple and XRP are, the relationship between them, and how they work in Web2 and Web3. This kind of project that combines Web2 and Web3 business models is worth learning from the industry, especially in the current context of Crypto Mass Adoption, where many things that have been put into practice still need to be promoted through the Web2 model, while combining the advantages of Web3 in the ecological network.

1. Ripple Labs - a financial technology company

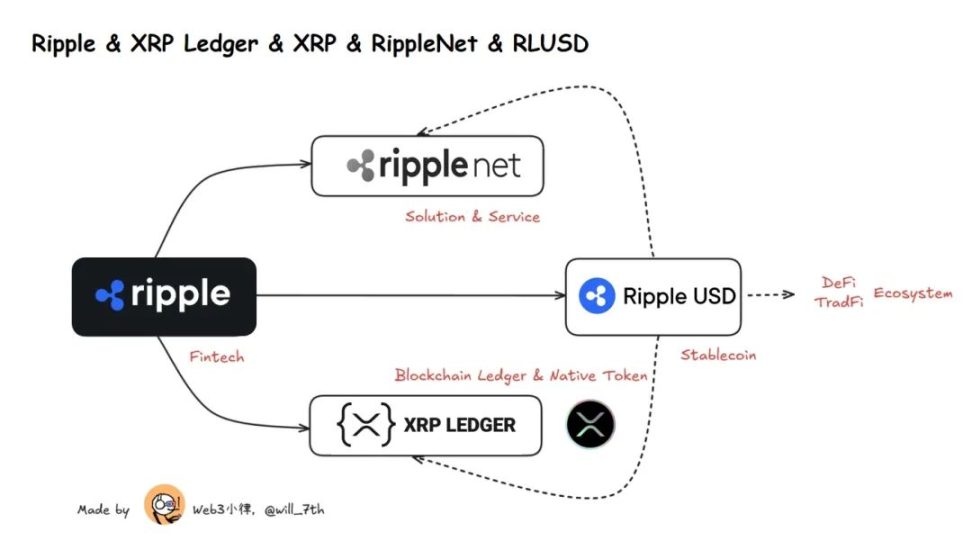

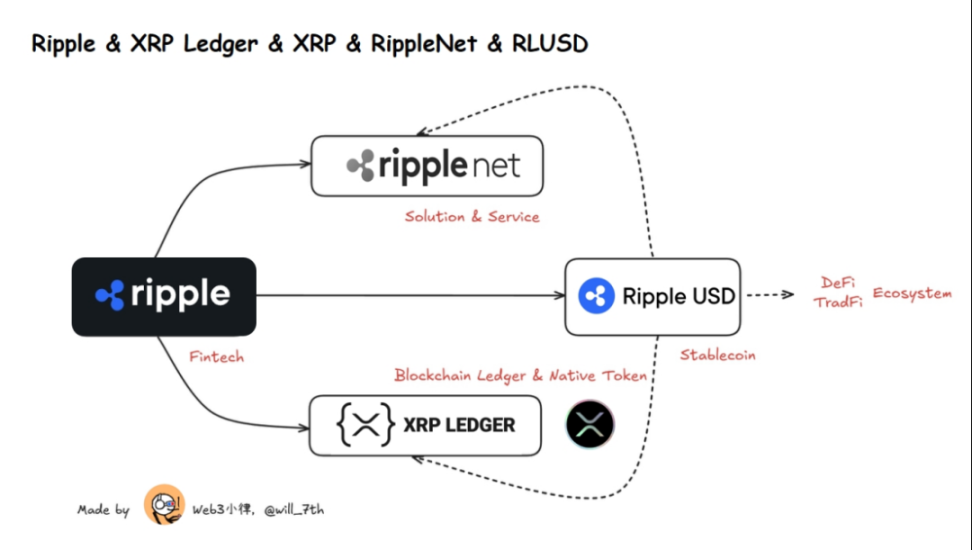

Ripple is a financial technology company based in the United States, also known as Ripple Labs, which focuses on providing cross-border payment and financial settlement solutions based on blockchain technology. Its core goal is to optimize the international remittance process in the traditional financial system through blockchain technology, increase the speed and reduce the cost of global financial transactions. Ripple's main products and services include (i) cross-border payments and remittances through RippleNet, and (ii) the recently launched RLUSD stablecoin.

The blockchain-based technology mentioned above is the XRP Ledger network ledger that Ripple's technology and services mainly rely on. This is an independent distributed ledger technology (DLT) used to record and verify transactions, and XRP is the original utility token running on this ledger. It is seen as an alternative to the SWIFT payment network used by traditional financial institutions.

XRP Ledger or XRPL is a payment-focused blockchain network developed by Ripple in 2012 that enables financial institutions and payment providers to offer innovative financial services, including custody services, digital crypto wallets, and other decentralized applications (DApps).

After the initial release of the XRP Ledger, Ripple focused on helping financial institutions process cross-border remittances and payments through blockchain distributed ledger technology. In addition to the XRP Ledger and the XRP native token, Ripple has developed a variety of cross-border payment products over time. Since these developments, the team has integrated them all into a top-level service called RippleNet.

RippleNet is one of Ripple's many products, and while Ripple has developed a variety of financial products designed to utilize the XRP Ledger and XRP over the years, it eventually rebranded many of these ideas into one brand: RippleNet, a global payment network that connects financial institutions such as banks and payment service providers to provide real-time settlement and currency exchange services.

2. XRP Ledger - Blockchain Ledger Network

As early as 2011, Jed McCaleb began to develop a new digital currency consensus network, and in 2012 he approached Ryan Fugger (founder of the peer-to-peer debt payment network RipplePay (now Ripple Payments)) to further reiterate the concept that Ryan Fugger had been developing since 2004. After discussions with the community, Ryan Fugger handed the platform to Jed McCaleb, and the project was renamed Ripple. Further efforts by Jed McCaleb, Arthur Britto, and David Schwartz led to the creation of the XRPL ledger in 2012, with XRP as the native token of the ledger.

