In the dizzying and rapid rise of BTC, which was higher and higher, we bid farewell to the skyrocketing February of 2024 and ushered in the uneasy March.

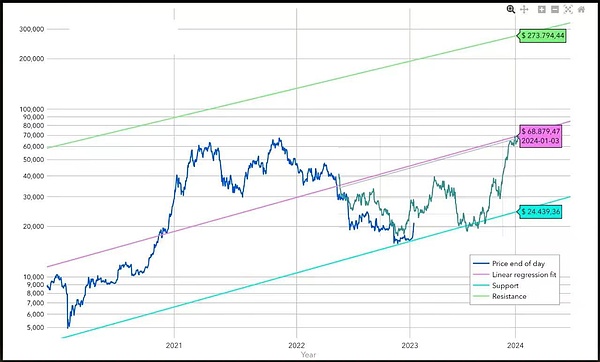

On the last day of February, the internal reference "The rapid rush to the previous high has almost come true. I dare to ask where is the way forward?" "", Jiaolian took out the "Bitcoin Breathing Chart" drawn in the "Bitcoin 2023 Price Forecast" article as early as January 16, 2023 and pasted it up, which is the picture below:

One year has passed. The tail end rushed toward the water, and it was as expected. The author can't help but suspect that this Bitcoin really seems to be alive, breathing, exhaling~inhaling~, inhaling~~exhaling~~

In the secular world, it is probably Advocating AI artificial intelligence seems to be moving towards AGI superhuman intelligence. However, in the author’s opinion, the current AI, no matter how explosive the effect, is ultimately just a cold tool without the breath of life; on the contrary, BTC, which is not understood by ordinary people, is more in line with the life described by Prigogine’s dissipation theory. body characteristics.

After working in the industry for several years and gaining some experience, Jiaolian launched the "Bazi Jue·Ten Years Agreement" on June 7, 2023. Three quarters have passed in the blink of an eye, and it is already the 18th issue.

As the saying goes, women change at the age of 18. At the age of 18, the budding girl is about to become a beautiful young girl. In the 18th period, calculated based on the closing price in February, the ROI return rate of the ten-year contract witness position also surged to 99% with the sudden rise of BTC, which is nearly double the floating profit.

Three quarters, doubled. Naturally, in the 18th period, we continued to refrain from adding positions due to the increase in February. Therefore, there are still 6 reserves for subsequent increase in positions on dips.

Although I have said it many times, there are still friends who still cannot get rid of the obsession of "seeing mountains as mountains and water as water", that is, the so-called principal numbers of 1,000, 18,000, and 12,000 are not numbers in essence. It's a proportional relationship. If you want to jump out and see, 1,000 is 1 share of principal, 18,000 is 18 shares of principal, 12,000 is 12 shares of principal, and so on.

In this model, it does not matter how much the principal is. Whether it is 1000, 100,000, 100 million, 1 billion, whether it is CNY or USD, it does not matter. ROI rate of return, also called return on investment, will not change.

The idea of working and receiving wages is to focus on absolute values. However, investment thinking must focus on percentages, that is, relative proportions, rather than being too obsessed with absolute values. Although Jiaolian emphasized the importance of this thinking upgrade many years ago. For details, you can review the article "Focus on percentages, not absolute values" written by Jiaolian on January 18, 2021. However, a large number of new students, New friends are still stuck in the old thinking and will often ask obvious layman questions such as "Why is it so big and why is it so small?" This wrong thinking habit is absolutely harmful to navigating the financial market and must be changed and overcome as soon as possible.

When BTC stood at 60,000 and hit the previous high, many people began to say things like "missing Bitcoin".

There is nothing worse than "missing Bitcoin" than another classic saying: "You have already missed Bitcoin, how can you still miss XXX (copycat) currency)?” or “Bitcoin is already too expensive, XXX (altcoin) is still at a low level and has greater potential!”

The first kind of thinking is harmful People are harming their destiny. The second kind of thinking harms people, and it harms people's wallets.

