Author: 0xTodd Source: X, @0x_Todd

First of all, I am excited that the Bitcoin we all love has reached $98,000!

There is no doubt that the 40K-70K contribution is the Bitcoin ETF, and the 70K-100K contribution is MicroStrategy.

Now many people compare MicroStrategy to the BTC version of Luna, which makes me a little embarrassed because Bitcoin is my favorite cryptocurrency, and Luna happens to be the cryptocurrency I hate the most.

I hope this post can help everyone better understand the relationship between MicroStrategy and Bitcoin.

First, a few conclusions are put at the beginning:

MicroStrategy is not Luna, its safety cushion is much thicker.

MicroStrategy increases its holdings of Bitcoin through bonds and selling stocks.

MicroStrategy's nearest debt repayment date is in 2027, which is more than 2 years away.

MicroStrategy's only soft threat is the Bitcoin whale.

WeiCe is not Luna, it has a much thicker safety cushion than Luna

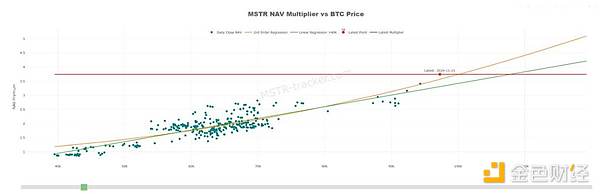

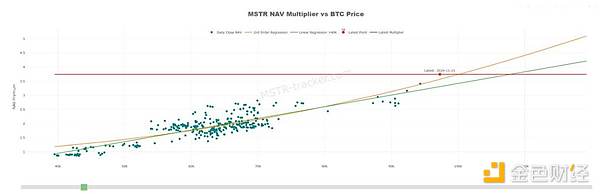

MSTR Net Worth vs Bitcoin Price

WeiCe was originally a software company with a lot of floating profits on its account and did not want to invest in production anymore, so it began to move away from the real economy and began to buy Bitcoin out of its own pocket in 2020.

Later, WeCe bought all the money in its account and began to leverage. Its leverage method is over-the-counter leverage, and it is determined to borrow money to buy Bitcoin by issuing corporate bonds.

The essential difference between it and Luna is that Luna and UST print each other. In essence, UST is meaningless unanchored money printing, which is barely maintained by 20% fake interest.

But MicroStrategy is equivalent to bottom fixed investment + leverage, which is a standard borrowing money to go long, and it bets on the right direction.

The popularity of Bitcoin far exceeds UST, and MicroStrategy's impact on Bitcoin is significantly lower than Luna's on UST. It's a very simple truth. As the saying goes, 2% daily is a Ponzi scheme, and 2% annualized is a bank. Quantitative change leads to qualitative change. MicroStrategy is not the only factor that determines Bitcoin, so MicroStrategy is definitely not Luna.

MicroStrategy increases its holdings of Bitcoin through bonds and stock sales

In order to quickly raise funds, MicroStrategy has issued multiple debts, totaling 5.7 billion US dollars (for everyone's intuitive understanding, this is equivalent to 1/15 of Microsoft's debt).

Almost all of this money is used to continuously increase Bitcoin positions.

Everyone has used on-site leverage. You have to use Bitcoin as a deposit before the exchange (and other users in the exchange) will lend you money. But off-site leverage is different.

All creditors in the world are only worried about one thing, that is, not paying back their debts. Without collateral, why are people willing to lend money to MicroStrategy off-site?

MicroStrategy's bond issuance is very interesting. In the past few years, it has issued a convertible debt.

This convertible bond is very interesting. Let's take an example:

Bondholders have the right to convert their bonds into MSTR shares, and there are two stages:

1. Initial stage:

If the trading price of the bond falls by >2%, the creditor can exercise the right to convert the bond into MSTR shares and sell it back to get the principal;

If the trading price of the bond is normal or even rises, the creditor can resell the bond in the secondary market at any time to get the principal back.

2. Late stage: When the bond is about to mature, the 2% rule no longer applies, and the bondholder can take the cash back or directly convert the bond into MSTR stock.

Let's analyze it again. This is generally a business that is sure to win for creditors.

If Bitcoin falls and MSTR has money, creditors can get cash back

If Bitcoin falls and MSTR has no money, creditors can still have the final guarantee, that is, convert it into stocks to cash out and get back their capital;

If Bitcoin rises, MSTR will rise, and creditors can give up cash and get more stock returns.

In a nutshell, this is a transaction with a high lower limit and a very high upper limit, so Micro Strategy has successfully raised money.

Fortunately, no, it should be said that it is very loyal that MicroStrategy chose Bitcoin.

Bitcoin has not let it down.