The XRP Ledger is a blockchain-based payment protocol used to facilitate cross-border payments and central bank digital currency (CBDC) management. Contrary to most blockchains, the XRPL ledger does not use a Proof of Work (PoW) or Proof of Stake (PoS) consensus mechanism. The network relies on a Cobalt-based consensus mechanism, a Byzantine Fault Tolerant (BFT) governance framework for open networks, and the Ripple protocol consensus algorithm.

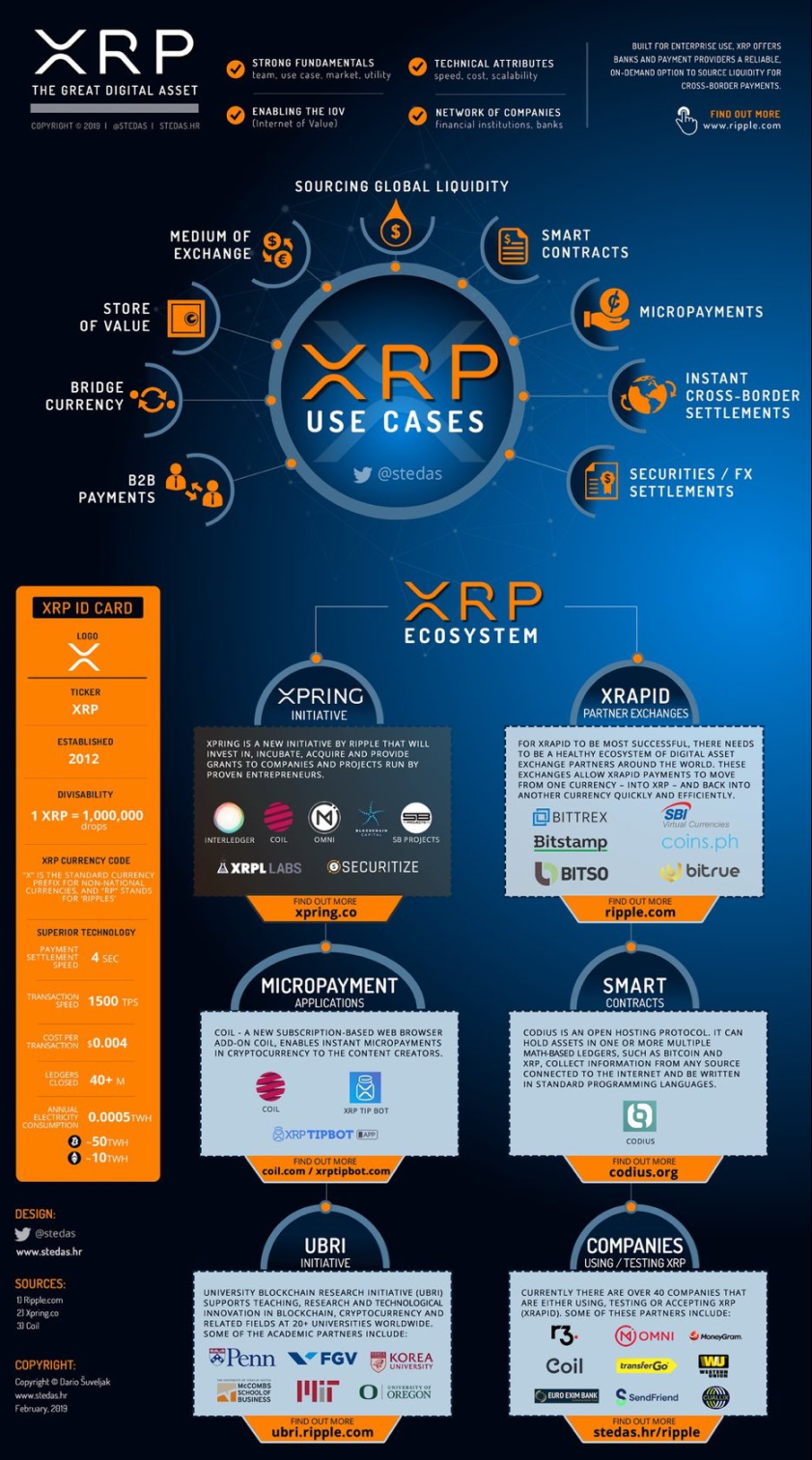

The XRP Ledger offers low transaction costs and high performance, and its native token XRP is classified as a payment cryptocurrency. These tokens provide a way to store and trade value using a distributed network instead of a centralized government. In this way, the main use of XRP is as a medium of payment for transaction fees on the XRPL.

Soon after the launch of the XRP Ledger network, Jed McCaleb and Arthur Britto co-founded a company called NewCoin with Chris Larsen, which was eventually renamed OpenCoin and then Ripple Labs Inc. Upon the formation of the new company, the entity received 80 billion XRP (80.00% of the initial total token supply). The following year, Jed McCaleb left Ripple and later founded Stellar.

3. XRP - Native Token

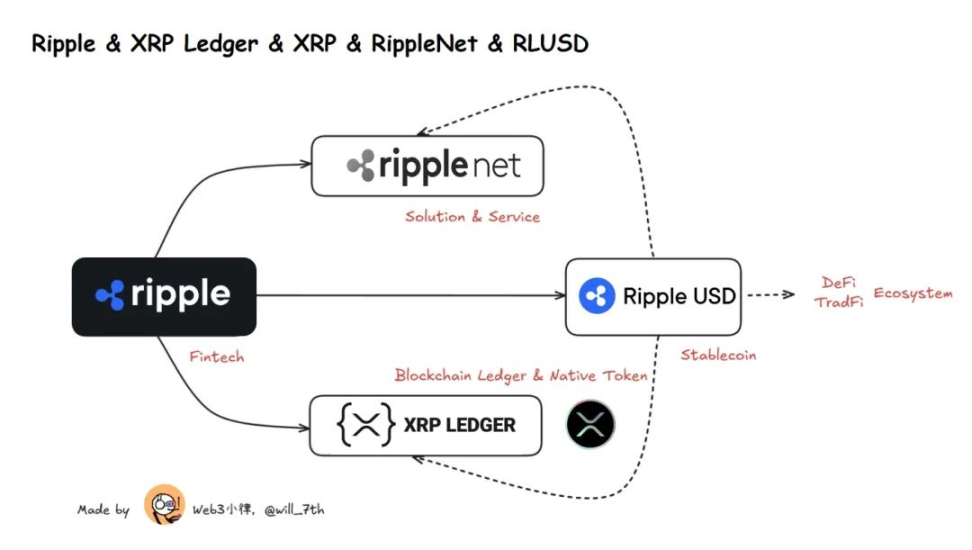

XRP is the encrypted asset in the XRP Ledger and the native token of the XRP Ledger. The main function of XRP is to provide a faster and lower-cost global payment solution than the traditional financial system.

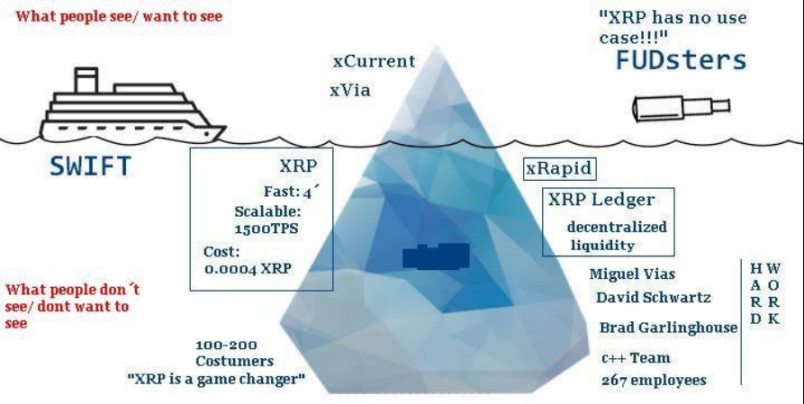

XRP is relatively independent and does not completely rely on Ripple. XRP Ledger is maintained by independent verification nodes around the world (such as universities and exchanges). Ripple only holds a large amount of XRP and participates in technology development. Even if Ripple goes bankrupt, XRP can still exist. This independence also provides XRP with greater scalability, thereby building a financial payment ecosystem based on XRP. For example, DeFi and tokenization: XRPL supports the issuance of stablecoins, NFTs and other assets (such as CBDC); independent payment tools: users can directly use XRP for peer-to-peer transfers without going through RippleNet.

(https://x.com/meandivergence/status/1391416092229349379)

Therefore, the value of XRP is not directly tied to the success or failure of Ripple Labs, and vice versa. Similarly, Ripple cannot restrict anyone from using it for their own services through the XRP Ledger network, even though Ripple's holding of so many XRP may limit any competition.

Ripple is committed to improving the global payment system through its technology, and XRP is one of the key tools to achieve this goal.

In short, Ripple is a private company that provides financial payment services, and XRP is the company's native cryptocurrency in the blockchain network to support fast and low-cost cross-border payments.

It is worth noting that Ripple is not as decentralized as other public blockchains and holds a large number of XRP tokens. On the contrary, Ripple is a for-profit entity that provides services to financial entities. It initially developed the XRP Ledger ledger and served as a core contributor to the XRP network. At the same time, the Ripple team holds most of the XRP tokens.

(XRPL.org)

The core function of XRP is the bridge currency for cross-border payments. In Ripple's ODL (On-Demand Liquidity) solution, XRP acts as an intermediary to replace the "pre-deposited funds pool" in the traditional agency banking system. For example:

Bank of America converts dollars into XRP → XRP is sent to Mexico → Bank of Mexico converts XRP into pesos.

In this case, XRPL's consensus mechanism (non-proof of work) ensures that transactions are confirmed within 3-5 seconds, which is much faster than Bitcoin (10 minutes) or the traditional banking system, and avoids capital occupation and exchange rate risks caused by currency pre-deposits, and the transaction cost is extremely low.