The first type of thinking will make you unconsciously develop ungrateful and selfish thinking habits. At the end of 2022, it dropped from a high of 69,000 to 16,000. You will be miserable and regret not jumping out of the car earlier and fleeing BTC. It will rise to 60,000 in early 2024, and you will regret not taking advantage of the low price to buy more. You only consider your own feelings, and always regard BTC as an object of play. If it falls, you will be disgusted, if it rises, you will be afraid of heights, and you will always regret it. What you regret is that BTC does not favor you, a heartless person!

But we know that Bitcoin never lives up to everyone who lives up to it. Whenever BTC returns to new heights, we can’t help but be silently grateful in our hearts. When it rises, we applaud it, cheer for it, and are sincerely happy for it; when it falls, we buy at the bottom and add positions, and stick with it through the darkest moments. Yes, if you want BTC to live up to you, you must first live up to BTC.

To borrow a sentence from US President Kennedy, don’t ask what BTC has done for you, but ask what have you done for BTC?

Mrs. Thatcher said: Be careful with your thoughts, they will become your words; be careful with your words, they will become your actions; be careful with your actions. Act and it will become your habit; be careful with your habits and it will become your character; be careful with your character and it will become your destiny.

Why are some people destined not to hold BTC? The root cause lies in the problem of thinking habits.

Teaching how to write articles has never been positioned as an industry media or self-media. Industry media and self-media mostly focus on external factors, which are disturbing, erratic and elusive variables. The teaching chain focuses on the inner, enlightens the mind and communicates with the soul. It is the invariant of the subtlety of human nature, the simplicity of the Tao, and the eternal. Jiaolian also writes about external variables, but the purpose is different from the media. It is not simply for dissemination and excitement, but for understanding equations, using falsehoods to cultivate truth, solving invariants from variables, and gaining a glimpse of the mysteries of things.

In fact, you are far from missing Bitcoin.

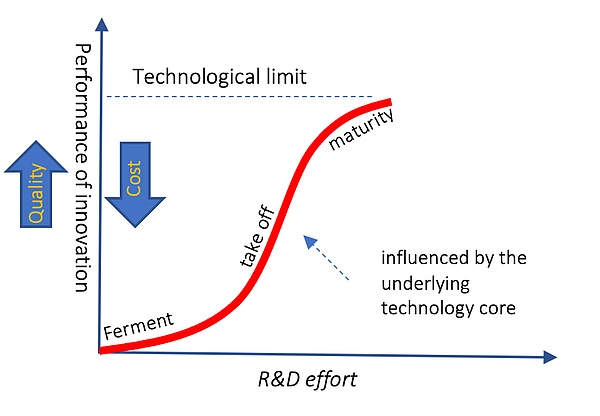

From the perspective of the innovation growth S-curve, Bitcoin, which has been around for only 15 years, is still at the left end of the S-curve, that is, the "fermentation" stage. The explosive growth in adoption rates, the “take-off” stage, is still far away. This can be seen from how many people around you express incomprehension and doubt when they hear about BTC, and even how many comments below online stock reviews are full of contempt and hatred for BTC. According to Liu Jiaolian's introduction in the article "The Show Has Just Begun" on December 19, 2020, according to the Rogers Innovation Acceptance Curve, BTC has just entered the Early Adopters stage, and it should be far away. It has not reached the Early Majority stage. In other words, those who enter now are all very early users.

I used to think that the way to change the world was to make great products. Now I find that it doesn’t matter whether a product is great or not, the most important thing is that it can always live and live uniquely. It will live until the sea is dry and the rocks are rotting, it will live until the end of the world, it will live until all those who question it and oppose it have died and died again and again, and they will still be alive, and people will be conquered by its Sartrean existentialism: existence is reasonable. , Living is great, living long enough is enough to change the world!

If simply regretting "missing out on Bitcoin" is "stupid" with low self-awareness, then using missing out on Bitcoin as an argument leads to the conclusion that you can't miss it again The argument for certain altcoins, meme coins, and dogecoins is that others are “bad” in their schemes.

