Author: Zixi.eth, Source: Twitter @Zixi41620514

Abstract

1. The team background of most projects is That’s right, there is no grassroots team,it’s either a Ph.D., a university teacher, or a serial entrepreneur. And Western teams account for the vast majority. [Excellent Team]

2. In current or future head projects, what they will do at the beginning is most likely to be unique,but everyone may not be able to accept it. Can't understand. [Advanced prediction of the market]

3. Obtaining financing from leading institutions is the only way to take off. You may not succeed if you get it, but if you don’t get it, there is a high probability that the ceiling is not high. [Reliable Institutional Endorsement]

4. For lnfra projects, the core competitiveness across cycles is whether one or two trump projects can be produced in the public chain. In the early days, the launch of public chains did not rely on ecology, but when the wave recedes, only public chains with real ecology can transcend the cycle. Infra project parties must pay attention to ecological construction. Ace projects are the real competitiveness that enables public chains to transcend cycles. For product project developers, once the product becomes big, they can expand downward and become a public chain. [Ecology is the core competitiveness in the mid-to-late period]

5. Whether it is a product or a public chain, it must solve a pain point in the market, and its own solution is unique , definitely not copycat. [Innovation]

1.Avalanche: The team has a good background + unique technical means, so it has strong financing capabilities and has created a good ecosystem

2021 is an undeniable copycat season, especially in the second half of the year. As Ethereum reached 4000+, the mainnet gas fee was too high, and there was no L2 at the time, so users and funds began to overflow from Ethereum to other L1s. The biggest puller at that time was Solana. Since it was a bull market, the market was still looking for other targets, so the market’s attention gradually fell on Avax because of:

1. Avalanche The team is good. CEO Emin Gǔn Sirer: Computer scientist and associate professor at Cornell University. Sirer developed the Avalanche consensus protocol underlying the Avalanche blockchain platform and is currently the CEO and co-founder of Ava Labs. He was an associate professor of computer science at Cornell University and the former co-director of the Initiative on Cryptocurrencies and Smart Contracts (IC3). He is known for his contributions to peer-to-peer systems, operating systems, and computer networks.

2. Unique technical means. It can be said to be the earliest "modular" idea, using XCP three chains, X chain is used to create and trade assets, C chain is used to create smart contracts, P chain is used to coordinate validators and subnets, and gossip avalanche is used to confirm the consensus. At that time, it seemed that the brain circuit was very big, and it was a very good idea.

3. Because of 1+2, the financing ability is very strong. In 2020, it completed 12 million private placements and 46 million public placements. In September 2021, the foundation raised 230 million U.S. dollars, and in November the ecological accelerator raised 18.5 million. The strong financing capabilities combined with the MM pull offer allowed retail investors to see, understand, and believe in the team's endorsement, so retail investors' buying orders were extremely strong.

4. At that time, avalanche had the ace project Defikingdoms in the ecosystem. This was a very creative DeFi + GameFi project at the time, using games (not bad) with beautiful graphics. Showing the meaning of DeFi, DFK subsequently changed from an ecological project to Avalanche's Appchain. This project made avalanche famous. Secondly, there are also good projects such as GMX, traderjoe, etc.

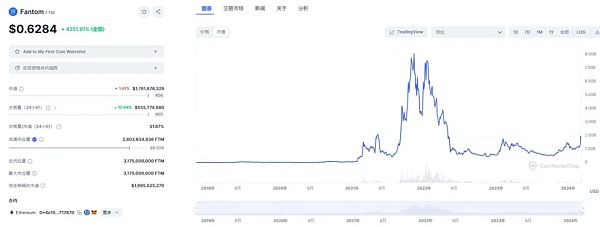

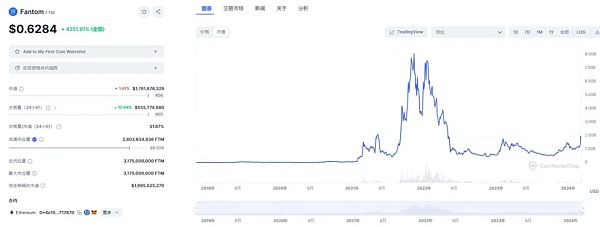

2.Fantom: The soul figure leads the public chain to the peak and also to the bottom

The soul figure of Fantom is AC, and AC is DeFi Old OG is the founder of Yearn Finance, Phantom, etc. YFI has created a thousand-fold myth in the bull market, so the community’s expectations for AC are so high that the community calls him the father of DeFi.

