First principles of blockchain: Sui and Arweave AO as examples

The first principle of blockchain is a decentralized accounting method, and "blocks" and "chains" are not necessary.

JinseFinance

JinseFinance

The first half of 2024 will end in the correction and consolidation of the crypto market. In this cycle, BTC has risen rapidly due to the influence of ETFs, and the performance of altcoins is relatively average. A large number of retail investors who missed out on BTC often complain that they "don't feel involved".

As the market continues to pull back and consolidate, especially with a large number of altcoins almost losing their gains in the past six months, new opportunities may be quietly brewing.

This article combines market hotspots and insights into future trends to review the tracks and targets that we think are worth paying attention to in the second half of the year. The views only represent current ideas.

In the initial stage of this cycle, the three core driving forces of ETFs, BTC halving, and interest rate cuts have been deeply rooted in the hearts of the people.

From the farce of "ETF approval" reported by a well-known media in October last year, which ignited the market, to the official approval of BTC ETF in early January, the expectation gap for ETF dominated the trend and game of the entire market;

The BTC halving in April did not cause drastic fluctuations in the market due to the influence of geopolitical conflicts at the time.

With the implementation of the first two core driving forces, it is difficult for the two to become the fuel for the subsequent market detonation.

Therefore, the hype around the expectation of interest rate cuts and the improvement of liquidity caused by interest rate cuts will be the biggest external driving force for the subsequent outbreak of the crypto market.

For most crypto investors, perhaps waiting for the release of each core data to earn short-term fluctuations is not the main way to make profits, so we just need to make it clear that in the longer time span, the market still has the expected interest rate cuts, which is enough to show that the bull market is likely not over yet, and corrections and consolidation mean the breeding of opportunities.

Comparing the consolidation range of this round with the previous round, we can see that the current BTC seems to have a panic "M top" in terms of technical form, but the degree of correction is far less than the correction of more than 50% after the first surge in the previous round, and the consolidation time is also much shorter than the previous round.

From the perspective of risk, the depth of BTC's callback is relatively small compared to the previous round. In the case of external negative factors, it may further decline and test a lower support position;

From the perspective of opportunity, the formation time of the "M top" is short and the amplitude is small. The existence of the expectation of interest rate cuts also indicates that the market is likely to still accumulate strength for the next climb, and the market has encountered support at around 55,000.

There is a high probability of long-term opportunities. The cost of chips and the preservation of principal will be the determining factors for the next wave of yields.

Source: https://www.tradingview.com/chart/mBmRDBZW/?symbol=BINANCE%3ABTCUSDT

2.1 Track background and core logic

The wealth-making myths of Memecoin such as $DOGE and $SHIB have been enduring in the industry, and it is also an opportunity for a large number of users to choose to enter Crypto.

Memecoin's position in this cycle has been further highlighted. It has gradually developed into one of the core tracks of Crypto in terms of asset market value and trading volume.

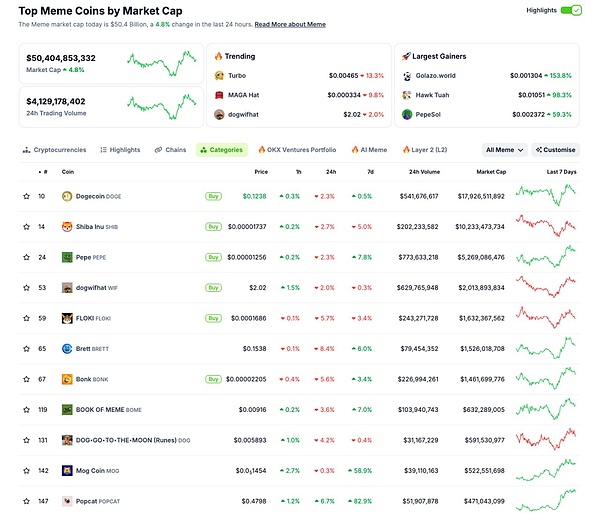

The total asset market value of Meme has exceeded 50 billion US dollars, accompanied by a trading volume of more than 4 billion US dollars.

We can also find from the ranking of Memecoin that Meme after $DOGE and $SHIB are all new stars in this cycle, which further proves the excellent performance of Memecoin in this cycle.

Source: https://www.coingecko.com/en/categories/meme-token

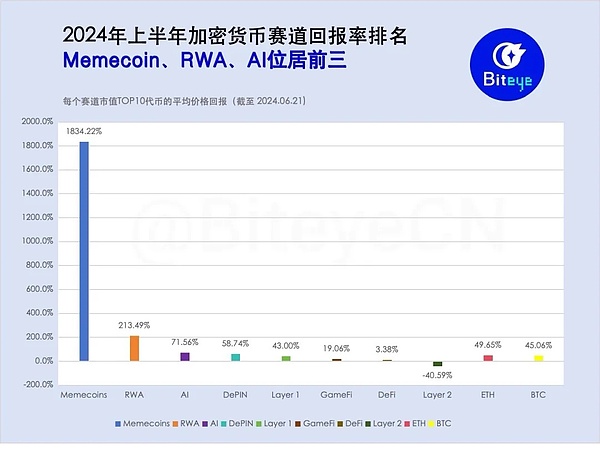

From the perspective of the track's return rate, Memecoin is also the track with the highest overall return, surpassing popular narratives such as RWA, AI, and DePIN.

