On July 18, 2025, the "2025 Hongru Global Financial Governance Forum" was successfully held in Shenzhen. The forum, co-organized by the Hongru Financial Education Foundation, the Center for International Finance Research at the Central University of Finance and Economics, and the Tsinghua University PBC School of Finance's Greater Bay Area Alumni Association, and hosted by Zero One Think Tank, was themed "Stablecoins and RWAs: The Changing Global Payment and Asset Management System." Zou Chuanwei, President of the Jiangsu Jinke Digital and Technology Finance Research Institute, was invited to deliver a keynote speech (online) titled "Tokenization, Stablecoins, and RWAs." Thanks to Professor Zhang Liqing for the invitation! The topic of my speech today is "Tokenization and Stablecoins." Tokenization: Digital assets are attracting significant attention both domestically and internationally, with stablecoins drawing the most attention recently. Understanding digital assets requires understanding tokenization, and understanding tokens requires understanding accounts.

In 2023, Professor Li Yang pointed out in "The Essence of Money is Credit Relationship": "The earliest and most systematic revelation of the status and role of banks and their accounts in the monetary system and even the entire economic system was made by Keynes, the founder of macroeconomics we are very familiar with... Keynes systematically expounded on the nature of bank deposits as money and the nature of bank accounts as real transaction intermediaries, and thus revealed the secret of money creation", "Analyzing money from the perspective of banks and accounts has an obvious advantage, which is to highlight the payment function of money and reveal that this function of money is realized through the increase, decrease and transfer of accounts in a series of interconnected balance sheet systems", "The secret of money, the function of money, the 'creation' and 'elimination' of money are deeply hidden in bank balance sheets and bank accounts", "Unfortunately, a comprehensive analysis of bank accounts and an analysis of payment and clearing as the core functions of the financial system are both vague in American finance textbooks and our country's finance textbooks." For financial assets such as currency and securities (excluding cash), accounts are the fundamental vehicle for asset holding, trading, clearing, and settlement, as well as for statistical monitoring and oversight by financial authorities. They are the foundation of the PMI. Of all forms of currency, only cash is physical and independent of accounts. Tokens are digital credentials within the blockchain, achieving characteristics similar to but exceeding those of cash in a digital environment: First, the characteristics of property rights: possession equals ownership (whoever holds the private key to an address owns the tokens at that address), peer-to-peer transactions are independent of third parties, and settlement is immediate. The simplest way to understand these characteristics of property rights is to compare them to cash. Cash is bearer; whoever holds it owns it. Cash transactions between two people can be conducted directly, without the need for witnesses or recordkeeping by commercial banks or payment institutions. Second, it is open, supporting controllable anonymity. Anyone with a digital wallet can participate in the blockchain token ecosystem, without the need for review by any person or organization. Third, it supports smart contracts and programmability, allowing tokens to be intelligently manipulated using computer code, thus supporting intelligent transaction scenarios. Fourth, messaging and capital flows are not separated. This has important policy implications for cross-border payments, eliminating reliance on the SWIFT messaging system. Fifth, transactions are inherently cross-border. Blockchains operate on the internet. Token transactions on blockchains naturally transcend national borders. Exchange of value between any two people on earth through tokens is as easy as exchanging information over the internet. Figure 1 summarizes the blockchain token paradigm. Tokens and smart contracts are inextricably linked. Smart contracts are computer codes that run within the blockchain and primarily operate on tokens, enabling functions such as token definition, issuance, destruction, transfer, pledge, freezing, and unfreezing. Consensus algorithms guarantee the mathematical accuracy of information related to token status and transactions. There are two types of interactions within and outside the blockchain. The first is information exchange, specifically the writing of off-blockchain information into the blockchain, a process also known as an oracle. Blockchain applications in areas such as evidence storage and tamper-proofing fall into this category, with the core characteristic being the absence of tokens. The second is value exchange, including the use of tokens to represent off-blockchain value (i.e., tokenization) and the trading of tokens with off-blockchain value (such as the trade between Bitcoin and fiat currency). Figure 1: Blockchain Token Paradigm

AI-generated content may be incorrect.

Source: Xu Zhong and Zou Chuanwei, "What Blockchain Can and Can't Do," Financial Research, Issue 11, 2018.