1. There is no need to say anything about the team, AC is the face of Fantom.

2. Fantom raised 40 million in ICO in 18 years. In the 21-year bull market, there were three consecutive rounds of financing, with Alameda investing 35 million, Blocktower investing 20 million, and Hyperchain investing 15 million. After experiencing a major correction in May.

The reasons why Ftm has been making rapid progress are:

1. AC has been calling for orders, and everyone believes in AC.

2. A lot of money has been raised, so Fantom has the confidence to spend 370 million tokens (approximately equivalent to 200 million US dollars) to stimulate ecological development, and DeFi on the chain is developing rapidly. .

Why Ftm began to plummet at 22:

1. Ftm started because AC was a cofounder, and will also return to zero because AC left. The lack of soul figures has caused the community to lose confidence;

2. The ecology is very ordinary, without any innovation, basically all defi, and all copycat. Big projects in the currency circle are all unique. It's just that the ugly ones are unique or the beautiful ones are unique, but neither one is copycat.

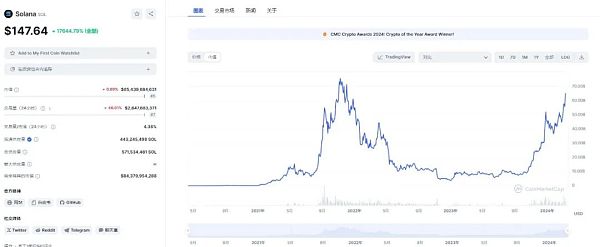

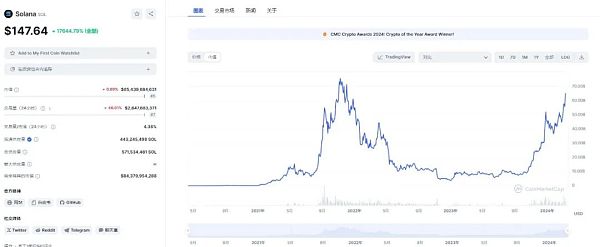

3.Solana: Development goes through ups and downs, hackathons create project miracles, This bear market has come back to life, and its ecosystem is unique

It was very difficult for Solana to raise funds in the early stages. Despite the strong team background, it was not easy to raise funds in 2018-19. In a market that is increasingly wary of high-performance public chain stories, Solana had to compete with other projects. At that time, Solana was not widely known by the market. However, through persistence in its products and a pragmatic attitude, Solana gradually attracted the attention of investors.

During the development of Solana, there was a key disagreement, which involved the strategic choices of the founders of Multicoin and Solana. As an early investor, Multicoir insists that Solana needs to be listed as soon as possible to build brand community consensus. At the same time, Solana’s founders hope to launch a stable and reliable mainnet first. This decision ultimately proved to be correct, as it laid the foundation for subsequent cooperation with SBF, which was looking for a high-performance public chain to work with.

Several key reasons for the follow-up from 0-1:

1. SBF’s participation played a decisive role in the rise of Solana. SBF not only invested in Solana, but also led his team to develop the Serum project based on Solana, which greatly improved the visibility and legitimacy of Solana. Later it was even spread that 70% of Solana’s TVL was supported by the SBF team.

2.Solana’s hackathon project has created many miracles. Through hackathons and various incentives, Solana cultivates an active developer community, which fuels the growth of its ecosystem. Subsequently, Top projects such as Magic Eden, Stepn, and jito appeared.

3.Solana, in the hands of SBF, creates miracles by pulling the market, and the wealth effect is the best marketing tool.