Fourth, RippleNet-Global Payment Network

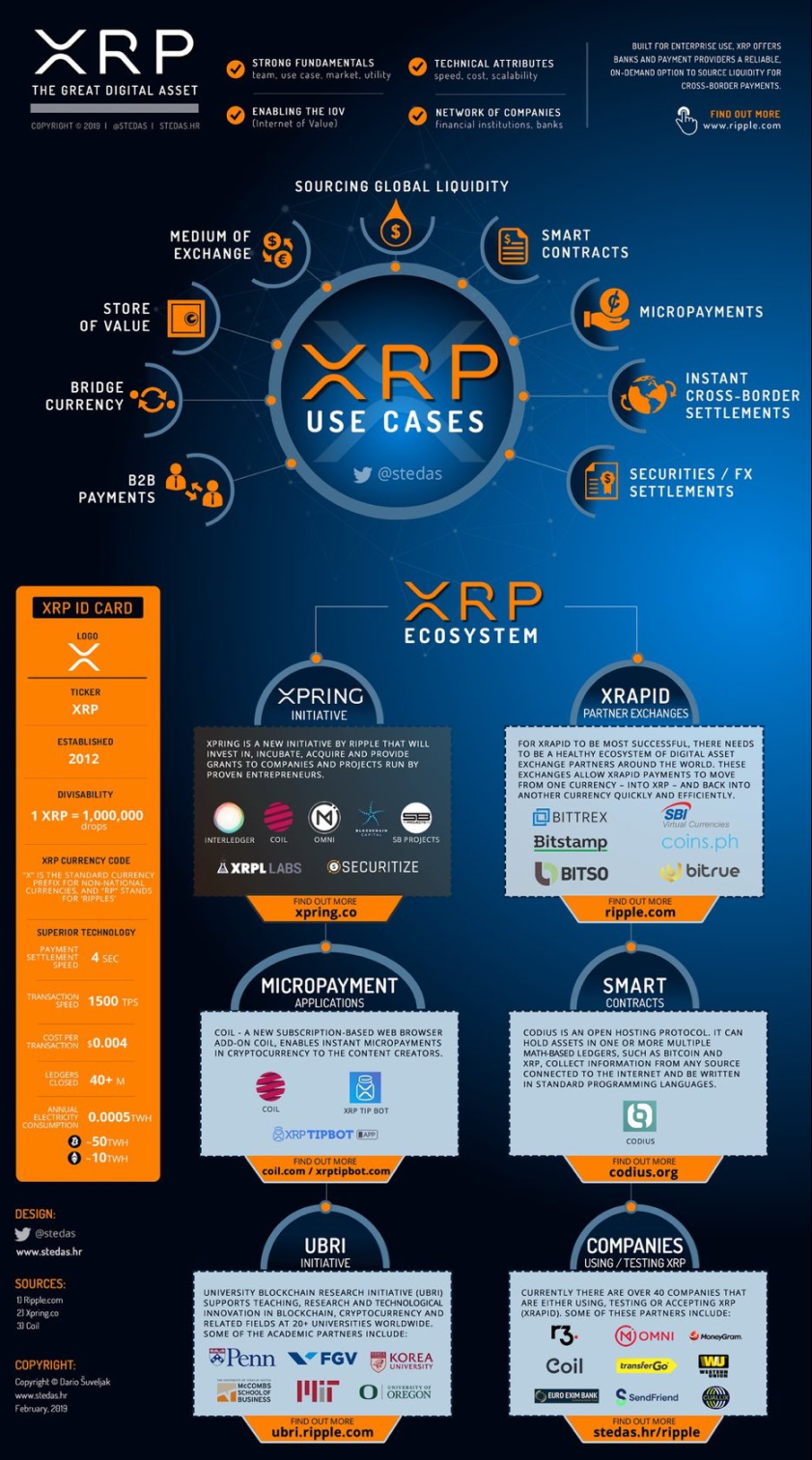

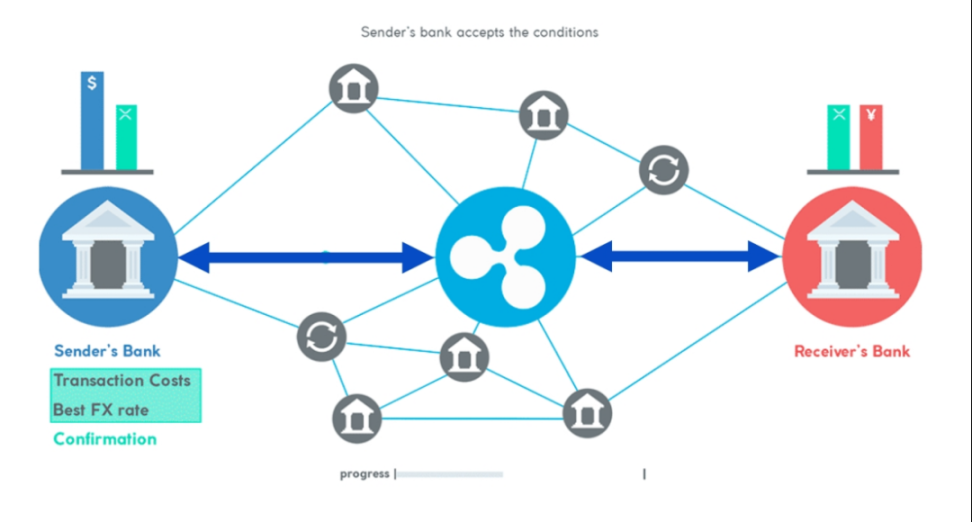

RippleNet is a global financial payment network built by Ripple, which aims to connect financial institutions such as banks, payment service providers, and remittance companies to optimize cross-border payment processes. It is not a public network based on blockchain, but a privatized enterprise-level solution that mainly solves the efficiency problems of the traditional financial system.

(SWIFT vs. Ripple – the fight for better, faster, cheaper bank transfers)

RippleNet uses blockchain technology to provide financial institutions around the world with the ability to transfer funds, aiming to establish a unified global payment system. There is no unified global payment system in traditional finance, but various financial institutions have established isolated transfer systems for international payments. These systems do not interact well with each other, and international payments through the above systems are expensive and time-consuming.

This outdated payment system is out of place in today's internationally connected world. Despite high fees, users of all kinds have to wait weeks for payments to be completed, which limits the number of users who can enter international markets.

RippleNet aims to solve these problems by providing a decentralized global banking network that is available to everyone. Connecting to the network through an application programming interface (API), users can move funds internationally faster and cheaper than traditional methods. The decentralized network claims to process payments in just three seconds, leveraging the global reach of its XRP token.

Technically, RippleNet is a group of products that utilize the capabilities of the XRP Ledger blockchain network, rather than a standalone blockchain. That is, all transactions conducted using RippleNet products are recorded on the XRP Ledger blockchain, but this does not mean that RippleNet itself is a blockchain.

