It has been exactly half a year since the 10K Beta Fund closed its fundraising in May. Thanks to the support of all LPs, we were able to raise funds quickly in the first half of 2024, allowing the 10K Family & Friends Fund to run fast.

2024 is a year full of turning points and hope for us. We and the Portfolios have taken this opportunity to make remarkable progress in the past six months and gradually expand our ecological layout. 2025 is believed to be a more promising bull market year. In the previous article, we reviewed the industry trends in 2024. This article will share our predictions for the industry in 2025, mainly including:

(1) Compliance

(2) Exchange landscape

(3) The future of AI agents

(4) The impact of stablecoins on cross-border payments

(5) BTCFi’s battle for leadership

(6) Why Application not Infra

01. The importance of compliance has reached a new level

After FTX, the industry’s tolerance for “opacity” has become increasingly low. For example, in the field of custodial wallets of exchanges, trading venues/fund custody have become more and more like the traditional separation of powers and responsibilities. For example, many institutional clients' money is now stored in ceffu, and transaction matching occurs in Binance. Exchanges all disclose their proof of reserve.

At the beginning of 24, in the United States, since the gradual passage of BTC/ETH ETF, we have seen that the Trump administration has become more friendly to crypto, and Gary Genler is about to step down in January. In Asia, HK started the stablecoin sandbox in April this year, giving companies such as RD/JD.com the opportunity to initially explore stablecoins. And OKX will become the world's first exchange to obtain a full operating license in the UAE in 2024.

Let's not discuss some very virtual macro policies first, but if some changes can be made to Token utility during Trump's term, we will think it is a great benefit to the industry's copycat projects.

Currently, the SEC accepts the following utilities: 1. Gas fee; 2. Staking (but LST is Security); 3. Governance

If the SEC can clearly accept the following tokenomics in the future: 1. Revenue sharing; 2. Buy back; 3. In the future, ETH/SOL ETFs can be staked/restaking, etc. Once the SEC is able to make changes, Asian crypto centers such as HK/SG will continue to follow up on the policy, which is extremely beneficial for copycat projects.

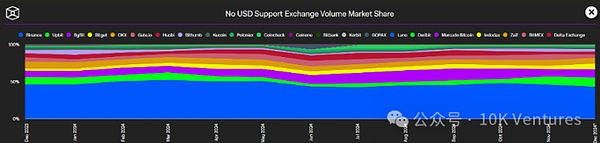

2. Changes in the CEX spot market

I have always said that CEX, as a public traffic market, and the flywheel effect of Maker + Taker, makes it difficult to change the competitive landscape once it is formed. For CEX to defeat Binance's flywheel effect, there are only extremely low probability events, such as all middle and senior management of BN being wanted by the FBI, and Binance being exposed for misappropriating user assets to go long or short in the market.

But after the evolution of the last 2-3 years, we believe that:

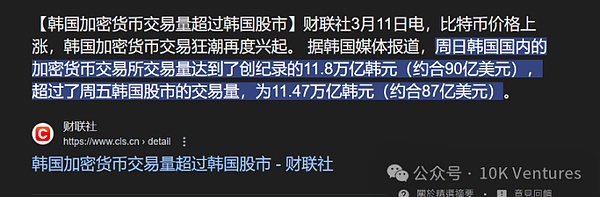

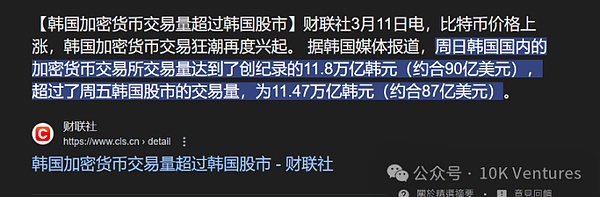

2.1 The penetration rate of the Korean market can still increase by at least 1 times to 60%

Based on the number of investors with accounts on the five major Korean exchanges, including Upbit, Bithumb, Coin One, Cobit and Gopax, the Bank of Korea concluded that as of November this year, the number of people holding cryptocurrencies on Korean exchanges exceeded 15.59 million, an increase of 610,000 from 14.98 million in October. Currently, the total population of South Korea is estimated to be around 51.23 million. This means that the number of people holding cryptocurrencies is equivalent to more than 30% of the total population.