How do tokens acquire value? This requires tokenization. Tokenization uses tokens to enable asset holding, trading, clearing, and settlement. Assets include both financial assets like currency and securities, as well as physical assets like gold. The product of tokenization is digital assets. Digital assets offer novel risk-return characteristics, support new application scenarios, and can serve as new policy tools, but they also raise new regulatory issues. Central bank digital currencies (CBDCs), tokenized deposits, mainstream stablecoins, tokenized securities, and tokenized investment products are all products of ownership tokenization. The tokenization process requires a trusted issuing institution. This issuing institution issues tokens based on reserve assets. Stablecoins: Mainstream stablecoins are pegged to a single fiat currency, issued with sufficient fiat currency reserves, and the management of these reserves is subject to strict oversight. The following discussion will focus on these mainstream stablecoin solutions.

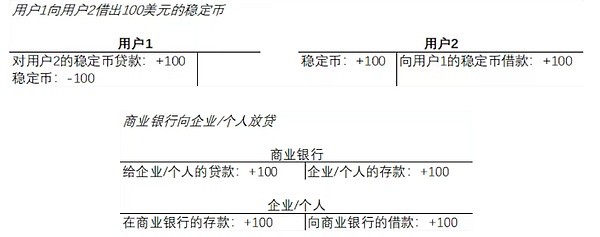

The issuance of stablecoins involves neither the expansion of the central bank's balance sheet nor commercial bank lending. Therefore, no new central bank currency or commercial bank deposit currency is created. Instead, in the secondary bank account system composed of the central bank and commercial banks, existing currency is tokenized through the blockchain, and a new way of currency circulation has emerged based on the blockchain.

The mainstream stablecoin schemes have the following points:

1. Use tokens in the blockchain to represent currency;

2. The circulation of tokens in the blockchain replaces the circulation of currency in the secondary bank account system;

3. Although tokens are constantly circulating in the blockchain, the corresponding currency remains locked in the secondary bank account system;

4. Stablecoins are tokenized commercial bank deposits. These deposits can be invested in low-risk, highly liquid assets, such as government bonds, to form the stablecoin's reserve assets. 5. The most important goal of reserve asset management is to protect the redemption of stablecoin users. 6. Stablecoins are widely accepted as a payment tool outside of their issuers. Mainstream stablecoins and China's non-bank payment systems (particularly those operating stored-value accounts) are both general-purpose payment instruments based on prepaid funds by the payer. Both are categorized as e-money (translated as "electronic currency" in Chinese) in International Monetary Fund (IMF) literature [Note 1]. The EU's Markets in Crypto-Assets Directive (MiCA) defines mainstream stablecoins as e-money tokens, meaning e-money in token form.

(II) Comparison of mainstream stablecoins and non-bank payments

In 2001, the Committee on Payment and Settlement Systems (CPSS, the predecessor of the current Committee on Payments and Market Infrastructures (CPMI)) of the Bank for International Settlements defined e-money as follows:

1. Monetary value expressed as a claim against the issuer;

2. Stored in electronic devices;

3. Issued based on prepaid value;

4. Accepted as a means of payment other than by the issuer[Note 2].

In 2021, the IMF updated the definition of e-money to:

1. Stored monetary value or prepaid product;

2. A record of funds or value stored on a prepaid card or electronic device;

3. Funds or value used by consumers for multiple purposes and accepted as a means of payment outside the issuer;

4. The stored value represents an enforceable claim against the issuer, who must repay the full amount on demand [Note 3]. Figure 2 compares the architecture of stablecoins with that of non-bank payments in China. Although they use completely different technologies, their architectures are similar: Figure 2: Comparison of the Architectures of Stablecoins and Non-Bank Payments

AI-generated content may be incorrect.

Not only that, they also share many similarities in their business development logic:

Table 1: Comparison of the Business Development Logics of Stablecoins and Non-Bank Payments There are four key differences between stablecoins and non-bank payments. First, stablecoins are based on distributed ledgers, offering high levels of openness and anonymity, and transactions are naturally cross-border. Non-bank payments use centralized ledgers, implement real-name registration, and are primarily used for domestic retail payments. Second, stablecoin reserve assets can be held in multiple commercial banks and diversified. Reserve asset investment income is the primary source of revenue for stablecoin issuers, but it can also incentivize them to engage in high-risk investments.

When issuers suffer investment losses, they may find it difficult to meet users' requests to redeem stablecoins. In extreme cases, a run on the stablecoins may even occur.

Customer reserve funds of China's non-bank payment institutions will be centrally deposited with the People's Bank of China after 2018 and will be included in M1 statistics from 2025, providing greater security.

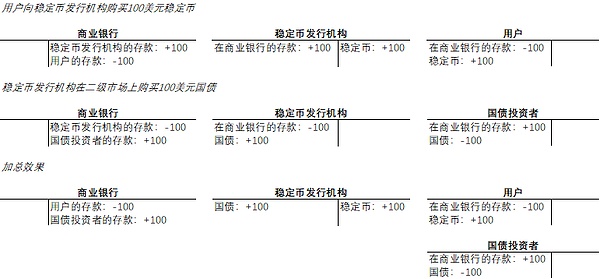

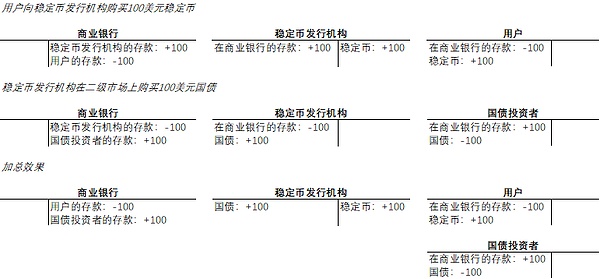

Third, stablecoins exist in the secondary market, and non-bank payment institutions only support deposits and withdrawals in the primary market. Fourth, a significant proportion of US dollar stablecoins (estimated to be over 70%) are issued offshore based on US dollars and are subject to inadequate oversight in areas such as Know Your Customer (KYC), Anti-Money Laundering (AML), and Countering the Financing of Terrorism (CFT). These regulations have even been used to circumvent US financial sanctions. For example, USDT, the largest US dollar stablecoin, falls into this category. Chinese non-bank payment institutions are strictly regulated by the People's Bank of China. (III) The Impact of Stablecoin Issuance and Redemption on Currency Using a strict definition of currency, stablecoins are payment instruments, below deposits, rather than monetary instruments. Figure 3 analyzes the impact of stablecoin issuance on the total amount of deposit money. For simplicity, Figure 3 assumes that users, stablecoin issuers, and treasury bond investors maintain deposit accounts at the same commercial bank, and that stablecoin reserve assets are invested in treasury bonds. Relaxing these assumptions does not affect the core conclusion of Figure 3: stablecoin issuance does not affect the total amount of deposit money; nor does stablecoin redemption, as the reverse operation of issuance, affect the total amount of deposit money.

Figure 3: The impact of stablecoin issuance on currency

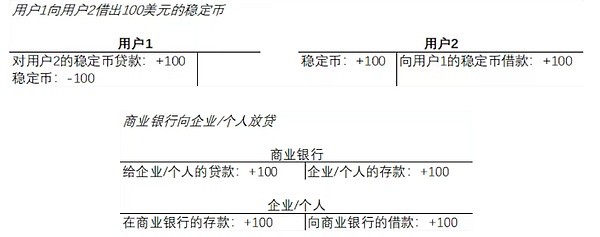

(4) The impact of stablecoin lending on currency

Stablecoin lending has been occurring in large quantities, which can be carried out through centralized institutions or through DeFi, and is generally carried out through over-collateralization of Bitcoin and Ethereum. Users who need to borrow stablecoins provide excess collateral to borrow stablecoins from centralized institutions or DeFi smart contracts, and use the stablecoins to pay interest on the loans. The majority of the stablecoins they borrow come from financial management users who deposit stablecoins with centralized institutions or DeFi smart contracts, and a portion of the stablecoin interest they pay constitutes the latter's financial management income. The analysis in Figure 4 shows that stablecoin lending does not create new stablecoins. In this sense, stablecoin lending is similar to cash lending and physical lending. New stablecoins are issued only when users provide reserve assets to the issuing institution. For comparison, Figure 4 also illustrates the process by which commercial banks create deposit money through lending.

Figure 4: The impact of stablecoin lending on currency

The stablecoin model is not fully comparable to the currency board system represented by the Hong Kong dollar. Under Hong Kong's note-issuing system, Hong Kong dollar notes and coins are backed by sufficient US dollar reserves (i.e., certificates of US dollar liabilities of note-issuing banks with the Hong Kong Monetary Authority). Hong Kong dollar M2 is primarily created through lending by Hong Kong commercial banks. In May 2025, the former (HK$9,116 billion) was 15 times the latter (HK$603 billion). Stablecoin lending, on the other hand, only creates credit, not stablecoins. On June 24, 2025, the Bank for International Settlements (BIS) Annual Economic Research Report, Chapter 3, "Next Generation Monetary and Financial Systems," argued that stablecoins lack elasticity. However, theoretically, stablecoins (or e-money in general) are issued based on user prepayments and, by design, lack monetary elasticity. (V) Stablecoins and the Singleness of Currency The singleness of currency refers to: Can commercial bank deposit currency be converted into central bank currency at a 1:1 ratio “without any question”?

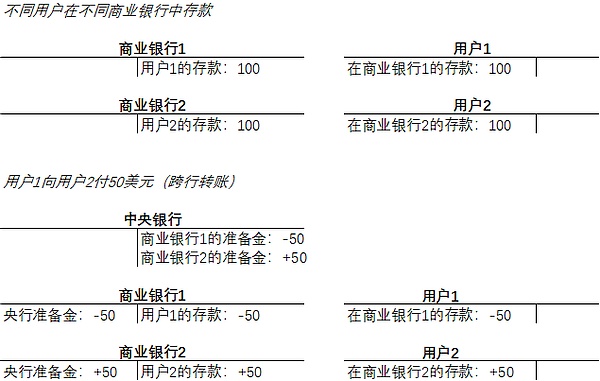

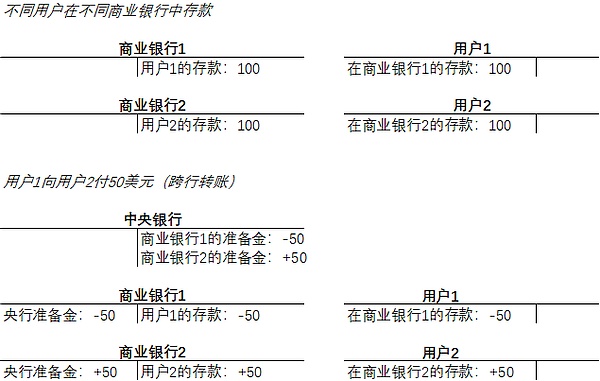

On the one hand, this depends on the regulatory measures on the capital adequacy ratio, leverage ratio and liquidity of commercial banks, as well as the support of financial safety nets such as the central bank's lender of last resort and deposit insurance; on the other hand, it depends on the arrangement that deposit currency transactions across commercial banks are settled through central bank currency:

Figure 5: Inter-bank transfer process

Chapter 3 "Next Generation Monetary and Financial System" of the BIS "Annual Economic Research Report" believes that stablecoins do not have the singleness of currency. However, theoretically, stablecoins (or e-money in general) as payment tools were not designed to adhere to the singularity of currency. First, Figure 5 illustrates that transferring stablecoins across issuers is not feasible. In fact, stablecoins issued by the same issuer on different public blockchains are not technically interoperable. This creates a liquidity fragmentation issue for stablecoins. By analogy, transfers between WeChat Pay and Alipay are also impossible. Secondly, the goal of stablecoin regulation is to ensure that the intrinsic value of the stablecoin is equal to 1 (the unit is the fiat currency to which the stablecoin is anchored, such as the US dollar). However, in the secondary market, the rise and fall of buying and selling power can cause the price of the stablecoin to fluctuate away from 1. Figure 6 illustrates this using the price of USDC as an example. Figure 7: USDC Price Fluctuations

AI-generated content may be inaccurate.

Source: Yahoo Finance, data from July 21, 2025

The price of stablecoins converges to 1, primarily through arbitrage in the primary market.

When the price of a stablecoin exceeds 1, users will use 1 worth of fiat currency to purchase 1 unit of stablecoin from the issuer. This way, they can sell it at a price higher than 1 in the secondary market and obtain arbitrage profits, while expanding the supply of stablecoins and causing the price of stablecoins to fall.

Conversely, when the price of a stablecoin is lower than 1, users will buy stablecoins at a price lower than 1 in the secondary market and redeem 1 worth of fiat currency from the issuer. This can also obtain arbitrage profits, while reducing the supply of stablecoins and causing the price of stablecoins to rise.

The ideal picture and practical progress of tokenization

(1) The ideal picture of tokenization

There is a rational picture (also called the target picture) in the field of tokenization:

First, all assets can be tokenized, and currencies, securities, and RWAs all exist in the form of tokens on the blockchain;

Second, anyone can hold any digital asset through a digital wallet;

Third, anyone can trade digital assets at any time, anywhere, and in any way, including direct peer-to-peer transactions, regardless of national borders. Fourth, the programmability and composability of smart contracts support the flexible application of digital assets. In this ideal scenario, tokenization will reshape humanity's monetary, financial, and property rights systems.

In 2023, the Bank for International Settlements (BIS) proposed the "Unified Ledger" concept, allowing CBDC, tokenized deposits and tokenized assets to exist on a programmable platform such as the "Unified Ledger", thereby improving existing financial processes through seamless integration of transactions, and expanding financial arrangements that are currently not possible through programmability[Note 4]. In 2024, BIS President Agustín Carstens and Infosys Chairman Nandan Nilekani further envisioned a future-oriented financial system, Finternet (Figure 8), which will support tokenized central bank currencies, deposits, stocks, and real estate, with the goal of establishing a user-centric, unified, and universal financial ecosystem in the digital age [Footnote 5]. Figure 8: BIS's Vision for Finnet

AI-generated content may be inaccurate.

(II) Practical Progress of Tokenization

(II) Progress in Tokenization Practice: The following are some of the advancements in tokenization practice.

(II) Progress in Tokenization Practice: First, currency was the first to be tokenized, manifested in digital currencies such as CBDCs, tokenized deposits, and stablecoins. Second, the tokenization of money market funds and government bonds revolves around stablecoins, with the primary goal of generating returns for stablecoin holders. Third, the tokenization of securities and investment products has entered the pilot phase, gradually moving from post-trade processing to holding and trading. Fourth, RWA tokenization has made some commercial progress. The evaluation of tokenization involves three core questions. First, "Can it be tokenized?" How can the authenticity of off-blockchain assets be ensured? How can off-blockchain assets be reliably uploaded to the blockchain?

Second, "How to tokenize": Is the asset itself being tokenized, or the cash flow generated by the asset?

Third, "Why tokenize": Can it help issuers raise funds? Can it help existing investors exit? Is the risk-return profile attractive to investors? Can it improve financial infrastructure? Are the functions of tokenization irreplaceable? An assessment of major asset types shows that not all asset types are suitable for tokenization, or worth tokenizing. (III) Regulatory framework in Hong Kong, China In Hong Kong, China, the regulation of tokenization involves the Securities and Futures Commission and the Hong Kong Monetary Authority: Figure 9: Regulatory framework for tokenization in Hong Kong, China In November 2023, the Hong Kong Securities and Futures Commission (SFC) issued the "Circular on Activities Related to Tokenized Securities by Intermediaries" and the "Circular on Tokenized SFC-Authorized Investment Products." Key points are as follows. First, tokenized securities are essentially traditional securities that are tokenized and packaged. The laws and regulations of the traditional securities market apply to tokenized securities. Based on the principle of "same business, same risks, same rules," intermediaries need to manage the new risks posed by tokenization, particularly ownership and technology risks. Second, whether tokenized securities are considered complex products depends on an assessment of the complexity of the underlying traditional securities. If the offering of tokenized securities is not authorized under Part IV of the Securities and Futures Ordinance or does not comply with the prospectus regime, it can only be targeted at professional investors (PIs).

Third, according to Section 19 of the Hong Kong Securities and Futures Ordinance, tokenized shares can only be traded on the Hong Kong Stock Exchange.

Fourth, tokenized investment products can be marketed to retail investors.

The Hong Kong Securities and Futures Commission (SFC) is relatively open to the primary market (subscription and redemption) of tokenized investment products, but is more cautious about secondary market trading. In March 2024, the Hong Kong Monetary Authority launched Project Ensemble, a wholesale central bank digital currency (wCBDC). It will first use wCBDC for interbank settlement of tokenized deposits, followed by the use of tokenized deposits for tokenized asset transactions, including the delivery of tokenized real-world assets (RWAs) (such as green bonds, voluntary emission reductions, aircraft, electric vehicle charging stations, electronic bills of lading, and treasury management). Therefore, some of the Hong Kong SAR's RWA tokenization projects are being carried out in conjunction with Project Ensemble.

[Note 1]Adrian, Tobias, and Tommaso Mancini-Griffoli, 2019, "The Rise of Digital Money", IMF Note/19/01.

[Note 2]CPSS, 2001, "Survey of Electronic Money Developments".

[Note 3]Dobler, Marc, Jose Garrido, Dirk Jan Grolleman, Tanai Khiaonarong, and Jan Nolte, 2021, "E-money: Prudential Supervision, Oversight, and User Protection", IMF DP/2021/027.

[Note 4] BIS. Blueprint for the Future Monetary System: Improving the Old, Enabling the New[R]. 2023,www.bis.org/publ/arpdf/ar2023e3.pdf

[Note 5] Carstens, Agustín, and Nandan Nilekani. Finternet: the Financial System for the Future[R]. 2024, BIS working paper No. 1178.

Alex

Alex