A new leek who has just entered the crypto market, blocking all those who try to use this logic to convince you not to buy BTC, spend money to invest in altcoins, meme coins, and local dogs. People who have money can probably escape 90% of pitfalls.

The mentality of working and receiving wages is to obey, not to know how to refuse, and to always say "yes" to others' words. Investment thinking is just the opposite. It is a spirit of skepticism, rejecting first and then thinking, and always saying "no" to other people's words.

Blockchain thinking has refined this spirit of skepticism so well that every novice should print it out and stick it on the bedside: Don't trust, verify. (Don’t believe, verify)

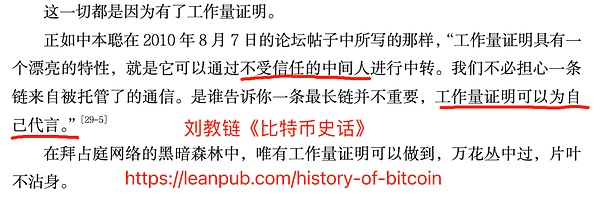

The original logic of Satoshi Nakamoto’s invention of Bitcoin is: don’t trust anyone. So, Satoshi Nakamoto invented PoW proof-of-work, which eliminated the dependence on unreliable human intermediaries.

Some people may still be worried about what if they really miss the wealth password?

In fact, as long as you use your brain to think about it, you will be relieved: refusing will only reduce the risk of one loss and save the funds in the wallet, but it will not increase anything. Risk of missing out. Why? Because the underlying logic of investment must be that the world will develop and progress rapidly. Since it is developing and progressing rapidly, it means that there will definitely be opportunities in the future that are better than the opportunity we just rejected, even 10 times better, 100 times better, or 1,000 times better. Rejecting this good opportunity in front of you and preserving your principal will preserve the possibility of seizing better opportunities in the future.

Conversely reasoned: If the opportunities in the future will only get worse, not better, then those who enter the market in the future will have no chance to surpass the early entrants. ? If young people cannot surpass the elderly, children cannot surpass their fathers, and one generation is inferior to the other, then the end of the industry will be decline, and the fate of mankind will be destruction. As long as you don’t believe that humanity is headed for destruction, you can absolutely believe that the world is developing and progressing rapidly, and there will definitely be bigger and better opportunities in the future than those you reject now.

With a little calculation of mathematical expectations, the conclusion is obvious: by rejecting the offer to buy altcoins, you avoid the risk of loss and gain better control over the future. Gains from opportunities; by accepting an offer to buy an altcoin, you bear the risk of losing all your principal and lose the possibility of seizing better opportunities in the future.

After reasoning to this point, some smart people may ask, isn't this reasoning the same for Bitcoin?

That's right. This exactly echoes what was said earlier, you can’t miss Bitcoin. Even if you didn't open a position before 60,000 out of caution or for any other reason, you didn't miss out. Even if BTC reaches 100,000, 1 million or even 10 million in the future, people at that time will still not miss it.

For BTC, any buying point is a reasonable buying point, and any time is a time to enter the market. Entering at any time will not be a "miss".

There is only one reason, that is, BTC has lived long enough, longer than any individual, any organization, or any country. It is reasonable to live as long as it exists. , lived a great life, lived enough to change the world.

The core idea of Satoshi Nakamoto's design of Bitcoin is this - live and live forever.

Eternal survival, in investment terms, is called never quitting. Never quit, so you can embrace all opportunities in the infinite time in the future, all opportunities that are 10 times better, 100 times better, or 1,000 times better.

Einstein praised that the greatest discovery of the 21st century is compound interest. The core gist of compound interest is precisely this: never quit.

Never quit, so there are infinite possibilities.

When you have unlimited possibilities in the future, you will never miss it. When you know that you will never miss it, you will be confident enough to reject all temptations at the moment.

Holding BTC, you will have unlimited possibilities in the future.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Davin

Davin The Crypto Star

The Crypto Star Beincrypto

Beincrypto Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph