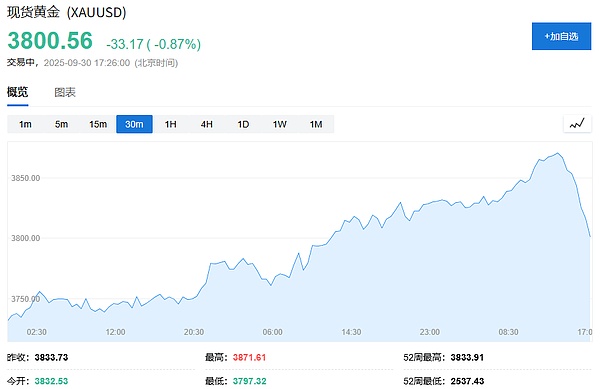

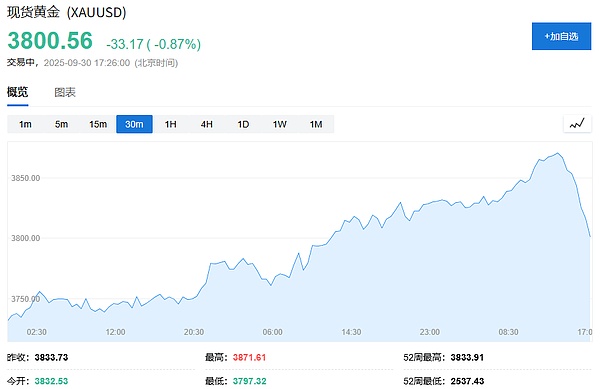

With less than two days left in the US government shutdown, key negotiations between the two parties in Congress over funding have failed. Market anxiety caused by this political deadlock has pushed gold prices above $3,800 per ounce. A meeting between US President Trump and bipartisan congressional leaders at the White House on Monday local time failed to break the deadlock. The federal government's existing funds will officially run out at 12:01 a.m. local time on Wednesday (12:01 p.m. Beijing time on Wednesday). If no agreement is reached by then, a government shutdown that will force hundreds of thousands of federal employees to take leave and disrupt public services will be inevitable. After the negotiations, both sides maintained tough positions and exchanged accusations. Vice President JD Vance warned that the US was "heading for a shutdown" and accused Democrats of holding the government "hostage." Senate Minority Leader Chuck Schumer countered that the decision on a shutdown lay with the Republicans, that the Democrats had made recommendations to the president, but that "the ultimate decision maker is Trump." Concerns about uncertainty in the US political system, coupled with a weakening US dollar, pushed gold, a traditional safe-haven asset, above $3,800 an ounce on Monday morning. It rose to $3,871 today before retreating to around $3,800.

Goldman Sachs said that the stock market is most worried about the possibility that the US government shutdown may delay the release of non-farm payroll data.

If the government shuts down, the September non-farm payroll report is likely to not be released as planned at 8:30 a.m. on Friday, which may lead to a delay in the Federal Reserve's October interest rate cut plan.

Negotiations broke down, with both parties blaming each other

With less than two days before funds ran out, Trump and Vice President JD Vance met with Republican Senate Majority Leader John Thune, House Speaker Mike Johnson, and Democratic Senate Minority Leader Chuck Schumer and House Minority Leader Hakeem Jeffries, but failed to reach any agreement.

Jeffries described it as a "frank and direct discussion." Republican lawmakers had previously proposed a short-term agreement, a "Continuing Resolution," which aims to extend current funding levels until November 21 to buy more time for negotiations. But Democrats refused to endorse it, insisting that any agreement must include an extension of health insurance subsidies that are set to expire at the end of the year. Jeffries emphasized: "Democrats are fighting to protect the American people's health care, and we will not support a partisan Republican spending bill that continues to undermine people's health care." The core of the deadlock lies in the fact that although Republicans hold a 53-47 majority in the Senate, any appropriations bill needs at least 60 votes to pass, which means they must win the support of at least seven Democratic senators. With the two parties still far apart, the prospects of reaching a consensus are slim.

Trump's tough stance increases shutdown risks

The White House has shown no willingness to compromise, which has further exacerbated market concerns.

White House Press Secretary Karoline Leavitt said in an interview with the media earlier on Monday that Trump has "leverage" and is not interested in compromise. "The leverage is in the hands of the president because the vast majority of the American public wants the government to remain open," she said. Trump himself sounded pessimistic in a phone interview with the media on Sunday evening, saying, "I just don't know how we're going to resolve this." The impasse is reminiscent of the 2018-2019 government shutdown during Trump's first term, which lasted 35 days over funding for a U.S.-Mexico border wall. More notably, the White House seemed to suggest last week that the shutdown might involve more than just temporary furloughs of non-essential government employees. A memo distributed by the Office of Management and Budget late Wednesday instructed federal agencies to "use this opportunity to consider layoffs" or permanent layoffs.

Risk aversion intensifies, pushing gold prices to new highs

The political deadlock in Washington has directly translated into market demand for safe-haven assets. On Monday, gold prices broke through $3,800 per ounce, becoming the preferred tool for investors to hedge against dollar risk and US political uncertainty.

Gold prices have risen 45% so far this year, driven by factors beyond simple short-term risk aversion. Analysts point to rising government debt, persistent inflation, and doubts about the dollar's status as the world's primary reserve currency as fundamental factors supporting the long-term strength of gold prices. The impending government shutdown has served as the catalyst for the latest round of gains. A "double-edged sword" of institutional and central bank buying has also fueled the rally. According to a report by Deutsche Bank analysts, the recent surge in gold prices has been driven by buying from ETF investors and central banks. Data shows that Western investors are pouring into gold ETFs. According to the World Gold Council, inflows into gold ETFs have been positive for four consecutive weeks, with inflows approaching 100 tons in September, the fastest monthly growth rate since April. John Reade, senior market strategist at the World Gold Council, noted that some hedge funds that previously missed out on gold's price increases are experiencing a fear of missing out (FOMO) and are starting to chase the rally. Meanwhile, speculative investors, primarily hedge funds, are also increasing their bullish positions. According to the latest data from the U.S. Commodity Futures Trading Commission (CFTC), their net long gold positions have reached a record $73 billion.

Michael Haigh, head of commodities research at Societe Generale, said: "They have not reduced these positions because recent policy speeches and inflation data point to lower interest rates and sustained inflation." Central banks around the world have also been increasing their gold reserves this year, viewing it as an effective tool to hedge against dollar risks, providing solid structural support for gold prices.

Jasper

Jasper

Jasper

Jasper Hui Xin

Hui Xin Jasper

Jasper Jasper

Jasper Jasper

Jasper Jasper

Jasper Hui Xin

Hui Xin Hui Xin

Hui Xin Joy

Joy Jixu

Jixu