Source: https://mp.weixin.qq.com/s/uy6y45d9rinmxkoCj7d1EQ

The core reason why Memecoin is so popular among investors in this round is that Meme's odds are relatively better.

It is easier for retail investors to get early chips: With the expansion of the primary investment market in the encryption industry, the increase in project valuations by VC institutions has squeezed the profit space of retail investors to some extent. In contrast, Meme's chip distribution is relatively fair, and retail investors have more opportunities to get more chips, so the price disadvantage can be significantly reduced.

Unlimited valuation, large imagination space:Most Memecoins do not have core businesses, and their valuations are entirely based on market imagination.

Low consensus threshold:The content carried by Memecoin is more easy to understand, and does not require investors to reserve a lot of fundamental knowledge, which can accommodate the consensus of the vast majority of investors; in addition, Memecoin can capture various hot spots in reality in real time, and continue to attract attention and funds

The risk of Meme is that the supply of tokens is too large, and it is difficult for investors to find certain targets. At the same time, Memecoin fluctuates violently, and high returns are accompanied by extremely high risks.

2.2 Focus on the target

Memecoin is difficult to value and classify from other perspectives, so the following will select Memecoins with odds from the perspective of current market value for classification.

Compared with the old blue chips $DOGE and $SHIB, the new blue chip Meme that emerged in this cycle has a better chance.

2.2.1 Blue chip level: $PEPE, $WIF

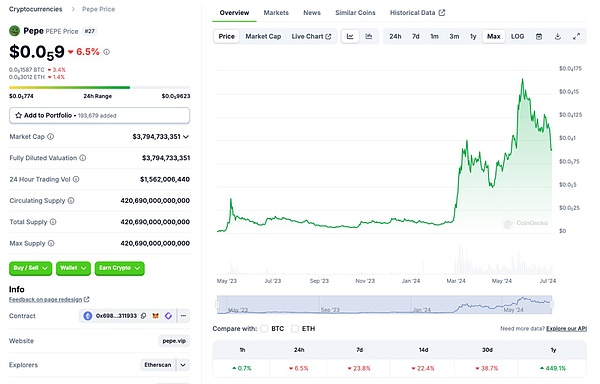

As one of the most eye-catching Memecoins in this cycle, $PEPE has a very strong price performance in this round.

As for the symbol of $PEPE itself, as a Meme widely circulated on major social media, it has a very high recognition.

From the perspectives of pull consensus and cultural consensus, $PEPE is a well-deserved first choice for Memecoin investment.

In addition, $PEPE's current market value is about 5.3 billion US dollars, and the market value level of $DOGE or $SHIB at its peak has certain odds and market acceptance.

Source: https://www.coingecko.com/en/coins/pepe

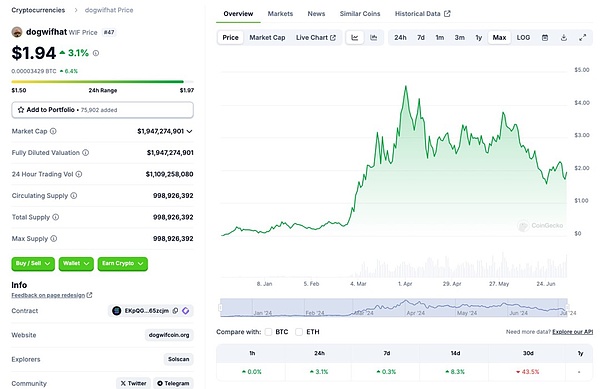

$WIF, as one of Solana's most representative Memecoins, has also achieved outstanding performance in this cycle.

The image of wearing a hat is deeply rooted in the hearts of the people, and various other Memecoins with hat images have been derived.

$WIF's strong rebound after the decline has also become the preferred target for many investments to buy at the bottom.

Source: https://www.coingecko.com/en/coins/dogwifhat

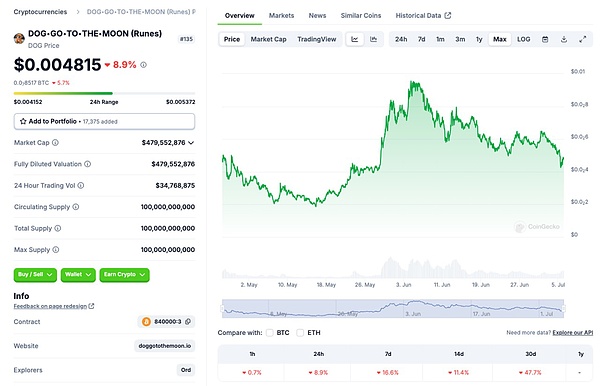

2.2.2 Small and medium market value: $DOG, $BOME

$DOG, as the first dragon in the rune track, is very likely to explode in the future with the rise of BTC.

