In 2022, the cryptocurrency market reached an all-time high and lost $1.4 trillion in total market value, leading to widespread pessimism.

However, the crypto market once again showed its resilience, starting to recover from 2023, with BTC rising from less than $16,000 to over $40,000, and ETH also rebounding to around $2,200.

In 2024, the prospects for the cryptocurrency industry will be more optimistic for the following reasons:

1. Enhanced scalability of blockchain infrastructure

In 2023, Ethereum completed the merger, and the consensus mechanism changed from PoW By switching to PoS, network scalability has been improved, but this is obviously not enough to meet market demand. To further improve scalability, developers have created several on-chain and off-chain scalability solutions, including:

Sidechains ( For example, Gnosis chain)

State channel (for example, Raiden network)

Optimistic rollup (e.g. Optimism)

ZK rollup (e.g. zkSync)< /p>

Validium chains and shards (e.g. Zkporter root)

These types of solutions are basically based on Ethereum's secondary chain and connect to the Ethereum network through interoperability protocols and (increasingly secure) bridges. Most of them have survived and have been in use for longer periods of time, allowing their technology to mature and improve. Projects like Optimism have released tools to make developing new scaling solutions easier.

In addition, there are some innovative projects that are continuing to be launched, such as Zircuit (EVM-compatible ZK-Rollup), and LayerZero (Omnichain message transmission that just launched V2 protocol). If developers are not satisfied with the scalability of the blockchain, they can also choose to build on a more scalable blockchain, or even launch a blockchain suitable for specific apps at low cost, while still benefiting from Ethereum’s Benefit from the security guarantee.

For users, better scalability means faster transaction processing, lower fees and improved user experience, which Crucial for mainstream adoption.

2. Blockchain innovation is accelerating

Like any other emerging technology, the initial development of blockchain was slow and encountered various resistances. But now, it's starting to gain momentum and upgrades are accelerating.

As blockchain technology matures, several new solutions have emerged to make innovative projects easier to create. For example, ZK rollup adds privacy to the blockchain while combining high security, scalability, and ease of operation. Thanks to the early efforts of various projects, ZK-proofs have begun to be widely adopted and become one of the biggest development trends in the blockchain industry.

According to Cryptomeria Capital's zero-knowledge report,in 2024, ZK technology is expected to redefine the security and privacy paradigm and provide excellent solutions to emerging challenges plan. This is just one example in the crypto industry, as other innovations are emerging to drive the adoption of blockchain technology.

3. The Web3 developer community is active

Despite the experience We're in a deep bear market, but the Web3 developer community is still active. This is also one of the most important factors to look forward to in the crypto industry in 2024. After all, the developer community is Web3's greatest asset. Since all blockchains and cryptocurrencies are built by developers, having a vibrant development community is crucial to keeping the industry moving forward.

As you can see from websites such as Coindesk and Cointelegraph, new Web3 projects are created every day or updates to outstanding projects are made. The developer community is more optimistic than ever, which is also a very critical metric.

4. Major improvements to developer tools

2023 Developer tools have been significantly improved over the years. Notable examples include:Modern smart contract frameworks (such as Foundry); blockchain APIs (such as QuickNode); leading rollup development frameworks (such as Optimism’s Bedrock), etc.

Building blockchain applications is becoming faster and faster, which can promote innovation, attract more developers and improve interoperability , and improve cost efficiency.

5. Improved security of smart contracts

Smart contracts It has been fighting hackers since its inception, and hackers have taken away a lot of money from DeFi projects, but the community is working hard to improve the security of smart contracts.

Currently, the smart contract auditor community is very active, and checking smart contract security issues can help them earn considerable income. In the past, this kind of thing was usually done by large companies, but now more individual auditors are involved, thanks to bounty incentives offered by crypto bug bounty platforms like Immunefi and Hackenproof. With the participation of more security auditors, the future of cryptocurrency will become more secure, which is a key step in winning the trust of Web2 businesses and users.

6. Encrypted user experience improved

In the crypto industry, just as important as security is user experience (UX), which is a key driver of mainstream adoption and engagement. Since most users are unable to spend a lot of time and energy learning things like cross-chain compatibility and encryption private keys, effective design must be relied upon to simplify usage. Poor user experience can lead to serious consequences such as lost assets, etc., resulting in user losses and reduced engagement. Optimizing UX design is key to building user trust, especially considering the anonymous nature of blockchain transactions.