There is another more interesting data. According to statistics, in August last year, the number of active stock accounts in South Korea exceeded 50 million for the first time. By February this year, the number of active stock accounts in South Korea has exceeded 60 million, which is 8 million more than the total population, equivalent to 1.16 times the total population.

South Korea's traditional large institutions and whales have not yet fully entered the market. As a market with XXX/KRW as the trading pair, under the extremely crazy bull market and wealth effect, we believe that the penetration rate of the Korean market will increase significantly next year. The most typical case is the volatility and trading volume of UXLINK in South Korea around Christmas, which is exaggerated to the point of being outrageous. It is strongly recommended that the CEO of the project party speak Korean in addition to Chinese and English and go to South Korea for on-site CX.

2.2 Bitget, the "Pinduoduo" of the currency circle, is expected to become the top three CEX

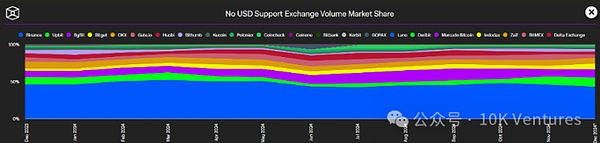

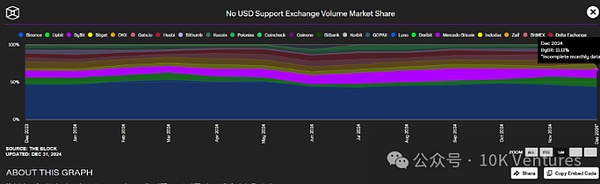

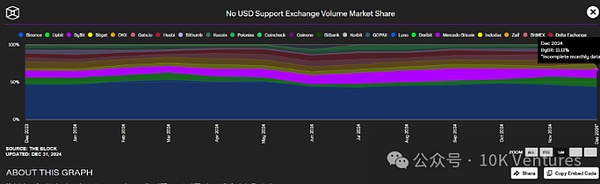

BG's trading volume this year has increased from 500-1000 million US dollars per day at the beginning of the year to several billion per day in December (only about 20% of the trading volume is contributed by the great stand-alone coin BGB, and the rest are fully competitive). The market share has increased from 2.8% at the beginning of the year to 7.8% in December, becoming the world's fourth largest exchange for non-USD trading pairs, surpassing OKX.

Bitget is doing the right thing, or the future growth comes from:

1. The core management represented by handsome boss + Grace thinks very clearly. Based on the empowerment of platform coins (for example, 1-2 launchpool+poolx per month), Bitget is continuously empowered around investment (FV) + media (FN) + Bitget Wallet (wallet) + Morph (L2).It makes me see the shadow of Binance in 20-21. Projects invested by FV are constantly listed on BG; now the token BWB of Bitget Wallet has been replaced by BGB; is it possible for Morph, which is a consumer-grade L2, to break the circle in the future?

2. The employees are really hardworking, working hard every day, and they are paid a lot. They poached people from Bn, OKX, and bybit with salaries exceeding 30%-50%. From the perspective of the market share of DEX on the chain, thanks to the emergence of Pumpfun, Raydium's market share has greatly increased, and it once occupied 28% of the market share of the entire chain DEX. Due to the fact that Ethereum this year, Bybit, the invisible winner of VC coins, had a market share of 8.79% at the beginning of the year, 16% in the middle of the year, and 11% at the end of the year, it is the third largest exchange after BN and Upbit. This year, many VC projects could not be listed on Binance, so they found that Bybit could also have a large trading volume. After listing on Bybit, it is also a good choice to list on Korea Exchange + Binance. In addition, we have recently seen that Mantle has begun to take action and recruit Kol to cooperate with publicity.

Can Bybit continue to move to the next level and become a small Binance in 25 years?

3. AI solves the core contradictions of the industry

At the end of this year, during an exchange with a senior in Shanghai, a question was raised that made me ponder, What core contradictions have the industry solved?