Not only that, RippleNet also solves the need to pre-fund accounts in cross-border fund transfers through the On Demand Liquidity (ODL) solution, which uses XRP tokens to obtain liquidity. RippleNet supports nearly 100 countries/regions and is paired with more than 120 legal currencies, ensuring that countries can easily pay each other.

RippleNet Core functions and features:

Real-time settlement: Traditional cross-border payments rely on the agency banking network and need to go through multiple transit banks (taking 1-5 days), while RippleNet can complete transaction confirmation within seconds through direct point-to-point communication.

Unified standards: Provide standardized APIs and protocols (such as ILP, Interledger Protocol) to enable financial institutions in different countries to seamlessly connect and eliminate format and compliance differences.

Multi-currency support: Supports instant exchange of fiat currencies, cryptocurrencies and even commodities (such as gold) without the need for intermediate currencies (such as the US dollar) as a bridge.

Reduce costs: Reduce cross-border payment costs by up to 60% by reducing intermediaries and liquidity pre-deposit requirements.

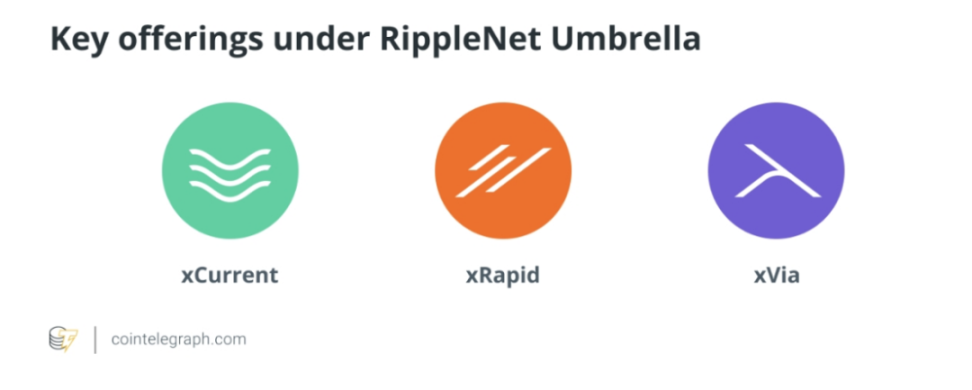

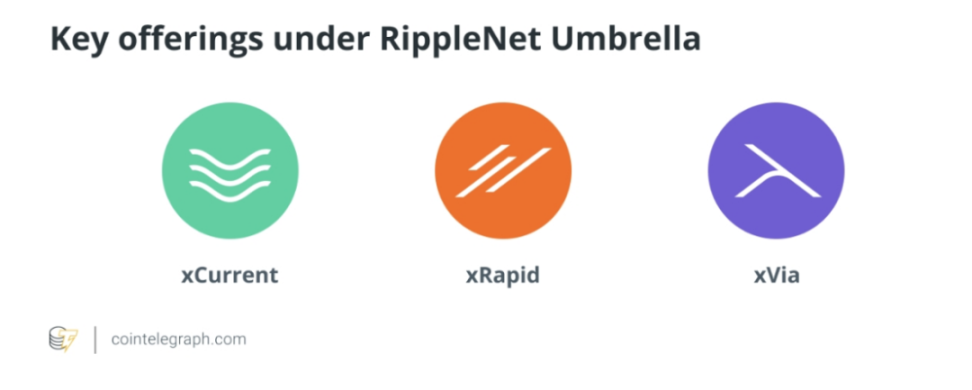

RippleNet is further divided into several key products: xCurrent, xRapid and xVia.

4.1 xCurrent

xCurrent focuses on banks and provides cross-border payments to banks at a lower cost than traditional international settlements. Banks access it through an application programming interface (API), which can convert traditional payments to an XRP-backed blockchain alternative.

xCurrent is designed to fit into banks’ existing compliance and risk capabilities, simplifying the installation process. The xCurrent documentation states that the solution complies with all current know-your-customer (KYC) and anti-money laundering (AML) policy requirements.

4.2 xRapid

If xCurrent provides cheap and fast cross-border payments, xRapid ensures that customers can access liquidity through XRP tokens. Traditional financing methods require businesses to pre-fund accounts abroad, as converting one fiat currency to another can take weeks.

xRapid provides near-instant conversion, unlocking liquidity, also known as on-demand liquidity, and eliminates the need for businesses to pre-fund foreign accounts, instead keeping the funds in their own accounts.

4.3 xVia

xVia is the API part of Ripplenet , ensuring that customers can easily connect to the above services. xVia supports sending payments with detailed information while attaching details such as invoices. According to the RippleNet documentation, other benefits of RippleNet include supply chain payment management, international bill payments, real-time remittances, peer-to-peer payments, cash pools, and global currency accounts.

