Cardano (ADA) Prices Stabilize as Whales Accumulate, Hinting at Bullish Outlook

Whales seized the recent market downturn to amass Cardano (ADA), leading to a noteworthy stabilization in ADA's value over the past week. This accumulation phase coincided with a decline in short-term ADA holders, potentially mitigating price volatility.

ADA's price EMA lines exhibit a consolidation pattern, indicating market stability. Despite this, there's anticipation of a forthcoming golden cross, a technical signal often associated with bullish trends. This could signal positive momentum for ADA's price, potentially preceding an upward trajectory.

ADA Price Drop Sees Whale Accumulation, Decline in Short-Term Traders Hints at Reduced Volatility

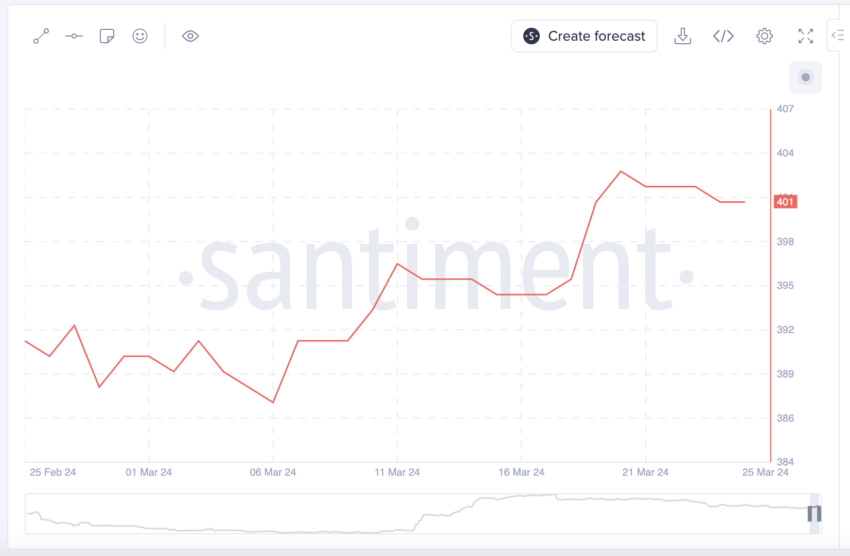

Between March 11 and March 20, Cardano witnessed a price decrease from $0.71 to $0.57. During this period, addresses holding over 10,000,000 ADA saw a slight uptick, suggesting whales capitalized on the dip to bolster their holdings. However, this accumulation trend halted post-March 20, indicating a strategic pause by whales.

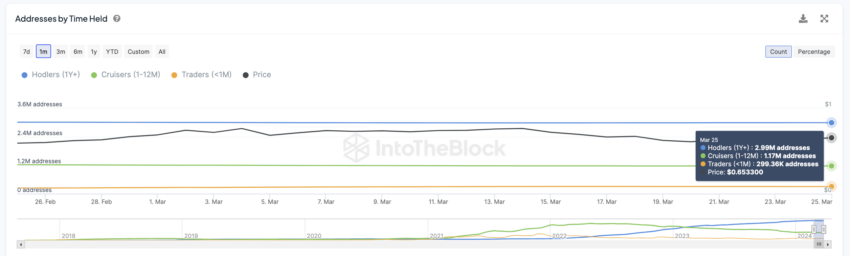

Traders, defined as addresses holding assets for less than a month, experienced a surge in ADA holdings from 244,000 to 303,000 between February 1 and March 18, correlating with ADA's price rise. Yet, starting March 19, a decline in short-term traders emerged, potentially signaling reduced price volatility for ADA.

ADA Price Prediction: Potential Uptrend Continuation

ADA's price surged 14.24% in the last six days, prompting speculation about its future trajectory. The current position of ADA's price line above all EMA lines indicates bullish sentiment. If the uptrend persists, ADA's price may challenge and surpass the $0.82 resistance level, but a reversal could see it retract to around $0.56.

YouQuan

YouQuan