As an iterative upgrade solution for inscriptions, runes have a certain probability of reproducing the fomo effect of inscriptions in the future, and the enthusiasm of retail investors is easier to arouse.

In addition, the label of new assets and the unrealized expectations of the exchange may also become the core factors driving the rise of $DOG.

Source: https://www.coingecko.com/en/coins/dog-go-to-the-moon-runes-2

$BOME is also a representative asset of this cycle. It broke the record on Binance in 3 days and exceeded the market value of 1 billion US dollars, opening a new trend of pre-sale payment, and has an important position in the hearts of investors.

$BOME still belongs to the PEPE culture. Now the market value is about one-tenth of $PEPE. Although it peaked at its debut, it did not start the second market, so $BOME has a certain potential for explosion.

Source: https://www.coingecko.com/en/coins/book-of-meme

3.1 Track Background and Core Logic

The explosion of ChatGPT has completely detonated the entire AI industry, and the impact of AI on humans has been elevated to the level of the "Fourth Industrial Revolution". The explosion of AI is directly and profoundly affecting the encryption industry through the two core logics of digital economy and hardware demand.

As the penetration rate of AI in people's daily work and life continues to increase, the problem of computing power continues to become prominent, and the market continues to increase pricing for computing power companies such as NVIDIA.

Computing power equipment is also the core pillar of the encryption industry. Before AI became popular, the demand for computing power in the encryption industry once led to NVIDIA's rapid development period.

With the development of the encryption industry, computing power began to be in excess, and AI gradually became the demand side of this idle computing power.

In addition, AI's task execution, resource allocation, and data element investment are completely in the digital world. The distribution of interests behind it is difficult to clearly define under the traditional framework. This article temporarily calls it a digital economic dispute.

The characteristics of the encryption industry such as accounting and proof of work can naturally be used to resolve such digital disputes and coordinate the interest disputes behind AI software and hardware.

The explosion of AI has brought a clear development direction to Crypto in the bear market. Various distributed AI computing power, algorithm and other projects have emerged, forming the current AI/DePIN track.

As the binding between the AI/DePIN track and AI continues to deepen, the behavior of companies such as NVIDIA and OpenAI begins to affect the market of related tokens. With the birth of hot spots for the advancement of AI technology, the crypto industry will develop together with the trends and hot spots of the AI market.

3.2 Focus on the target

At present, the Crypto x AI project has penetrated into all aspects of AI. The following will analyze the targets worthy of attention from three aspects: computing power supply, algorithm, and AI economy.

3.2.1 Computing power supply

The AI products we are currently using rely on the underlying large language model, and the construction of the large language model relies on the underlying GPU computing. The crypto industry has both a reserve of computing power equipment and can also build a computing power market through blockchain incentives, thereby providing additional computing power sources for AI.

Keywords such as distributed and idle computing power are the characteristics of the computing power provided by the crypto industry, and the corresponding core narrative is cost reduction.

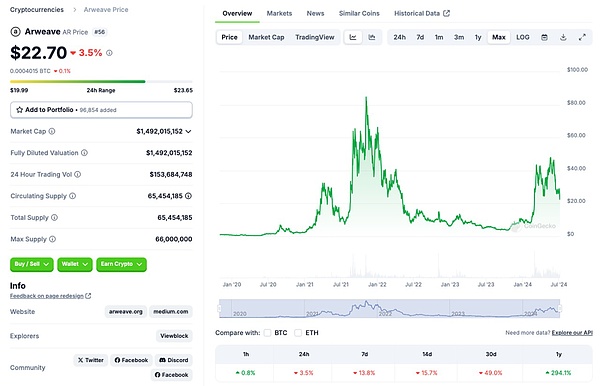

3.2.1.1 Arweave/AO

As an old storage project, Arweave has firmly occupied the position of the top player in the storage track with its excellent ecology and storage cost-effectiveness.

With the launch of the computing platform AO by Arweave, Arweave officially entered the distributed computing market and officially became a computing power concept token.

Compared with other computing power projects, AO can naturally take advantage of Arweave's ready-made storage advantages to achieve a high degree of coordination between the computing layer and the storage layer, which is crucial for computing large models on the chain.

In addition, AO has made radical designs in parallel computing and message passing, which brings AO stronger performance than other distributed computing projects. Therefore, AO actually has a natural advantage in computing power.

The launch of the AO platform and related public relations (PR) activities have jointly promoted the rise in the price of $AR, which is enough to show the market's recognition of AO.

With the continued development of Crypto x AI, $AR/AO will become one of the most promising AI tokens.

Source: https://www.coingecko.com/en/coins/arweave

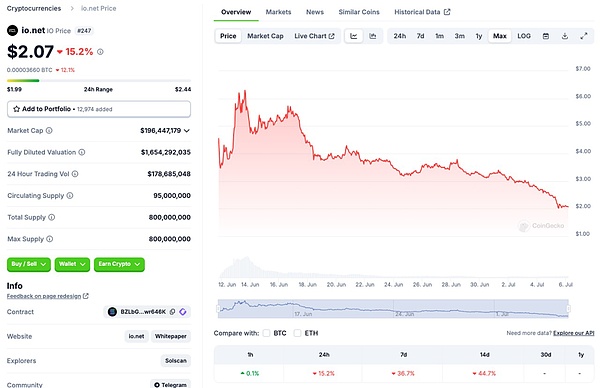

3.2.1.2 io.net

io.net, which was recently launched on Binance, is the hottest chicken in the current track. io.net is a decentralized GPU network designed to provide huge computing power for machine learning applications.

Their vision is to unlock fair access to computing power by assembling more than one million GPUs from independent data centers, crypto miners, and projects such as Filecoin, making computing more scalable, accessible, and efficient.

io.net provides a completely different approach to cloud computing, using a distributed and decentralized model to provide users with more control and flexibility in computing power, and its services are license-free and low-cost.

According to io.net officials, their computing power is 90% lower than centralized service providers such as Amazon AWS. The combination of all these factors makes io.net a leader among decentralized providers.

Source: https://www.coingecko.com/en/coins/io-net

3.2.2 Algorithm

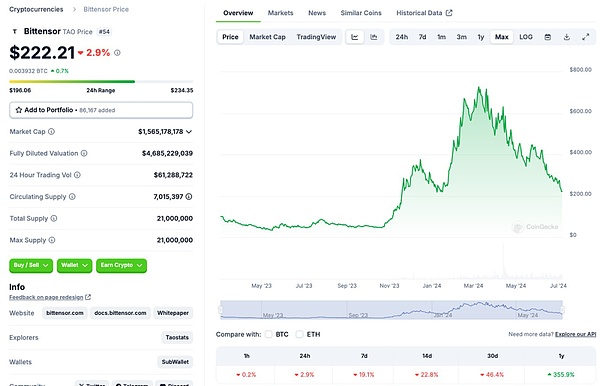

3.2.2.1 Bittensor

Bittensor is a decentralized network that connects machine learning models around the world. By coordinating multiple specialized AI models, it improves the accuracy and efficiency of solving complex problems. This approach combines the unique advantages of each model and produces more accurate and comprehensive results, which is better than the traditional single model approach.

Bittensor also achieves scalability by building an ecosystem. Currently, it can accommodate 32 subnets to adapt to services in various vertical scenarios.

Bittensor's practice in algorithms and ecology is highly innovative, making full use of decentralization to stimulate AI. The current market value is close to 6 billion, which is a relatively safe target.

Source: https://www.coingecko.com/en/coins/bittensor

3.2.3 AI Economy

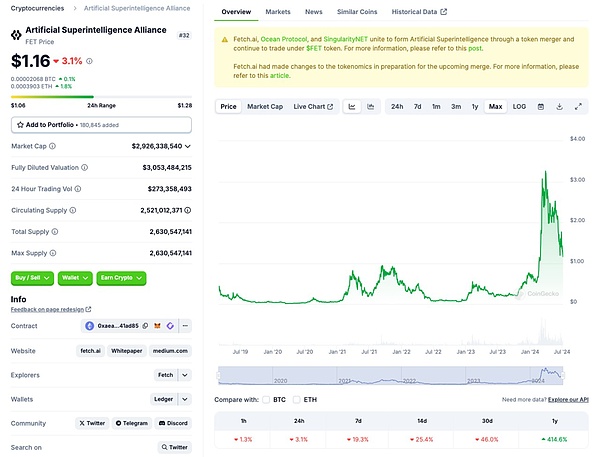

3.2.3.1 Artificial Superintelligence Alliance($ASI)

ASI is a merger of Ocean Protocol($OCEAN), SingularityNET($AGIX), and Fetch.ai($FET), three Crypto x AI projects that have been deeply involved in related fields for many years.

After the merger, the three projects will establish a team called Superintelligence Collective, with SingularityNET founder Ben Goertzel as CEO. The three projects will still operate as independent entities, but will work closely together in the shared $ASI token ecosystem and the operation of Superintelligence Collective.

In the merger announcement issued by the three teams, not much was introduced about the new business to be carried out after the merger.

According to Ben Goertzel on his social platform, after the merger, the future work direction will revolve around AGI (general artificial intelligence) and ASI (super artificial intelligence), which is why the name of the merged token is $ASI.

Token conversion information:

Fetch.ai's token $FET will be converted to $ASI at a ratio of 1:1

SingularityNET's $AGIX and Ocean Protocol's $OCEAN will be converted to $ASI at a ratio of approximately 1:0.433

$FET, as the alliance's base token, will be directly renamed $ASI, and an additional 1.48 billion tokens will be minted, of which 867 million $ASI will be allocated to $AGIX holders and 611 million $ASI will be allocated to $OCEAN token holders

Fetch.ai in AI It already has relatively mature experience in agency. On February 20, Deutsche Telekom announced a partnership with the Fetch.ai Foundation and became Fetch.ai's first corporate ally. At the same time, Deutsche Telekom's subsidiary MMS will also serve as a Fetch.ai validator. Fetch also announced the launch of a $100 million infrastructure investment project "Fetch Compute" at the beginning of this month, which will deploy Nvidia H200, H100 and A100 GPUs to create a platform for developers and users to take advantage of computing power. Ocean Prtocol has built many module services in decentralized data sharing, access control and payment. According to reports, its Predictoor product has sold more than $800 million in six months since its launch.

SingularityNET is the one that explored the most in the AGI direction before the merger of the three projects. Its AGI team and partners TrueAGI and the OpenCog community have been focusing on developing the AGI framework OpenCog Hyperon since 2020. SingularityNET will also launch a decentralized artificial intelligence platform this year to create a basic environment suitable for running AGI systems.

ASI, which was formed by the merger of three long-standing powerful projects, can be said to be the product of a strong combination. With the synergy of business and economic systems, ASI is expected to achieve a new leading position in the field of Crypto x AI, while maximizing the capture of the incremental "attention" brought by the development of external AI technology.

Source: https://www.coingecko.com/en/coins/artificial-superintelligence-alliance

4.1 Track background and core logic

RWA is the key track that closely connects blockchain with the real world. In the long run, it is an inevitable requirement for large-scale application of blockchain. In the short term, it can introduce a large amount of funds and liquidity to the encrypted market and the real market.

RWA involves tokenizing illiquid real assets and introducing them into the crypto market. The introduced RWA assets mean more value support for real assets for the crypto market, bringing potential overflow funds. At the same time, the interest-bearing assets in RWA can also provide enhanced returns for the crypto market;

For traditional assets, a new liquidation method is obtained, which enables illiquid assets to be arbitrage or quickly liquidated.

The inflow of funds brought by BTC ETF has fully demonstrated the interest of non-industry funds in the crypto market. With the emergence of representative cases in the RWA track, the track will further explode.

4.2 Focus on the target

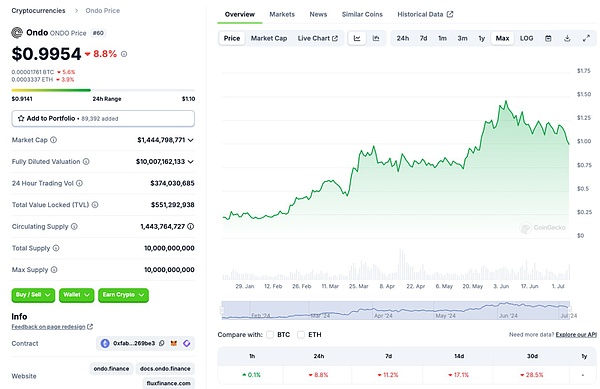

4.2.1 Ondo Finance

Ondo Finance is a decentralized financial platform for RWA. Through blockchain technology, Ondo Finance has created a transparent investment infrastructure for institutional investors and is committed to becoming an investment bank on the chain, providing a variety of RWA products including bonds, real estate and commodities to meet the needs of different investors.

With the rapid growth of the RWA market, Ondo Finance, as a pioneer in the industry, has great development potential.

Its transparent and efficient investment platform will continue to attract more institutional investors and further promote the development and maturity of the market.

Source: https://www.coingecko.com/en/coins/ondo

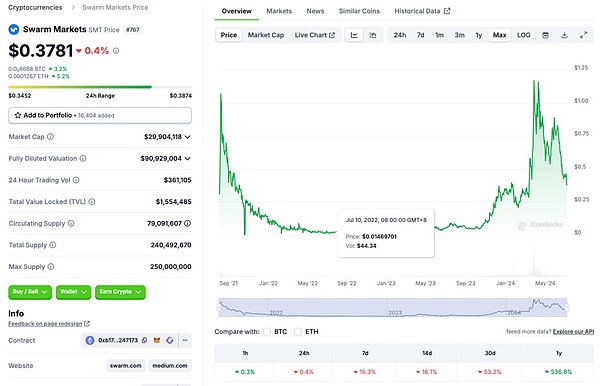

4.2.2 Swarm Markets

Swarm Markets is a blockchain platform that provides traditional financial digitization and trading solutions.

It will encrypt physical assets including US Treasuries and stocks and provide legal trading infrastructure.

Swarm Markets is the world's first DeFi platform licensed by BaFin (German Federal Financial Supervisory Authority), ensuring that its operations meet the regulatory standards of the financial market.

As more and more traditional financial assets are tokenized, Swarm Markets' compliant and diversified trading platform will gain more market share in the future.

Its innovative financial solutions will continue to attract institutional and retail investors and drive the continued development of the platform.

Source: https://www.coingecko.com/en/coins/swarm-markets

5.1 Track Background and Core Logic

Whether in Web2 or Web3, social is the most important and core track.

For the industry, social networking can onboard new users and retain existing users through the relationships between users;

For various services and applications, social networking also plays an important role in growth, retention, and increasing user stickiness.

At present, the penetration rate of the Web3 industry still needs to be improved, and increasing user retention and stickiness is also one of the core problems it faces. Social networking is the main solution to the above problems.

In previous cycles, a large number of social projects have been tried, but no phenomenal applications have been achieved.

In this cycle, various technologies that reduce user barriers and infrastructure that guarantee performance and experience have become unprecedentedly mature, and the social track is likely to have great opportunities in this cycle.

5.2 Focus

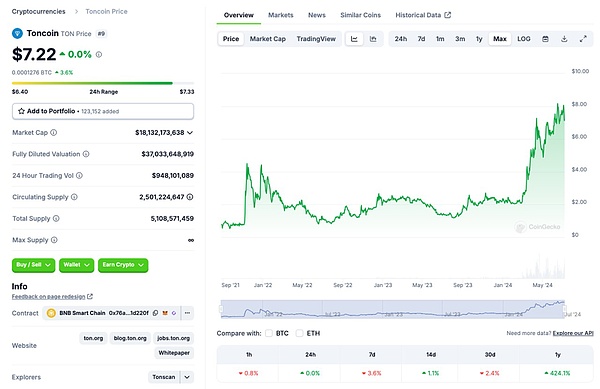

5.2.1 TON and Ecosystem Projects

TON (The Open Network) is the only public chain officially supported by the social giant Telegram. Relying on Telegram's huge 900 million monthly active users, it has created a unique narrative in terms of payment, social networking, and mini-programs.

TON does not need to increase the cost of user migration. By using Telegram's existing social network, TON can reconstruct the business model of Web2 in a Web3 way.

Currently, the TON ecosystem is still in the early stages of construction, but ultra-high-traffic projects such as Notcoin and Catizen have emerged, showing a huge userbase backed by Telegram.

Therefore, TON and its ecosystem will most likely further stimulate the vitality of Telegram users in the future and foster a more prosperous ecosystem.

For more analysis, please refer to Biteye's previous articles: "From Web2 to Web3: How TON Chain Reshapes the Future of Social and Payment"

Source: https://www.coingecko.com/en/coins/toncoin

5.2.2 Farcaster

Farcaster is a decentralized social network protocol that uses smart contracts and hybrid storage technology to achieve social connections, content sharing and data ownership between users, while supporting diversified and flexible client and application development.

Farcaster is not a new social project, but a leader that has been tested by the market and finally emerged.

Farcaster just opened registration in October last year. This year, it has attracted market attention with multiple progress in data, ecology and financing, and has secured its position as the leader in the social track.

For more analysis, please refer to Biteye's previous articles:"Can Farcaster, a social leader with a valuation of 1 billion, become a new hot spot in the bull market?"

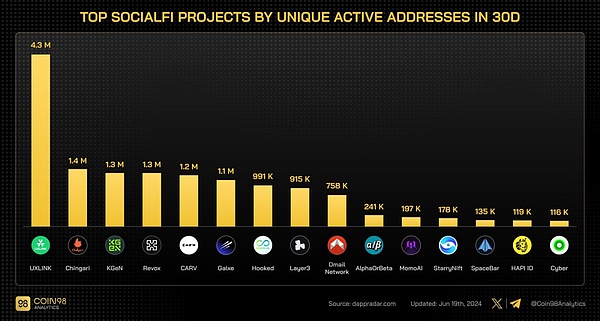

5.2.3 UXLINK

UXLINK is a dApp that focuses on acquaintance social networking. Relying on the good experience provided by Telegram and the clear idea of "fission of acquaintance relationships", UXLINK has achieved remarkable results in data. In the second half of the bull market, UXLINK will have great potential to achieve a user explosion.

For more analysis, please refer to Biteye's previous articles: "Understanding the Web3 Social Monster in One Article: UXLINK"

Source: https://x.com/Coin98Analytics/status/1803363935875375499

6.1 Track background and core logic

LSD/LSDfi It is the core component for building the basic income of the ETH ecosystem. With the imminent approval of the ETH ETF, we expect a large amount of funds to flow into the ETF, driving up the price of ETH. LSD/LSDfi will most likely usher in a growth point for the business and become a sector directly driven by incremental funds.

6.2 Focus on the target

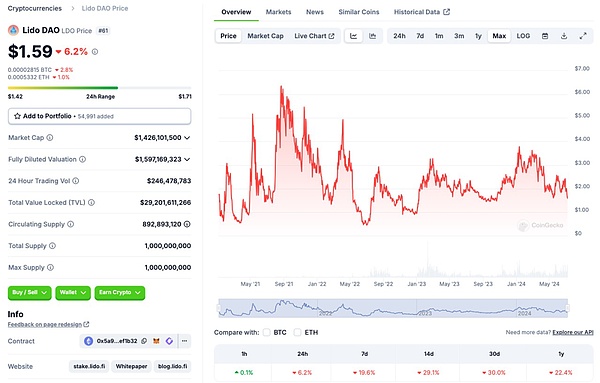

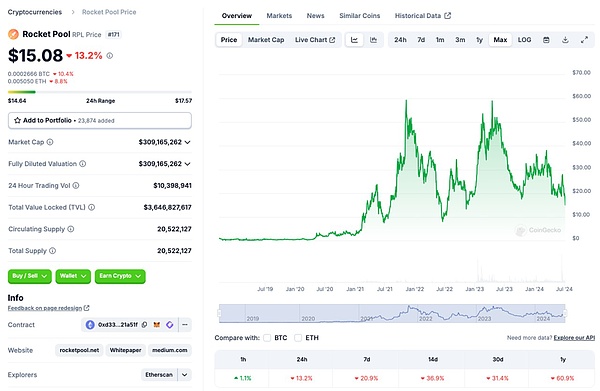

6.2.1 Lido/Rocket Pool

As two leading LSD players, their brands have been deeply trusted by large investors, and they are likely to occupy an absolute market share in the incremental ETH pledge.

Source: https://www.coingecko.com/en/coins/lido-dao

Source: https://www.coingecko.com/en/coins/rocket-pool

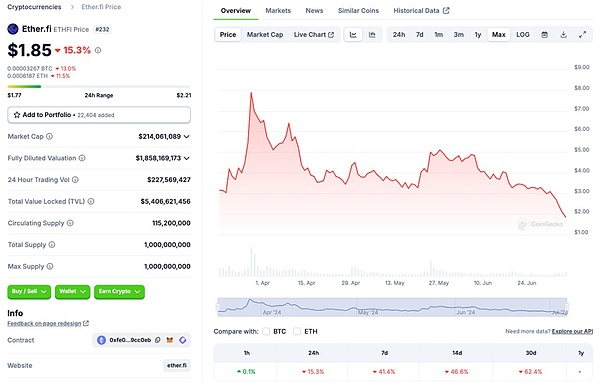

6.2.2 Ether.fi

Ether.fi is a fully self-custodial and decentralized LSD protocol. Unlike other liquidity staking protocols, ether.fi allows participants to retain control of their keys when staking tokens, and can exit the validator at any time to recover their ETH.

While ensuring full self-custody, ether.fi can also automatically re-stake users' deposits to Eigenlayer to obtain returns, further protecting users' economic interests.

With full self-custody and EigenLayer's guaranteed yield, Ether.fi also has great potential to capture significant market share in the next round of track growth.

Source: https://www.coingecko.com/en/coins/ether-fi

6.2.3 EigenLayer

As the pioneer of Restaking, EigenLayer has promoted LSD to enter LSDfi, further adding a source of income to the Ethereum ecosystem.

The LST ecosystem built around EigenLayer will also enjoy the incremental dividends brought by the ETH ETF. The EigenLayer token distribution has been determined, and the official launch should not be too far away.

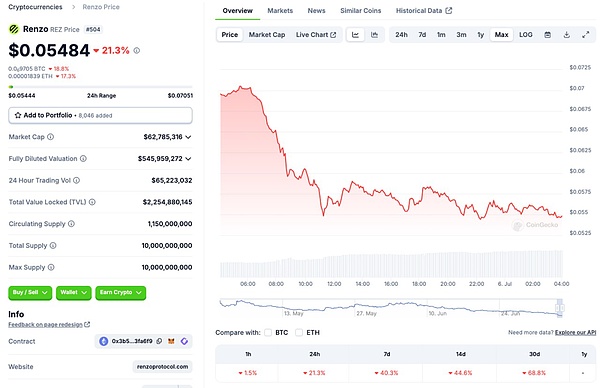

6.2.4 Renzo

Renzo is a re-staking protocol based on EigenLayer, which aims to simplify the complex process of re-staking for end users.

It introduces the liquid re-staking token ezETH, so that stakers do not need to worry about the active selection and management of operators and reward strategies, providing higher returns and liquidity.

As an important project in the LRT ecosystem and with the investment background of Binance, Renzo's current market value is attractive.

Source: https://www.coingecko.com/en/coins/renzo

6.2.5 StakeStone

StakeStone is a comprehensive LSD/LSDfi project. StakeStone integrates mainstream staking pools, Re-Stake, and LSD's blue-chip DeFi strategy income to provide a highly adaptable staking income base asset for all protocols that require LSD liquidity.

Users can obtain STONE tokens by staking ETH, and then obtain the income of native staking and blue-chip DeFi strategies.

In addition, StakeStone also supports multi-chain operations, further improving liquidity and adaptability, and has unique advantages in supporting new ecosystems and obtaining early rewards.

As a project invested by Binance, StakeStone has certain expectations for Biancne after the coin is issued. With the growth of the business, StakeStone is a great potential opportunity.

6.2.6 Karak

Karak Network is a restaking network, similar to restaking projects such as Eigenlayer, which also uses a points model to encourage users to restake, thereby obtaining multiple benefits.

In December 2023, Karak announced that it had received $48 million in Series A financing, led by Lightspeed Venture Partners, with participation from Mubadala Capital, Coinbase and other institutions. Mubadala Capital is the second largest fund in Abu Dhabi. This round of financing valued Karak at more than $1 billion.