(Why the Momentum for Ripple XRP『s Use Case Continues to Gather Pace)

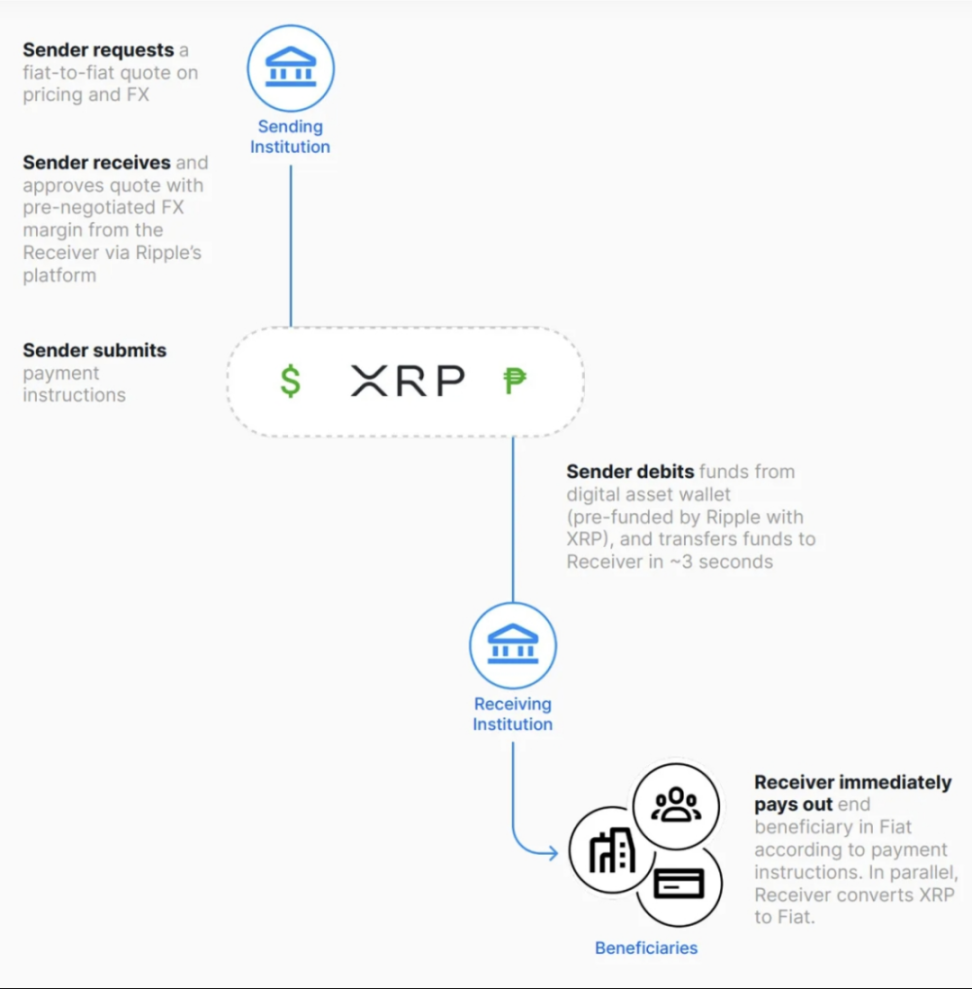

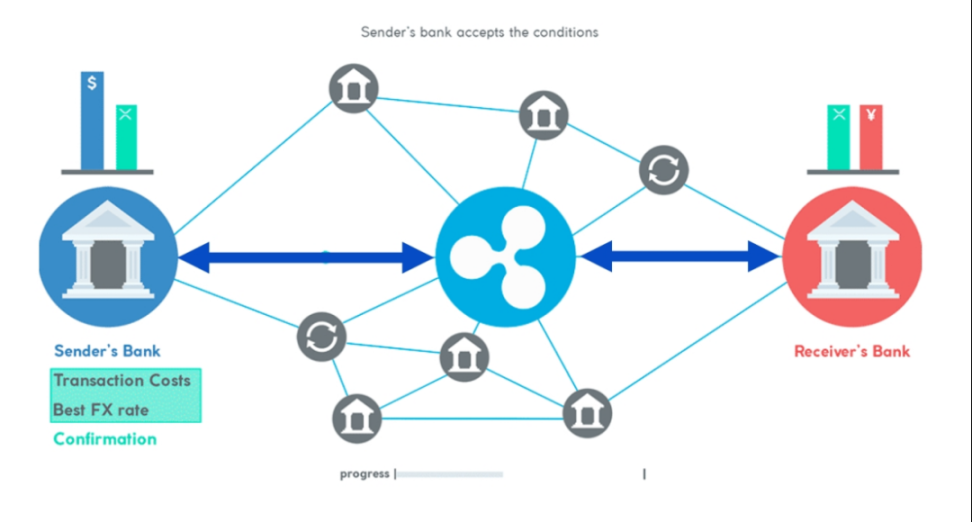

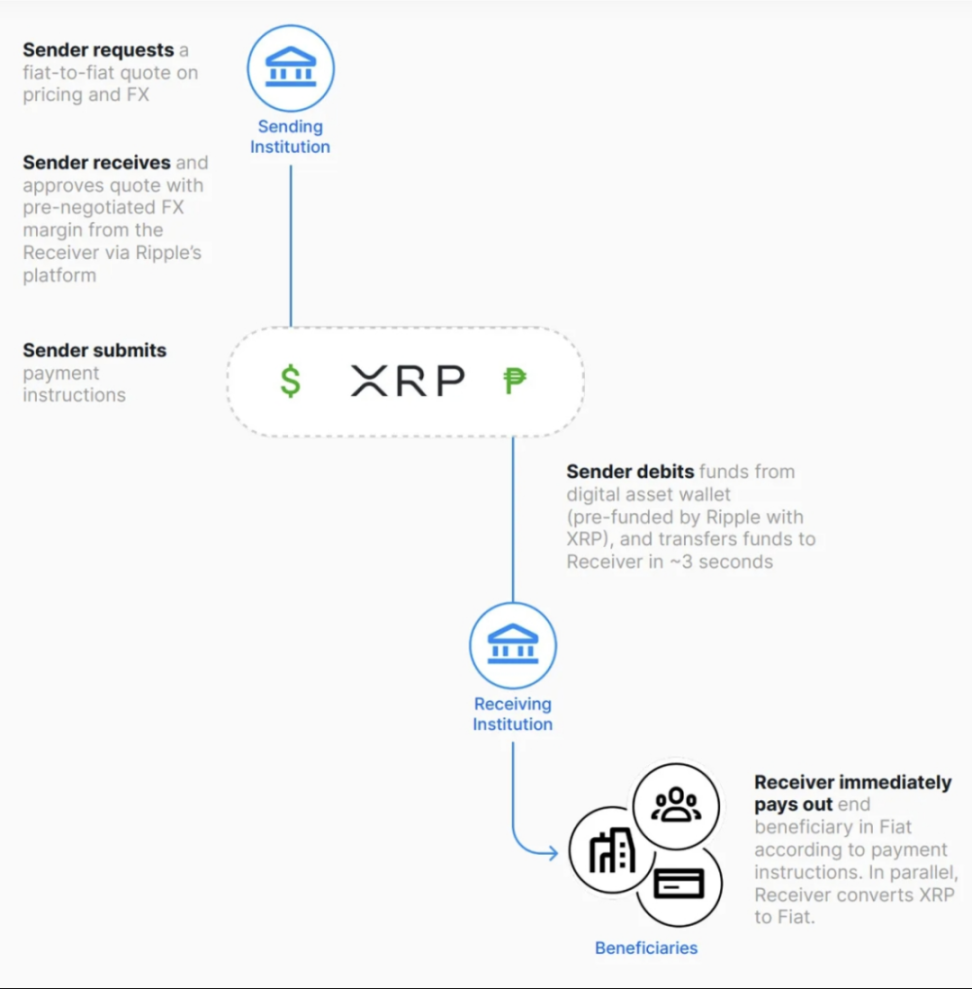

RippleNet's operating process (taking cross-border remittances as an example):

Initiator: Bank A (United States) initiates a transfer request to Bank B (Mexico) through RippleNet.

Routing and Verification: RippleNet automatically selects the best path (such as direct connection or through liquidity providers).

Settlement: If ODL is used, Bank A converts USD to XRP and sends it to Bank B, which immediately converts XRP to Mexican pesos.

Completion: Funds arrive in seconds, and neither party needs to pre-deposit the other party's currency.

4.4 Who is using RippleNet?

Although Ripplenet claims to be a global operation, people may wonder how many banks use Ripplenet. This includes 300+ financial institutions around the world such as Santander, SBI Remit (Japan), etc.

(Ripple Digital Asset Report: XRP Review And Investment Grade)

Ripple pointed out that hundreds of banks are using their services, ranging from small entities to global institutions. For example, Bank of America, Santander and American Express are all large groups using Ripplenet services. Santander is a company that has processed more than 450 million euros through RippleNet in six European and American countries.