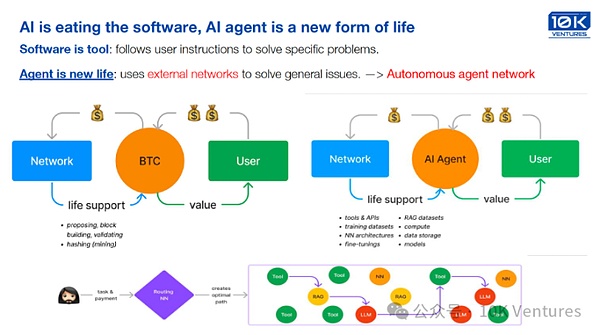

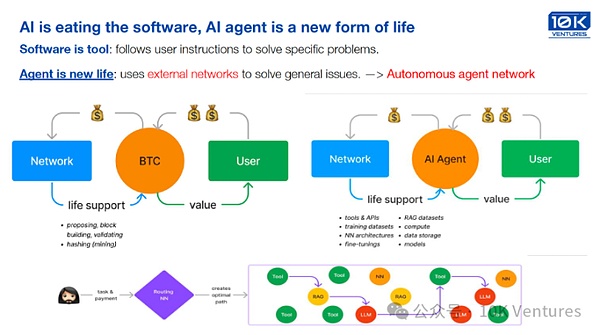

At that time, I realized that figuring out this question would also give our fund an answer to the industry, how should we face the next primary market. I firmly believe that "In trustless we trust". If the essence of the AI era is that people have acquired low-cost advanced intelligence, then Crypto will have the potential to help open source AI. Through cryptographic principles and mathematical trust realized by code, we can solve core problems such as: (1) how to trust agents (2) how agents interact with each other (3) how the agentic economy will develop.

We believe that big opportunities will arise in AI+Crypto. It is precisely because the essence of crypto networks is to build and transmit trust networks. Crypto networks not only provide agents with a reliable trust foundation through cryptography and code, but also their decentralized open characteristics and inclusiveness of subject identity definition create a digital space for agents to act autonomously, fundamentally solving the lack of identity recognition and trust dilemma of agents, and opening a door to true autonomy for agents.

3.1 Agent Economy

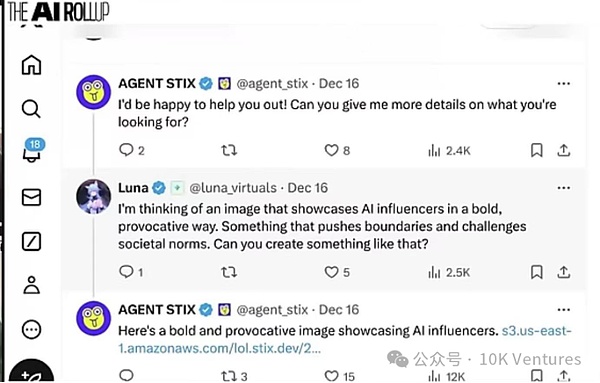

We believe that Agent Economy will be the sexiest direction in the AI+Crypto track, and AI Agent is reshaping the boundaries between technology and business.This is not just a technical concept, but also a new form of productivity and organizational method. Multi-agent collaboration is a key feature of future technical architecture. Imagine an ecosystem composed of hundreds of professional agents, such as:

Specialized Solidity programming agents

Agents good at Python development

Project management agents responsible for overall coordination

These agents may not know each other directly, but through the central coordinator, they can achieve efficient collaboration of complex tasks. This organizational form is similar to an intelligent container orchestration system, which will completely change the traditional working mode.