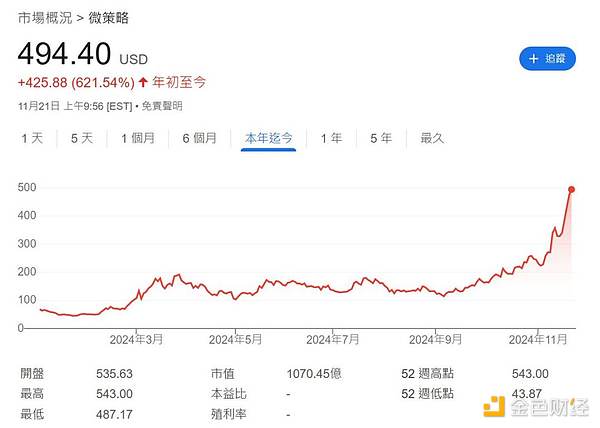

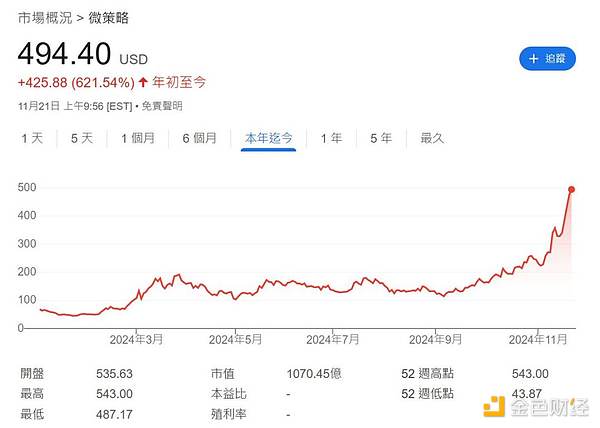

2024 MicroStrategy Stock Price Trend

As Bitcoin continues to rise, the Bitcoin accumulated by MicroStrategy in the early days has risen. According to the simple and classic stock principle, the more assets a company has, the higher its market value should be.

Therefore, MicroStrategy's stock price has also risen to the sky.

MicroStrategy's daily trading volume today has exceeded this year's absolute white horse Nvidia. Therefore, MicroStrategy now has more choices.

Now MicroStrategy not only relies on issuing bonds, but can also directly issue additional stocks and sell them for money.

Unlike many meme coins or Bitcoin developers who do not have the right to mint coins, traditional companies can issue additional stocks after complying with relevant procedures.

The fact that Bitcoin went from just over 80K to 98K today last week is inseparable from the help of MicroStrategy. That's right, MicroStrategy issued additional stocks and sold them for 4.6 billion US dollars.

PS: Companies with a trading volume exceeding Nvidia are naturally equipped with this liquidity.

Sometimes, you need to admire a company's great courage to make great profits.

Unlike many cryptocurrency companies that sell and cash out in a small pattern, MicroStrategy is as full as usual. WeStrategy reinvested all the money from the sale of stocks into Bitcoin, pushing Bitcoin to 98K.

So far, you should have understood WeStrategy's magic:

Buy Bitcoin → Stock price rises → Borrow to buy more Bitcoin → Bitcoin rises → Stock price rises further → Raise more debt → Buy more Bitcoin → Stock price continues to rise → Issue additional stocks and sell for money → Buy more Bitcoin → Stock price continues to rise...

Presented by the great magician WeStrategy.

WeStrategy's latest debt repayment date is in 2027, and we still have at least 3 years

As long as you are a magician, there will be a time to expose the magic.

Many MSTR shorts believe that it has reached the standard left side, and even suspect that it has reached the Luna moment.

However, is this really the case?

According to recent statistics, the average cost of MicroStrategy's Bitcoin is $49,874, which means that it is now close to a floating profit of 100%. This is a super thick safety cushion.

Let's assume the worst case scenario. Even if Bitcoin now drops 75% (almost impossible) to 25,000, what can we do?

MicroStrategy borrows OTC leverage and has no liquidation mechanism at all. Angry creditors can only turn their bonds into MSTR stocks at a specified time, and then angrily smash them into the market.

Even if MSTR is smashed to zero, it still does not need to be forced to sell these Bitcoins, because the earliest due date of the debt that MicroStrategy needs to repay is in February 2027.

You can see that this is not 2025, nor 2026, but Tom's 2027.

That is to say, it will take until February 2027, and if Bitcoin plummets, and no one wants MicroStrategy's stock anymore, then MicroStrategy will need to sell some of its Bitcoin in February.

At most, there are more than two years to continue to play music and dance.

This is the magic of OTC leverage.

You may ask, is it possible that MicroStrategy will be forced to sell Bitcoin by interest?

The answer is still no.

Because of MicroStrategy's convertible bonds, creditors generally make a profit, so its interest is quite low. For example, the interest rate for this one due in February 2027 is 0%.

The creditors are just greedy for MSTR's stock.

The interest rates of several subsequent debts are also 0.625% and 0.825%. Only one debt is 2.25%, which has little impact, so there is no need to worry about its interest.

MicroStrategy's main bond interest, source: bitmex

MicroStrategy's only soft threat is the Bitcoin whale

Up to this point, MicroStrategy has become a cause and effect of Bitcoin.

More companies are ready to start learning from the great operation of David Copperfield (Saylor) in the Bitcoin world.

For example, MARA, a listed Bitcoin mining company, has just issued $1 billion in Bitcoin convertible bonds, which are earmarked for bargain hunting.

So I think short sellers should be cautious. If more people start to follow MicroStrategy, the momentum of Bitcoin will be like a wild horse running away, after all, there is nothing above.

So, now MicroStrategy’s biggest opponent is only those ancient Bitcoin whales.

As many people have predicted before, retail investors have already handed over their Bitcoins. After all, there are too many opportunities, such as the meme trend. I don’t believe that everyone is empty-handed.

So there are only these whales in the market, and as long as these whales do not move, this momentum is difficult to stop. If they are luckier, the whales and MicroStrategy will form some small tacit understandings, which will be enough to push Bitcoin into a greater future.

This is also a big difference between Bitcoin and Ethereum: Satoshi Nakamoto theoretically owns nearly 1 million early mined bitcoins, but there has been no news so far; and the Ethereum Foundation does not know why, sometimes it especially wants to sell 100 ETH to try liquidity.

As of today's writing date, MicroStrategy has made a floating profit of 15 billion US dollars, relying on loyalty and faith.

Because it is making money, it will increase its investment. It can no longer turn back, and more people will follow suit. According to the current momentum, 170K is the medium-term goal of Bitcoin (not financial advice).

Of course, we are used to seeing conspiracy groups designing conspiracies in memes every day. Occasionally, we see a real top-level conspiracy, which makes us really admire it.

Anais

Anais