4. Despite the subsequent collapse of FTX and significant price fluctuations, Solana still maintains its developer ecosystem and community activities. Through continuous incentives and hackathons, Solana continues to improve its infrastructure. It also stimulates the development of more innovative applications and further promotes the prosperity of the ecosystem, demonstrating its resilience and the key to its ability to survive this bear market. And we have seen on Solana that its ecological development is gradually different from that of the Ethereum community, especially the collective migration of DePIN to Solana.

Good endorsement + the wealth effect of market pull + the existence of SBF has attracted many developers and ecological projects. And because of its high performance, Solana has attracted many unique ecological projects.

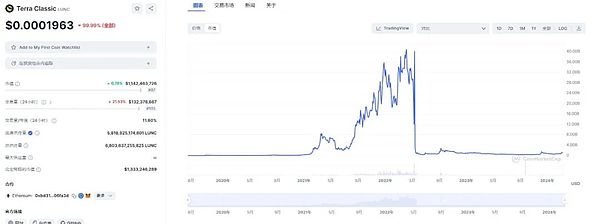

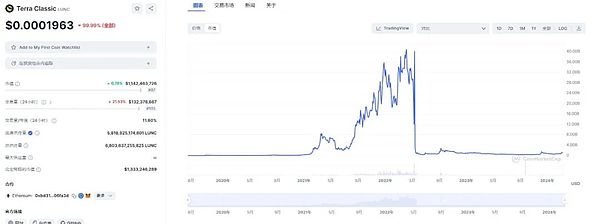

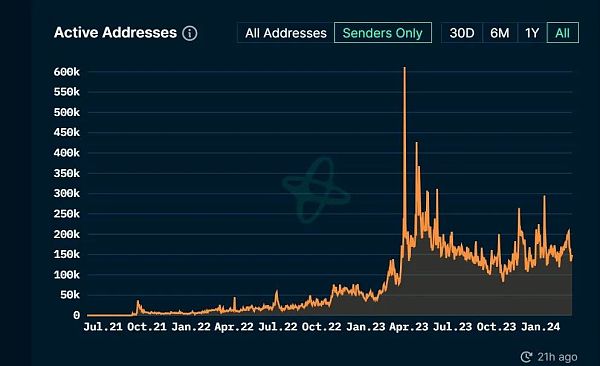

4.Terra: Because of the ecological double generation The currency spiral structure + high interest rate took off, but also because the ecological spiral structure died and returned to zero

Terra has several key points from 0-1 Reasons:

1. In terms of team, Do Kwon graduated from Stanford and has a good team background. Moreover, I am very active on Twitter and am very good at causing trouble.

2. South Korea’s national chain is extremely FOMO in South Korea. Korean VC, 3AC, etc. took off because of Terra, and also returned to zero because of Terra. Financing is also quite good, raising US$77 million in two rounds.

3. In terms of ecology, Luna+UST relies on the arbitrage mechanism and supply and demand to adjust and stabilize prices, while LUNA serves as the stabilizer of UST and became the most eye-catching dual currency on the market at that time. Algorithmic stablecoin system, the two interact to form a positive spiral. Terra also subsequently launched the important DeFi project Anchor, which provided an ultra-high current yield rate of 19%-20%. It was once touted as the "gold standard of Crypto passive income" and attracted a large amount of investment as a highlight. Otherwise, it will pave the way for a thunderstorm later. Everyone is calculating every day how many days Terra’s money can still pay 20% interest. During the bull market, UST became the third largest stablecoin with a market value of US$18 billion, and LUNA’s market value reached a maximum of US$41 billion. Its ecological payment project Chai is also pretty good. Chai once received a US$45 million investment from SoftBank.

Once the market reverses, the positive spiral will turn into a death spiral:

3. In 2022, the cryptocurrency market will decline as a whole, causing investors to Transferring funds from other cryptocurrencies to UST to obtain high interest rates makes Anchor's deposit size much higher than its borrowing size, resulting in a huge balance of payments. In the early morning of May 8, 2022, LFG was withdrawing US$150 million of UST liquidity from the UST-3Crv pool in preparation for the formation of the 4Crv pool. An address suddenly sold 84 million UST, which seriously affected the balance of the 3Crv pool. Multiple whale accounts began to sell UST continuously on Binance, causing UST to briefly unanchor.

As the reserves gradually depleted, the market's confidence in UST began to waver, and a large amount of UST was sold, causing the price of UST to further destabilize. In order to stabilize the price of UST, a large amount of LUNA was issued, causing the price of LUNA to plummet, forming a so-called death spiral. In order to prevent Luna and UST from plummeting, LFG needs to sell the treasury's BTC and other tokens, causing the market to plummet. Luna and UST brought down the entire market.

Good tokenomics (actually bull market ponzi) + unique ecology create Terra. But Tokenomics also caused the collapse of Terra. If the ecosystem can keep up, will Terra not collapse?

5. Arbiturm: The first team to talk about OPL2 + the bull market has received huge amounts of financing and created an excellent ecosystem

Several key reasons why Arbitrum went from 0-1:

1. The team offchainlabs started working on L2 in 2018 and completed the angel round in 2019, making it the earliest Batch L2 team. The team's first-mover advantage is extremely obvious. Then in April 2021 and August 21, two consecutive financing rounds totaling US$140 million were completed. The team’s technical background has a clear first-mover advantage.

2. The earliest batch was launched on the OP L2 mainnet. It was in the bull market in September 21. It is relatively easy to accumulate users and the ecosystem. It is easy to accumulate. Ecological first-mover advantage.

3. Because we have raised a lot of money, we have money to work on the ecosystem and attract developers.

4. The airdrop went very well, creating a large wealth effect in the early bear market in March 2022. Unlike Starkware, which saw its DAU drop by 90% after its airdrop, Arbitrum did not lose much DAU after its airdrop.

5. There is a trump card project in the ecosystem, GMX. I won’t go into details about how awesome GMX is. During the bear market, it rose 100% against the trend. It is an innovative idea to use spot dex as perp dex. GMX contributed a large number of users and transactions to Arbitrum in the early days.

Good team background + leader of the story——》Easy to raise funds——》Launch the mainnet at the “right time”——》Because a lot of money has been raised, it can spread to developers Money——》Until a trump card project can stand up and support the public chain.

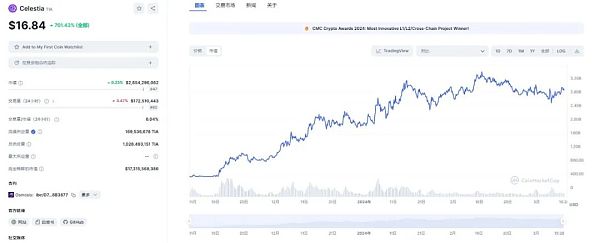

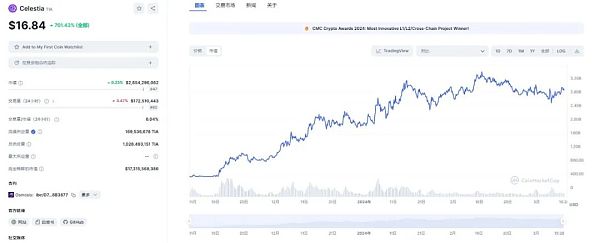

6. Celestia: Clear positioning, but ecological Weak

Celestia went from 0-1 for a few key reasons:

1 .The story of Celestia is well told. As the first project to propose a modular blockchain network, Celestia adopts a modular design to separate consensus and execution and provide DA services. At its inception, there were few modular blockchain and DA-focused solutions, so Celestia had few direct competitors. This gives Celestia a unique market position.

2.Celestia was founded at a time when the market was clearly moving towards greater scalability and efficiency, by providing a solution focused on data availability , meeting the market’s demand for higher performance Layer 2 solutions. Celestia is ideally suited as the data availability layer for Rollups. It allows Rollups to push stateful execution off-chain, relying on Celestia for consensus and data availability, thereby improving overall scalability.

3. The team is good. Mustafa is the co-founder of UCL and Chainspace, which was later acquired by Facebook.

4. Celestia’s ecological construction is weak. But after choosing to join the cosmosecosystem, Stakingtia’s subsequent airdrop rewards are very rich. Therefore, tia has certain value support.

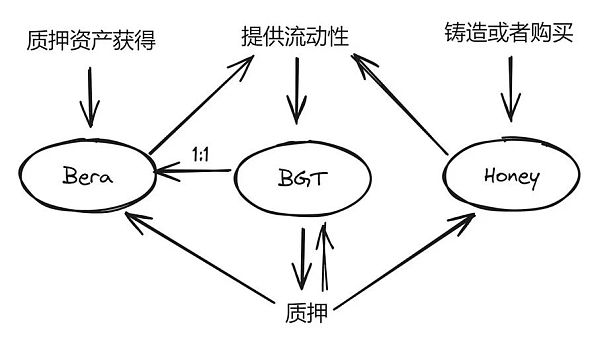

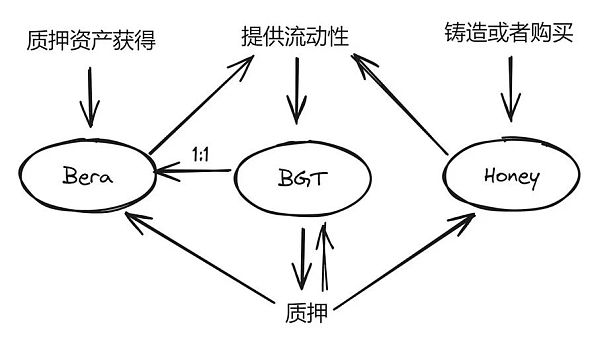

7.Berachain:Luna2.0, third generation Can the currency model reshape Luna’s bull market growth miracle?

Berachain is getting a lot of attention now (after all, it hasn’t taken off yet), so let’s talk briefly Talk:

1. Although the team is an anonymous team, it is an old OG that has been in the currency circle for 15 years. In 2021, I issued a Smoking Bear NFT. After experiencing defisummer, I deeply realized the importance of liquidity to the public chain, so I launched Berachain.

2. It is also because the team background should be good, so it was able to obtain 42m financing from polychain and hackvc during the deep bear period in April 2023.

3. Although the story told by the entire chain still serves defi (taking the sword of the previous dynasty to kill the officials of this dynasty), the token design is very exquisite, and the three-token design is bera/ Honey/bgt has the design feel of luna/terra with the left foot stepping on the right foot. Luna/UST’s interest rate design is very imaginary and relies on Anchor’s lending interest rate difference. Learning from the failure of Luna/UST, Berachain’s three-token model may be able to effectively mitigate (not avoid) the dual-token death spiral. Referring to Luna’s wild surge in the bull market, the market naturally has high expectations for Berachain.

8. Axie: a special product during the epidemic, Southeast Asian users Tools to Survive

Axie went from 0-1 for several key reasons:

1. The impact of the epidemic at that time caused the daily income of Southeast Asian users to be very low. The P2E model created by Axie has changed players' expectations for games, turning it from a recreational activity into a possible source of income. The key point is that the income is not low. Thanks to the background of the bull market, more and more people As players join the game, the currency price rises, and the peak weekly income can reach 300-400 US dollars. In areas with unstable economies or affected by the COVID-19 epidemic, this model provides a new income opportunity. Games not only provide entertainment but also give players control over the tools of production by allowing them to participate in economic activities, which is particularly attractive to players in developing countries.

2. As the leader of blockchain games at the time, in 2021, with the strong support of various community associations and investment institutions, Axie Infinity’s daily revenue and number of active users reached its peak, and its market share occupied Nearly 2/3 of blockchain games. During this stage, game revenue and token value reached historical highs. AXS's market capitalization peaked at US$10 billion.

Resetting to zero is also very simple. There are no positive externalities in the Ponzi game, and the results are all returned to zero.

9.Eigenlayer: In line with the general direction of user funds and leverage, and DA is well combined with restaking

The story of Eigenlayer from O to 1 can be understood as:

1. This story is told sufficiently halal,The whole story in early 2022 When the ETH staking ratio was less than 5%, we dared to talk about a subdivided track.

2. As a PR-type CEO, Kannan can attract the attention of VCs.

3. The Eth staking ratio is gradually increasing visibly to the naked eye, from 0 to the current 30% eth staking in 3 years.

4. Eigenlayer’s star ecological project is EigenDA. The story of restaking can later be combined with DA. The modular blockchain’s DA has become one of the best use cases for restaking.

5. Because 1+2+3+4, VC is willing to pay. And this also meets the needs of Ethholders, which is to continuously increase leverage and improve capital liquidity.

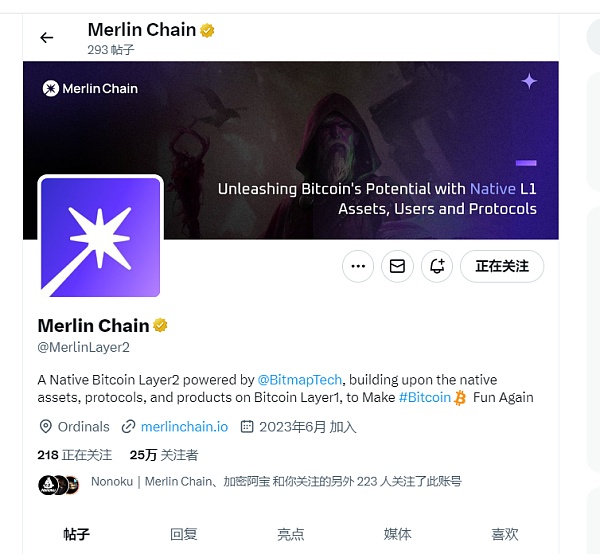

10.Merlin: Core Figure + Wealth Effect It created community unity, and the subsequent TVL volume was also very clever.

Merin has basically taken off now. We can briefly talk about the factors:

1. Founding The person's background is very nice.In many offline communications, I can understand my thoughts on entrepreneurship over the past 10 years. I have raised a lot of money in the past, I have a high level of self-awareness, and I have a deep understanding of the community. It's going to be a very, very good team in an uptrend. In addition, the founder also has a very charismatic personality. He dived into the ordinals ecosystem in March 2023 and has been actively optimistic about it very early.

2. Community unity. The community of BRC420/Merlin is indeed very united and religious, but it is also true that it makes money on the blue box. The factor that unites the community is the consensus created by the Miracle Pull at the Blue Box. The subsequent blue crystals and music boxes have very good wealth effects. Using the wealth effect to complete a quick cold start and establish a user group.

3. Ecological support. With a certain building in Singapore as the core and several subway stations as the radius, a circle of ecological project parties has gathered, and everyone is supporting each other. Therefore, the ecological growth is very fast.

4. The method of selecting TVL is very clever. In addition to BTC Staking, the head inscription + 420NFT can be pledged to redeem TVL, so the TVL book value is very large.

5. Because of 1+2+3, financing is fast. And the founder understands MKT and branding very well, so he launched it at the right time, creating the largest BTC L2 on the market.

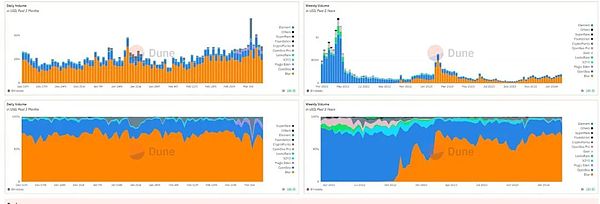

11.Blur: Think through the NFT market The core is MM and giant whales, through continuous tokenincentive incentives

In understanding why Blur can go from 0 to 1, it is necessary to Understand that there is only one core competitiveness of NFT Mktplace or exchange. It is not whether the product is good-looking or easy to use, but how to attract Makers. Only with Maker can we have Taker users and be able to talk about product experience.

So what did Blur do:

1. Use pending orders (Maker) and Bidding (Maker) to attract different makers, and give Their Token rewards. And the only ones that can use tokenincentive are blue-chip NFTs. This is also easy to understand. The vast majority of NFT trading volume is blue chip NFT, and the final destination of non-blue chip NF7 is zero. A large number of blue-chip NFTs are still in the hands of giant whales and MMs, and retail investors actually don’t have much in the hands. Therefore, the core is to serve the MM and whales of blue-chip NFT well. Retail investors are not important at all.

2. The Token incentive mode is different from X2Y2 and Looksrare. X2Y2 Looksrare's direct vampire airdrop is a one-time use and really doesn't mean much. Continuously using tokenincentive to attract whales and MM to provide liquidity is one of the core factors for Blur’s success.

3. Others are small things, product-related, such as being able to batch transactions, making an aggregator, etc., but this is not the key.

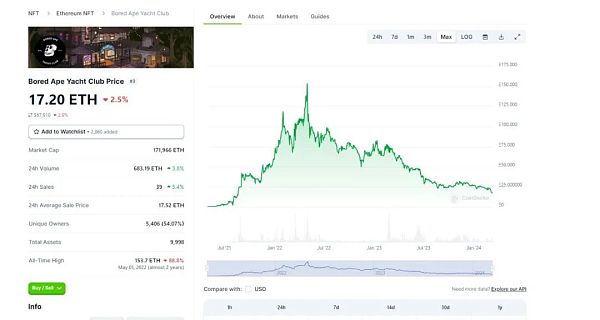

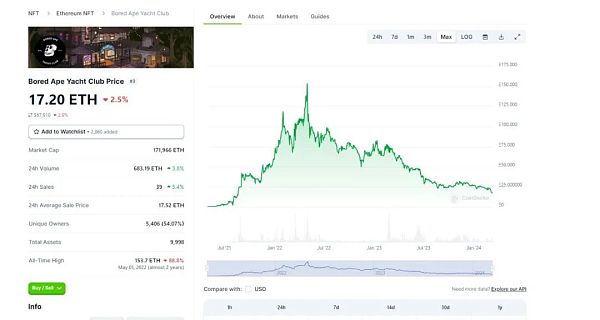

12.BAYC: The earliest NFT membership club , building consensus through celebrity effect

BAYC’s ability to go from 0-1 in the last cycle can be understood as:

1. People with BAYC NFT automatically become members of an exclusive club. This community provides a new way of socializing and creates a strong sense of belonging;The project’s strong BD has attracted a large amount of investment investors and collectors, including many celebrities, which further increases the exposure and appeal of the project; in the context of the NFT bull market, BAYC has launched a unique business model that decentralizes the IP rights of NFT owners so that holders can utilize Their own ape creates and sells goods to further promote BYAC;BAYC, with its unique artistic style and strong community utility, achieved the status of a cultural icon in a short period of time in the NFT market at that time.

2. BAYC was launched at the peak of the NFT craze and also took advantage of the market’s high interest in emerging digital collectibles at the time. Subsequently, through social media and celebrity effects, BAYC quickly established strong brand recognition and community. YugaLabs continues to expand the BAYC universe, including new NFT projects and game launches such as MutantApe Yacht Club and Bored Ape KennelClub, further increasing revenue and continuing to increase membership value and community participation; and partnering with Adidas to launch the AdidasxBAYC NFT. However, some people believe that BAYC’s model requires constant new additions and capital inflows to maintain its value, which has led some people to call it an ape universe scam. However, this was also the time when the currency market gradually entered a bear market, and NFT was difficult to crack. One of the dilemmas.

BAYC’s gradual decline in this cycle can be understood as:

1. Still has not solved the problem of what the use of NFT is. . And during the bear market, YugaLabs did not provide many airdrop benefits to the community.

13. Little Penguin: on and off the chain The marketing combination of punching and pulling brings the little penguin back to life

The fact that the little penguin can be reincarnated in this cycle can be understood as:

< /p>

1. The project has already been reset once in 2022, but because the picture is really cute, Lukaz decided to acquire it

2. The NFT story at that time was based on Onboarding web2 user toweb3 Lord, I hope to reproduce BAYC. Investors believe that Little Penguin can acquire a certain amount of outside users by using toy retail off-chain + NFT marketing airdrops on the chain.

