Author: Day, Vernacular Blockchain

With the new round of bull market Bitcoin narrative becoming the main line, the Ethereum ecosystem that has been optimistic about the bear market is gradually weakening, and the With the strong outbreak of Solana, the encryption industry seems to be ushering in the beginning of 2024 with the "narrative of the rise of new public chains".

Although the price of Ethereum has doubled in the past year, it is still criticized by many people, and even started to FUD Vitalik. There are major problems in the decision-making level. The main reason for this phenomenon is that everyone has too high expectations for ETH ( At least outperforming the big pie), and it is also related to SOL’s outstanding performance. Today we will take stock of the new changes that have occurred in the Ethereum ecosystem this year in the past year. (FUD: Fear, Uncertainty, Doubt, an abbreviation for fear, hesitation and doubt, which refers to the negative feelings spread by people and causing panic among investors.)

01 Ethereum has entered complete deflation

Year to date, the number of Ethereum has reduced from 120.5 million to the current 120.1 million, with a total of 340,000 Ethereum destroyed in a year, worth 750 million US dollars. . With the advent of the bull market, the amount of destruction is bound to increase significantly.

Changes in the total supply of Ethereum, source: ultrasound.money

Changes in the total supply of Ethereum, source: ultrasound.money

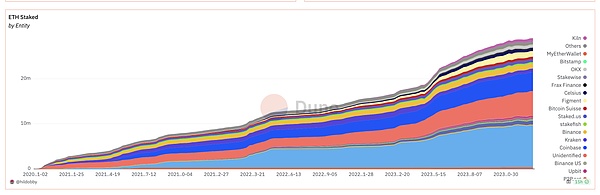

02 LSD track outbreak

Since the completion of the merger of Ethereum in September 2022, after several months of development, it has become a hot spot in the first quarter of 2023. As the end of the bear market, financial management with a stable annualized income of about 4% has attracted a large amount of funds to join, including Lido, RPL, SSV, etc. The LSD project ushered in a wave of explosion, and the pledge rate of Ethereum continued to rise. As of January 3, 2023, the pledged amount reached 28.8 million.

Changes in the amount of Ethereum pledged, source: dune.com

Changes in the amount of Ethereum pledged, source: dune.com

As the amount of pledged funds continues to expand and the Shanghai upgrade approaches, a small number of project parties have begun to target this part of the funds and launch their own DeFi products, through layers of nesting dolls, improve the utilization rate of pledged funds. After the wealth effect appears, more institutions and funds begin to pour in and lay out related tracks, thus deriving LSDFi related tracks and gradually improving LSD related tracks. infrastructure.

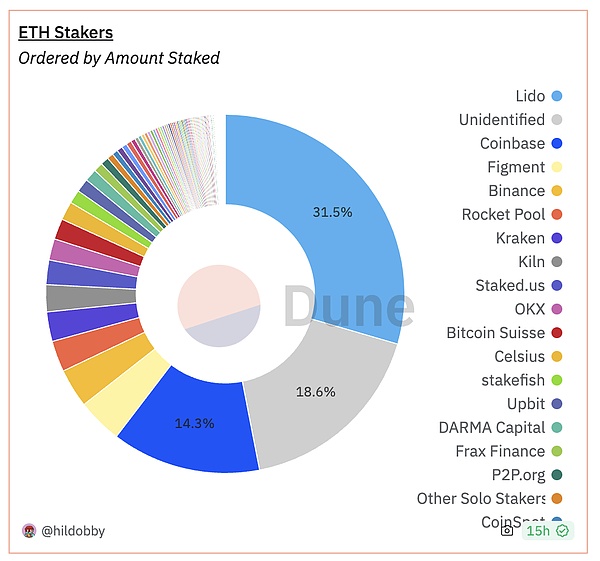

There are good things, but there are also things that make people dissatisfied. As the pledge rate increases, Lido will occupy more than 1/3 of the Ethereum pledge market share, and the pledge track is too centralized. , the market began to worry about whether the growth of LIdo threatened the consensus security of the Ethereum main network. There are different opinions on whether Lido centralization is harmful.

On December 28, Vitalik mentioned the DVT (Distributed Verifier Technology) technology to solve related problems from the perspective of pledge centralization and verification decentralization. On November 28, 2023 Today, Lido DAO has begun to adopt DVT technology provided by Obol Network and ssv network.

Market share of various projects in the staking track, source: dune.com

Market share of various projects in the staking track, source: dune.com

With the arrival of the bull market and the growth of Ethereum, it can be said that the Ethereum staking track has become a market with a scale of hundreds of billions. This is a sure thing, and with the development of the industry, stable financial management will gradually become a rigid need for some people. The development and innovation of related tracks are worth looking forward to.

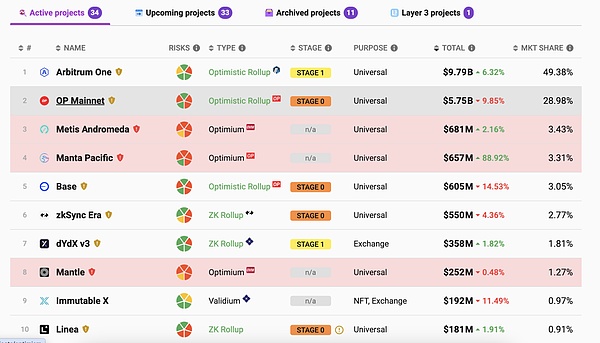

03 Layer2 blooms

Layer2 has developed into an important part of Ethereum. Each Layer 2 has made different progress in various aspects. It can be said that each chain has its own characteristics. Let’s briefly review it.

Layer2 TVL top ten ranking, source: L2 Beat

Layer2 TVL top ten ranking, source: L2 Beat

With the establishment of the bottom of the bear market in 2022, the price of Optimism will usher in a wave of explosion in early 2023. Although the ecology is obviously weaker than Arbitrum in all aspects,the project has found a different path OP Stack has cooperated with many projects, including BASE, opBNB, Manta Network, DeBank and many other well-known projects have chosen to use OP Stack technology. Recently, because the specific time of Cancun’s upgrade has been confirmed, second floors such as Optimism have once again attracted everyone’s attention.

Last year In the quarter, with the issuance of Arbitrum Token, the Arbitrum ecosystem ushered in a big explosion, and was even called "Arbitrum Summer". Representative projects include GMX, MAGIC, RDNT, GNS, AIDOGE, etc., most of which have been listed on BN.

But "institutional tokens" such as Optimism and Arbitrum have the same problem, that is, high market value and low circulation. In the past year, I have watched the two Layer 2 circulation market values go up. Although the price of Token has been rising rapidly, it can be said that the price of Token remains unchanged, and it has completely become a “cash machine” for institutions. It can be said that the project is good in all aspects, but it only provides a sip of soup for retail investors.

zkSync and StarkNet can be said to be the two leading PUAs in the industry. They have been merciless by charging handling fees, and the Woolies have been completely countered. Especially in StarkNet, the project side has been doing all sorts of tricks. The community and the project side have become like fire and water, and the Woolies hate it. Itchy, but zkSync insisted on pua to the end, and even announced that 2025 tokens would be issued. However, ZK progress is generally slow, and there will be nothing worth mentioning in 2023.

< strong>Base relied on the ecological wealth effect to attract a lot of funds in the short term, and it took advantage of several waves of traffic to rise. However, most ecological projects do not last long. As the Base mainnet launch approaches in early August, a thousand-fold meme Token Bald appeared on the chain, and the market value exceeded 100 million US dollars in 2 days. FOMO users entered the market with a huge wealth effect. Unfortunately, the project ended rug in the end, but the funds that entered were settled. down.

Not long afterward, the social track project Friend Tech’s Ponzi gameplay and the blessing of Paradigm organization were expected to make Airdrop one of the few phenomenal products in the bear market, bringing hundreds of thousands of users to the Base chain. , which has completely established the status of Base chain in Layer 2, but Friend Tech is currently in a cool state.

Online on November 21st , relying on blur's own traffic and Airdrop's expected Ponzi gameplay, although the problem of centralized wallet management arose midway, it still did not prevent it from going online for about two months, its own TVL exceeded 1 billion US dollars, and it has now become a large-capital user in the industry Another place for stable financial management.

Less than three In a week, TVL skyrocketed from 30 million to 650 million. It uses the same financial management method as Blast, attracting funds to pledge through the New Paradigm activity to obtain Airdrop. The selling point is that the pledge period is shorter than Blast and the fund utilization rate is high.

The recent Cancun upgrade is approaching , Metis suddenly emerged, with outstanding market performance in the short term, and TVL also rose to the top three in the short term. Since most Layer 2s have the problem of over-centralization of the Sequencer (sequencer), Metis is doing a decentralized Sequencer solution. As for whether it is driven by technology or capital, people have different opinions.

Via Gas fee Airdrop In the form, 100% Token Airdrop will be given to all community users to attract user participation in the short term. After the Gas fee Airdrop event was launched, in less than a week, the gas fee consumed on the chain exceeded 60 million USDC, the number of active addresses exceeded 200,000, and the TVL exceeded 120 million, which has declined after the recent event, focusing on fair distribution. It can be said that it is very conscientious for users who continue to be affected by zkSync and StarkNet PUA. As for the subsequent development, you can continue to pay attention.

It can be seen that the development of the second floor is the result of each company taking advantage of its own advantages. As the market gets better, the rise speed becomes faster and faster, and it becomes more and more simple and crude. Many of them are no longer as necessary as before. It accumulates slowly over months or even years,but through a series of stimulations and short-term bursts to occupy the market. As for whether it can be sustained in the long term, it remains to be seen.

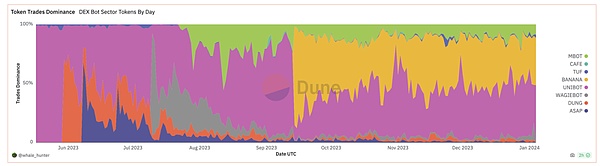

04 Dex Bot The sudden rise

It can be said that before the BRC20 inscription came up, almost 90 More than % of all issuances are on Ethereum. Dozens or hundreds of new projects are launched every day, and some players keep an eye on the dynamics on the chain every day, hoping to obtain benefits beyond expectations. As the number of players increases, good tools become even more powerful for investors. Dex Bot was born in this environment.

In mid-May, the Unibot project was established and became a phenomenon-level product in just over 2 months. It made tens of millions of dollars in profit in a bear market environment, causing the entire track and related concepts to be Stir-fried. However, after the launch of Banana Gun in September, Unibot’s market share was compressed due to its better operating experience. Recently, due to the limelight being overshadowed by Bitcoin and SOL, the transaction volume on the Ethereum chain has plummeted, and the demand for Dex Bot has naturally decreased. However, as a new narrative that emerged this year, it deserves continued attention.

Dex BOT trading market share, source: dune.com

Dex BOT trading market share, source: dune.com

05 Ethereum Inscriptions&meme

The emergence of the Ethereum Inscriptions protocol Ethscriptions can be said to be a complete replica of the Bitcoin Ordinals protocol, and it has been proposed since From the beginning, it has been rejected by everyone. The mainstream view is that it is reversing the course of history. However, it cannot withstand this wave of Bitcoin ecological explosion, and other reasons have brought it along.

At present, in the entire Ethereum Inscription track, except for ETHs, there is no other eye-catching presence. Although there are some micro-innovations and the emergence of runes + NFTs, most of them are short-term hype. , a wave of FOMO and then all of it. In addition, the inscription casting of new public chains is also hot. It is lively during the game and tests the performance of each public chain. But in the end, most of them are short-term prosperity. Anyone who dares to take over will be buried without exception. As for whether new narratives and new things will come out in the follow-up of relevant tracks, we need to continue to pay attention. (Note: FOMO: Fear Of Missing Out, fear of missing out)

Meme, as one of the mainstream narratives in the last round, has launched many phenomenal projects such as doge and shib. In this round, the emergence of PEPE can be said to have further stimulated the activity on the Ethereum chain. In mid-2023, users began to FUD institutional tokens, and the projects were launched just to dump their chips, leaving retail investors always at the last resort.

The Meme coin just solves this part of the pain points. Relatively speaking, it is fairly distributed, community-driven, and has no threshold. Anyone can participate. The BRC20 that became popular later is related to this. It doesn't matter either. Although many projects are extremely popular in the short-term like meteors, and there will be no more after the popularity is over, and very few actually take off, they are indeed a track closest to retail investors.

06 Others

Except for the above, the performance of the rest of the tracks was mediocre.

In the DeFi track, RWA represented by Maker began to expand outwards, but the response was mediocre. Old DeFi represented by Uniswap began to expand inward. Expansion, carrying out some technical micro-innovations, and launching a full-chain expansion plan, hoping to further capture more market share;

The chain game track is completely stalled, Although other chains have launched some chain games, and full-chain games have also been promoted to a certain extent, they have not completely detonated the market.

On the NFT track, Yuga Labs has made great achievements in games. Must work hard, but the response is mediocre, and its own NFT has not made much progress this year. Azuki raised 20,000 Ethereum at the end of June, but the final product directly copied Hongdou, taking away the NFT market. With little liquidity, the Hongdou series also experienced a wave of decline. As for the NFT trading market, OpenSea has shrunk from its previous valuation of tens of billions to 1.4 billion or even less, with the institution losing more than 90%. Blur is also constantly encroaching on OpenSea's market share. Projects on Ethereum have already occupied market share. It can be said that they are currently in a red ocean and the market competition is fierce. It is extremely difficult to make any achievements. However, Bitcoin is exactly the opposite. You can directly copy Ethereum and it is completely an unexplored virgin land. .

07 Summary

The above are some of the new innovations in Ethereum that I have noticed this year, including: Although concepts such as account abstraction and AI are still under construction, there are no phenomenal products, so they are not listed one by one.

On the other hand, due to the recent poor performance of Ethereum, many people have begun to FUD, believing that the reason is that Vitalik has major problems in the decision-making level of Ethereum development, and the decentralization of tax authority will lead to the separatism of Layer 2 princes, and Ethereum The value capture of the market has weakened, and everyone has different opinions on this statement.

Finally, regarding the next things to look forward to in Ethereum: one is the Cancun upgrade, which will benefit the second layer; the other is the approval of the Ethereum ETF application after the Bitcoin ETF is approved.

In 2024, are you more optimistic about the development of the Bitcoin ecosystem or the development of the Ethereum ecosystem?

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice Hui Xin

Hui Xin Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph