Author: insights4.vc Translation: Shan Ouba, Golden Finance

Total US venture capital deal value soared to $91.5 billion, up 18.5% month-over-month — the highest level since Q1 2022 — but the headline was misleading. Ten mega-deals (including OpenAI’s landmark $40 billion round) accounted for 61.2% of all invested capital, while the rest of the market remained sluggish. Excluding OpenAI, the next nine largest deals still accounted for 27% of total venture capital, highlighting investors’ continued flock to later-stage and AI-centric companies.

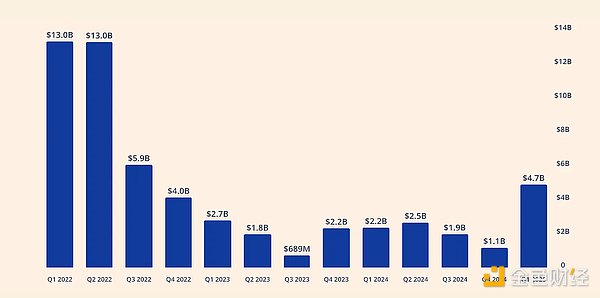

Venture Capital Deal Activity by Quarter

The number of deals was 3,990, up nearly 11% from Q4 2024, but essentially flat compared to Q1 2024. Notably, deals under $5 million now account for only 36% of activity, down from 42.9% in 2023 and the lowest share in more than a decade. The median pre-money valuation for late-stage venture rounds reached $299 million, with the median for venture growth rounds being the same—the highest level since the 2021 bull cycle. Meanwhile, limited growth in valuations and activity for seed and pre-seed rounds suggests that early-stage investors remain hesitant amid macroeconomic uncertainty.

In an overall sluggish market, artificial intelligence remains the lone bright spot. AI and machine learning-related startups received a staggering 71.1% of total U.S. venture funding in the first quarter, up sharply from 46.8% in 2024 and 33.2% in 2023. In addition to OpenAI, Anthropic raised $4.5 billion in two rounds, Infinite Reality nabbed $3 billion, and Groq raised $1.5 billion, confirming that big tech giants are not retreating from AI despite macroeconomic uncertainty and a potential tariff-driven chip supply shock. However, any disruption to AI hardware costs due to escalating trade policy could curb this momentum in the future. Meanwhile, exit activity remains historically low. Only 12 companies completed an IPO in the first quarter, and nearly 76% of M&A exits occurred before companies reached Series B funding—highlighting a lower return environment that has limited distributions to limited partners. While CoreWeave’s IPO and Wiz’s acquisition generated the highest exit values since Q4 2021, these exceptions mask an underlying drought. JPMorgan’s commentary noted that IPO timelines are lengthening and exit preparation activity is increasing – but has yet to translate into actual listings. However, the secondary market is heating up – over 50% of late-stage funding rounds in the past six months included a secondary market component, up from historical 20-30%, which provides some liquidity as the traditional exit window closes.

Funding also reflects investor caution. Q1 2025 marked the lowest quarterly funding pace in more than a decade. Investors are rotating capital into proven winners, with little interest in new or unproven managers. The number and amount of first-time funding rounds fell both quarter-over-quarter and year-over-year, with just $3.8 billion deployed in 892 deals, highlighting the growing selectivity of limited partners. This risk-averse sentiment has been exacerbated by macro and policy turmoil – new tariffs, public market volatility, and delayed Fed rate cuts have all dampened new commitments. Meanwhile, corporate venture capital (CVC) participation fell below 23% of deal count, even as dollar participation reached a record 61.1%, driven primarily by mega-deals led by AI.

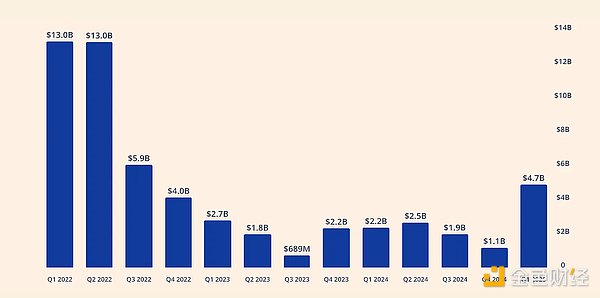

Cryptocurrency Deal Value Hits Post-2022 High

Global cryptocurrency venture capital investment reached $4.8 billion in the first quarter alone, the highest quarterly total since the end of 2022. Investments in this quarter accounted for 60% of all venture capital investment in 2024, indicating renewed investor interest despite a cautious macro backdrop. Notably, despite the increase in total capital, the number of deals fell slightly, suggesting a larger average deal size. Early-stage activity remains strong (seed rounds make up the majority of deals), but there were 12 large deals over $50 million completed in the first quarter, reflecting investors’ willingness to back more mature projects.

Quarterly Cryptocurrency Venture Capital (Source: cryptorank.io)

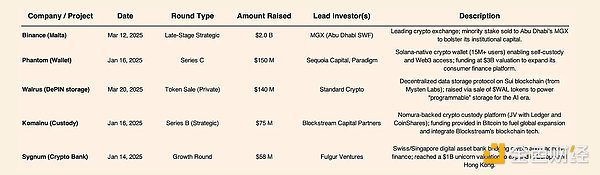

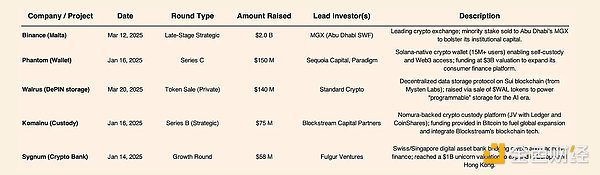

The table highlights the 2025 Q1 VC funding was focused on CeFi infrastructure, blockchain services, and DePIN (decentralized physical infrastructure networks). For example, CeFi platforms such as Binance and Phantom attracted significant funding to scale exchanges and wallet platforms. DePIN startups gained momentum with Walrus’ $140 million decentralized storage round. Investor interest in the AI x crypto and real world asset (RWA) sectors is also growing. While funding rounds for dedicated AI crypto startups were modest, traditional crypto companies are integrating AI capabilities (e.g. Chainalysis’ acquisition of Alterya for fraud detection – see M&A) to enhance their services. The RWA tokenization narrative continues to grow: crypto bank Sygnum’s funding round highlights interest in platforms that connect real-world assets to blockchain. All in all, Q1 venture funding data suggests the early stages of a new cycle — one focused on projects with pragmatic utility and institutional appeal, from blockchain infrastructure (e.g., custody, compliance) to novel Web3 use cases like DePIN and RWA integrations.

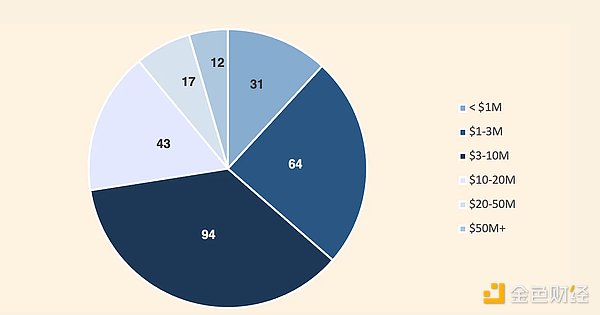

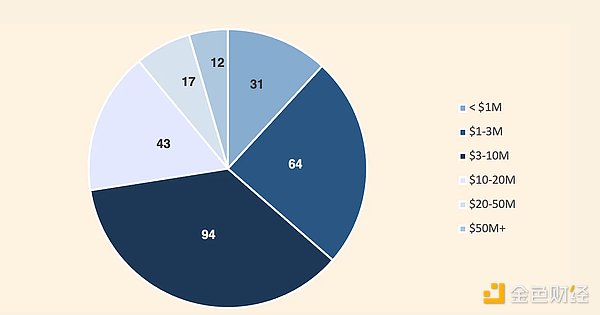

Funding Rounds by Size, Q1 2025

In Q1 2025, nearly two-thirds of cryptocurrency rounds were less than $10 million, highlighting continued support for early-stage innovation. However, the presence of 12 mega-deals over $50 million reflects growing investor confidence in mature, high-impact projects with proven traction and institutional backing.

M&A and Private Equity Transactions

Consolidation accelerates as crypto-native and traditional companies execute major mergers, acquisitions, and strategic investments in early 2025. As of mid-March, more than two dozen crypto/Web3 acquisitions have been announced, suggesting that buyers are taking advantage of improved market sentiment and regulatory clarity. Key M&A and PE deals in Q1 2025 include: Kraken Acquires NinjaTrader ($1.5 billion, March 2025): U.S.-based cryptocurrency exchange Kraken has agreed to acquire leading retail futures trading platform NinjaTrader for $1.5 billion. The deal, expected to close in the first half of 2025, gives Kraken a foothold in the regulated futures and multi-asset trading space in the U.S. It reflects the deepening ties between crypto companies and traditional finance, as crypto players expand into equities and derivatives. An analyst at Oppenheimer noted that this was a “crypto-native acquisition of a traditional finance” platform — a landmark deal of more than $1 billion that highlights the convergence of the two industries. Kraken plans to operate NinjaTrader as a standalone brand, leveraging its ~2 million user base and licenses to integrate crypto futures products.

MoonPay Acquires Helio ($175M, Jan 2025): Crypto payments company MoonPay acquired Solana-based crypto payments processor Helio for a reported $175M. Helio enables merchants to accept digital currencies (USDC, SOL, ETH, etc.) and has processed over $1.5 billion in transactions for over 6,000 merchants. MoonPay’s CEO called the acquisition “an important step in advancing our vision for the future of payments” as it strengthens MoonPay’s infrastructure for crypto commerce and markets. The deal provides MoonPay with a robust on-chain payment gateway (integrated with Discord, Shopify, etc.) to complement its fiat-to-crypto onramp business, signaling consolidation in the crypto payments and merchant services space.

Chainalysis Acquires Alterya ($150M, Jan 2025): Blockchain analytics firm Chainalysis has acquired Alterya, an Israeli AI-driven fraud detection startup, for approximately $150M. Alterya uses AI and a massive fraud database to block fraudulent transactions in real time. By combining Alterya’s AI agent approach (which blocks scammers during the money transfer process) with its own on-chain data, Chainalysis aims to “sniff out more scammers” and expand its compliance solutions from crypto to traditional finance. The acquisition illustrates a trend of crypto companies acquiring fintech/AI startups to bolster risk management. (It’s worth noting that Alterya had only raised about $6 million previously, meaning a high multiple exit, indicating its strong strategic value.)

Coinbase Acquires BUX Europe (Q1 2025, Undisclosed Amount): Driven by regulation, Coinbase quietly acquired the Cyprus branch of Dutch brokerage Bux, obtaining the EU’s MiFID II investment firm license. The deal (announced in October 2024 and completed in early 2025) enables Coinbase to offer regulated cryptocurrency derivatives and CFDs in the European market. While the amount is small, it highlights how the demand for traditional financial licenses is spurring M&A—established cryptocurrency companies are acquiring traditional financial entities to speed up compliance and market access in jurisdictions such as the EU.

Other notable deals that straddled the crypto and traditional sectors included SoftBank’s $50 million investment in crypto miner Cipher Mining (providing growth capital for crypto infrastructure), and Abu Dhabi’s $2 billion investment in Binance (discussed in the venture capital section), which is effectively a private equity investment by a sovereign-backed fund. Taken together, these moves highlight a pattern of consolidation: well-capitalized crypto companies are acquiring capabilities (trading platforms, payment technology, AI tools), while traditional tech/finance players are entering the crypto space through acquisitions. The prospect of looser regulation is driving this trend — a shift in U.S. policy under a pro-crypto government has eased concerns and “attracted” large buyers. Industry insiders expect the convergence of crypto and traditional finance to continue as large institutions ask “what is our strategy? Why aren’t we doing this?” and seek to catch up. In fact, 2025 could see a large number of Web3 startups being acquired, turning the promise of long-awaited exits into reality.

Stripe – Bridge and XRP – Hidden Road Deal

Stripe Acquires Stablecoin Bridge for $1.1B

Global fintech company Stripe made a major move in late 2024 that closed in early 2025: it acquired stablecoin infrastructure startup Bridge for a reported $1.1B. Founded in 2022 by former Coinbase executives, Bridge is a payments network that has been dubbed the “Stripe for Web3” because it allows businesses to easily create, store, and transfer stablecoins across multiple blockchains. The deal, announced in October and finalized in January, is Stripe’s largest acquisition ever and one of the largest in cryptocurrency M&A history.

Stripe's acquisition of Bridge demonstrates its strong commitment to blockchain-based payments and stablecoins. Stripe had previously begun integrating Circle's USDC and other stablecoins into its global merchant platform. By acquiring Bridge, Stripe gains a turnkey platform for issuing and managing stablecoins, accelerating its cryptocurrency capabilities. Stripe processes payments worth about 1% of global GDP, so enabling stablecoin transactions could significantly expand its reach. Analysts at Javelin Strategy commented that the deal confirms Stripe's view that stablecoins will proliferate in use cases ranging from cross-border payments to digital commerce. In short, the acquisition of Bridge provides Stripe with the technology and talent (Bridge's team of former Coinbase engineers) to become a major player in the cryptocurrency payments space, potentially integrating stablecoin issuance capabilities for Stripe's millions of business customers. The landmark fintech-cryptocurrency deal also delivered a quick return for Bridge’s venture capital backers (Index Ventures and Haun Ventures reportedly tripled their investments) and set a precedent for fintech giants acquiring crypto startups at unicorn valuations.

Ripple Acquires Hidden Road for $1.25 Billion – A ‘Once-in-a-Lifetime’ Deal

In April 2025, Ripple Labs, the company behind the XRP cryptocurrency, announced an agreement to acquire multi-asset prime broker Hidden Road for $1.25 billion. This is one of the largest acquisitions ever by a crypto company and will make Ripple the first crypto-native company to own and operate a global prime broker. The transaction (revealed on April 8, 2025) is expected to close in the coming months, subject to regulatory approval.

Here’s an analysis of the landmark deal:

Parties: Acquirer – Ripple Labs, a leading blockchain payments company valued at around $15 billion (as of its most recent funding) and provider of the XRP Ledger. Target – Hidden Road, an established prime broker that provides institutions with clearing and trading services in FX, fixed income, swaps, and digital assets. Founded by CEO Marc Asch, Hidden Road serves over 300 institutional clients and clears over $3 trillion in annual volume. Notably, Hidden Road has been a liquidity partner for the cryptocurrency market (described as “crypto-friendly”) and even uses Ripple’s USD stablecoin in its operations.

Deal Structure: The acquisition is an all-cash transaction for $1.25 billion (no stock consideration is reported). Ripple will use its large cash reserves (bolstered by past sales of XRP) to finance the acquisition. The transaction will allow Hidden Road to leverage Ripple's balance sheet to grow exponentially. In other words, Ripple is injecting a significant amount of venture capital and providing Hidden Road with its regulatory licenses, allowing the prime broker to accelerate growth. Hidden Road's CEO confirmed that with Ripple's "new resources, licenses and additional venture capital, this transaction will unlock tremendous growth potential" and allow them to enter new markets and product lines. Post-acquisition, Hidden Road is expected to continue operating under its existing management (Marc Asch will continue to lead), but with significantly stronger capital. This structure ensures continuity for Hidden Road’s clients while leveraging Ripple’s capital.

Strategic Motivation: This is a bold move for Ripple to expand from primarily a cross-border payments and cryptocurrency liquidity provider to becoming a full-blown institutional financial player. By owning Hidden Road, Ripple acquires a platform that provides prime brokerage services (trading, custody, funding, and clearing) to hedge funds and financial institutions. Ripple’s CEO Brad Garlinghouse called the acquisition a “once-in-a-lifetime opportunity” that gives crypto companies “access to the largest and most trusted traditional markets — and vice versa”. In essence, Ripple aims to bridge the gap between crypto liquidity and traditional asset markets. Hidden Road’s infrastructure and client network bring instant credibility and connectivity to institutional capital markets. It also has the potential to greatly increase XRP’s utility: Garlinghouse noted that Hidden Road will integrate XRP and the XRP Ledger (XRPL) to speed up trade settlement and improve efficiency. In fact, Hidden Road plans to migrate its post-trade clearing to XRPL, demonstrating the blockchain’s ability to handle high-volume institutional trade flows. The deal also bolsters Ripple’s stablecoin strategy — Hidden Road already uses Ripple’s USD stablecoin (RLUSD) as collateral in its prime brokerage service. By owning Hidden Road, Ripple can drive broader adoption of RLUSD and XRP for settlement, potentially making XRP part of traditional markets’ infrastructure. For Hidden Road, joining forces with Ripple provides a huge infusion of capital and cryptocurrency expertise at a time when digital assets are gaining traction. Backed by over $1 billion in funding from Ripple, Hidden Road will be able to grow its business faster and expand globally. CEO Asch said the partnership with Ripple will allow Hidden Road to “increase capacity, expand into new product lines, and serve more markets with institutional-grade reliability.” In short, Hidden Road gains a strong balance sheet and Ripple’s blockchain technology, while Ripple inherits a ready-made prime broker to distribute its crypto liquidity.

Public Comments: The acquisition has been hailed as a defining moment for Ripple and XRP. Analysts noted that it “cemented [Ripple’s] position as the first crypto-native company to operate a global prime broker” and could usher in a new chapter for XRP in the financial sector. Ripple’s CEO believes the timing is ideal, saying that with regulatory barriers lifted, “the U.S. market is actually opening up for the first time,” enabling transactions that meet traditional financial needs. Led by a more crypto-friendly US government, US regulators have recently signaled an openness to cryptocurrencies (in fact, this was the second cryptocurrency transaction to exceed $1 billion in 2025, after Stripe-Bridge). This supportive environment may have bolstered Ripple’s confidence in making such a large acquisition. From Hidden Road’s perspective, industry observers have highlighted that being acquired by Ripple (which has deep crypto liquidity and a network of banks using its RippleNet payment system) could enable Hidden Road to offer unique services – for example, providing on-demand crypto liquidity for FX trading, or real-time settlement via blockchain, thus differentiating it from traditional prime brokers. One market commentator said the deal “could connect the largest institutional capital to the cryptocurrency markets” and has the potential to accelerate XRP adoption if Ripple successfully integrates its technology into Hidden Road’s workflow.

Other Large Deals and Capital Flows ($100M)

In addition to formal venture capital rounds and M&A, Q1 2025 saw several mega-deals in the crypto/Web3 space, including token buybacks, strategic token initiatives, and non-traditional capital transfers:

StepN’s $100M Token Buyback and Burn (March 2025): Popular “earn as you walk” Web3 fitness app StepN initiated a community-driven buyback of its governance token, GMT. The StepN DAO repurchased 600 million GMT tokens (valued at approximately $100M) and has a proposal to burn (permanently destroy) those tokens pending a user vote. This “burn GMT” initiative seeks to significantly reduce the circulating supply of GMT, potentially increasing value for holders. The rationale is to reward the community and shore up the token’s economics: by slashing supply by nearly 10%, StepN demonstrates a long-term commitment to the token’s value. Holders are invited to lock up tokens and vote on whether to burn repurchased GMT in exchange for rewards (such as exclusive NFTs and a rewards pool). Such a large-scale token buyback is rare in the cryptocurrency space — StepN effectively taps into its $100 million treasury (accumulated from profits) to reinvest in its ecosystem, similar to a stock buyback by a public company. The move — described as a potential “game changer” for the GMT token — sheds new light on how some Web3 projects are using treasury funds to manage token supply and incentivize their user base.

Binance Raises $2 Billion in Stablecoins (March 2025): As mentioned earlier, Binance’s $2 billion in funding from Abu Dhabi’s MGX is not only the largest venture capital deal ever, but it also has a unique structure: the investment was conducted entirely in stablecoins. The parties did not disclose which dollar-pegged stablecoin was used, but the multi-billion-dollar equity investment via a crypto stablecoin is unprecedented in its scale. This approach enables fast cross-border settlement and is consistent with Binance’s crypto-centric operations. It illustrates the growing application of crypto assets in corporate financing - a sovereign-backed fund actually bought a stake in a major company using digital dollars. The stablecoin structure of the deal also demonstrates MGX and Binance’s confidence in using blockchain-based transactions for large transactions, which may indicate more large transactions settled on-chain in the future. (Notably, regulators later praised the transparency of recording such transactions on a public ledger, even if the specific stablecoin remains private.) This stablecoin-funded equity round highlights an innovative way of trading that combines traditional private equity with cryptocurrency liquidity.

Bitget-Bybit Emergency Funds Transfer (April 2025, ~$100M): In a high-profile inter-exchange mutual aid move, cryptocurrency exchange Bitget transferred nearly $100 million in ETH to competitor Bybit after the latter suffered a major security breach. The incident occurred in late March and resulted in a large amount of assets being stolen from Bybit. Bitget’s management chose to temporarily provide support, transferring approximately $100 million in ether to Bybit’s wallets to bolster its reserves. This kind of alliance in crisis—effectively a short-term bailout—is almost unheard of between rival exchanges, but it is seen as key to preventing contagion and maintaining confidence in the broader market. Bybit was able to continue operating without solvency issues, and Bitget’s необычная assistance was seen as a move to stabilize the industry (and perhaps hint at Bitget’s own strength, with its PoR above 130% throughout the quarter). The funding was withdrawn after Bybit raised funds to cover its losses, but it set an example for crypto companies to coordinate in emergencies, similar to the coordinated actions sometimes taken by banks during financial crises. While rare, this act of cooperation could become a precedent as the crypto industry matures and realizes that collective resilience is beneficial.

Conclusion

These large transactions highlight the diverse ways capital is flowing in the crypto/Web3 space, beyond just direct investment. From protocol treasury operations (token buybacks/burns) to novel trade financing (stablecoin payments) to solidarity in crisis management, Q1 2025 showcased an increasingly mature ecosystem willing to strategically deploy hundreds of millions of dollars in capital. For institutional investors, these developments are worth watching: they show that crypto companies are using tools similar to traditional finance (buybacks, M&A) alongside unique crypto-native solutions. The end result is a stronger, more connected crypto industry — one that can mobilize large amounts of capital quickly and sometimes in tandem. Looking ahead to 2025, analysts expect more of these mega-deals and innovative structures as consolidation continues and both crypto incumbents and new entrants from traditional finance leverage vast swathes of capital to shape the Web3 landscape.

Kikyo

Kikyo