3. Because Lukaz acquired Little Penguin, he has a lot of chips on hand. Combined with market makers, it is easy to pull the market and establish consensus.

4. Users outside the circle learned about crypto and Little Penguin through extracurricular toys. Users in the circle re-recognized Little Penguin because of the pull offer/airdrop, so Little Penguin In the second half of 2023, it came back to life and once flipBAYC.

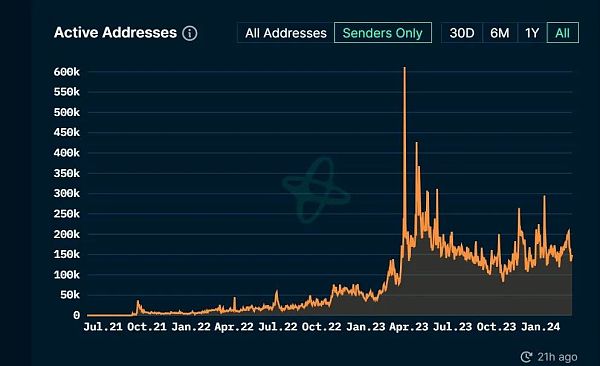

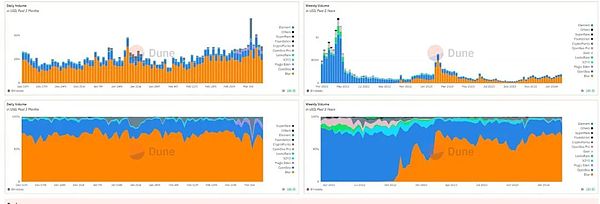

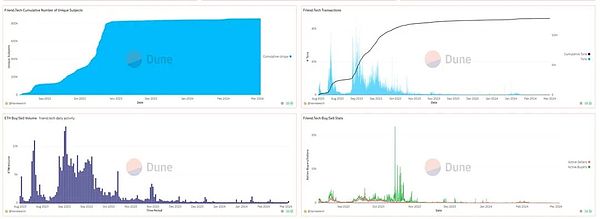

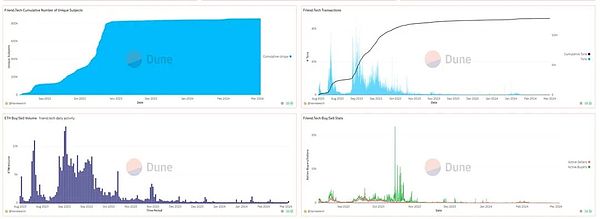

14.Friend.Tech: Quantification using tokens Personal social value, amazing brain circuit idea

Friend.tech’s growth from 0-1 can be simply summarized as

1. Did something that no one could do before - quantify personasocial value. In the Web2 world, there is no way to launch/use similar products in large quantities due to payment channels and compliance issues (the crime of illegally opening casinos). But in the crypto world, the best way to make money is to issue new assets. Therefore, FT solves the above-mentioned problems very well. Everyone can issue their own key and use E-standard + quantification curve to quantify a person’s social value. In the most simple and simple ICO, how many people can buy and sell keys depends entirely on the individual. branding. The brain circuitry of the product is amazing.

2. Although the product experience is not good, the website is often crashed, and creating an account requires gas, which is mutually exclusive within the circle, it is undeniable that this is a phenomenal product.

Judging from the amount of interaction in the figure below, FT is basically in the dark. The reasons are:

1. The model is not lasting, it is completely mutual cutting within the circle, and everyone still has more money to play. If a considerable proportion is handed over to the FT project side, the fee is too high. Stepn can at least tell a story about positive externalities, but FT can't even tell a story about positive externalities.

2. No new features were developed in the future, and it was over after making money. If the team can add some new ways to play in the future, such as placing ads on web2, advertising, and taking some positive externality measures, it might be possible There will be different outbreaks.

3. It is too late to introduce the Token mechanism. Without token incentives, it will be difficult to continue the mutual cut.

If we refer to blur’s continuous token incentive method, can FT be sustainable?

< /p>

< /p>

Anais

Anais

< /p>

< /p>