With the popularization of blockchain technology, only products with good user experience can attract and retain more users. Furthermore, blockchain solutions will have to compete with existing services such as financial, social media and supply management applications that have seamless UX and familiar interfaces.

In the past, the user experience of Dapps was not satisfactory, but now it has been improved through various practices. For example, crypto wallets now offer a smoother experience, making it easier for non-technical people to participate in Web3. An example is the Immutable project’s “Passport,” which allows users to enter the game through a single login process rather than connecting to a wallet. This abstracts the interactions of the blockchain and makes logging in more familiar to users. This increased convenience could lead to greater adoption of blockchain-based games.

7. The blockchain user base continues to grow

The purpose of building crypto infrastructure is to support the development of Dapps and serve a large number of users, so user adoption is an important metric. The crypto world is attracting more users thanks to better security, improved user experience, and lower fees. Although adoption is still low at the moment, we can see some progress in adoption in some decentralized social media, such as Lens. Additionally, the Web3 gaming landscape is vibrant, with many new games being released.

According to Vaneck’s 2024 cryptocurrency predictions, projects with more than 1 million daily active users will appear in the blockchain gaming field this year, most likely Candidates are games launched by Immutable.

8. Tradfi and Fintech merge with the crypto world

A good example of the integration of Tradfi and Fintech into the crypto world is the financial technology company Paypal’s embrace of cryptocurrencies. Paypal has a whopping 42% market share in online payments, and it has been allowing merchants to accept crypto payments since October 2020. In August 2023, PayPal launched its own stablecoin, continuing its development into the cryptocurrency field. It also introduced crypto wire functionality, enabling users to buy and sell cryptocurrencies.

Considering that PayPal is the preferred payment method for most online merchants and a key player in the e-commerce space, this is a huge improvement. It can be said that PayPal opens up new possibilities and opportunities for wider adoption of digital currencies for online transactions by increasing accessibility, credibility, liquidity and mainstream awareness. Additionally, the involvement of major players like these may encourage regulators to develop clearer and more favorable regulations for the crypto industry.

9. The passage of Bitcoin ETF and the arrival of the halving cycle

As we all know, a large amount of money in the United States is tied up in pension funds, and these funds are usually limited to investing in stocks. Technically, a Bitcoin ETF is also a stock, and in the long term, pension funds may diversify their allocations into cryptocurrencies.

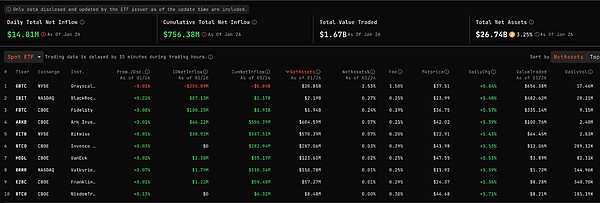

As of January 26, the cumulative historical net inflow of Bitcoin spot ETF has reached US$756 million, and the total net asset value of Bitcoin spot ETF is US$26.74 billion. The current value of the entire crypto market is US$1.67 trillion, and according to relevant statistics, the annual investment amount of pension funds can reach more than US$60 trillion. From the perspective of market size, cryptocurrency ETFs have huge potential for future growth.

In addition,the fourth Bitcoin halving cycle will occur in April this year, and miners’ selling pressure will continue to decrease. From the perspective of market supply and demand, Look, this is also a factor that is good for Bitcoin in the long term.

10. The interest rate cut cycle is coming

Cryptocurrencies are highly correlated with the stock market and are therefore highly affected by interest rate levels. Since the end of 2021, central banks around the world have been raising interest rates in an effort to drive down inflation. According to Reuters, most major developed economies have now decided to stop aggressive interest rate hikes as inflation has eased significantly.

In order to ensure a soft landing rather than an economic recession, some Fed officials believe that interest rate cuts will begin in 2024, and it is expected that interest rates will be reduced by 75 basis points throughout 2024. The European Central Bank may also start cutting interest rates in June 2024. When interest rates are lowered, more capital will be available in the market, which is conducive to the prosperity of the stock market, and this positive effect will also extend to the cryptocurrency market.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Joy

Joy JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Huang Bo

Huang Bo Cointelegraph

Cointelegraph