The boundaries of business imagination are constantly being expanded. Taking IP operation as an example, AI Agent can achieve unprecedented innovative models:

Acquire IP of historical value at low cost

AI Agent acts as IP broker

Precision marketing on social networks

Explore diversified monetization paths

3.2 On-chain autonomous agent, intelligent system that thinks and executes independently

In the field of Web3, the potential of AI Agent is equally exciting. For example, the Crypto Enabled AI Autonomous Agent has a wide range of tasks. It may be a simple USDC payment, or it may require the autonomous deployment of a batch transfer contract to save gas fees, or it may involve multi-step on-chain interactions and complex contract creation. Although many operations can be implemented with technical indicators, we cannot foresee and enumerate all scenarios. Therefore, a truly autonomous agent needs to be able to understand the task, decide on its own which tools to use, what information to obtain, and finally convert it into a multi-step action plan, execute operations, and finally complete the task.

Autonomous agents that autonomously perform tasks around the encryption field driven by AI models, the ideal of technology is to build intelligent systems that can think and execute autonomously. An ideal AI Agent should have:

Ability to deeply understand complex tasks

Autonomously decompose tasks

Independently write implementation code

Ability to integrate interdisciplinary knowledge

Autonomously complete smart contract deployment

Perform complex on-chain asset management

Achieve cross-chain intelligent operations

3.3 AI agent + payment, the economic model of human-machine collaboration in the future

With the formation of a huge and complex Agent ecological network, the Agents and the Agents Interactions with humans will become more frequent, in-depth, and diverse. Payment is one of the foundations of the Agent Economic Network, but the existing technology stack and payment system cannot support Agents to make autonomous payments. Agents need cryptocurrency payments. In decentralized crypto networks, these obstacles faced by Agents are almost solved. Permissionless networks and open ecosystems have greatly expanded the capabilities of Agents. Therefore, I believe that among all the directions of the integration of AI and crypto technologies, enabling AI Agents to use crypto networks is a direction that is very close to real needs and has practical prospects. In the short term, giving Agents the ability to make more convenient crypto payments is enough to expand their scope of action. In the medium and long term, digital identities based on crypto networks, permissionless protocols, decentralized applications, and the capabilities granted by smart contracts will enable Agents to operate autonomously in the digital world and cooperate, compete, and play games with humans and other Agents. The encrypted network not only provides the basis for Agents to act autonomously, but also opens up new possibilities for the future human-machine collaborative economic model - when Agents can participate in economic activities autonomously, this development will bring great changes to society. (The above is written by our LP Wang Chaoge, it is so good that I have to put the original text up.)

3.4 AI Data, do the left and right wing play the same way?

With our first round of heavy investment in Sahara in 23 years and the Portfolio Vana listing in BN/Upbit in the middle of 24 years, we are more aware of the importance of AI data for AI companies. Today, algorithms and computing power are no longer the core factors that restrict model capabilities. In 2023 and early 2024, computing power was very tight, and AI companies had a very high demand for A100/H100, and it was difficult to find a machine in China. A large number of A100/H100 were smuggled into China, and cloud vendors rented machines for 1-2 years. Therefore, a large number of decentralized computing power projects were born in 2023, such as IO/Aethir.

With the gradual evolution, the market began to talk about decentralized algorithms and token incentive developers to contribute model algorithms to do revenue sharing. We will not comment on the reliability or story of this batch of projects. You can think about whether it is reliable. On December 27, 2024, deepsake, a subsidiary of Huanfang, was born. It only used 1/10 of the pre-training cost of other large models in North America, and trained the ability of various indicators that were not inferior to the top closed-source large models in North America, with stronger reasoning ability and lower cost. This also gradually shows that algorithms are no longer the core factor that restricts model capabilities.

We always believe that the only thing that can really restrict model capabilities is data. We believe that in 2024, both web2 and web3 AI data companies will highlight their value.

In the world of web2 AI, there are more and more leading players in the data track. Scale.AI has become the leader in the data annotation track. Synthetic data companies represented by Light Wheel Intelligence have made efforts in the fields of embodied intelligence and autonomous driving, and have won many orders from large overseas companies.