V. RLUSD Stablecoin

5.1 The role of stablecoins

Ripple is at the forefront of financial innovation, not only creating compliant, scalable and enterprise-grade solutions, but also connecting traditional finance with digital assets through its recently issued RLUSD stablecoin. The launch of the RLUSD stablecoin, with a focus on regulatory compliance, brings customers and users the opportunity to benefit from the stability and transparency that Ripple uniquely provides, marking an important milestone in Ripple's journey to build the next stage of development in global financial services and support the Internet of Value.

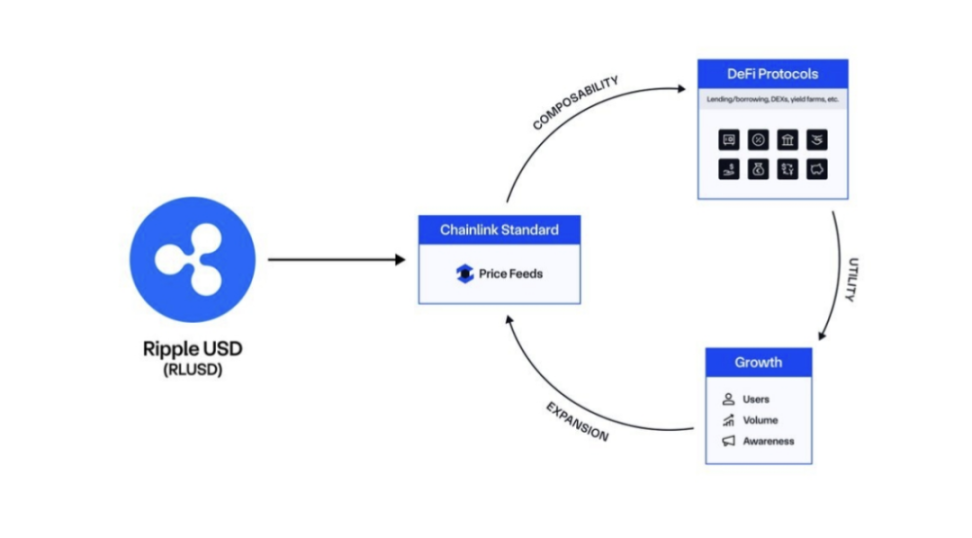

RLUSD will seamlessly integrate with the XRP Ledger and Ethereum networks, providing a base asset for enterprises to build additional blockchain solutions. It provides a secure, fast and scalable infrastructure for stablecoins, with features that support issuance, trading and payment:

Native Stablecoin Support: XRPL natively supports stablecoins without the need for complex smart contracts.

Automatic bridging and DEX integration: Stablecoins on XRPL can benefit from deep liquidity and seamless FX swaps.

Institutional DeFi applications: RLUSD and other stablecoins can be used for lending, tokenized RWA, and cross-border settlements.

