Author: Lars, head of research at The Block

Translated by: Jordan, PANews

In May, most indicators in the cryptocurrency market fell. This article will use 11 pictures to interpret the crypto market conditions in the past month.

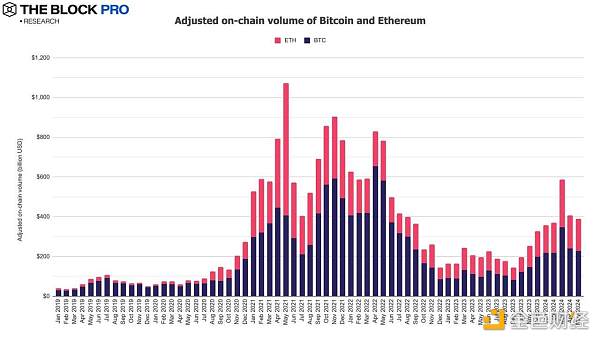

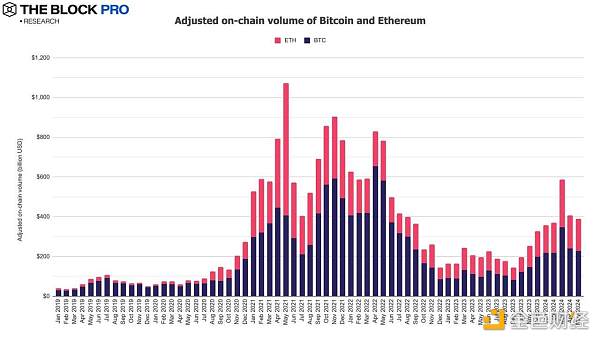

1. In May, the adjusted total transaction volume on the Bitcoin and Ethereum chains fell by 4.4% to $390 billion, of which the adjusted transaction volume on the Bitcoin chain fell by 4.7%, and the transaction volume on the Ethereum chain fell by 3.9%.

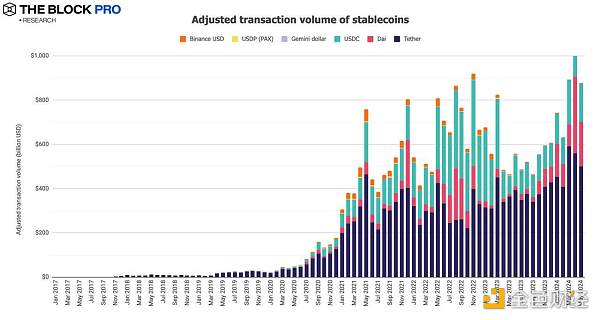

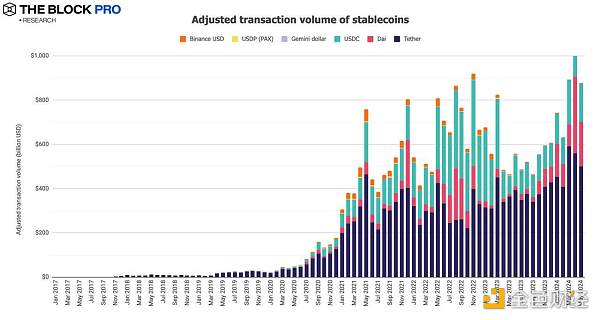

2. The adjusted stablecoin on-chain transaction volume in May fell by 20.5% to US$879 billion; the supply of issued stablecoins increased by 0.5% to US$141.9 billion, of which the market share of the US dollar stablecoin USDT increased to 78.8%, while the market share of USDC fell slightly to 17.1%.

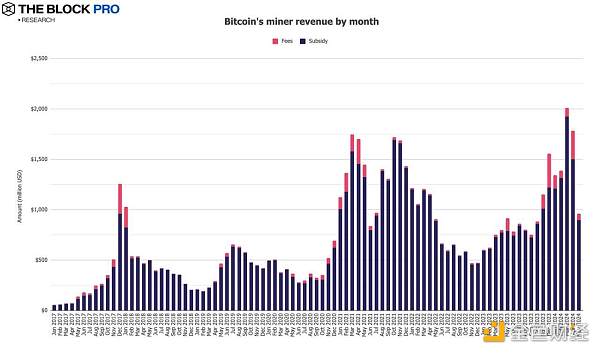

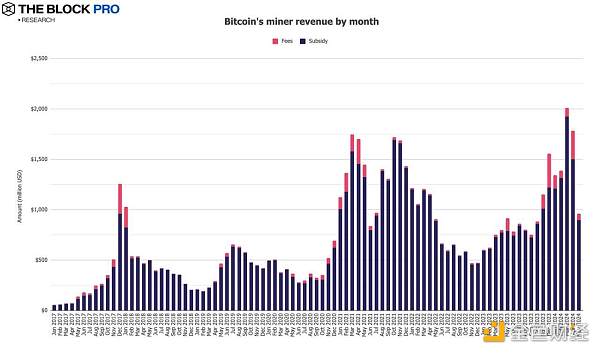

3. Bitcoin miners' income fell to $963 million in May, a drop of 46%. In addition, Ethereum staking income rose 4.1% to $267 million.

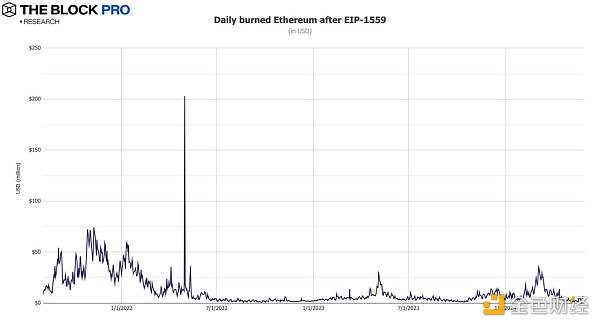

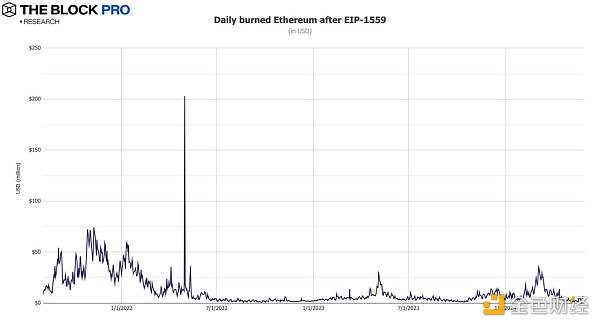

4. In May, the Ethereum network destroyed a total of 26,747 ETH, equivalent to $91.7 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has destroyed a total of about 4.3 million ETH, worth about $12.1 billion.

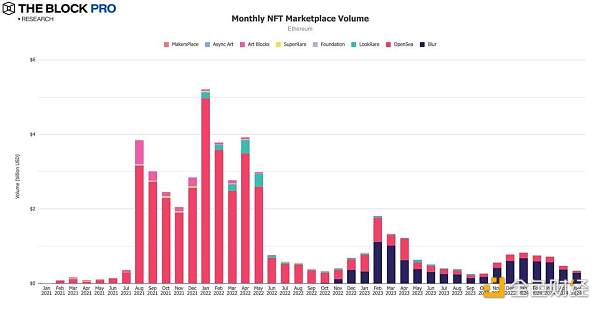

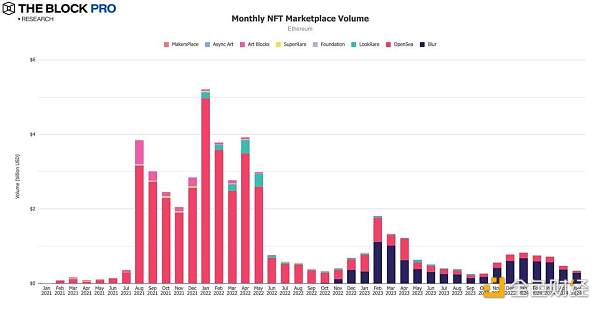

5. In May, the transaction volume of the NFT market on the Ethereum chain fell sharply again, down 27.8%, further falling to about $344 million.

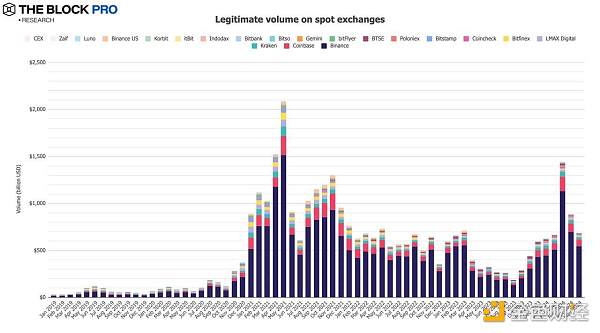

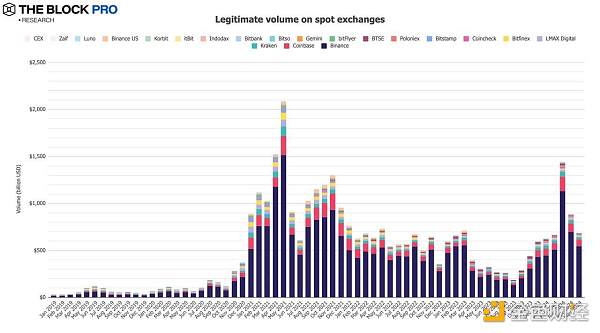

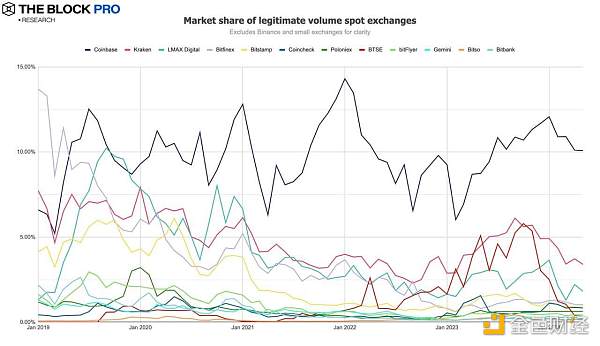

6. The spot trading volume of compliant centralized exchanges (CEX) fell in May, down 22.5% to US$68.9 billion.

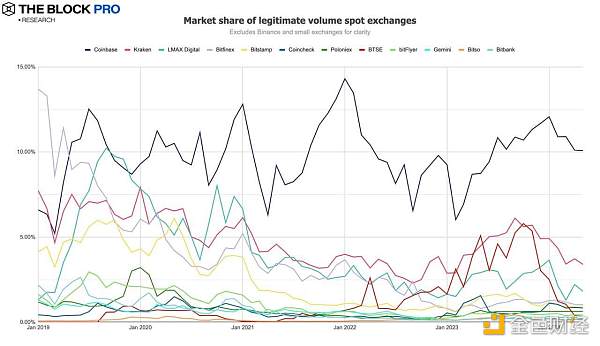

7. The spot market share rankings of major cryptocurrency exchanges in May are as follows: Binance is 79.4% (an increase from April), Coinbase is 10.1%, Kraken is 3.4%, and LMAX Digital is 1.8%.

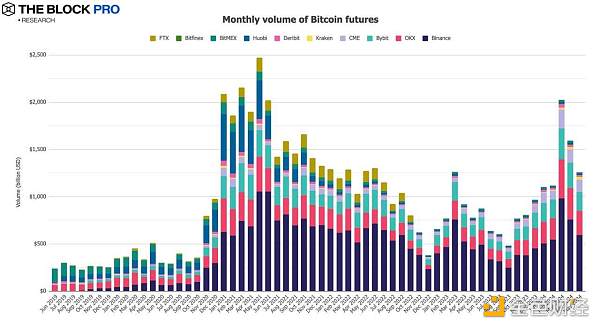

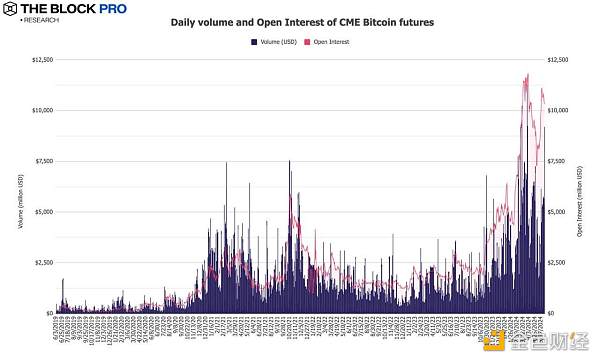

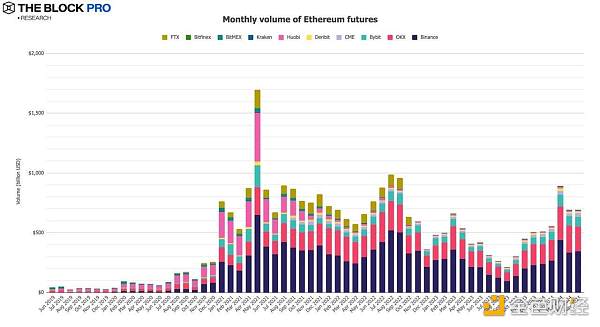

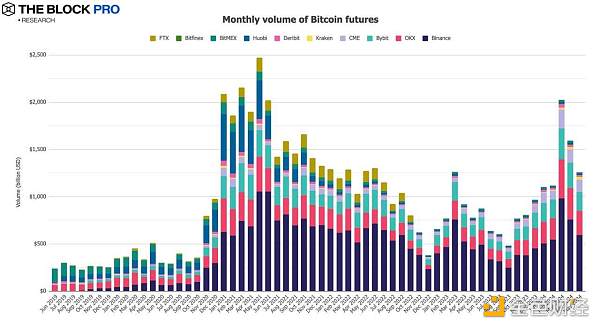

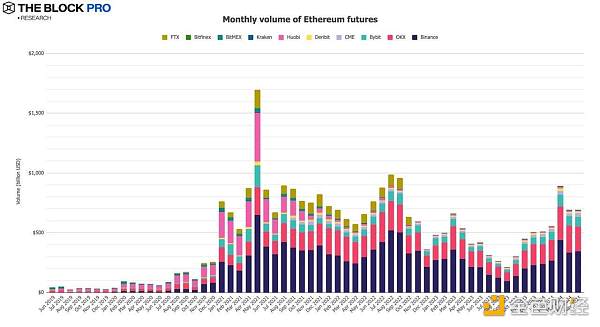

8. In terms of crypto futures, the increase in open interest of Bitcoin futures in May reached 12.9%; and thanks to the approval of the spot Ethereum ETF by US regulators, the open interest of Ethereum futures increased by 52%, setting a historical high; in terms of futures trading volume, Bitcoin futures trading volume in May fell 21% to US$1.26 trillion, and Ethereum futures trading volume rose 0.2%.

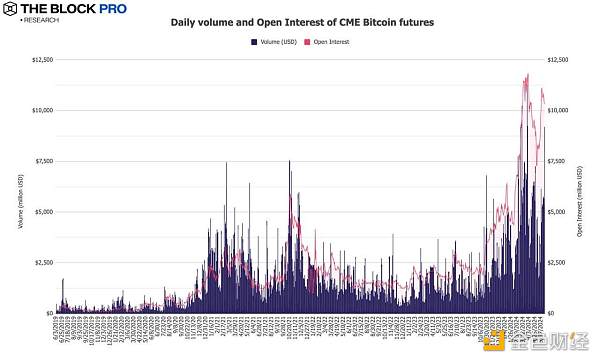

9. In May, the open interest of Bitcoin futures at the Chicago Mercantile Exchange increased by 15.9% to US$10.3 billion, and the daily average volume (daily avg volume) fell by 9% to about US$4.35 billion.

10. The average monthly trading volume of Ethereum futures decreased to US$692 billion in May, a slight increase of 0.2%.

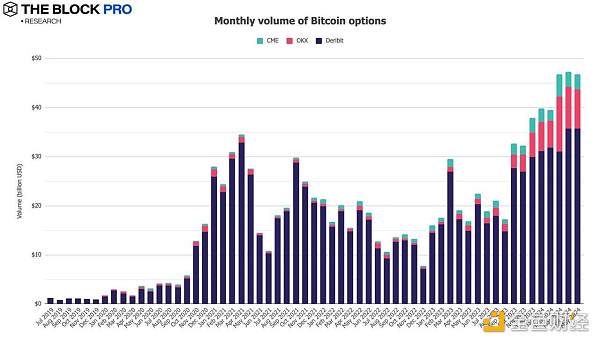

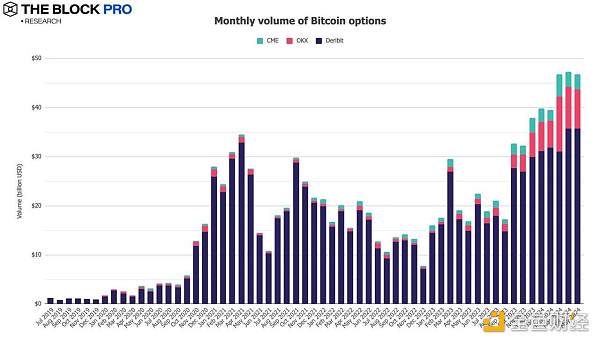

11. In terms of cryptocurrency options, the open interest of Bitcoin options rebounded in May, with an increase of 30.5%, and Ethereum positions also rose, with an increase of 41.4%. In addition, in terms of Bitcoin and Ethereum option trading volume, Bitcoin option trading volume reached US$46.8 billion, a decrease of 1.2%; Ethereum option trading volume reached a new high of US$31.4 billion, an increase of 19.2%, setting a new historical high.

Weatherly

Weatherly