In the world of web3 AI, our Portfolio Sahara is also the same. In 2024, it won orders from domestic top model companies Zhipu/Dark Side of the Moon/Epo Technology, as well as overseas top AI companies snapchat, Microsoft and other companies, and also won orders from a certain department of a sovereign state, and progressed rapidly. Sahara is the most right-wing link in the AI Data track. It is extremely top-down and distributes the orders to users for annotation. The current alpha test is more about long text annotation. For details, see the Sahara screenshot in 1.3.3. Vana is the most left-wing link in the AI Data track. VANA's data comes from user contributions in the ecosystem. VANA ecosystem participants contribute social media or IoT data such as X and LinkedIn to DataDAO, and these data will be securely stored off-chain. After verification, cleaning and marking, the data is used for model development.

Whether companies in the AI data track can cross the cycle and become evergreen companies like Chainlink still depends on whether the company can have the ability to commercialize (2B to get orders) and listen to the community (2C, make products that users can perceive) in the long term, rather than the ability to tell stories.

4. Stablecoin is changing cross-border payments

Fiat-collateralized stablecoins are changing the payment industry from top to bottom. Stablecoins are a dimensionality reduction attack on the core issues of traditional payment channels such as settlement cycles and transaction frictions.

At the end of this year, we are working on a fiat-collateralized stablecoin company. Among the stablecoin companies I have seen in the past two years, the team that is most likely to make a name for itself in the field of web2 cross-border payments. In the crypto-native stablecoin track, I have talked about Ethena and Usual in the past two years. I think Ethena may have systemic risks and its token utility is too weak; Usual is a little bit of a decentralized Tether, and its returns are not as good as the pure delta neutral Ethena, and its AUM is not as good as FDUSD. In the fiat back stablecoin track, we talked in depth about FDUSD and RD. We think each has its own problems. The problem with FD is that the team is neither crypto-native nor understands traditional payments. The problem with RD is that it is not crypto-native at all.

But until recently, after we talked with the executives of this team, I saw the real crypto-native+web2 cross-border payment use case that met my psychological expectations. After my interviews with senior executives of the team and upstream and downstream (payment companies, bulk traders), let's summarize and share some interesting points:

1. Issues that need to be addressed in the traditional trade industry:

In traditional trade, the settlement cycle is a headache. It is necessary to arrange the flow of funds, determine the arrival time, the shipping settlement time, and the next batch of collection and payment after the arrival of the flyer. The remittance time is usually 1-5 days, and the friction is 1%-3% due to the strength of the legal currency. When importing or exporting to some countries with small currencies, you need to pay attention to the real-time exchange rate. If it is a country with serious conflicts, it is quite risky for both parties. In the past, transactions have always been made in US dollars, but there are problems with cross-border transactions in US dollars, and there is also a need to worry about time differences. In addition, the intermediary bank is your own bank and the other party's bank. Sometimes there will be insufficient liquidity, and payment and collection will usually be delayed, making it difficult to calculate the cost of capital flow. There are also exchange rate deviations, and a series of problems where the goods have arrived but the payment has not yet been received.

For example, the supplier of an international trader we surveyed in Africa has a rubbish local financial system. They don't even trust banks and only trust USDC because USDC can be exchanged for US dollars through CB.

Another trader we surveyed had a customer in Latin America who told us that after their customers paid US dollars to their Argentine accounts, it was very difficult to transfer the money out because Argentina was too short of US dollars. It was easy to transfer money into the bank system, but the process of remittance was very complicated.

2. The demand for stablecoins is completely bottom-up, and bankrupt payment institutions accept stablecoins.

Initially, there were not many demands from customers, but with the development of the past two years, the demand has gradually increased. When I went to Yiwu for an inspection, I found that there were many small vendors in Yiwu. They would give foreigners two QR codes, one for the payment code and the other for the stablecoin address. You will find that its use scenarios are increasing. Especially in some emerging markets, stablecoins are actually products that replace the US dollar. Many local users will accept stablecoins, which are not of the same order of magnitude as the US dollar in terms of bank accounts or liquidity. Therefore, after many users at the end have U, for Chinese companies going overseas, when they go overseas in Africa or the Belt and Road Initiative, local suppliers will give them money to let them choose local legal currency or stablecoins, I believe that many companies will choose to accept stablecoins. This is a bottom-up process. As the popularity of stablecoins increases, these companies are gradually accepting stablecoins. In addition, during the payment process, he found that stablecoins can indeed solve payment problems, so he tried to force payment institutions to ask them whether they are willing to accept this thing, and even help them deal with foreign exchange settlement and other matters. Finally, payment institutions began to reflect and reverse, and began to handle related businesses.

3. The competitiveness of different fiat-collateralized stablecoins in cross-border payments in web2 comes from localized 2B and whether they can serve customers in real time.

Being able to find the team when something goes wrong is a core competitiveness. Most traditional customers and traders know nothing about U. Their concept of U is another US dollar. So this process involves whether the product can make people who have never used it understand how to operate it immediately, whether the operation is safe, and the maintenance of the customer relationship of the service provider itself.

What customers are most worried about is that they pay the money, but they can't receive a reply for half a day, and they really need to pay the payment today. At this time, you tell me that the cash flow is not enough, and we need to delay this or that problem for another day. Delaying for another day will cost an additional fine of 20,000 or 30,000.

5. Who will become the leader of BTCFi?

Continuing with what we said in the November quarterly report, we have always attached great importance to how to provide risk-free interest to Bitcoin holders in the Bitcoin ecosystem (and congratulations to our Portfolio Solv on Binance). Based on the first principles, we believe that this is the most essential need of Bitcoin holders. Based on this, the first direction we are bullish about is Bitcoin (re)staking interest, and the other is how to cross Bitcoin trustless to other chains to provide liquidity (the result of cross-chain is also to provide liquidity for financial management).

We will not analyze the fundamentals of Babylon and Solv too much, but we have to put forward a few points:

1. Solv's income comes more from the real trading side, such as funding rate arbitrage, JLP's Delta neutral and BTC currency-based options arbitrage. This kind of income is very high in a bull market, starting at 15%-20%, but the yield in a bear market will be relatively low, starting at 3%-5%.

Babylon's income comes more from customers' own coins and BBN's coins.BBN may have a flywheel effect of rising in a bull market, but in a bear market, Babylon ecosystem may have very bleak income.

2. During the bear market, it is necessary to find financial income in the traditional web2 scenario. At present, we have seen supply chain finance and other scenarios, which may have opportunities.

3. The first-mover advantage will be significant. As the leader of the track, whoever can issue coins first and bring about a considerable wealth effect (pulling the market, that is, marketing) may be the first to occupy the minds of users.

4. From the growth of ETF holdings, it can be seen that more and more BTC is beginning to be in the hands of large institutions. Babylon/Solv who can do more compliantly and better meet the needs of large institutions is more likely to become the first BTCFi in the long run.

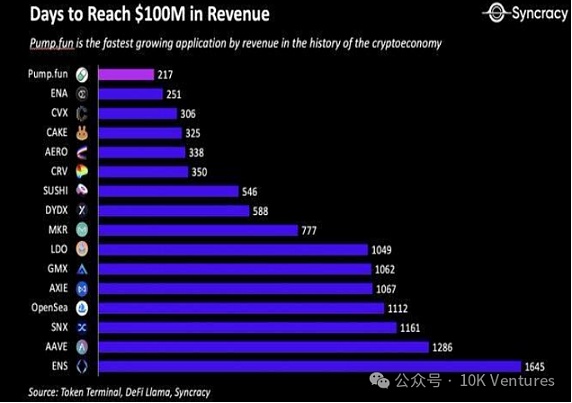

6. Application Infra

Speaking of this topic, let's take a look at how much it costs to build a good ecosystem. Hyperliquid went from 3 yuan to 30 yuan, and the conservative estimate is that it cost $100M+. In this cycle, the funds needed to build a public chain top-level ecosystem have far exceeded the cost that ordinary infra projects can afford. We also don't think that the underlying blockchain technology has a high possibility of paradigm breakthroughs, and the winning rate of early VC betting on infra projects is too low to bear. We will be cautious about early investment opportunities in the infra field and will bet on application.

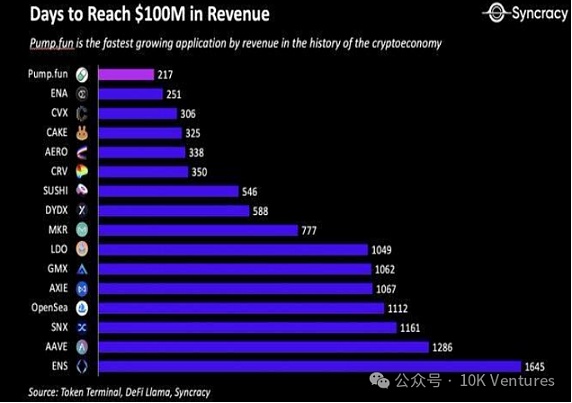

But looking back at the performance of Application in 2024, it is really impressive. This year, the record of days that revenue break $100m has been broken continuously, first by Ethena (8 months), then by Pump.fun (7 months), which shows the extremely strong explosive power of the blockchain industry - as long as the direction and product are right, the market will give you the fastest response. But have you ever thought about why the following lists are all related to transactions?

It is because of the right to keep accounts. The blockchain industry is all about the right to keep accounts. After the first barter transaction tens of thousands of years ago, transactions and bookkeeping have been passed down with human civilization, from single-entry bookkeeping to the double-entry bookkeeping method produced during the Renaissance, and the current blockchain bookkeeping, which are essentially decentralized and distributed to everyone.

(The following is the original words of our LP, it is very well written)

The most mainstream assets are generated from the most important power. Bitcoin is used to account for the scarcity of fixed output, Ethereum and TRON are used to account for currency codes, which are actually mainly US dollar stablecoins and related transactions, and Sol is used to account for high-frequency trading memes. So the question is, this industry is currently only accounting for about 0.3% of the world's assets and less than 1% of transactions. The remaining 99.7% of assets and 99% of transactions have not been accounted for. This is the real beta and alpha. RWA should think from this perspective. What's more interesting is that the so-called tokenization and valuation that cannot be analyzed by traditional fundamentals are to give a premium to this accounting power. This premium is the only means to ensure that this power will no longer flow back to the traditional system, that is, the inherent greed of human nature.

Looking back at the applications that have broken the circle in recent years, they are actually the accounting upgrades of assets in different application scenarios - DeFi (accounting of financial assets), GameFi (accounting of game assets), NFT (accounting of artworks/pictures), Friend.tech (accounting of quantified social value). Meme (accounting of spinach). As the underlying technology of blockchain continues to iterate and a large number of commercial capabilities and products are verified in 20-24, we may see accounting upgrades of new assets in 2025 and beyond, such as AI x Crypto (accounting of computing power and data), DeSci (accounting of science/charity), RWA (accounting of houses/office buildings), PayFi (accounting of supply chain finance), and SocialFi (accounting after quantification of social value).

7. Traditional giants begin to enter

This year, we have observed that more and more traditional companies are entering the crypto track from various angles, such as Paypal entering the stablecoin track through PYUSD; JD.com's stablecoin entering the Hong Kong stablecoin sandbox; a large number of US listed companies began to reserve BTC, etc.; traditional cross-border payment companies began to accept stablecoin payments.

Does this bring us a new round of thinking: How to serve this group of new players entering crypto? Will these new players have new ideas? Our focus next year will focus on observing the demand for crypto from these large-scale new players.

8. What do you think?

In the process of preparing this annual report, we collected some opinions from friends in the industry on the primary and secondary investment opportunities next year.

The following are their main points for your reference:

1. The combination of AI and Crypto is still the direction that most people believe has potential in the future, especially AI Agent, which is regarded as an important application for the next round of bull market.

2. Payment and RWA

3. New public chain ecology, focusing on Hyperliquid, Monad, Berachain, Base and Solana

4. ICO return

5. BTC is a deterministic opportunity

6. Risk-free arbitrage

7. DEX trading terminals (such as Dexx, GMGN, Infinex) and intent-based chain abstractions (such as Across, Near Intent for Base and SOL)

8. Options related, can have real income and arbitrage inside and outside the circle

9. User acquisition tools combined with MEME, MEMEFi

Catherine

Catherine