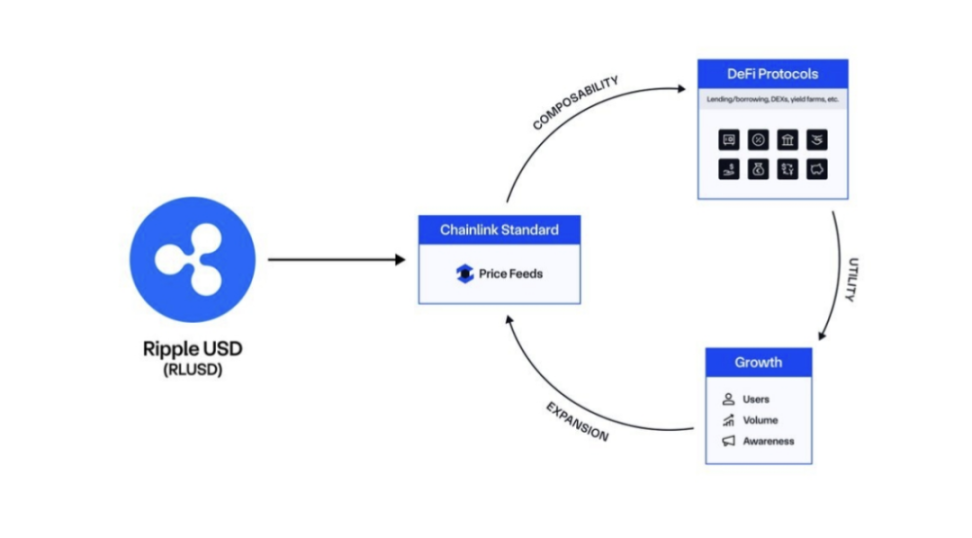

(Chainlink partnership brings RLUSD utility to DeFi; Source: Chainlink)

This integration enables the Ripple USD stablecoin to be useful in a number of areas:

Fiat-to-Crypto Gateway: Making it easier for users, traders, and businesses to convert between fiat and cryptocurrencies.

Global Remittances: Fast and affordable international transactions used by individuals and businesses.

Daily Transactions: A reliable way to make everyday transactions, an alternative to cash or cards.

RWA Tokenization: Can be used for collateral support of tokenized assets on XRPL and transactions involving them.

DeFi Integration: Users can use RLUSD for trading, yield farming, staking, and as loan collateral in XRPL and Ethereum dApps and DeFi platforms.

5.2 The significance of RLUSD

Ripple's launch of the stablecoin RLUSD is an important step in its strategic layout, aiming to consolidate its leading position in cross-border payments and expand a wider financial ecosystem. With the rapid expansion of the global stablecoin market, the launch of RLUSD directly responds to the demand of financial institutions for low-volatility cryptographic tools. Although XRP has speed and cost advantages in cross-border settlement, its price volatility is still a concern for some conservative institutions. RLUSD is collateralized by 1:1 US dollar reserves and short-term Treasury bonds, providing compliant and stable settlement options, complementing XRP, allowing RippleNet users to flexibly choose settlement methods based on risk preferences, further optimizing capital efficiency and trading experience.

This move also reflects Ripple's active adaptation to the regulatory environment. In the context of the SEC's legal dispute over XRP not being fully resolved, RLUSD attempts to avoid potential compliance risks and maintain the trust of institutional clients through transparent audits and designs that comply with the US regulatory framework. At the same time, Ripple positions RLUSD as a multi-chain asset and plans to deploy it on public chains such as XRP Ledger and Ethereum, which not only enhances the cross-chain interoperability of its payment network, but also lays the groundwork for future participation in the central bank digital currency (CBDC) and institutional-level DeFi markets. For example, RLUSD may become a bridge connecting traditional finance with emerging scenarios such as on-chain treasury bonds and mortgage lending, helping Ripple seize the initiative in compliant financial innovation.

From the perspective of market competition, RLUSD relies on RippleNet's existing more than 300 financial institution partners and has the channel advantage of rapid implementation. Compared with general stablecoins such as USDT and USDC, RLUSD is more focused on vertically integrated cross-border payment solutions, taking advantage of the low-cost and high-speed characteristics of XRPL, targeting high-frequency cross-border settlement scenarios. In addition, the launch of RLUSD is also seen as the key to Ripple's ecological expansion - by attracting developers to build stablecoin-related DeFi applications on XRPL, indirectly enhancing the practical value and on-chain activity of XRP, and forming an ecological synergy effect.

However, this strategy still faces multiple challenges. Uncertainty in regulatory policies (such as the advancement of the US Stablecoin Act), fierce competition with established stablecoins, and pressure to manage the transparency of reserve assets may all affect the market acceptance of RLUSD. If Ripple can balance technological innovation, compliance requirements and customer needs, RLUSD may become the core pillar of its transformation from a payment service provider to a comprehensive financial infrastructure, but the realization of this goal still requires time and market verification.

Sixth, Final Summary

Ripple is a Web2 Fintech private company that has launched the XRP Ledger blockchain network, with XRP as the native token of the network. Ripple's technical foundation is the XRPL ledger, which is a distributed ledger technology, and XRP is the utility token running on this ledger.

At the same time, Ripple has integrated its cross-border payment solutions accumulated over the years and launched a payment solution for financial institutions called RippleNet, with the core of improving efficiency and reducing costs. Some of RippleNet's services are implemented through the blockchain network of XRP Ledger.

XRP is an independent cryptocurrency that serves as an efficient bridge currency in RippleNet, but its value and application scenarios far exceed Ripple's business scope. The relationship between the two is similar to that of "highway (RippleNet)" and "fuel (XRP)", but XRP can also be used alone in other scenarios.

The launch of RLUSD is seen as the key to Ripple's ecological expansion - by attracting developers to build stablecoin-related DeFi applications on XRPL, it indirectly improves the practical value and on-chain activity of XRP. At the same time, RLUSD can also be expanded beyond the XRP ecosystem to form an ecological synergy effect.

Catherine

Catherine