The strong team strength and the impressive investment background indicate that Karak has the strength to compete with EigenLayer and will also generate corresponding opportunities.

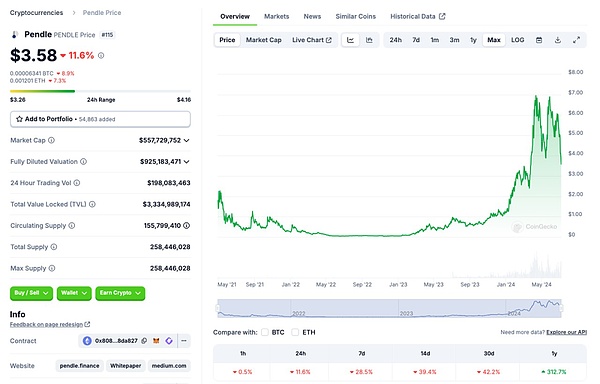

6.2.7 Pendle Finance

Pendle splits the volatility and principal of interest-bearing assets by introducing income tokenization and trading, bringing a new participation paradigm to the entire LSD.

Pendle's multi-collateral pool and risk management capabilities enable users to manage risks more effectively and hedge potential losses, thereby reducing volatility and risk in the DeFi market.

With the passage of the ETH ETF, a large amount of funds will flow into ETH, promoting the development of the LSD/LSDfi ecosystem. As part of this ecosystem, Pendle is expected to benefit from it.

Source: https://www.coingecko.com/en/coins/pendle

7.1 Track Background and Core Logic

The explosion of BTC ecology is one of the most eye-catching features of this cycle. Inscriptions have stimulated the market's enthusiasm for the BTC ecosystem. BTC L2 and various assets have sprung up. BTC pledge/re-pledge has occupied a certain market position in the explosion of ETH LSD/LSDfi and BTC ecological assets. Runes, as a new type of ecological asset, also shined during the halving.

There is a common starting point behind these attempts: to activate a large amount of BTC funds and create a more prosperous ecosystem.

However,with the callback of BTC and the wealth creation of inscriptions raising market expectations, the current BTC ecosystem is relatively quiet.

As the market improves, we believe that the BTC ecosystem will once again run out of phenomenal ecological assets and bring huge opportunities.

7.2 Pay attention to opportunities

7.2.1 Rune: $DOG

For analysis, see the Meme section. The expectations of runes are affected by inscriptions, and the market performance can be called "peak at debut". As the leader of the rune section, $DOG has certain defensive attributes while having odds, so the rune section only recommends $DOG for the time being.

7.2.2 Others

A large number of BTC L2s have not formed an active ecosystem, and BTC staking-related opportunities are still unclear. We recommend waiting for the market to make a choice.

The crypto market is no longer a separate market, but is gradually integrated into the real economy. When analyzing the opportunities in the crypto market, we increasingly feel the importance of external driving factors in the industry.

When the market changes and adjusts, the core needs to first clarify where we are in a cycle and which internal and external factors are driving the next small cycle.

During the consolidation and correction of the market, we should not be dominated by panic, but it is more worthwhile to think about the opportunities behind the decline.

We have summarized these tracks and opportunities worth paying attention to in the second half of the year, hoping to provide readers with useful reference.

The first principle of blockchain is a decentralized accounting method, and "blocks" and "chains" are not necessary.

JinseFinance

JinseFinanceI think one of the greatest technical values of AO is that it separates the consensus mechanism from the computation required by the application.

JinseFinance

JinseFinanceA new world of horizontal scaling awaits us in AO, but none of this would be possible without the pair of DePIN (Decentralized Physical Infrastructure Network) projects that underpin AO.

JinseFinance

JinseFinanceA new world of horizontal scaling awaits us in AO, but none of this would be possible without the pair of DePIN (Decentralized Physical Infrastructure Network) projects that underpin AO.

JinseFinance

JinseFinanceArweave AO breaks the shackles of blockchain. It does not deal with the calculation itself and the achievement of consensus. Instead, it uses economic models and lazy verification to ensure the correctness of the calculation results. It can be said that it has taken a different approach.

JinseFinance

JinseFinanceThe concept of DeSci (decentralized science) was first proposed in 2018. Although it has not yet attracted widespread public attention, it is considered by Messari to be a new narrative that is about to explode.

JinseFinance

JinseFinanceThere are two basic approaches to "parallelism": shared memory and message passing. AO's innovation lies in applying message passing to blockchains and smart contracts.

JinseFinance

JinseFinanceArweave is a new type of blockchain storage network designed to solve the problem of permanent data storage and access.

JinseFinance

JinseFinanceAO is actually an open and flexible data protocol for storing computational logs on Arweave's protocol. It is not a permanent ledger, nor is it a network per se.

JinseFinance

JinseFinanceWhat exactly is AO? What features gave its founders the confidence to compete with Ethereum?

JinseFinance

JinseFinance