Author: Josh O'Sullivan, CoinTelegraph; Translator: Deng Tong, Golden Finance

As 2024 draws to a close, the cryptocurrency space has had an important year for those who have played a role in promoting and hindering the space. One side embraces the technology and wants to push it forward, while the other side still has not accepted it or has given crypto a bad name.

This article highlights seven promoters and seven blockers who have had an important impact on the development of cryptocurrencies this year.

Pro-cryptocurrency fundamentalists

Donald Trump

US President-elect Donald Trump has become an advocate for Bitcoin and cryptocurrency this year, proposing the establishment of a Bitcoin reserve and promising that the United States will become the world's "cryptocurrency capital."

His speech at the Bitcoin 2024 conference in Nashville was a pivotal moment in his campaign’s crypto policy, as he changed the political narrative around BTC.

It was a dramatic shift from his 2021 views, when he said Bitcoin was “like a scam” and that he “didn’t like it because it’s another currency that competes with the dollar.”

Nayib Bukele

Salvadoran President Nayib Bukele has supported the adoption of cryptocurrencies through the continued status of BTC as legal tender and through blockchain in its economy.

In a $1.4 billion loan deal with the International Monetary Fund (IMF), Bukele’s government agreed to abandon some of the Bitcoin activities it had been conducting, but the National Bitcoin Office said it would “continue to purchase one Bitcoin a day.”

Hester Peirce

Securities and Exchange Commission Commissioner Hester Peirce, known as “Crypto Mom,” has been praised by the crypto community for her resistance to the agency and her advocacy for clarity in its approach to digital assets.

Peirce has pushed for reforms within the SEC to enact policies that support the long-term growth of the cryptocurrency industry and unleash its potential innovation.

Brian Armstrong

Coinbase boss Brian Armstrong has been at the forefront of the 2024 crypto wave, engaging with lawmakers on crypto issues and stepping up support for crypto in the U.S., U.K. and Australia through the Stand With Crypto lobbying group.

Coinbase has also been in a legal battle with the SEC and recently tried to push crypto companies to stop working with law firms that employ former SEC litigators.

Vitalik Buterin

Ethereum co-founder Vitalik Buterin continues to push the boundaries of blockchain capabilities to further decentralization and crypto innovation.

From proposing changes to Web3 wallets to improve security and privacy to defending against encryption-breaking quantum computers, Buterin has continued to promote crypto and ways to protect it in the financial sector this year.

Senator Cynthia Lummis

Senator Cynthia Lummis has been a staunch supporter of cryptocurrency on Capitol Hill, proposing the idea of a U.S. government BTC investment strategy and advocating for BTC in mainstream policy discussions.

Last November, Lummis said the U.S. Treasury should convert some of its 8,000 tons of gold holdings into BTC to build a strategic reserve of cryptocurrency.

She said the immediate impact of the conversion on the U.S. government's balance sheet would be "neutral," rather than spending about $90 billion to buy BTC at market prices.

Michael Saylor

MicroStrategy founder and Bitcoin bull Michael Saylor leads the way on how public companies are adopting BTC as their primary treasury reserve asset and reaping huge windfalls from it.

MicroStrategy owns 439,000 BTC, which is pushing the company beyond the value of established companies like Nike and Starbucks. Saylor also tried to get Microsoft in on the action but failed, but it was a nice try.

Opposition to Restricting and Hindering Cryptocurrency

SEC

In 2024, the U.S. Securities and Exchange Commission (SEC), under the leadership of Chairman Gary Gensler, has gradually stepped up its crackdown on cryptocurrency companies through lawsuits and enforcement actions, adding to uncertainty in the industry.

Gensler will resign in January. Gemini co-founder Tyler Winklevoss said no apology could "undo" the damage done to the crypto industry by Gensler and his SEC.

FCA in the UK

The UK’s Financial Conduct Authority has also continued to tighten its grip on the cryptocurrency industry — much like the SEC across the pond in the US — enforcing rules that the local industry believes stifle innovation and push crypto companies to friendlier jurisdictions.

The FCA recently issued warnings against unauthorized platforms such as Solana-based memecoin project Retardio and memecoin generator Pump.fun.Both platforms were allegedly offering financial services without proper authorization, with Pump.fun being banned by the regulator in the UK.

Sahil Arora

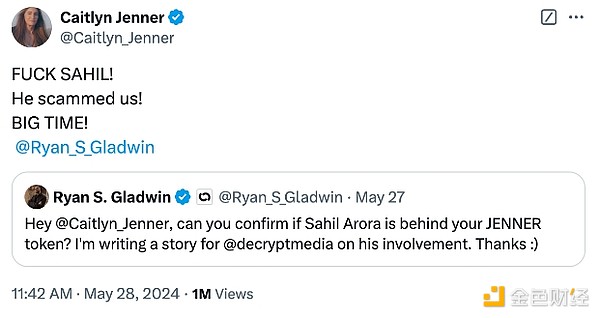

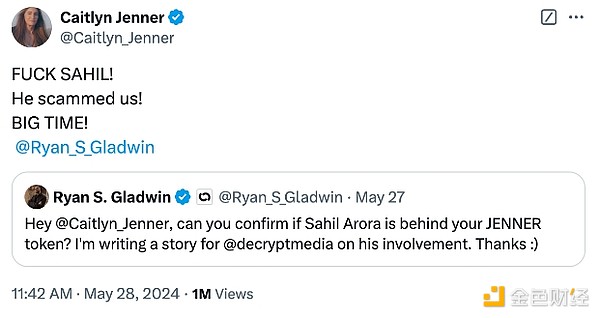

Sahil Arora, known as the mastermind behind Memecoin, gained notoriety in 2024 for launching a number of celebrity-endorsed Memecoins, which were then loudly condemned by some of those celebrities.

Source: Caitlyn Jenner

He allegedly worked with celebrities such as Caitlyn Jenner, Rich the Kid and Iggy Azalea to convince them to promote Memecoin through social media. He then allegedly sold his share of each token before the price plummeted.

Biden Administration’s ‘Operation Choke Point 2.0’

Those in the cryptocurrency space have long accused President Joe Biden’s administration of an elaborate plot to isolate cryptocurrencies from the banking system, dubbed “Operation Choke Point 2.0.”

More than 30 cryptocurrency and tech founders in the U.S. have reportedly been denied access to banking services, according to Andreessen Horowitz co-founder Marc Andreessen.

On Nov. 27, Coinbase’s Armstrong joined the chorus of accusations, calling it one of the “most unethical and un-American” things that could be done.

Dark Angels Ransomware Group

The Dark Angels ransomware group has hit the cryptocurrency industry hard in 2024 and is considered one of the most active cybercrime groups in the industry to date.

According to Chainalysis, the group received the largest ransom of $75 million paid in BTC in July, marking a 96% increase in ransomware payments from 2023.

The group has targeted centralized cryptocurrency exchanges, taking advantage of rising cryptocurrency prices and increased trading volumes to have the greatest impact.

Pig Killing Scams

Pig Killing Scams have become one of the most prevalent forms of cryptocurrency-related fraud, costing victims more than $75 billion worldwide.

These scams involve criminals establishing long-term, trust-based relationships online and ultimately coercing victims into participating in fake cryptocurrency investment schemes.

On December 10, nearly 800 people were arrested in a raid in Lagos, Nigeria, for their alleged involvement in the crime.

State-sponsored Cybercrime

State-sponsored cybercrime has surged this year, with the notorious Lazarus Group, which is linked to North Korea, moving more than $1 million in Bitcoin in January after a period of silence.

Since 2017, the Lazarus Group has been linked to over $3 billion worth of cryptocurrency thefts, including the $600 million Ronin Bridge hack.

The Elliptic 2024 report also shows that AI-driven tools are facilitating nation-state-sponsored cybercrime, leading to deepfake promotions, ransomware attacks, and other types of scams.

In short, 2024 unfolds as a long tug-of-war between innovators, regulators, scammers, and nation-states.

Cryptocurrencies are currently gearing up for 2025, driven in large part by the U.S. government’s promise of a crypto-friendly economy and hopes for continued institutional adoption.

JinseFinance

JinseFinance